An investigation by The Reporters Collective reveals how Baba Ramdev and his associates used a tax-free charitable organisation to support and grow their business, including acquiring the bankrupt company Ruchi Soya. Here’s a detailed look at their methods:

Yogakshema Sansthan: Charity or Business?

What is Yogakshema Sansthan?

Yogakshema Sansthan was founded in 2016 by individuals linked to the Patanjali Group. Its stated purpose was to establish and promote yoga and Ayurveda centers, granting it tax-free status as a charitable organisation.

An important principle under the Income Tax Act is that organizations established in India for “charitable purposes” are not subject to income tax, provided that certain conditions are met.- International Center For non Profit Law

What really happened?

Despite its charitable status, Yogakshema did not engage in any charitable activities for six years. Instead, it was used to funnel investments, including those in the bankrupt company Ruchi Soya.

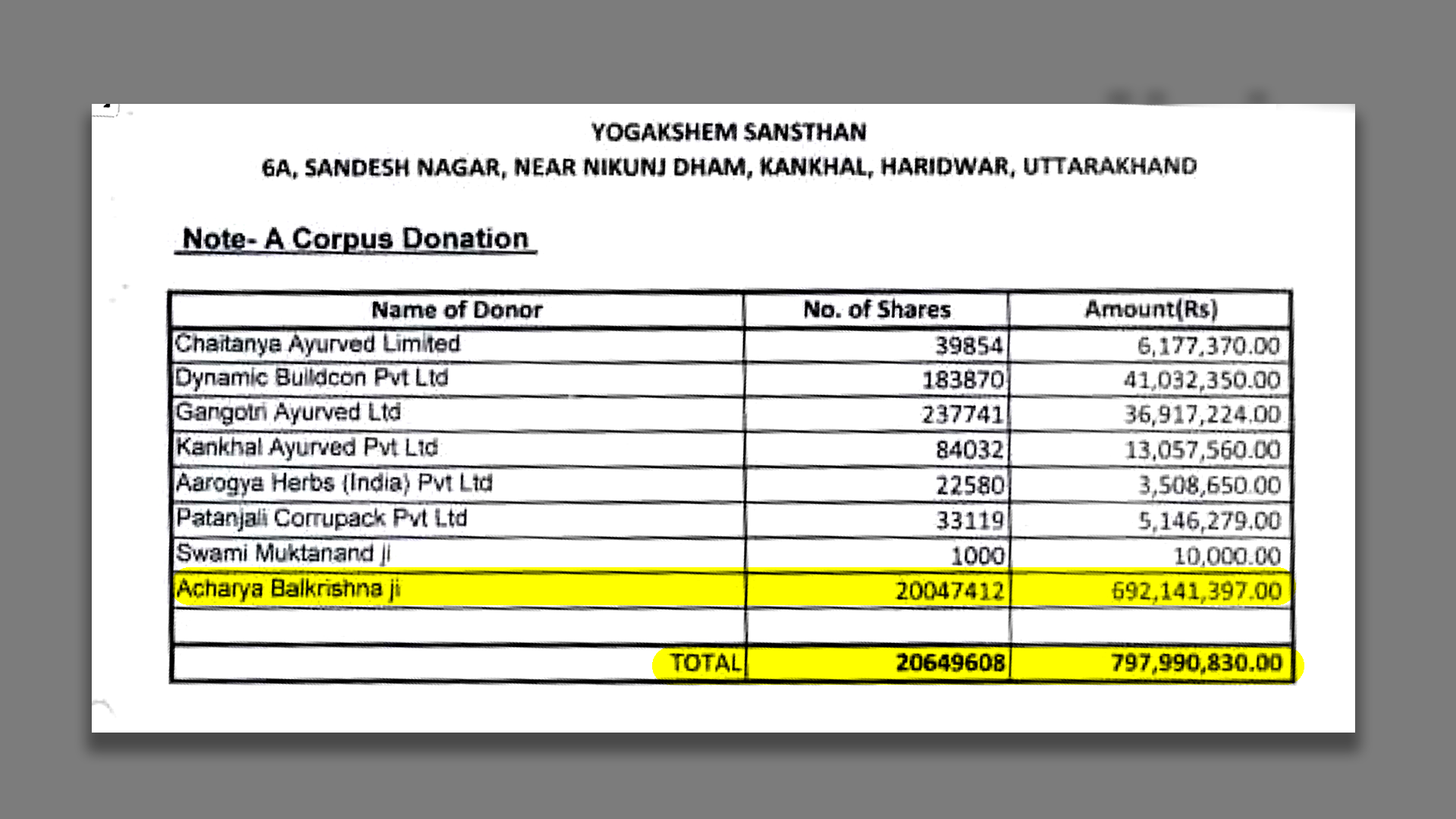

In January 2018, Yogakshem received over 2 crore shares of PAL (Patanjali Ayurved Limited) as corpus donation.

Breaking the Tax Laws

What Do the Laws Say?

Tax laws in India namely Section 12A of The Income Tax Act, 1961, prohibit charitable entities from making commercial investments and trading for profit to prevent them from being used as profit-making enterprises without paying taxes.

Yogakshema’s Reality

Yogakshema Sansthan avoided investigation and scrutiny despite not fulfilling its charitable mandate. It was used primarily to transfer money and make investments, deviating from its intended charitable purpose.

Patanjali’s Dubious Companies

Previous Investigations

Earlier investigations revealed that the Patanjali Group had set up multiple companies with zero revenue. These companies were used to buy and sell environmentally significant Aravalli forest land, falsely claiming plans to build factories for Ayurvedic products. This strategy helped obscure true ownership and minimise tax liabilities, a practice known as 'tax planning.'

_1716796533.png)

Control and Ownership Games

Key Players

Acharya Balkrishna, a close associate of Ramdev, plays a central role in controlling the Patanjali business group. Although Ramdev publicly claimed that Patanjali Ayurveda Ltd. would become a non-profit entity, it remained a profit-making enterprise.

Strategic Moves

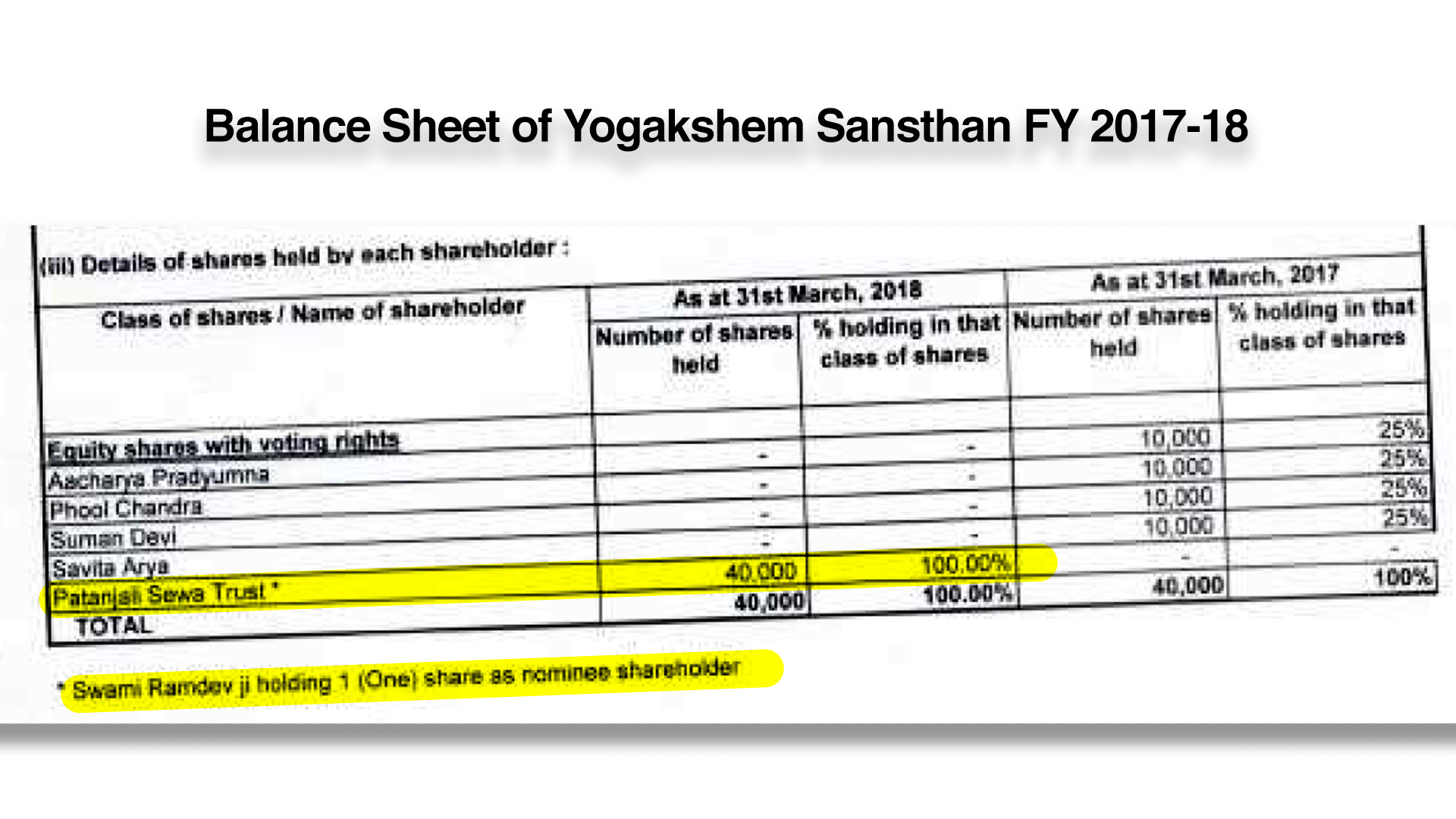

In January 2018, Yogakshema Sansthan received over 2 crore shares of Patanjali Ayurveda from Balkrishna and other associates. These shares were then transferred to the Patanjali Seva Trust, allowing the group to maintain significant financial control.

After the donation of shares in PAL (Patanjali Ayurved Limited), Ramdev and his associates took control of Yogakshem Sansthan.

Investments and Returns

Financial Maneuvering

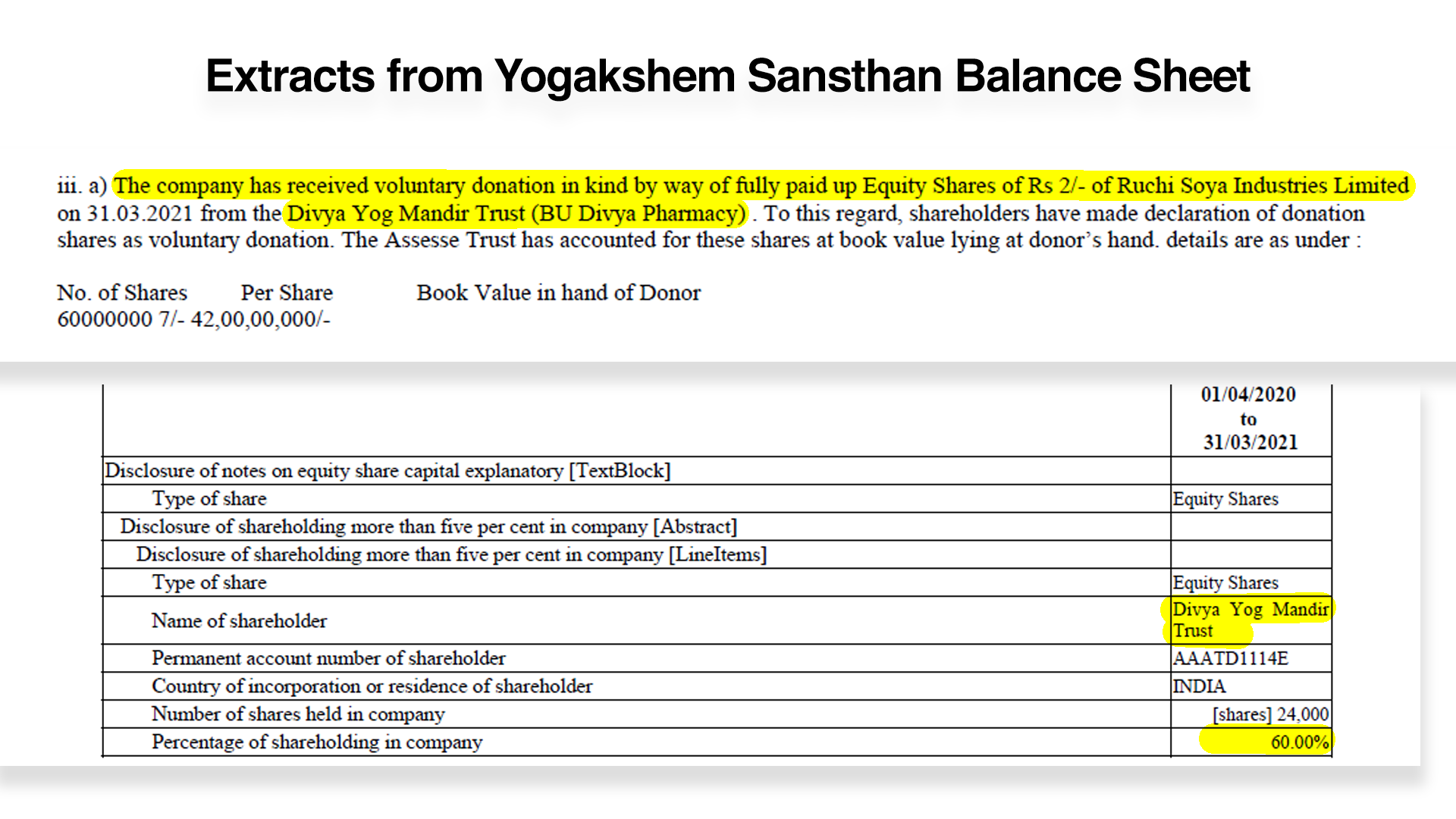

In the financial year 2020-21, Yogakshema had to return pledged shares due to pressure from banks. However, it acquired a substantial stake in Ruchi Soya through another Ramdev-affiliated entity, Divya Yog Mandir Trust. Despite this, no significant charitable activities were carried out.

After donating Ruchi Soya shares to Yogakshem Sansthan, Divya Yog Mandir became a 60% owner in the charitable company.

Profits Over Charity

In the financial year 2022-23, Yogakshema earned a Rs 30 crore dividend from Ruchi Soya shares. Although it spent nearly 60% of this income on donations to unspecified entities, it continued to claim tax-exempt status and held a 16.52% stake in Ruchi Soya (now Patanjali Foods).

Lack of Accountability

Government Inaction

Despite clear violations of its charitable mandate, Yogakshema faced no significant penalties or scrutiny. It continued to hold a large stake in Ruchi Soya while maintaining its tax-exempt status.

The Bigger Picture

Baba Ramdev’s use of non-profits to support his business ventures underscores the difficulty in enforcing tax laws on influential entities. While promoting a patriotic image, Patanjali managed to maximize profits and minimize taxes through strategic use of charitable status.

Conclusion

Baba Ramdev and his associates effectively used a tax-free charitable organization to expand their business empire, highlighting the challenges in regulating influential entities. Despite public claims of charity, the primary focus remained on profit maximization and exploiting legal loopholes.

For more legal news and updates related to Ramdev and company, read: SC Warns Firms About False Claims In Medicine Ads, Ramdev Baba Defends Patanjali

Input from: The Reporters Collective

Media Sources: Multiple agencies

ⒸCopyright 2024. All Rights Reserved Powered by Vygr Media.