In a dramatic move that has stunned policymakers, investors, and exporters alike, U.S. President Donald Trump has imposed a staggering 50% tariff on Indian imports — a decision rooted in New Delhi’s continued oil trade with Russia. This unprecedented escalation in the U.S.-India trade relationship not only threatens to reshape global supply chains but also raises questions of fairness, consistency, and geopolitical strategy in America’s broader effort to isolate Moscow.

The Breaking Point: Indian Imports of Russian Crude Oil

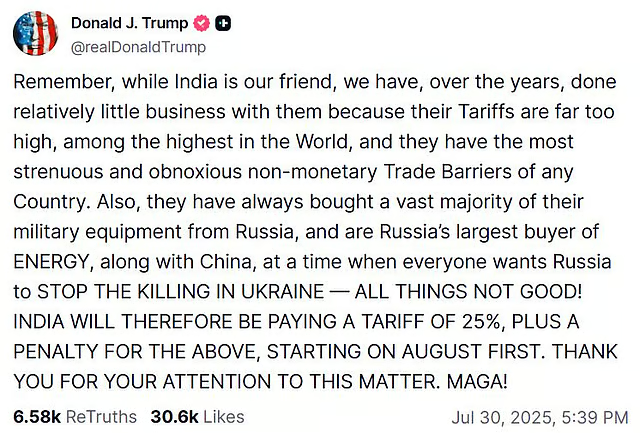

At the heart of this trade standoff is India’s decision to maintain crude oil purchases from Russia — a policy it justifies as essential for safeguarding energy security for its 1.4 billion citizens. Trump, however, views India’s oil trade as a means of indirectly financing Russia’s war on Ukraine. Citing national security concerns and strategic deterrence, Trump signed an executive order on August 6 imposing an additional 25% penalty tariff on Indian goods. This is on top of a prior 25% hike announced a week earlier, bringing the total tariff burden to 50% — among the highest imposed on any U.S. trading partner.

These measures, effective from August 27, follow a 21-day grace period. During this window, India and the U.S. could potentially negotiate a resolution, but tensions suggest that such a breakthrough remains unlikely.

Sectoral Impact: Export Pain and Economic Strain

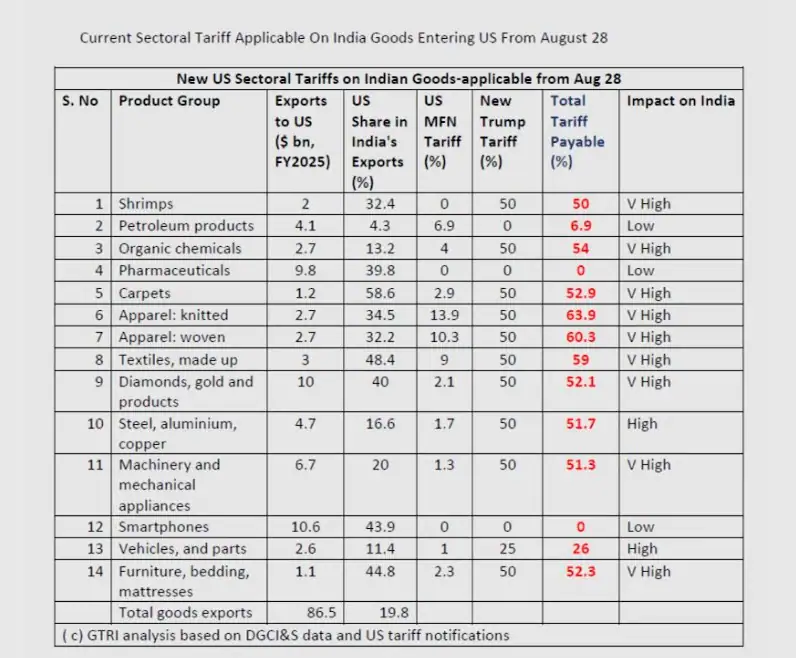

The tariffs hit India’s export economy at a particularly vulnerable moment, with many sectors already reeling from high inflation, muted global demand, and currency volatility. Analysts and industry bodies warn that the tariff shock could cut Indian exports to the U.S. by 40–50%, severely denting the country’s foreign exchange earnings and export competitiveness.

Most Affected Sectors:

-

Textiles & Apparel: Tariffs on textiles now stand at an effective 59–64%, endangering a $10.3 billion industry dependent on U.S. markets.

-

Gems & Jewellery: A $12 billion sector facing a 52.1% tariff burden.

-

Shrimp & Seafood: With Ecuador facing only a 15% tariff, Indian shrimp exporters (previously subject to 8.3% duties) now face a cumulative 33.26% tariff.

-

Leather & Footwear: $1.18 billion in exports now severely compromised by higher duties.

-

Chemicals & Organic Compounds: Tariffs now exceed 54%, crippling competitiveness.

-

Machinery & Auto Components: Including names like Bharat Forge and Suprajit Engineering, these sectors face tariffs over 51%.

Companies That Could Face the Brunt:

-

Textiles: Gokaldas Exports, Kitex Garments

-

Chemicals: Camlin Fine Sciences, Aarti Industries, Atul Ltd

-

Auto Ancillaries: Sona BLW, Bharat Forge

-

Oil Importers: Reliance Industries and OMCs could be vulnerable if India curtails Russian crude imports under U.S. pressure.

Stock Market Reaction: Volatility & Strategy

Financial markets responded with caution. Analysts anticipate a 1–2% knee-jerk correction as the news disrupts investor sentiment. Dhiraj Relli, CEO of HDFC Securities, estimates that if the tariffs persist for a year, India’s GDP could face a 30–40 basis point decline.

However, the structural integrity of India’s economy — largely driven by domestic consumption — offers resilience. Sectors like pharmaceuticals and electronics manufacturing, which were exempt from the tariffs, are expected to remain stable. But as Emkay Global’s Seshadri Sen points out, sentiment-driven weakness could temporarily affect even exempt sectors depending on announcements from global players like Apple.

Investor Playbook: How to Navigate the Turbulence

-

Don’t Panic Trade: Attempting to trade short-term volatility is risky given unpredictable geopolitical developments.

-

Reduce Exposure to Export-heavy Stocks: Focus on companies with stronger domestic demand tailwinds.

-

Buy the Dip: Should the market correct over 5%, valuations would fall below long-term averages, offering entry opportunities.

-

Stick to Sectoral Overweights: Emkay recommends Consumer Discretionary and Industrials, while remaining cautious on Financials, Tech, and Staples.

Swastika Investmart’s Santosh Meena echoes this sentiment, suggesting that long-term investors stay the course, viewing near-term volatility as an opportunity rather than a threat.

India Pushes Back: ‘Unfair, Unjustified, Unreasonable’

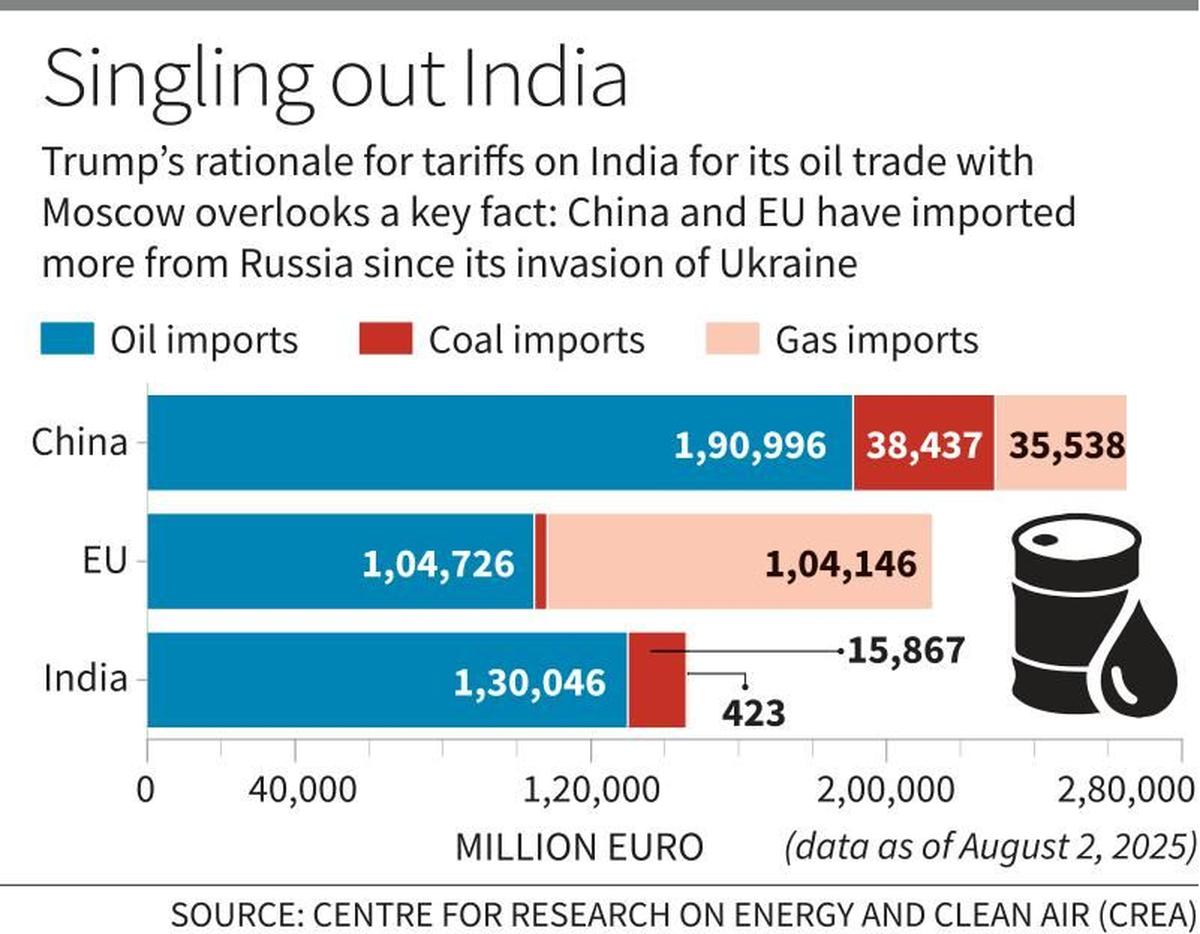

New Delhi has called out what it sees as Western hypocrisy and double standards. The Ministry of External Affairs noted that several other nations — including U.S. allies in the European Union — continue purchasing Russian oil, yet face no comparable penalties.

India’s official statement emphasized that its energy imports are dictated by market realities, not politics. “It is extremely unfortunate that the U.S. should choose to impose additional tariffs on India for actions that several other countries are also taking in their own national interest.”

India warned that it “will take all actions necessary to protect its national interests.”

The Global Context: Why Is India Being Singled Out?

Trump’s critics point out glaring inconsistencies in U.S. sanctions policy. For instance:

-

China, the largest consumer of Russian oil, has thus far avoided similar punitive tariffs. Despite a 21.5% share of total Chinese oil imports coming from Russia, Washington has been more circumspect with Beijing.

-

EU Countries, including Belgium and Hungary, continue to import Russian oil and LNG, even increasing purchases in 2024 — yet face no additional U.S. tariffs.

-

US-Russia Trade, although diminished, still exists. The U.S. imported $5.2 billion worth of goods from Russia in 2024.

Statement by Official Spokesperson⬇️

🔗 https://t.co/BNwLm9YmJc pic.twitter.com/DsvRvhd61D— Randhir Jaiswal (@MEAIndia) August 6, 2025

Trump’s Justification

In response to reporters questioning India’s selective punishment, Trump cryptically remarked, “It’s only been 8 hours. So let’s see what happens. You’re going to see so much more secondary sanctions.”

He also hinted at future tariffs on China, saying: “Could happen. Depends on how we do. Could happen.”

Nikki Haley, a senior Republican leader, even criticized Trump’s approach, tweeting: “Don’t give China a pass and burn a relationship with a strong ally like India.”

Geopolitical Theater: Are Tariffs a Bargaining Chip in Ukraine Talks?

In a surprising twist, Trump has linked the timing of the tariff escalation to apparent progress in U.S.-Russia negotiations on Ukraine. According to Trump, Moscow has shown a willingness to engage in peace talks — a shift that coincides with the imposition of new trade penalties on India.

“We put a 50 per cent tariff on India,” Trump posted on social media. “I don’t know if that had anything to do with it, but we’ve had very productive talks today [with Russia].”

Trump suggested that India’s oil trade profits were indirectly fueling the war effort: “India is not only buying massive amounts of Russian oil; they’re selling it on the open market for big profits.”

Pressed on whether the tariff would be rolled back if a peace deal were reached, Trump responded: “We’ll determine that later. But right now, they’re paying a 50 per cent tariff.”

भारत किसी भी कीमत पर अपने किसान, पशुपालक और मछुआरा भाई-बहनों के हितों के साथ कभी भी समझौता नहीं करेगा। pic.twitter.com/8nyKgliTwv— Narendra Modi (@narendramodi) August 7, 2025

The Road Ahead: Trade War or Tactical Deterrent?

The tariff saga between India and the U.S. is more than just an economic issue — it’s a flashpoint in a larger battle involving energy security, diplomatic autonomy, and geopolitical realignment.

While India continues to maintain its neutral stance and balance its global partnerships, Trump’s aggressive use of trade penalties signals a shift in Washington’s approach — one that may prioritize coercion over cooperation.

The real question now is not just about the fate of Indian exports, but whether the world’s largest democracies can navigate this storm without damaging the foundations of a strategically vital partnership.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved. Powered by Vygr Media.