India’s largest IT services firm, Tata Consultancy Services (TCS), has seen its market value plunge dramatically following the United States administration’s new H-1B visa rules. The stock tumbled to a 52-week low of ₹2,958 on Thursday, 25 September 2025, leaving investors anxious about the long-term implications for the company’s overseas business model. At its peak on 13 December last year, TCS had traded at ₹4,494. Since then, the stock has shed around 35 per cent of its value, wiping out ₹2,99,661.36 crore in market capitalisation. The fall has made it the single worst performer on the Nifty IT index during this period, reflecting both company-specific challenges and wider concerns for the sector.

H-1B Visa Concerns Cast a Long Shadow

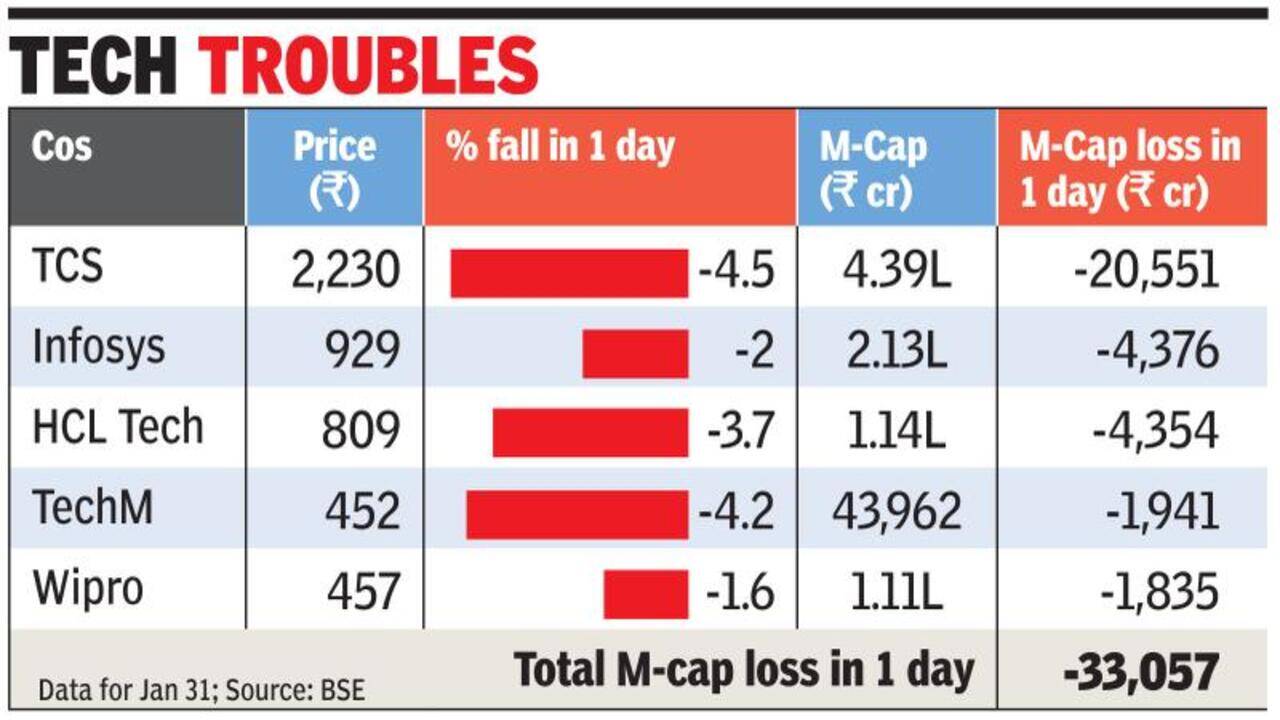

The immediate trigger for the sell-off has been Washington’s tightening of H-1B visa regulations. The new rules are expected to make it harder and more expensive for Indian IT companies to send employees onsite to work for American clients. With TCS and its peers heavily reliant on this model for high-value contracts, investors have been quick to reassess growth prospects. The announcement has sent ripples across the industry, wiping out nearly ₹2 lakh crore in market capitalisation from Indian IT giants within days. For TCS, the fall is particularly steep given its status as the bellwether of the sector and its reputation for steady growth.

Technical Signals Point to an Oversold Market

From a technical perspective, TCS shares are now trading below all major moving averages, including the 50-day DMA of ₹3,090. The Relative Strength Index (RSI) stands at 32, hovering just above the oversold threshold of 30. Analysts suggest that while the fundamentals appear challenged in the short term, such readings often precede a technical rebound.

Brokerages Remain Cautiously Optimistic

Despite the rout, global brokerages continue to express confidence in TCS’s underlying business model. JPMorgan, for instance, reiterated its positive stance in mid-August, upgrading the stock to “overweight” and raising its price target to ₹3,800. The firm argued that the current valuations are compelling: TCS is trading at a two-year forward price-to-earnings multiple of 19.7x, a full two standard deviations below its five-year average. According to JPMorgan, the company’s fundamentals remain robust, with expectations of a growth recovery in the second half of FY2026 once the sector adjusts to the new visa landscape and global demand stabilises.

The broader analyst community also remains tilted towards optimism. Of the 52 analysts covering the stock, 33 recommend buying, 13 suggest holding, and only 6 advise selling. Current trading levels are close to the lowest price targets on the market — Citi has set a floor of ₹2,850, while Morningstar sees potential downside to ₹2,620 — suggesting that the stock may not have much further to fall in the near term.

)

The sell-off in TCS highlights the vulnerability of India’s IT industry to shifts in US immigration policy. For decades, the H-1B visa programme has underpinned the outsourcing model, enabling companies to deploy Indian talent directly at client locations abroad. Stricter rules now force firms to rethink delivery strategies, invest in local hiring, and accelerate digital automation. While this may dampen margins in the short run, companies like TCS with deep client relationships, scale advantages, and robust offshore delivery networks are arguably better placed to navigate the transition. For long-term investors, the current crisis may eventually be remembered as a period of painful adjustment rather than structural decline. TCS’s market value erosion of nearly ₹3 lakh crore in less than a year has rattled investors and cast a shadow on the sector. Yet, with most analysts maintaining a positive outlook and the company continuing to command strong fundamentals, there are signs that the worst of the panic may already be priced in. The coming quarters will reveal whether TCS can stabilise and reclaim investor confidence — or whether the H-1B shock represents a more enduring threat to India’s flagship IT industry.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved. Powered by Vygr Media.