From April 1, 2026, India’s financial and digital world is going to change in a way most citizens may not even realize yet. The government has brought in a new Income Tax law which replaces significant parts of the earlier 1961 Act. On the face of it, the law is aimed at tightening tax compliance and reducing black money. But when you peel the layers, you begin to see an entirely different story—a story of privacy invasion, unchecked powers, and possible misuse of technology at the cost of citizens’ rights.

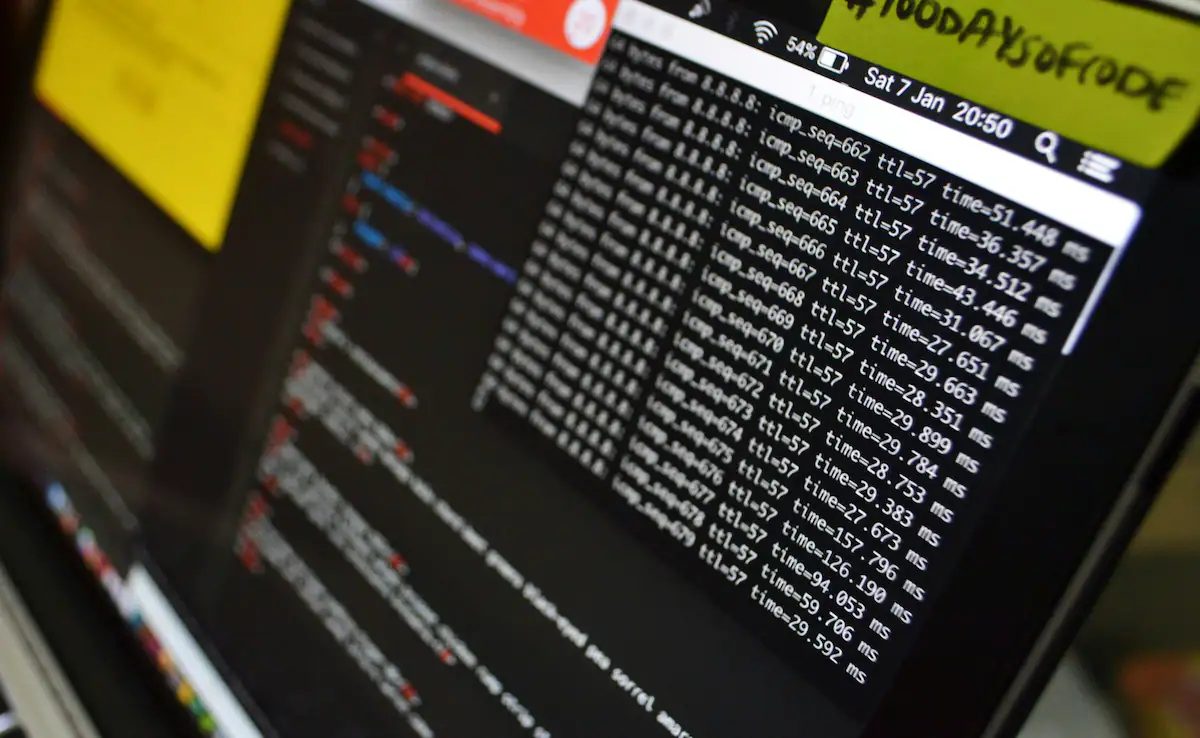

The provisions of this new law are deeply concerning because they give the Income Tax department powers to step into areas of personal life that were, until now, considered sacredly private. The law allows authorities to access WhatsApp chats, Instagram posts, Gmail accounts, and even cloud storage. In any tax investigation, you may be asked to hand over your email passwords, your social media logins, and even your personal one-time passwords (OTPs). Refuse? The law says the government can forcibly extract that data using “technical measures.”

This is not just about taxes anymore. This is about whether a citizen of India has the right to live with dignity, privacy, and personal freedom in the age of digital surveillance. And shockingly, the political opposition—normally vocal about government overreach—has remained silent on this issue. Why? Is it convenience, fear, or secret consensus?

1. What Exactly Does the New Law Say?

The new Income Tax law covers what it calls the “virtual digital space.” This phrase includes:

-

Social media platforms like WhatsApp, Instagram, Facebook, and Twitter (X).

-

Email services like Gmail, Outlook, or Yahoo.

-

Digital financial platforms like UPI apps (Google Pay, PhonePe, Paytm).

-

Trading and banking platforms, including stock market and mutual fund apps.

-

Even your personal storage: Google Drive, iCloud, Dropbox, or OneDrive.

During a tax investigation or raid, authorities can demand complete access to all of these. Not only that:

-

You will be required to provide login IDs, passwords, and even real-time OTPs.

-

If you hesitate, the authorities are empowered to use technical tools to break into your devices.

-

No prior permission from a court is clearly mandated.

-

No written explanation is required from officials before they demand access.

This is a drastic expansion of power—one that creates genuine fears of harassment, data theft, and misuse.

2. Why Is This Dangerous for Privacy?

Privacy is not just an idea—it is a fundamental right guaranteed by the Supreme Court of India in the Puttaswamy judgment (2017). The Court had made it clear: any breach of privacy is unconstitutional unless it meets strict tests of necessity, proportionality, and safeguards.

But this law does exactly the opposite:

-

Unrestricted Access: The government gains access to your personal messages, private images, financial records, cloud-stored files, and even personal conversations unrelated to taxes.

-

No Consent: You do not get the “choice” to deny access. Refusal is treated as non-cooperation.

-

No Safeguards: The law only makes vague promises about future “protocols” and “guidelines.” No clear checks are in place to prevent power abuse.

-

Surveillance State: By allowing AI to analyze transactions, chats, and emails, the government is essentially legalizing mass surveillance.

Ask yourself—would you feel safe knowing that an unknown officer could quietly read your private WhatsApp conversations or browse through family photos saved in the cloud?

3. Cash Transactions Under the Microscope

While digital space is one area of intrusion, cash transactions have also been tightly policed under the new rules. Some of the red-flag transactions include:

-

Depositing ₹10 lakh or more in your savings account in a single financial year.

-

Making a ₹1 lakh or more fixed deposit (FD) in cash.

-

Investing ₹1 lakh or more in shares, mutual funds, or bonds in cash.

-

Paying a credit card bill of ₹1 lakh or more in cash in a single month.

-

Buying property worth ₹30–50 lakh and failing to clearly prove the source of cash.

Now, while cracking down on black money is a legitimate goal, the concern is not about the limits—it is about the excessive policing linked to digital privacy. The government could justify snooping into your digital life even if there is only suspicion of “mismatch” in any of these cases.

Imagine you got a large wedding gift in cash, or your family pooled money for buying a small piece of land. Even if the source is genuine, the tax officer can still go digging through your emails, WhatsApp chats, and Instagram messages to “verify.” That is not investigation—it is outright intrusion.

4. The Rise of an All-Seeing Tax Department

Another alarming feature is how Artificial Intelligence will be used by the CBDT (Central Board of Direct Taxes). AI will automatically screen high-value transactions, compare data from banks, payment apps, and even travel bookings, and flag “suspicious activity.”

In theory, this sounds efficient. But in practice, AI can make mistakes. False positives are common. A wrongly-classified transaction could lead to invasive probes into completely innocent citizens.

This kind of AI-backed surveillance is not just about taxes—it normalizes the idea of a government “watchdog” always looking into your life. Today it is income tax. Tomorrow it could be health records, political opinions on social media, or private conversations critical of the ruling party.

The line between ensuring compliance and turning into a digital Big Brother is very thin, and this law seems to cross it.

5. Why Is the Opposition Silent?

Perhaps the most disturbing aspect is the silence of the opposition parties. Normally, when such a controversial step is taken, they jump at the chance to criticize the government. But here, reactions are muted or almost invisible. Why?

There could be several reasons:

-

Shared Interest: Every government, regardless of party, wants more control over financial data. Tomorrow, if a different party comes to power, they too would inherit this tool of mass scrutiny.

-

Fear of Public Backlash: Opposing this law outright could be painted as “supporting black money” or “helping tax evaders,” which no political party wants to risk.

-

Convenient Quietness: Many leaders themselves may not want to block a law that gives them potential power when they return to power.

But this silence is deeply problematic. If representatives of the people don’t defend the public’s basic rights, who will? Privacy invasion is not about ruling or opposition—it is about the dignity of every citizen.

6. The Real-World Risks

If this law is implemented as it stands, ordinary Indians could face multiple risks:

-

Harassment: Officers could misuse access, targeting individuals for personal or political reasons.

-

Data Leaks: Sensitive private data could leak—family pictures, business secrets, emails—all are vulnerable once authorities have direct access.

-

Chilling Effect: Citizens may begin self-censoring on social media, in private chats, and in financial dealings out of fear of constant monitoring.

-

Erosion of Trust: Instead of trust between the government and taxpayers, suspicion will deepen. This breaks the democratic relationship between citizen and state.

This is why such laws are not technical matters alone. They have serious consequences on the soul of democracy and the daily life of citizens.

7. Isn’t There Another Way?

Of course, tax compliance is important. Black money hurts the economy, and people must pay their fair share of taxes. The problem is not with the intent of fighting evasion but with the method.

There are better alternatives:

-

Strengthening banking systems and cash reporting mechanisms without spying on personal digital platforms.

-

Ensuring judicial oversight before accessing personal accounts.

-

Using anonymized AI analysis instead of direct snooping.

-

Developing clear Standard Operating Procedures (SOPs) with transparency and accountability.

Sadly, little of this has been promised clearly in the law. Citizens are being asked to trust the very institutions that now have unchecked power over their private lives.

8. The Silent Threat to Democracy

India is a democracy, not a surveillance state. When the state begins to access personal conversations, private memories, and family communications under the guise of financial investigation, the boundary between democracy and authoritarianism starts to fade.

What may begin as a financial law could end up as a political weapon. Imagine income tax officers using WhatsApp chats critical of the government as grounds for harassment. Or snooping into opposition leaders’ families during “routine tax investigations.”

It is not paranoia—it is a possibility. And history shows that power without safeguards gets abused.

9. What Should Citizens Do?

At this point, ordinary citizens cannot rely on political parties to safeguard their rights—their silence has proved it. It is now for citizens themselves, civil society groups, legal experts, and activists to:

-

Write to the select committee demanding stronger safeguards.

-

Raise public debate so that the issue cannot be quietly buried.

-

Spread awareness about the dangers of the law.

-

Insist on judicial checks before private data can be accessed.

-

Question political leaders on why they are silent.

The Constitution of India guarantees us fundamental rights. These cannot be quietly rewritten in the name of “tax compliance.” If citizens stay unaware, their silence will be seen as approval.

A Law Beyond Taxes

This new Income Tax law is not just about money. It is about freedom, privacy, and dignity. It represents an invisible chain being tied around every Indian’s digital life. Yes, black money is a serious problem. Yes, the government has the duty to collect taxes fairly. But no, this does not give the state the license to enter the private bedrooms of citizens through smartphones and email accounts.

What makes this law even more frightening is the silence of the opposition. If those elected to question the government fail to do so, who will stand up for our rights?

This law is a mirror to all of us. It asks: Do we want to live in a country where we are treated as citizens who must be respected, or as subjects who must be constantly watched?

Every Indian must think about this question—before it is too late.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved. Powered by Vygr Media.