On Saturday, 22nd June, The 53rd meeting of the Goods and Services Tax (GST) Council was convened in New Delhi. It was chaired by Union Finance Minister Nirmala Sitharaman. It was the first GST Council session after an eight-month hiatus, followed by the 52nd GST Council meeting held on October 7, 2023.

Union Minister of State for Finance Pankaj Chaudhary, Chief Ministers of Goa and Meghalaya, Deputy Chief Ministers from Bihar, Haryana, Madhya Pradesh, and Odisha, as well as finance ministers from various states and Union Territories (UTs) and senior officers from the Ministry of Finance and states/UTs, also attended the meeting.

During the session, Union Finance Minister Sitharaman also held pre-Budget consultations with finance ministers from states and UTs, aiming to gather their inputs and perspectives.

The 53rd GST Council meeting focused on refining the tax structure and service exemptions under the GST regime. The council deliberated on multiple proposals to streamline GST applicability across a range of goods and services.

Here are the key highlights:

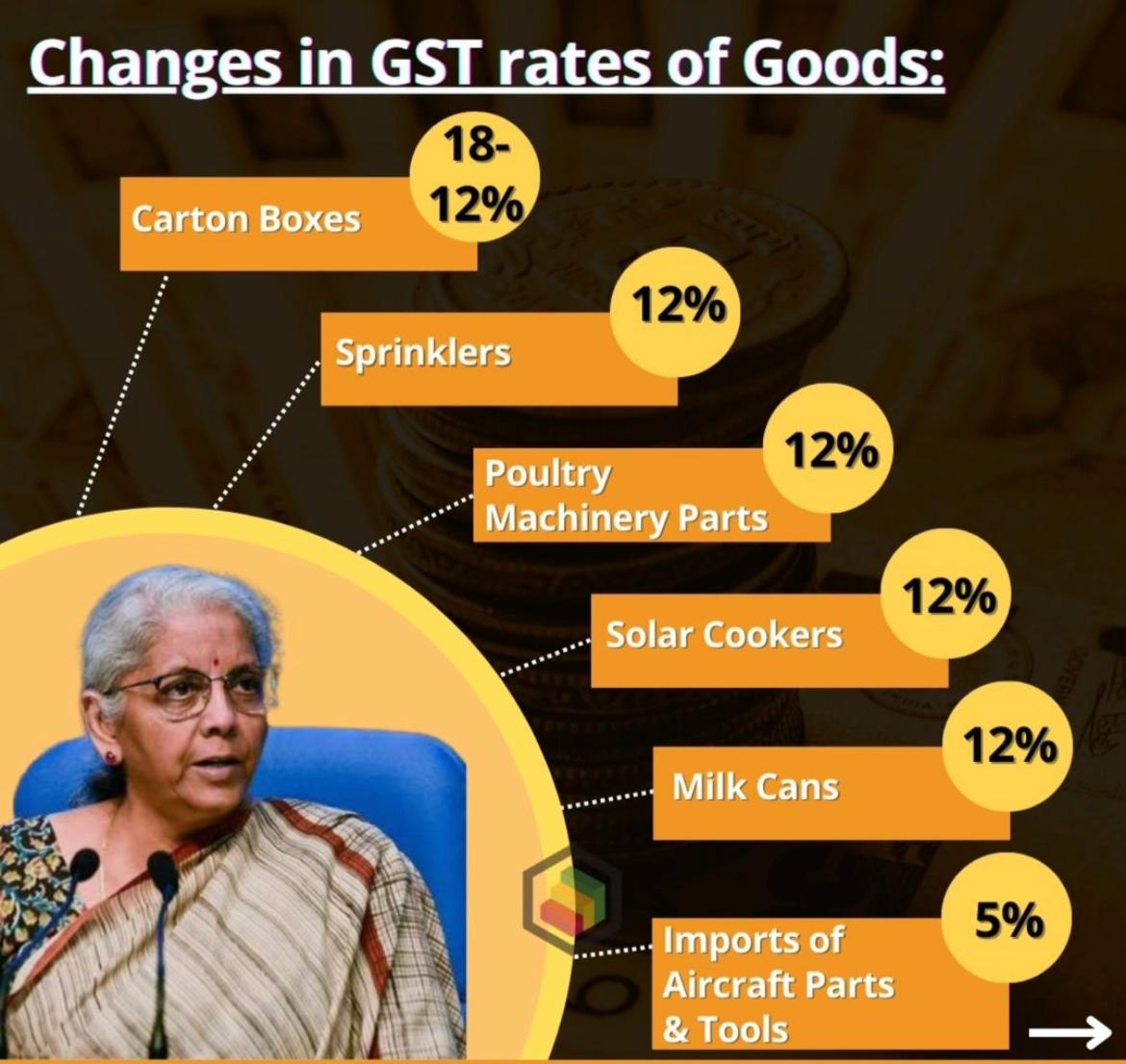

- A uniform IGST rate of 5% will apply to imports of parts, components, testing equipment, tools, and tool-kits for aircrafts, regardless of their HS classification, to support MRO activities under specified conditions.

- All milk cans made of steel, iron, or aluminium will attract a 12% GST. The GST rate on cartons, boxes, and cases made of corrugated and non-corrugated paper or paperboard (HS 4819 10; 4819 20) will be reduced from 18% to 12%.

- Solar cookers, whether single or dual energy source, will also attract a 12% GST.

- Exemptions include the supply of aerated beverages and energy drinks to unit-run canteens under the Ministry of Defence and ad hoc IGST exemptions on technical documentation for AK-203 rifle kits imported for the Indian Defence forces.

- The GST Council recommended a phased roll-out of biometric-based Aadhaar authentication for registration applicants on a pan-India basis to strengthen the GST registration process and combat fraudulent input tax credit (ITC) claims through fake invoices.

- Taxpayers with an aggregate annual turnover up to two crore rupees will be exempt from filing the annual return in FORM GSTR-9/9A for the FY 2023-24.

- Services provided by Indian Railways to the general public, such as the sale of platform tickets, the facility of retiring rooms/waiting rooms, cloakroom services, and battery-operated car services, will be exempt from GST. Intra-Railway transactions will also be exempt, and this will be regularized from 20.10.2023 to the date of the exemption notification.

- GST on hostel accommodation services outside educational institutions will be exempt up to Rs 20,000 per person per month, provided the student stays for a continuous period of 90 days, to prevent hotels from exploiting the exemption.

- Amend the CGST Act to start the three-month period for GST Appellate Tribunal appeals from a notified date.

- No interest will be charged on delayed return filing if the amount is available in the Electronic Cash Ledger on the due date.

(Image credit: FinQuest Instagram)

(Inputs from Agencies)

© Copyright 2024. All Rights Reserved Powered by Vygr Media.