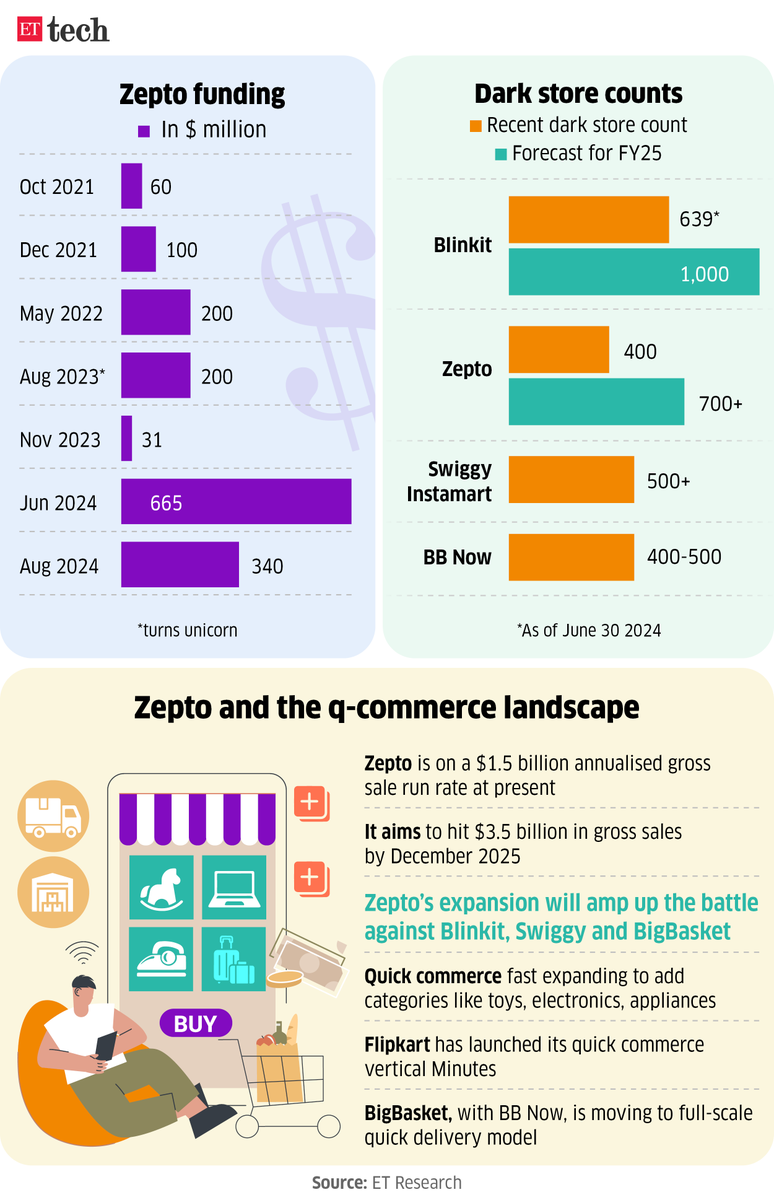

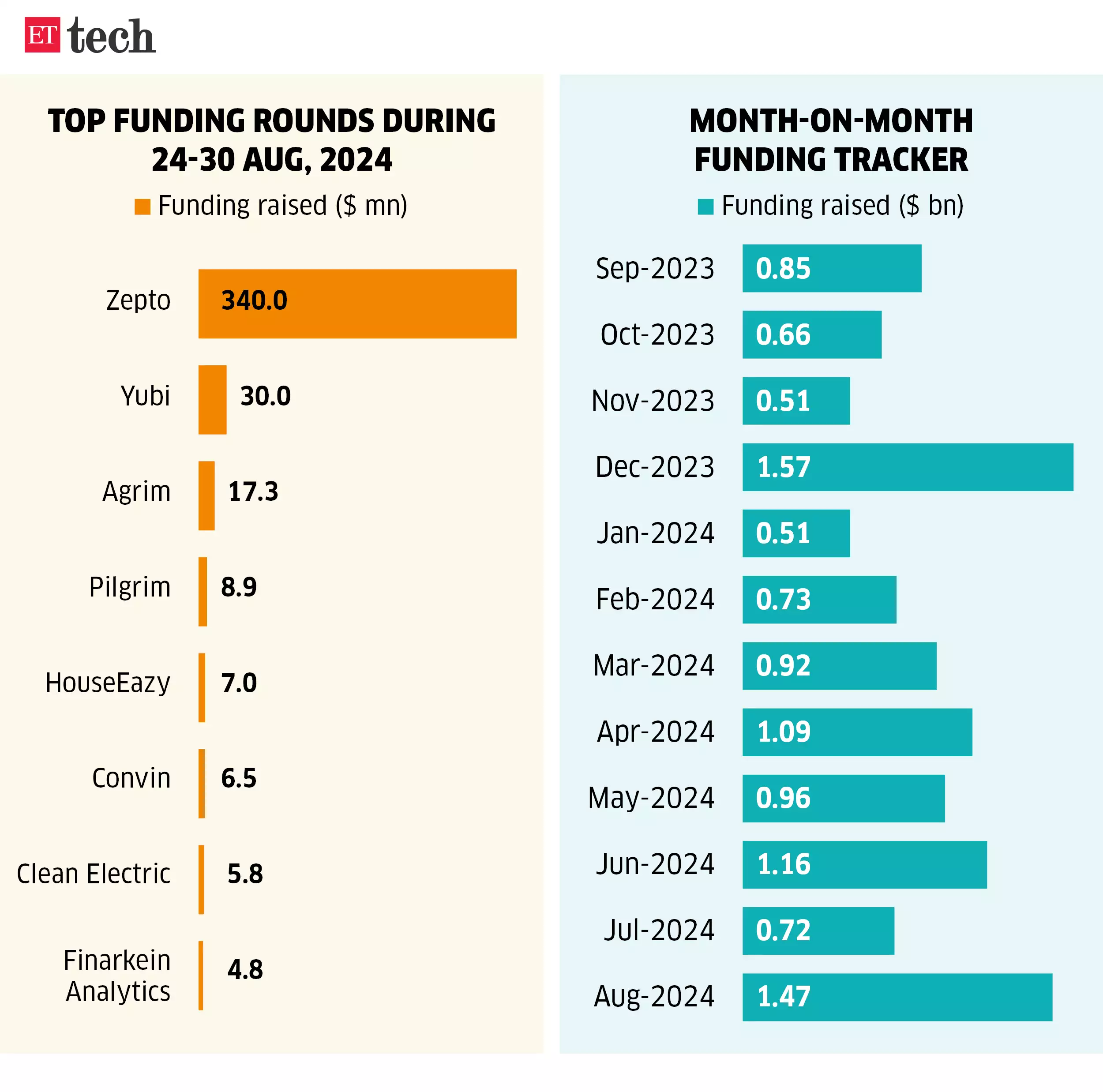

Zepto, a prominent player in the quick commerce sector, has once again disrupted the industry with a substantial $340 million funding round. This latest investment elevates Zepto's valuation to an impressive $5 billion.

Recent Funding Highlights

Zepto's recent $340 million funding round was spearheaded by General Catalyst and Dragon Fund, with Epiq Capital joining as a new investor. Existing investors, such as StepStone, Lightspeed, DST Global, and Contrary, also increased their stakes, demonstrating robust confidence in the company's trajectory.

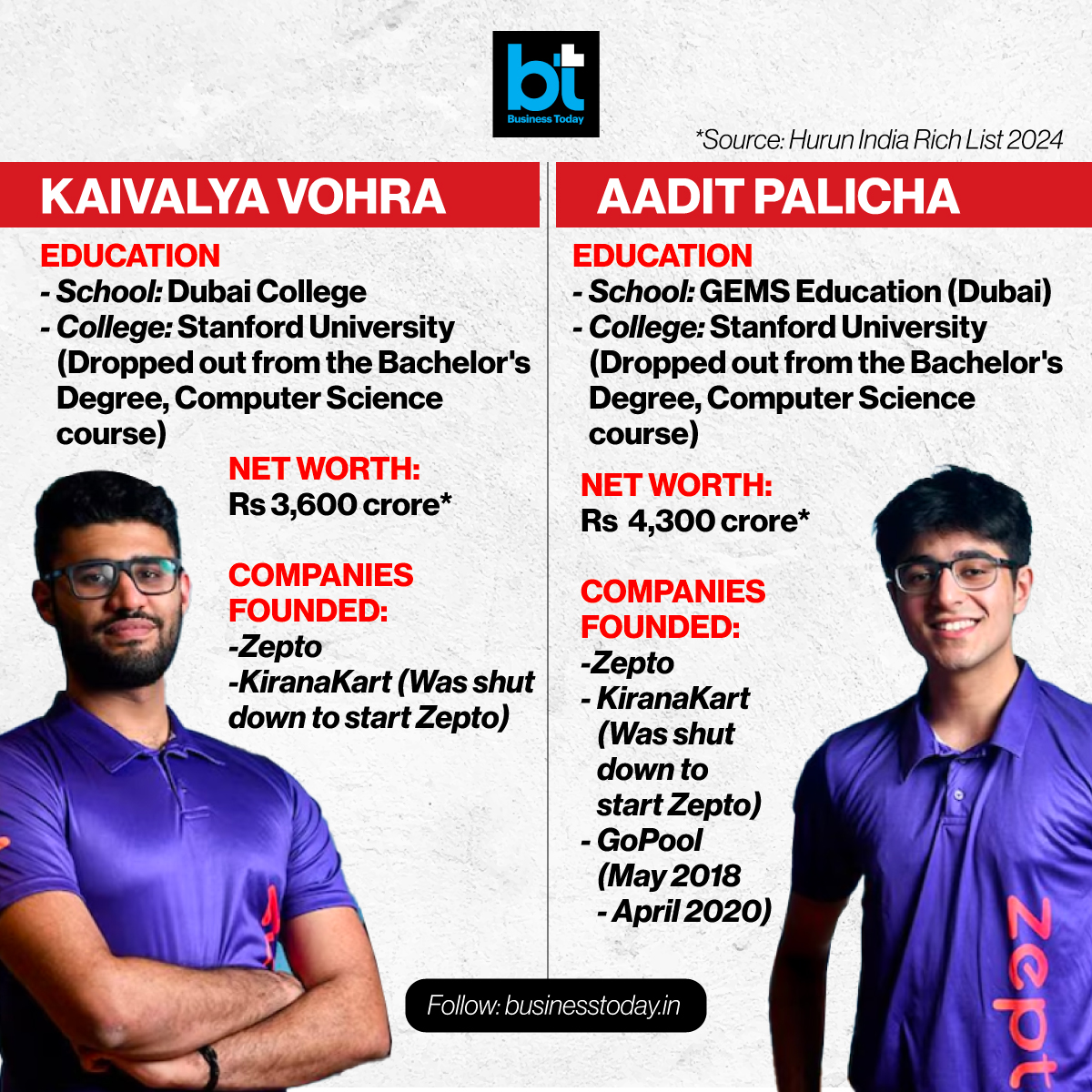

This new funding comes merely two months after Zepto's previous $665 million raise in June, which valued the company at $3.6 billion. With this, Zepto's total fundraising for 2024 surpasses $1 billion. According to Zepto’s co-founder and CEO Aadit Palicha, the company has experienced a 20% growth in the past 60 days, with 70% of stores now fully EBITDA-free and cash flow positive.

-

Preparing for an IPO

Zepto's latest round of funding is strategically aimed at preparing the company's balance sheet for a potential Initial Public Offering (IPO) within the next 18-24 months. Palicha has indicated that the company may aim for an IPO around late 2025 or early 2026. The key to a successful market debut will be generating significant free cash flow, with the goal set at $300-500 million.

Financial projections are optimistic, with sales expected to exceed ₹5,000 crore in FY24, doubling the ₹2,500 crore recorded in FY23.

-

Expansion Strategy

With the new capital injection, Zepto plans to accelerate its expansion efforts. The company aims to double its dark store count to 700 by March 2025 and enter new markets, including Nasik, Chandigarh, Vizag, and Ahmedabad. Additionally, Zepto will strengthen its presence in key metro cities like Mumbai, Delhi, and Bengaluru.

Palicha highlights the potential of Tier-2 and Tier-3 cities, noting that markets such as Nasik have shown remarkable growth in order volume, reaching 1,000 orders per day within six weeks. This is a faster achievement compared to metro cities, suggesting an underserved market with high potential for profitability.

-

Competitive Landscape

Zepto's aggressive expansion and funding come amidst heightened competition in the quick commerce sector. Key competitors include:

-

Blinkit: Plans to increase its dark store count from approximately 1,000 to 2,000 by the end of 2026.

-

Swiggy Instamart: Operating over 500 dark stores.

-

BigBasket: Entering the quick commerce space, acknowledging the consumer demand for instant deliveries.

-

Flipkart: Launching Flipkart Minutes to tap into the quick commerce market.

-

Amazon: Rumored to be entering sub-30-minute deliveries and considering acquiring a stake in Swiggy’s Instamart.

-

Category Expansion

Zepto is diversifying its offerings beyond groceries into high-growth e-commerce categories such as toys, beauty products, cosmetics, and low-ticket jewelry. Palicha explains that this expansion aligns with evolving customer expectations and usage patterns on the platform.

However, Zepto is cautious about entering high-stake categories like electronics, long-tail fashion, and furniture, where the product-market fit has been less favorable compared to categories like meat, seafood, and general merchandise.

-

Advertising Revenue Growth

Zepto is also focusing on boosting its advertising revenue, with plans to scale ad sales from ₹600 crore to ₹1,000 crore in the next year. Advertising has emerged as a high-margin revenue stream, with strong demand from Direct-to-Consumer (D2C) brands and FMCG companies.

-

Regulatory Challenges

As Zepto grows, it faces scrutiny from regulatory bodies concerned about the impact on traditional retail. Issues such as the rapid expansion of dark stores and aggressive discounting have drawn governmental attention. Palicha emphasizes the company’s commitment to constructive dialogue with regulators and an openness to feedback to ensure inclusive growth.

Looking Forward

Zepto’s bold strategies and rapid expansion underscore its ambition to dominate the quick commerce sector and reshape the broader retail landscape in India. The company’s focus on operational efficiency, expansion, and new revenue streams positions it as a formidable contender in the lead-up to its anticipated IPO.

Palicha envisions Zepto as a transformative force in the internet ecosystem, aiming to build a $70-80 billion company with significant free cash flow. This vision represents a potential milestone in the industry, comparable to the impact of Flipkart’s growth.

Funding Timeline

-

October 2021: Raised $60 million

-

December 2021: Raised $100 million at a $900 million valuation

-

August 2023: Raised $235 million in Series-E funding, with a valuation of $1.4 billion

-

June 2024: Raised $665 million in Series-F funding, increasing valuation to $3.6 billion

With inputs from CNBC-TV18

Image Source: Business Today, ET Tech

© Copyright 2024. All Rights Reserved Powered by Vygr Media.