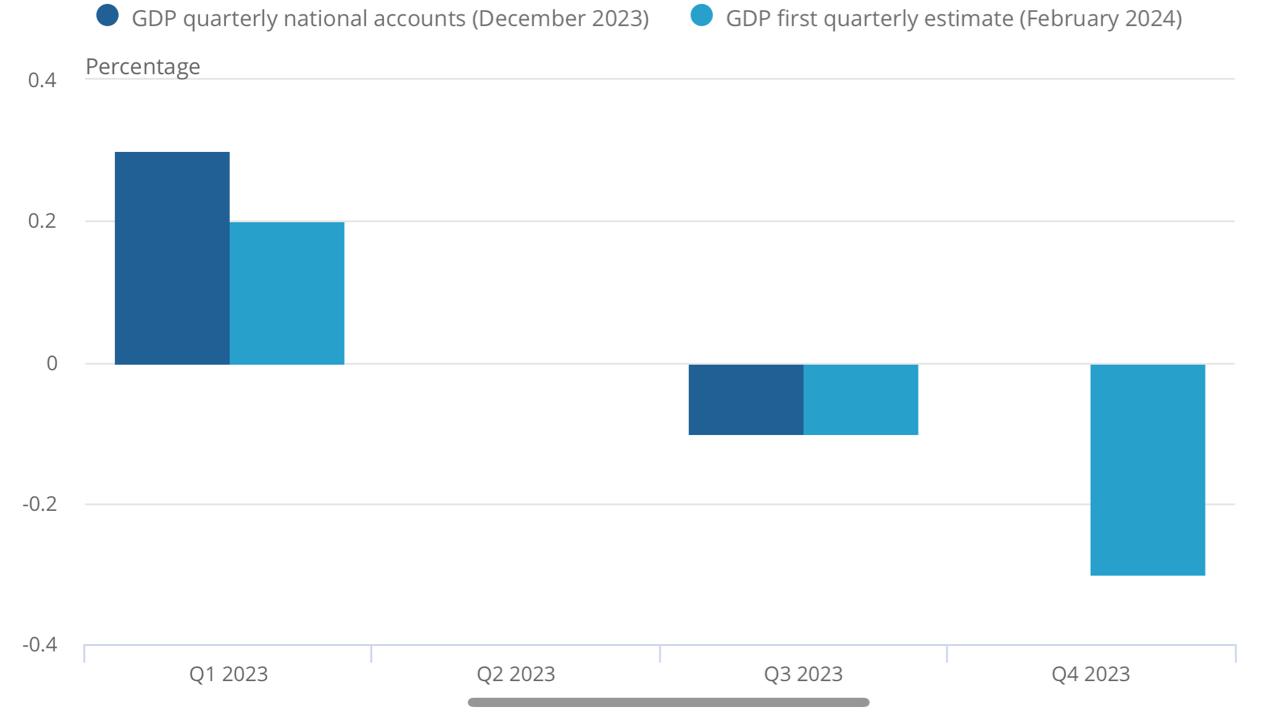

The UK has officially entered a recession. In 2023, the U.K. economy entered a "technical" recession, as indicated by a 0.3% decrease in GDP during the last quarter of the year, following a 0.1% decline in growth in between July and September, confirming two consecutive quarters of decreasing national output, as revealed by the Office for National Statistics (ONS) on 15 February.

What is recession? A recession occurs when the GDP figures show a negative trend, indicating a decline in the economy's performance. In simpler terms, it is defined as two quarters of falling GDP in a row.

In the UK, the measurement of the economy in recessions is conducted in pound sterling and represents the value of goods and services generated during a specific timeframe. However, the primary focus for most individuals is the percentage change, which reflects the growth of the nation's economy over a given period, usually a quarter or a year. This method of measurement has been in use since the 1940s.

Liz McKeown, the director of economic statistics at the ONS, stated: "Our preliminary estimate indicates that the UK economy contracted in the fourth quarter of 2023. Despite experiencing two consecutive quarters of contraction, the economy remained largely stagnant throughout 2023 as a whole.”

McKeown added,”All major sectors experienced declines during the quarter, with manufacturing, construction, and wholesale trade being the primary contributors to the downturn, partially offset by gains in the hotel and rental sectors for vehicles and machinery."

Pound Sterling dropped against the dollar and the euro, leading investors to bet on the Bank of England cutting interest rates this year. Meanwhile, businesses are asking for more government help in the upcoming budget plan on March 6.

_1708523814.png)

GDP per person has remained stagnant since early 2022, marking the longest continuous period of no growth since records began in 1955. GDP per capita has dropped for seven quarters, not just two. Since 2009, it's around £23,000 per household. With high interest rates and inflation, the financial strain will likely worsen.

Over the past two years, households have faced significant challenges, including surging mortgage rates and inflation. Although recent figures indicate that inflation increased less than anticipated, it remains at 4 percent, twice the level considered optimal by the Bank of England. Analysts predict that British households will experience their first decline in living standards between two consecutive national elections since World War II.

Despite a significant decline since reaching a 41-year high of 11.1% in October 2022, inflation in the UK, particularly in energy and food prices, continues to remain elevated.

Mild Recession ?

Recession is expected to be relatively brief and mild compared to historical norms. Ruth Gregory, an analyst at Capital Economics, said “This recession appears to be relatively mild, and current indicators suggest it may be nearing its conclusion."

The Office for National Statistics reported a 0.1% growth in the economy for 2023 compared to 2022. The Bank of England predicts a slight increase in output for 2024, but only by 0.25%.

Statistics: ONS

Analysts and experts suggest that the recent GDP contraction in the UK, particularly in December and the fourth quarter of 2023, may not accurately portray the economy's true state. Factors such as high inflation, labour market weaknesses, and low productivity growth, compounded by adverse weather conditions, have impacted the services and construction sectors, which are key drivers of the UK economy.

However, some of these challenges are temporary and are expected to ease, with inflation potentially falling in the coming months. Monitoring inflation in the services sector will be crucial, as it reflects wage growth and consumer demand, essential for the UK's recovery.

Finance Minister Jeremy Hunt’s Plan of ‘Tax-Cutting’

Finance minister Jeremy Hunt said " There are signs the British economy is turning a corner" and "we must stick to the plan, cutting taxes on work and business to build a stronger economy."

As reported he said, “But I would only cut taxes in a way that was responsible,” adding that he did not want to jeopardise inflation levels, which have fallen since last year.

Despite being faced with the latest GDP figures, as he mentioned, that "High inflation is the single biggest barrier to growth.” Mr. Hunt insisted that the economy was “more resilient” than most people had predicted, as he pointed to falling inflation and growing real wages.

UK’s Recession- More Political than Economic?

Britain in Recession is yet another setback to Prime Minister Rishi Sunak, as it is a major blow to Sunak's pledge to stimulate growth, having made growing the economy one of his five flagship priorities for government.

At the beginning of 2023, Rishi Sunak vowed as part of his five pledges that his government would "grow the economy, generating higher-paying jobs and opportunities nationwide." This commitment was among several promises Sunak made to boost his party's declining poll standings.

Ruth Gregory, deputy chief UK economist at Capital Economics, said, "The revelation that the UK entered a technical recession in 2023 will undoubtedly pose a challenge for the prime minister, particularly on a day marked by the potential loss of two by-elections.”

The Labour Party now holds greater trust in managing the economy, marking a shift from the long standing dominance of Rishi Sunak's Conservative Party, renowned for its economic competence over the past seven decades.

With opinion polls indicating this change, the Conservative Party is anticipated to suffer defeat in the upcoming general election later this year.

Labour Party called it ‘Rishi’s Recession’

The opposition Labour Party was quick to utilise the news as a reason to vote out Rishi Sunak's Conservative government in the elections later this year.

Labour slammed the government's stewardship of the economy. Calling it ‘Rishi’s recession.’

In a speech, Labour's finance spokeswoman Rachel Reeves, said "This is Rishi Sunak's recession and the news will be deeply worrying for families and businesses across Britain. The British people did not need to see these figures today to tell them that the economy isn't working.”

She accused Sunak of reversing the economy and shattering his pledge of economic growth. She said Mr. Sunak’s plan to grow the economy was “in tatters”.

Rejecting Hunt’s Claim, She added that the “ The Prime minister can no longer credibly claim that his plan is working or that he has turned the corner on more than 14 years of economic decline under the Conservatives.”

"Rishi Sunak has been unsuccessful in reversing 14 years of Tory economic decline," stated Labour leader Keir Starmer, emphasising that only Labour could enact the necessary change.

Russia Ukraine War impact on UK’s Economy

An Independent British Think Tank, The Resolution Foundation estimates households in the UK have lost nearly £1,500 in real terms since the crisis after the Russian-Ukraine War.

As per Chatham House, The invasion of Ukraine by Russia has added strain to the UK’s economy. The conflict has worsened price pressures, especially in energy and food, compounding existing challenges such as labour shortages, slow recovery from the pandemic, and Brexit effects.

The crisis prompted the UK and EU to build closer ties in trade, security, and politics. Yet, it might also accelerate the UK's shift towards strengthening trade ties with the Asia-Pacific region. With extensive sanctions on Russia prompting a reassessment of global economic engagement. This shift could significantly impact future trade relationships, particularly with China.

In January, the UK pledged £2.5bn in military aid to Ukraine, the largest annual commitment since Russia's invasion in 2022. This includes long-range missiles, air defense systems, artillery shells, and £200m in drones, with a focus on UK-made equipment. The aid package also includes £18m for humanitarian relief, support for energy infrastructure, and increased funding for online English language education, signifying a long-term partnership.

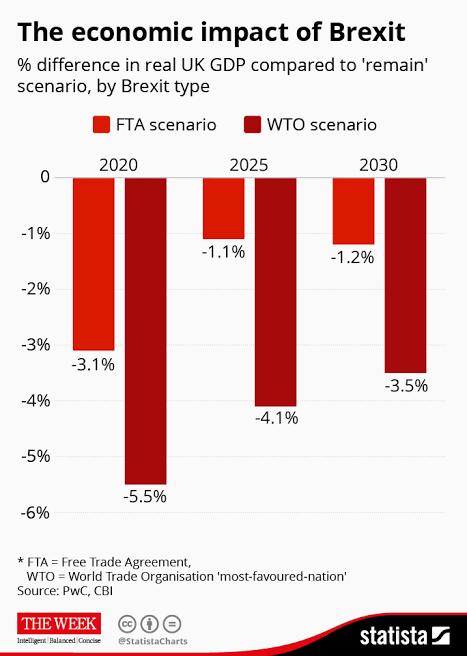

BREXIT’s impact on UK’s Economy

The UK, including Gibraltar, was an EU member from Jan 1973 to Jan 2020. Brexit occurred on Jan 31, 2020, making the UK the only sovereign nation to leave the EU.

As per the BBC reports, Post Brexit, the UK's economy is still struggling. Brexit, coupled with subsequent challenges like the pandemic and energy crisis, poised significant challenges like UK’s trade with the EU initially dipped due to new regulations, causing concerns and red tape issues for many businesses. New trade deals were struck, and most replicated previous EU deals. Investment was stalled, with uncertainty cited as a key factor, potentially leaving the UK less efficient economically. Changes to immigration rules have led to labour shortages in sectors like transport and hospitality, prompting calls for more workers.

As Per CNN, Brexit has led to increased costs for businesses, contributing to high inflation, with about one-third of food price inflation attributed to Brexit. UK food producers face full border controls into the EU from 2021, while checks on EU food into the UK have been repeatedly delayed. Inflation is at 6.8%, the highest in the G7, prompting government efforts to bring it down.

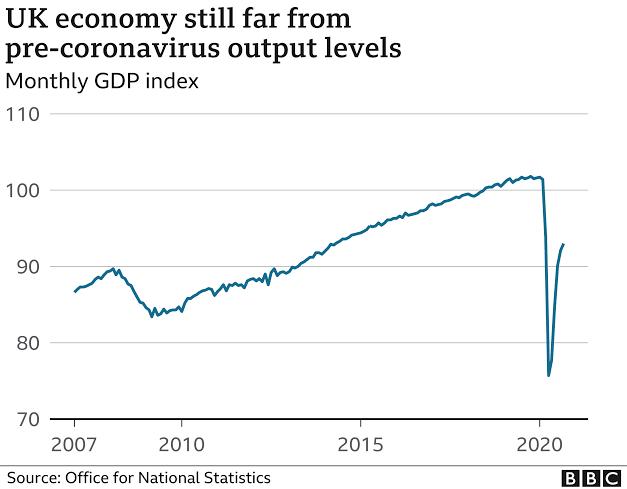

The Covid-19 Recession

Britain's economy has been stagnant for almost two years. The UK experienced its latest official recession in 2020, primarily due to the COVID-19 pandemic.

The COVID-19 pandemic caused the most severe contraction on record, with the economy plunging by 22% over two quarters in early 2020, due to prolonged lockdowns and forced closures of businesses for public safety.

According to the Office for National Statistics (ONS), the economy contracted by more than twice the previous largest annual fall on record. However, growth in December 2020, aided by easing restrictions, prevented a 'double dip' recession.

At the time, the ONS said: “This is the largest quarterly contraction in the UK economy since ONS quarterly records began in 1955, and reflects the ongoing public health restrictions and forms of voluntary social distancing that have been put in place in response to the coronavirus pandemic.”

Other Two of the Worst Recessions in UK:

The Great Recession (2008)

In 2008, known as the Great Recession, economies worldwide experienced the most catastrophic financial disaster since the Great Depression. Primarily driven by the housing market crash in America and the collapse of investment bank Lehman Brothers, numerous major institutions in the UK folded. The government intervened to bail out several banks. Unemployment soared to over 2.6 million people across the country, and the lingering effects persisted for a decade, marking the onset of the 'age of austerity'.

Early 90s Recession (1990-92)

In the 1990s, when Margaret Thatcher was the Prime Minister, Interest rates reached a historic peak, prompting the UK to join the European Exchange Rate Mechanism (ERM) in an effort to tackle inflation. However, Black Wednesday, occurring on September 16, 1992, marked the collapse of the pound sterling and Britain's withdrawal from the ERM. The UK's inability to prevent the pound from dropping below the ERM's lower limit led to its expulsion.

Before Black Wednesday, the UK was in the ERM for two years, but the pound's value was declining. Despite government efforts to support it, investor George Soros anticipated its failure and bet against it. Soros' actions, combined with widespread speculation, led to a self-fulfilling prophecy as businesses and investors panicked, exacerbating pressure on the pound.

Despite Bank of England intervention attempts, the UK left the ERM, earning Soros $1 billion and the nickname "the man who broke the Bank of England."

Japan is also in Recession

Britain, alongside Japan, now shares the distinction of being in a recession among the Group of Seven advanced economies. Canada has not yet released its GDP data for the fourth quarter.

Also Read: Japan's Recession and Global Ranking Shift (vygrnews.com)

Germany has now become the world's third-largest economy, after the US and China, replacing Japan. While Germany is on the edge, expecting stagnant growth in 2024, few European economies anticipate significant improvement.

Unlike Germany and the eurozone, Britain contends with higher interest rates and inflation. Additionally, its poor track record in investment and wage growth further complicates its prospects for a quick recovery.

Photo: Multiple Sources

(Inputs From Agencies)

©️ Copyright 2024. All Rights Reserved Powered by Vygr Media.