“A person doesn't know how much he has to be thankful for until he has to pay taxes on it - Ann Landers”

Many of us share common sentiments when it comes to taxes.

"I hate taxes!", “Are we working for ourselves or the Government?”, “Why must I pay a high tax rate of almost 30% and get nothing in return?” etc.

Paying 30% of your hard-earned income to the government feels like giving one-third of your earnings to the government. It's as if you're struggling for four months a year for the government.

But as we groan while paying tax, it's intriguing to look at countries that levy zero income tax and yet provide excellent public services. How do these countries manage to maintain that balance? Could India, too, dream of becoming a tax-free nation? Let's delve into the intricacies of taxation and explore potential solutions.

But before that let’s first understand what taxation in India looks like.

What does India's Tax System look like?

Tax, a mandatory financial charge imposed by the Indian government on individuals and organisations, is a crucial source of income for public expenditure programs. This revenue aids in the development of a nation's economy and infrastructure. To navigate the taxation system effectively, it's essential to be acquainted with the various types of taxes implemented in India.

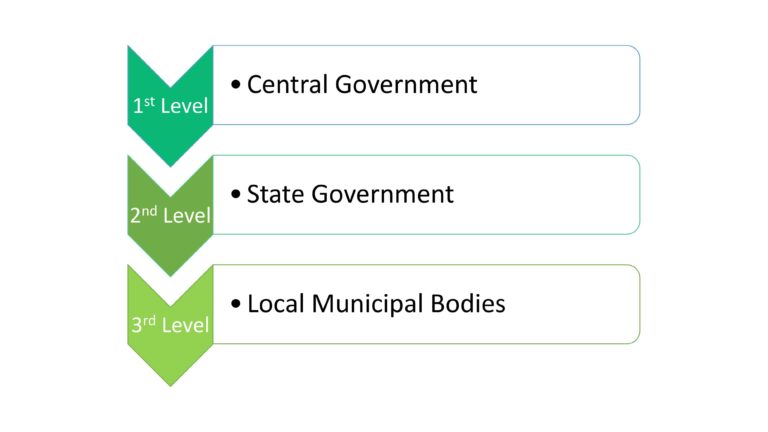

Taxation Structure in India:

The Indian taxation system operates within a three-tier structure, comprising state, central, and municipal corporations. Each tax levied is backed by legislation enacted by the State legislature or Parliament. The payment of taxes involves different forms and methods, and the types of taxes vary based on their implementation and collection mechanisms.

Historical Evolution of Taxation in India:

-

Ancient Roots to Formalization: References to taxes can be traced back to Manusmriti, but the formal taxation system emerged during the Mauryan Dynasty, where it constituted one-sixth of the produce. The Mughal Dynasty introduced the Jizya system later.

-

Colonial Influence: The modern taxation system evolved during the Colonial period when the British introduced a system to compensate for losses incurred during the 1857 revolt.

-

Income Tax Act: The Income Tax Act was enacted in 1866, undergoing multiple revisions. Post World War I, the Income Tax Act of 1918 was replaced by the Income Tax Act of 1922, in operation until 1961.

-

Modern Taxation System: The current taxation system, implemented in 1961, followed the recommendations of the Law Commission and the Direct Taxes Enquiry Committee.

Different Types of Taxes in India:

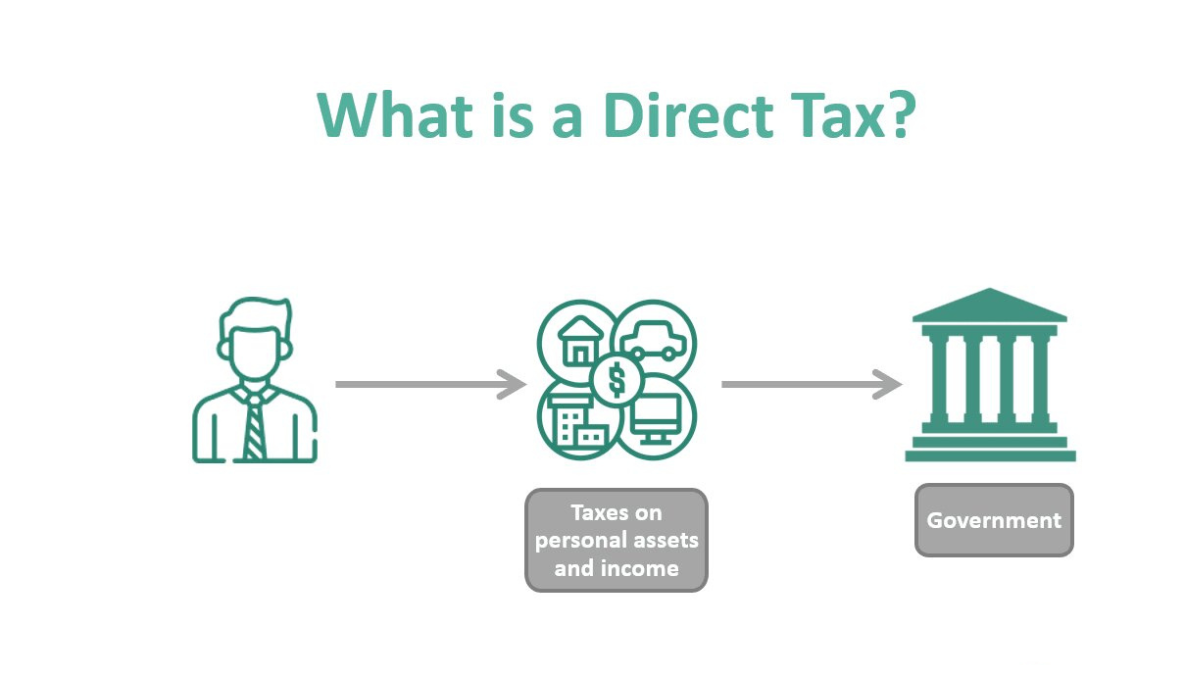

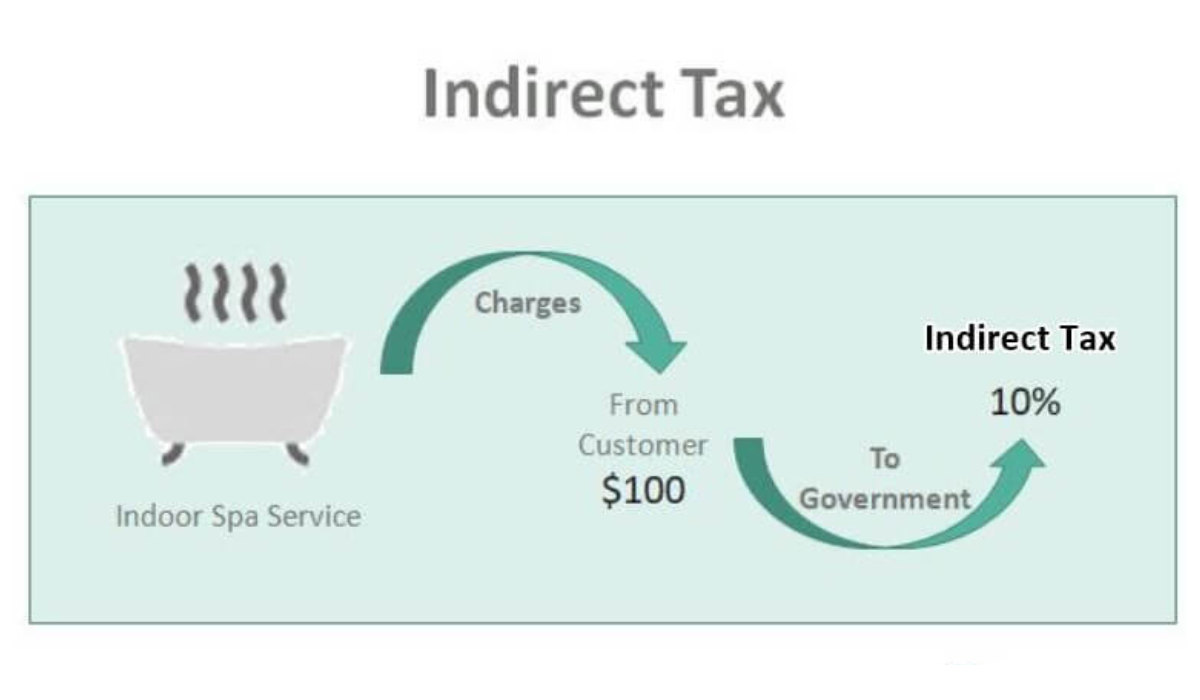

Taxation in India is broadly categorized into two types based on the submission process: Direct tax and Indirect tax.

Direct taxes are levied on earnings, while indirect taxes are imposed on expenses.

Additionally, the central government introduces 'Other taxes' for specific purposes, including Infrastructure Cess Tax, Swachch Bharat Cess Tax, Krishi Kalyan Cess Tax, etc.

1. What is Direct Tax?

Direct taxes are paid directly by individuals and corporate entities to the government, overseen by the Central Board of Direct Taxes (CBDT). These taxes, levied annually, are divided into different sections.

Types of Direct Taxes in India:

-

Income Tax:

Income tax is a fundamental tax applied to the personal income of individuals and companies. Tax slabs determine the amount payable, varying based on the taxpayer's income and age.

-

Corporate Tax:

Corporate tax is levied on the revenue or profit generated by businesses. Rates differ for domestic companies based on turnover, with additional surcharges for higher income brackets.

Types of Corporate Tax:

-

Minimum Alternative Tax (MAT): Imposes a minimum tax rate on companies.

-

Fringe Benefits Tax (FBT): Applied to various employer-provided benefits but abolished in 2009.

-

Dividend Distribution Tax (DDT): Levied on companies distributing dividends, currently at 15%.

-

Banking Cash Transaction Tax: Abandoned in 2009, proposed to tax all bank transactions at 0.1%.

-

Perquisite Tax:

Perquisite tax applies to benefits provided by employers, such as rent-free accommodation or company cars. Both taxable and non-taxable perquisites exist.

-

Capital Gain Tax:

Capital gains tax is incurred on profits from the sale of capital assets, with different rates for short-term and long-term gains.

-

Securities Transaction Tax:

Imposed on profits from securities trading, this tax applies to transactions in the domestic stock exchange market.

2. What is Indirect Tax?

Indirect taxes are charged on the consumption of goods and services, collected from sellers and passed on to buyers.

Types of Indirect Taxes in India:

-

Sales Tax:

Levied on items produced or imported, sales tax is imposed on the seller, who includes the tax in the product's price.

-

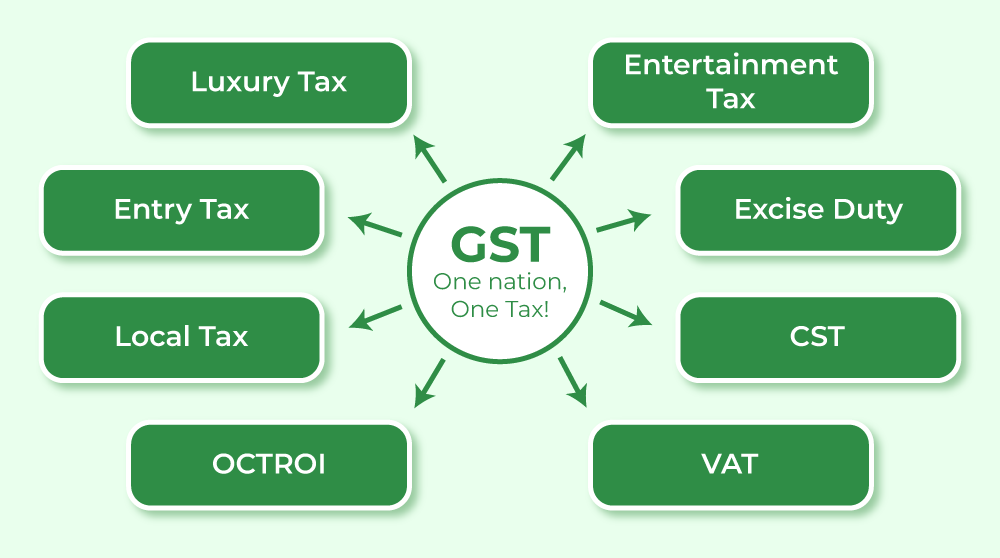

Goods and Services Tax (GST):

Introduced in 2017, applied to the cost of goods and services sold. It consolidates various indirect taxes.

Components of GST:

-

Service Tax: Applied to services provided in India.

-

Value Added Tax (VAT): Levied at different stages of the supply chain.

-

Excise Duty: Tax on goods manufactured in India.

-

Customs Duty & Octroi: Taxes on imported goods and state border crossings.

-

Customs Duty:

Charged on imported goods, customs duty is calculated based on the items' value, weight, and dimensions.

3. What are Other Taxes?

While direct and indirect taxes are primary, there are additional taxes, often referred to as "cess," although not major revenue generators support specific initiatives.

-

Professional Tax: Levied by state governments on professionals' income.

-

Property Tax (Municipal Tax): Collected by municipal bodies on residential or commercial properties.

-

Entertainment Tax: Imposed on films, exhibitions, and recreational activities.

-

Stamp Duty, Registration Fees, Transfer Tax: Supplement property transactions.

-

Education Cess/Surcharge: Supports government-sponsored educational programs.

-

Gift Tax: Applied when receiving gifts over Rs. 50,000 in a year.

-

Wealth Tax: Abolished in 2015, previously applied to net wealth.

-

Toll Tax & Road Tax: Collected for using government infrastructure.

-

Swachh Bharat Cess: Supports cleanliness initiatives, applicable to taxable services.

-

Krishi Kalyan Cess: Aids farmers and agricultural facilities, applied to taxable services.

-

Infrastructure Cess: Levied on specific vehicles based on fuel type and size.

-

Entry Tax: Levied in selected states on e-commerce purchases.

Understanding the diverse taxation system in India is essential for individuals and businesses to fulfil their responsibilities as contributing members of the economy.

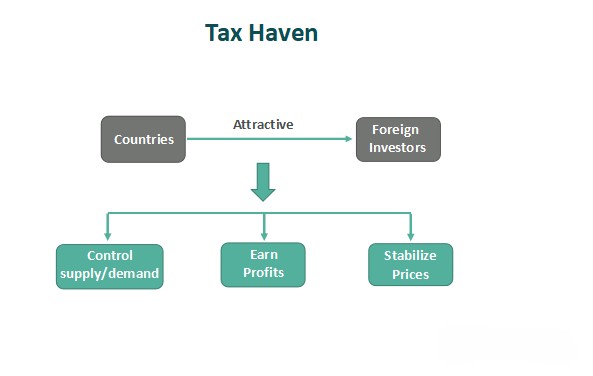

Tax Havens: What Sets Them Apart?

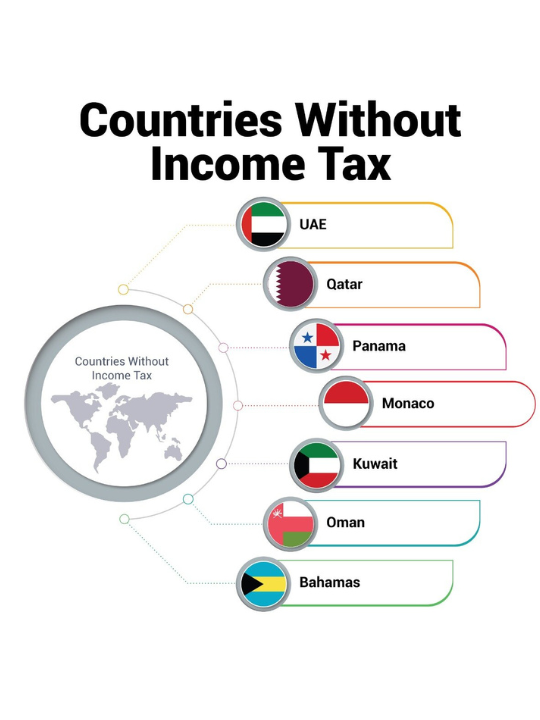

Zero-tax nations, aptly named tax havens, do not impose income taxes on their residents or foreign nationals. A tax haven refers to a nation or location with notably low tax rates, enticing individuals to reside or establish companies there to circumvent higher taxes in their home countries. Among the roster of tax havens, there are some unexpected entries:

Bahamas, Cayman Islands, Hong Kong, Panama, Bermuda, Curacao, Mauritius, Turks and Caicos Islands, British Virgin Islands, Dominica, Monaco and Cyprus

Interestingly, within these tax havens, there are countries renowned for their advanced development and exceptional living standards:

Singapore, UAE, Ireland, Netherlands and Liechtenstein

The logic is clear behind some countries prioritizing foreign investment over taxes is simple. By offering lower taxes, they attract investors from abroad. This influx of investment fuels local business growth and fosters progress within their borders.

For Example, in the U.S., there are two types of income taxes: Federal taxes imposed by the central government and State taxes imposed by individual state governments.

In certain states where state taxes are zero, corporations relocate their headquarters to these tax-friendly states.

For instance, Tesla strategically positioned its Gigafactory in Texas, a state without a state tax, allowing the company to sidestep certain tax obligations. Larger corporations, such as Facebook and Apple, take this strategy a step further by channelling their profits through countries like Ireland, leveraging the more lenient tax regulations there.

But amidst these manoeuvres benefiting companies and individuals by reducing their tax burdens, what advantages do these actions offer to a country or state?

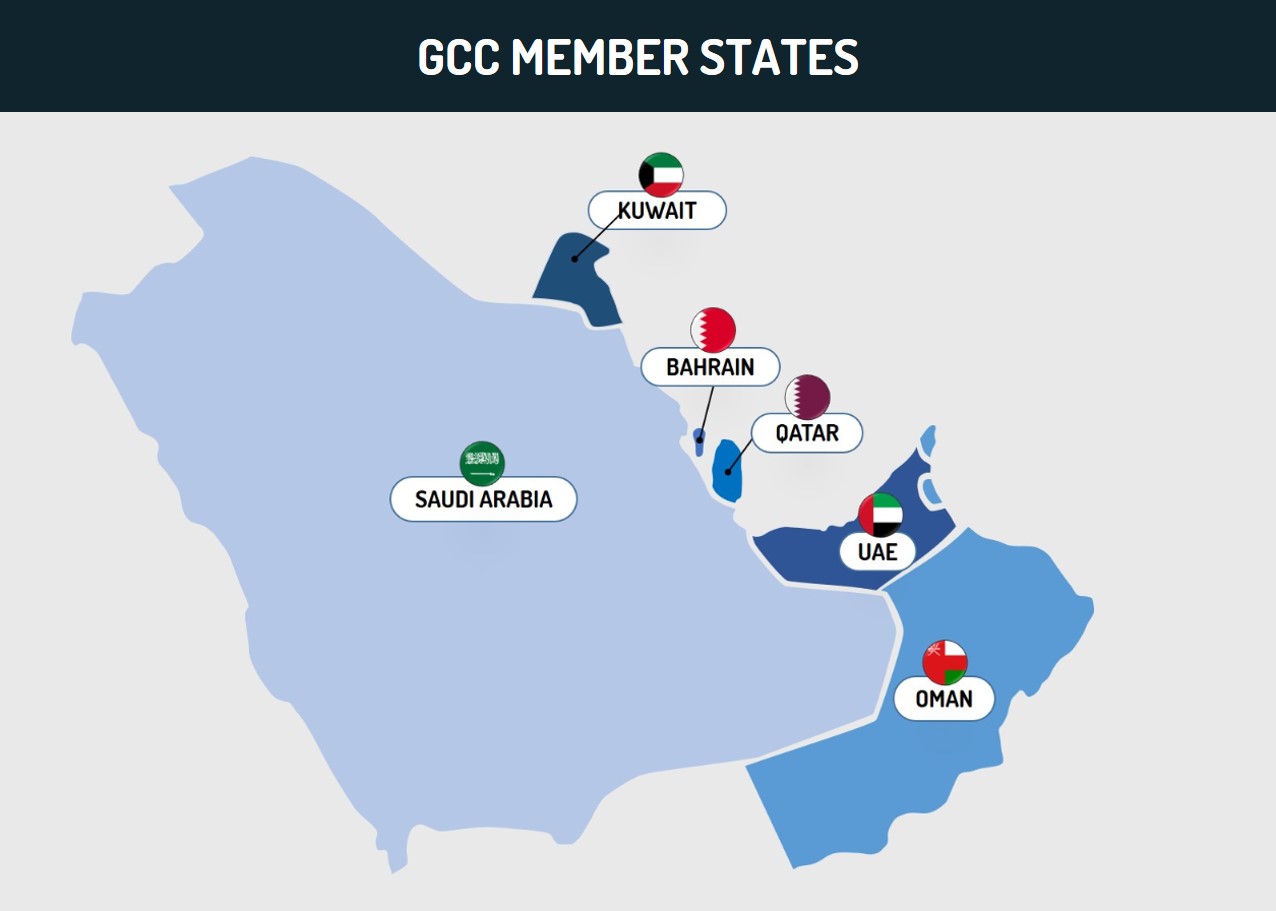

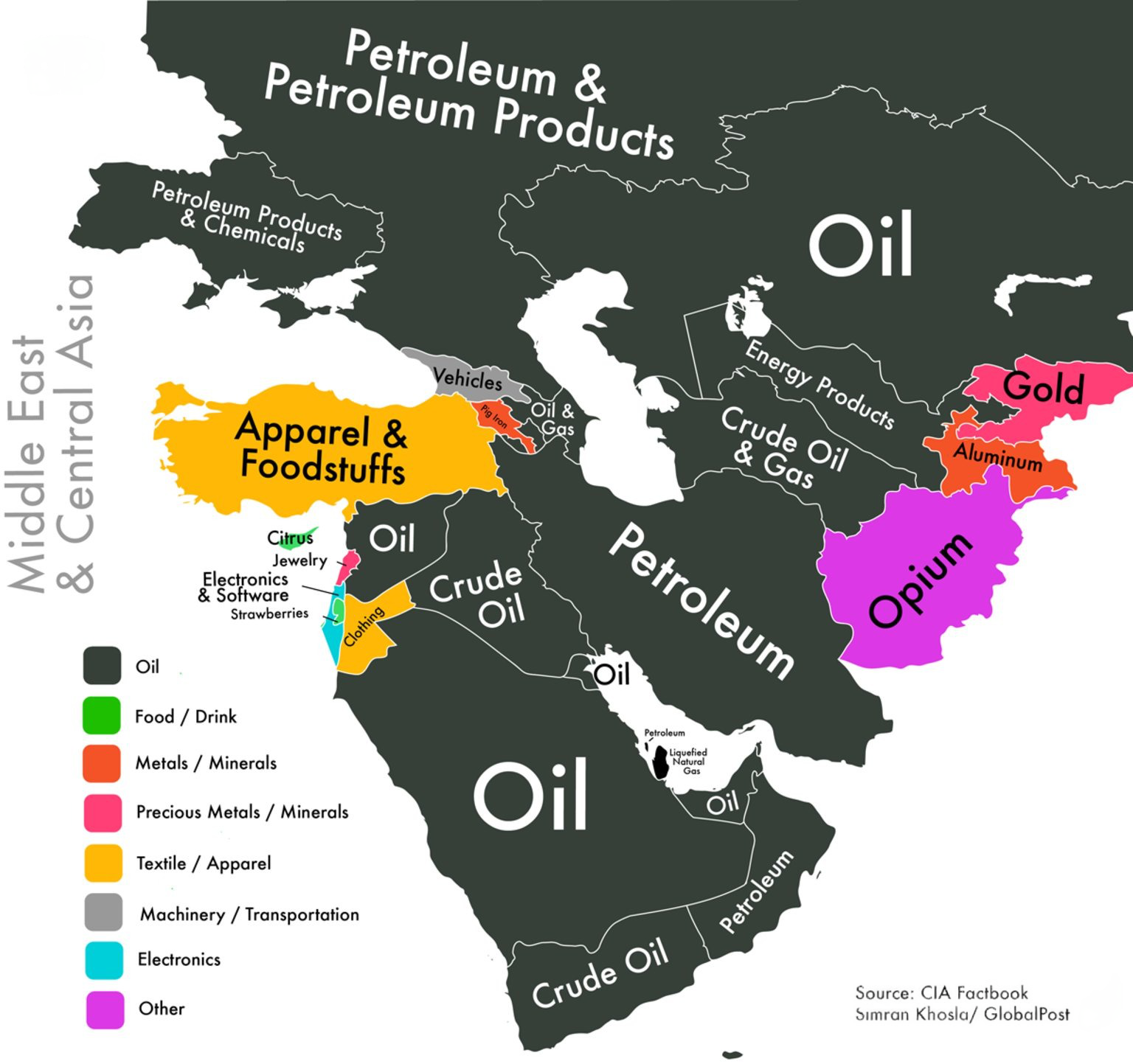

To understand how tax havens generate revenue, let's classify these nations into three categories: Island Nations, Gulf Nations, and Western Nations, offering a clearer insight into their financial strategies.

_1705848943.png)

How do the Island Nations generate their revenue?

Island nations, often reliant on tourism, have unique economic structures fueled by various revenue streams. Typically found in the Caribbean or as former European colonies their appeal lies in the zero-tax promoting, attracting both foreign investors and tourists who seek to establish businesses and generate revenue through various means. These methods encompass indirect taxes, tourism income, licensing fees, citizenship through investment, property taxes, and departure levies. Here's a breakdown:

-

Indirect Taxes: These encompass GST, VAT, and customs duties—taxes linked to consumption. Increased spending directly correlates to higher taxes. Customs duties are imposed on imports, meaning countries heavily reliant on imports bear a substantial tax burden.

-

Tourist Revenues: Take the Bahamas, for instance. Hosting 6.6 million tourists in just nine months illustrates the significant revenue potential. Tourists, whether staying in huts or Airbnb, contribute via property taxes during their stays.

-

License and Registration Fees: For foreigners establishing businesses in these tax-friendly nations, fees for licenses and registrations are customary.

-

Citizenship by Investment: Caribbean nations often offer citizenship through investment schemes. These programs necessitate investment in real estate or donations to specific funds. For instance, in Dominica, individuals can secure citizenship by investing substantial amounts in government-approved real estate or by contributing to the Economic Welfare Fund, contributing significantly to Dominica's budget.

-

Property Tax: This tax is linked to the purchase price of real estate. In citizenship by investment programs, individuals have the option to buy properties, leading to taxes being levied on these acquired assets.

-

Departure Taxes: Common in tourist-dependent nations, departure taxes are charged when tourists leave the country. Some countries incorporate this tax within the hotel bills.

Despite diverse income sources, most island nations primarily rely on GST (Goods and Services Tax) for revenue. This tax, embedded within prices, constitutes a significant portion of their earnings. Its inclusion in restaurant goods minimizes tax evasion but drives up costs for consumers. Think who shoulders this GST burden, it's everyday citizens and tourists, enticed by the prospect of a tax-free experience when visiting such places.

How do the Gulf countries generate their revenue?

Gulf countries, situated in the Middle East like UAE, Saudi Arabia, Qatar, Kuwait, Bahrain, and Oman, operate distinct financial systems.

Unlike many nations, they refrain from levying income, wealth, inheritance, or capital gains taxes on their citizens and foreign workers. Yep, zero tax on personal income, meaning your salary remains untouched if you're employed there.

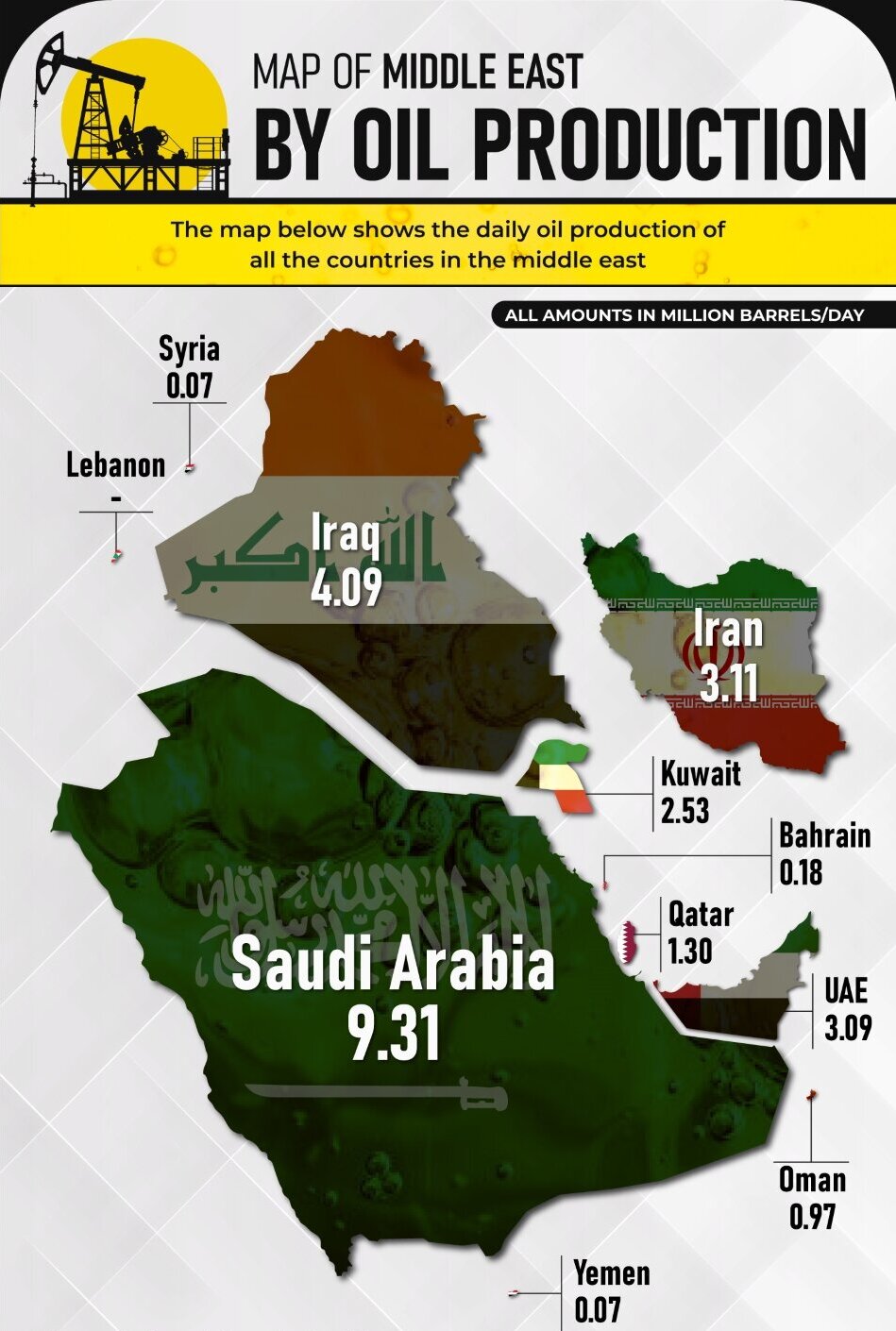

Oil is the big money-spinner for UAE and Saudi Arabia, garnering profits ranging from 50% to 80% from extraction. Recently, the UAE introduced a corporate tax policy where companies earning more than 3,75,000 dirhams (around Rs 85,00,000) face a 9% income tax, considerably lower than India's corporate tax of 25% and a hefty 40% tax for foreign companies.

The Gulf's strategy is simple: tax industries profiting from oil-related ventures while offering tax breaks to individuals. Beyond income tax, other levies exist: Bahrain imposes a seven to ten per cent tax on rental income, Saudi Arabia imposes a five per cent tax on real estate transactions, and foreign banks face a 20% tax in UAE.

These nations operate differently—they're not democracies but rather governed by royal families. They boast wealthy royal families capable of funding grand projects like Saudi Arabia's Neom and Dubai's Burj Khalifa from their personal finances. Their relatively small populations and high incomes enable these countries to sustain themselves with lower tax rates.

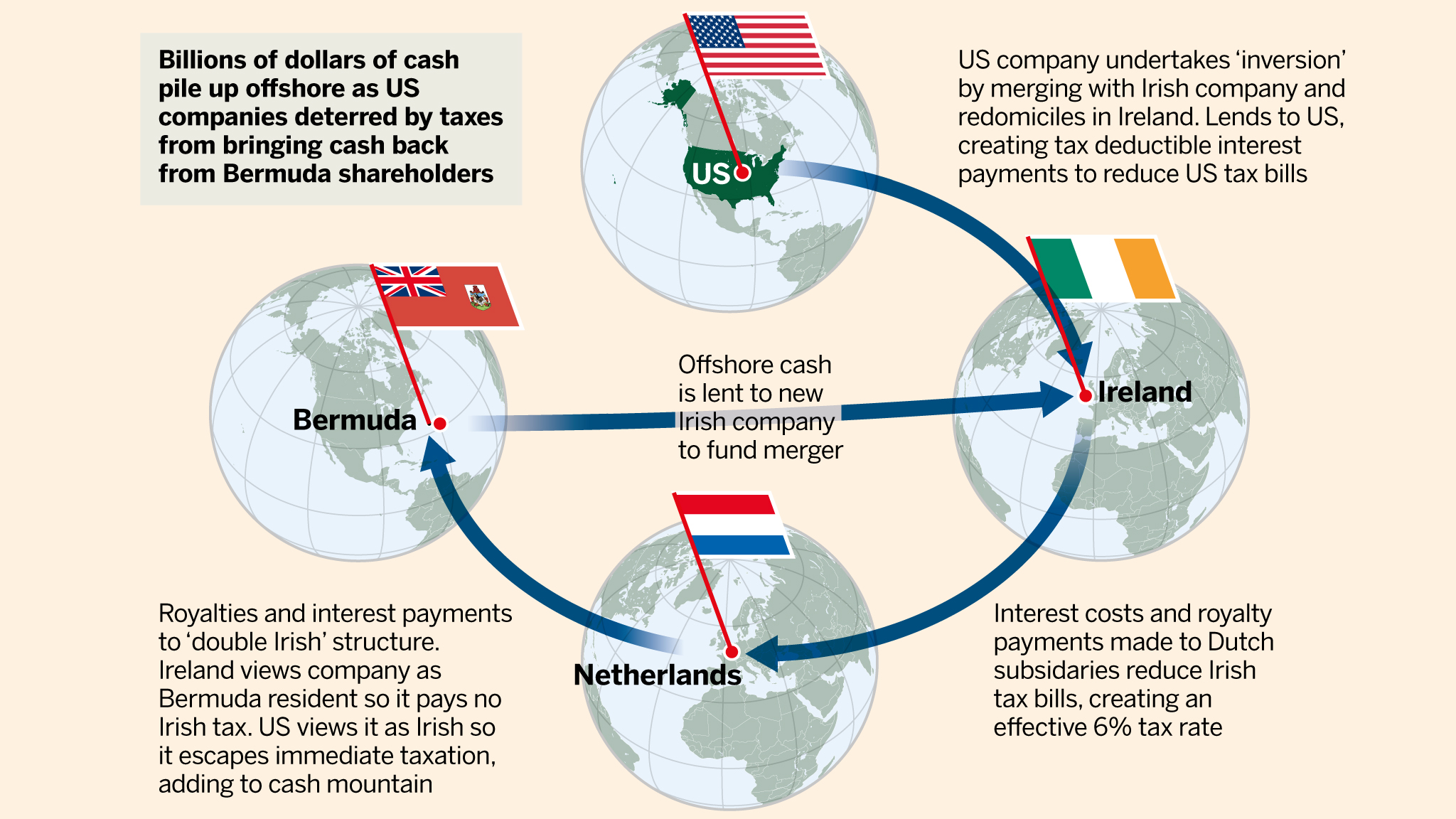

How do the Western Nations generate their revenue?

Several developed Western nations, including Ireland, the Netherlands, and the USA, offer selective tax exemptions on specific types of income, rendering them attractive options for businesses. While some US states waive income tax, they compensate through property taxes, along with levies on alcohol and cigarettes. Ireland, while not entirely tax-free, imposes a 12.5% corporate tax and exempts certain incomes.

Big corporations like Google and Apple take advantage of this by establishing offices in countries like Ireland and shifting their intellectual properties there. This setup routes their profits through jurisdictions like Bermuda, where a small company holds their rights and receives 80% of the profits as royalties. While this practice seems like these corporations are allowing a Bermuda-based company to manage their rights, it's essentially a method to exploit tax laws, albeit legally.

While this process might be seen as a loophole, it remains within legal boundaries. If these companies attempt to repatriate these profits to the US, they'd incur taxes. As a result, a significant portion of the revenue generated by these major American companies remains in the countries where they've established offices, contributing to the growth of nations like Ireland while facilitating higher-paying jobs in these regions.

“The hardest thing in the world to understand is the income tax - Albert Einstein”

Consequences of Zero income tax:

In India, there are three distinct categories of individuals:

-

Category 1: Those who earn and spend within India (the general public).

-

Category 2: Those who earn outside India, repatriate funds to India and contribute to the country's growth (NRIs).

-

Category 3: Those who earn in India but repatriate money abroad, including multinational corporations (MNCs) and others.

The taxation system is designed to encompass all three categories. Income Tax addresses the financial activities of the first and third groups, while Indirect Taxes cover the first and second groups.

If we were to eliminate Income Tax, several consequences would unfold:

Arguments in favour of Income Tax Abolition:

-

Abolishing income tax would enhance spending power, resulting in increased demand, heightened manufacturing and production, and subsequently, more job opportunities. In a rapidly growing economy, income tax often leads to evasion, as individuals hesitate to declare their actual income. Removing income tax would eliminate the need for such evasion.

-

The elimination of income tax would provide a stronger motivation for work, as a significant portion of one's salary or business profits is currently allocated to taxes, with little transparency regarding its utilization.

-

Abolishing income tax could serve as a means to repatriate funds hidden in tax havens, addressing the issue of black money. The staggering amount of approximately Rs 120 trillion, or 60 times the revenue from tax collection, currently stashed in overseas tax havens could be brought back, eliminating the problems associated with black money.

-

The absence of income tax would incentivize taxpayers to earn more without the fear of entering higher tax brackets or concealing their actual income.

-

According to tax experts and industrialists, the elimination of income tax is likely to reduce corruption. Taxpayers would be less inclined to engage in practices such as falsifying accounts, money laundering, and other illegal means of tax evasion.

-

Any revenue loss from income taxes could potentially be offset by higher value-added taxes, especially through mechanisms like the Goods and Services Tax (GST). Moreover, there is an ongoing discussion about replacing the income tax with an expenditure tax, where funds flowing out of bank accounts would be taxed—a viable strategy to gradually address the revenue gap.

On a lighter note, one of the most difficult and lengthy subjects shall be removed from the curriculum of CA students. Such a relief!

Arguments against Income Tax Abolition:

-

Increased Burden of Indirect Taxes: To compensate for the revenue shortfall from direct taxes, the government would likely raise the Goods and Services Tax (GST). This would disproportionately impact the general public (Category 1), as they would bear the tax burden currently shouldered by the third category. Moreover, both rich and poor individuals would be subject to the same tax rate, exacerbating income inequalities.

-

More repatriation of amount from India: Without taxes on their income, the third category (MNCs and others) would exploit the country's resources, paying minimal wages and interest rates. They would cut expenses and repatriate substantial profits to their home countries. This could lead to a reduction in economic activity and employment generated by this sector, ultimately resulting in the exploitation of the Indian economy.

-

Less repatriation of money in India: With higher taxes on expenses, individuals may be reluctant to bring their money to India unless necessary. This reluctance could have a detrimental impact on the country's economy.

The drawbacks associated with the absence of taxation are noteworthy. Income tax, being progressive, ensures that the wealthy contribute a fair share to benefit society, particularly aiding the vulnerable sections incapable of bearing direct tax burdens. Furthermore, the absence of direct taxes could exacerbate income inequality. The wealthy would continue to amass wealth without the obligation of paying direct taxes, while the burden of indirect taxes would disproportionately affect the poor and the middle class.

In contrast, indirect taxes exhibit a regressive nature, following the principle of "YOU BUY, YOU PAY." Eliminating direct taxes could lead to a substantial increase in prices for common people, as the government might seek to compensate by imposing higher taxes on consumer goods. This, in turn, would adversely impact consumers.

While acknowledging the burdensome nature of taxes, it's crucial to recognize their importance for the greater good. Abolishing Income Tax could potentially wreak havoc on the Indian economy, adversely affecting the citizens who would bear the brunt of such a decision.

It is crucial to note that these considerations are based on hypothetical scenarios. In a country like India, characterized by a large population and significant income disparity between the rich and the poor, achieving a tax-free system may prove challenging.

Incomes which are tax-free in India:

There are various types of tax-free income in India. Let’s have a glimpse at those sources:

1. Agriculture Income: Given India's agrarian economy, the government exempts agricultural income from taxation. This encompasses activities such as cultivation, processing, and sale of crops, as well as revenue from leasing agricultural land or structures and gains from agricultural land transactions.

2. Partnership Firm Profit: Income generated by a partnership firm is subject to entity-level taxation. However, partners receive their share of income after taxation, and they are not required to pay additional income tax on their individual portions.

3. Individual Share from HUF: Hindu Undivided Family (HUF) is a taxable entity that pays income tax on its earnings. Once taxed, the remaining earnings are distributed to its members, who are then exempt from income tax on these distributions.

4. Interest Income from NRE Accounts: Non-Resident Indians (NRIs) can invest in India through Non-Resident External (NRE) accounts. Interest earned on NRE deposits is tax-free, and funds can be transferred to the NRI's country of residence.

5. Capital Gains: Certain capital gains are non-taxable for Indian individuals, including compensation for forcibly acquired urban agricultural land and capital gains under specific schemes like the Andhra Pradesh Capital City Land Pooling Scheme.

6. Scholarships: Government and private institutions offer tax-free scholarships to students pursuing their studies, as per the provisions of the Income Tax Act.

7. Gratuity: Gratuity provided by employers to employees after retirement or death is partially or fully exempt from tax, depending on the type of employment.

8. Income from Provident Fund: Contributions to provident funds made by employees are tax-free upon retirement, provided the employee has actively contributed for more than 5 years.

9. Leave Encashment: The amount received for leave encashment at retirement is partially tax-free, with different exemption limits for government and private sector employees.

10. Tax-Free Pension: Pensions from specific organizations, such as the UNO, and family pensions received by dependents are exempted from tax, subject to certain limits.

11. Voluntary Retirement: Amounts received on voluntary retirement before superannuation are exempted from tax, up to a specified limit.

12. Gifts from Relatives or Marriage Occasion: Gifts from relatives or on the occasion of marriage are exempt from tax. Gifts from non-relatives are exempt up to a certain limit.

13. Employer Allowances or Compensation: Certain allowances, like foreign allowances for Indian government employees working abroad, are exempt from tax. Compensation from PSU companies upon voluntary or superannuation retirement is also tax-exempt.

14. Insurance Maturity or Claims: Amounts received from insurance companies, including bonuses, are fully exempt from tax under Section 10(10D) of the Income Tax Act, 1961, applicable to maturity benefits and death benefits.

These exemptions are subject to specific conditions outlined in relevant tax laws.

Could India Thrive Without Taxation?

India, a land brimming with a myriad of taxes faces a critical question: Can it sustain itself without the revenue generated from taxes?

The fiscal structure of India relies significantly on these taxes. Removing income tax alone would result in a staggering deficit of Rs 16,50,000 crores. Presently, the income from various sources falls short by 44 per cent compared to national expenses, leading to reliance on loans to bridge this deficit. However, borrowing against future earnings merely accelerates financial strain, potentially leading to the country's bankruptcy. Eliminating income tax would not just create a void but cripple the nation.

So, what's the solution?

1. Expanding the Taxpayer Base

At present, a mere 6 per cent of India's colossal 1.42 billion population pays direct taxes. This burden falls disproportionately on this small segment. Is this fair? One of the reasons why many Indians leave India is because of taxes and not good facilities. Broadening the tax base is crucial to alleviate the burden on the current taxpayers.

-

Taxing the agriculture sector to some extent

Agriculture is a contentious issue—while numerous farmers struggle, there are also those with substantial wealth and assets. Imposing taxes on agricultural income above a certain threshold, say Rs 1 crore, could be a viable approach. This move would exempt many small farmers while ensuring a fair contribution from those with substantial incomes. Controversial as it may be, this shift could involve a significant portion of the population, given that 58% are engaged in agriculture-related work according to the TOI report.

-

Taxing Unorganized Sectors

Taxation measures should extend to unorganized sectors where individuals earn substantial profits exceeding 15 lakhs yearly. From street vendors to small-scale shop owners, levying taxes ensures a fair contribution.

2. Citizenship through Investment

Reducing the tax load on citizens requires alternative revenue streams. Consider the model of countries like Cambodia, which offers citizenship through investment. India has its own paradises, like Lakshadweep and Andaman, yet to be fully explored. By turning these areas into attractive hubs for foreign investors and travellers, and offering reduced taxes akin to those in developed nations, revenue could surge.

Who doesn’t dream of working far from the hustle and bustle of city life in mountains/hills/beaches? Here comes the latest and welcoming trend WORKATION.

Developing top-notch infrastructure in these regions could create special investment zones, drawing in global travellers, remote workers, and content creators, thereby boosting the country's income. The recent introduction of broadband internet in Andaman (2020) adds to the appeal.

3. Managing Expenditure

The trend of luring votes by promising freebies—free electricity, ration, vaccines—must be scrutinized strictly. These handouts ultimately derive from taxpayers' pockets. Scams like: The Coalgate scam, the 2G Spectrum scam, the Commonwealth Games Scam, and a recent incident, like the Bihar bridge collapse causing a loss of 1700 crores, highlight the repercussions of misallocated funds.

_1706019890.jpg)

4. Impose taxes on income and wealth, not on the type of job

Taxation based on income and wealth rather than the type of profession ensures fair contributions from individuals across various fields. For instance, a progressive tax system could levy higher taxes on higher-income brackets regardless of whether the earnings are from a corporate executive or a successful entrepreneur, ensuring equitable contributions towards societal needs based on financial capacity.

This approach ensures that individuals engaged in various forms of work, such as entrepreneurs, investors, or traditional employees, contribute equitably to public services and societal welfare based on their financial capacity, rather than the specific nature of their occupations.

So, is paying taxes is the root problem? No! The issue isn’t paying high taxes but the mismanagement of funds.

After all, taxes are like a subscription to your country which you can’t cancel no matter how bad the service gets.

Taxes are an essential evil due to natural resources, a vast population, and systemic challenges. Removing taxes isn't possible as every country, irrespective of policy, relies on direct or indirect taxation. However, effective governance and resource management are pivotal to ensuring that taxpayer money is used judiciously.

Hence, rather than whining about not paying taxes and being a member of a tax evasion club, let’s make a fair share of contribution to our country’s development. However, let's also exercise responsibility by questioning the use or misuse of our tax funds.

Perhaps one of us alone might not make a huge impact, but each of us individually can certainly make a significant difference.