-

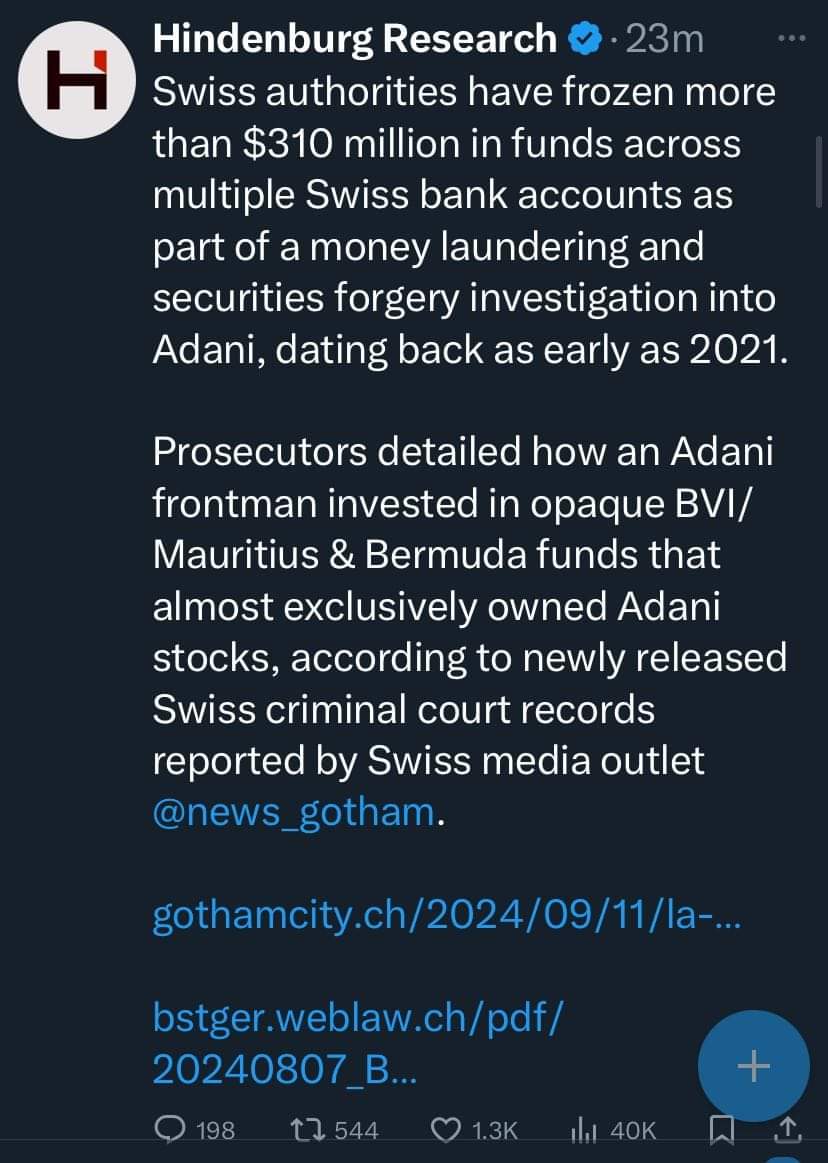

Funds Frozen: Swiss authorities froze $310 million linked to an alleged Adani associate amid money laundering and forgery investigations.

-

Financial Misconduct Claims: Hindenburg Research alleges investments in opaque offshore funds primarily holding Adani stocks.

-

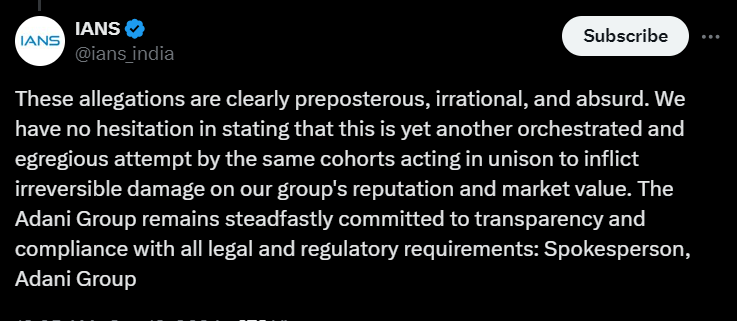

Adani Denies Allegations: The Adani group denies any involvement in Swiss court proceedings or asset freezes.

-

Ongoing Swiss Probe: Swiss courts confirmed an ongoing investigation into alleged Adani-linked financial misconduct since 2021.

-

Asset Freeze Justified: The Swiss court upheld the freeze, citing the complex and international nature of the case.

-

Opaque Investments Reported: OCCRP previously reported hidden investments in Adani stocks through offshore funds, violating Indian laws.

-

Stock Manipulation Alleged: Hindenburg claims the Adani group used offshore entities for stock manipulation and undisclosed transactions.

-

Supreme Court Ruling: India’s Supreme Court refused to form a special probe, citing insufficient evidence beyond media reports.

Image Source - X

A report cited by US short-seller Hindenburg Research from Swiss media outlet Gotham City said more than $310 million in funds had been frozen by Swiss authorities across various banks. The use of offshore shell companies includes 38 entities in Mauritius and others in the UAE, Cyprus, Singapore, and Caribbean islands, controlled by However, the Adani group has strongly denied the charges. Whereas Swiss criminal courts do not name involved parties, descriptions contained in court documents, combined with subsequent reporting from the Financial Times, suggest connections to the Adani group and its alleged associate, Taiwanese businessman Chang Chung-Ling.

Allegations of Investments in Opaque Funds

In a thread on X, Hindenburg Research explained how a close associate of Adani had assumed stakes in some obscure funds based in the British Virgin Islands, Mauritius, and Bermuda, which were heavily loaded with Adani stock. Damning evidence of allegedly illegal financing implicates the Adani group, according to Swiss court records, as reported by Gotham City.

Adani Group Condemns all Allegations as Baseless

These, however, the Adani group has dismissed as unfounded. Its spokesperson said to IANS: We categorically deny and reject the unwarranted allegations made.

The Adani group has no relation whatsoever with any Swiss court case, nor has any of our company accounts been attached or sequestered by any agency." The spokesperson said the overseas holding structure of the group is fully transparent and disclosed and in full compliance with all laws.

Details of Swiss Court Ruling on Investigation

The report from Gotham City further shows that an order of the Swiss Federal Criminal Court (TPF) exposed that long before initial allegations by Hindenburg Research, the Geneva public prosecutor's office was investigating alleged financial misconduct linked to Adani. The court had confirmed the sequestration of over $310 million linked to an alleged frontman of billionaire Gautam Adani in five Swiss banks. The Swiss Federal Prosecutor's office reopened the investigation after the case drew media attention.

Image Source - X

Court of Appeal's Observations on Freezing of Assets

The Swiss court order, while stating that the asset freeze needs to be proportionate in amount, duration, and relevance regarding the investigation, made an observation that because the case was so complex, the exact amount of the allegedly unlawful assets has not been determined. The court considered it proportionate for the office of the Attorney General of Switzerland to seize all assets of the concerned individual because a compensatory claim may be issued later on. Therefore, the court held that the length of the sequestrations, which, for some of them, extend to two and a half years does not violate any principle of proportionality.

Links with Previous Allegations and Financial Misconduct

OCCRP is an investigative journalism network that earlier reported hundreds of millions were invested in Adani group stocks through Mauritius-domiciled funds that appeared to be specifically set up to mask the involvement of Adani family associates. The investigation further claimed that two Adani insiders, Nasser Ali Shaban Ahli of the UAE and Chang Chung-Ling, wrongly were viewed as public investors when both had been tied to the Adani Group and, therefore, Indian statutes. Here are the broader Hindenburg allegations against the Adani Group in summary.

The Hindenburg Research report accused the Adani group of being involved in manipulating share prices, non-disclosure of related-party transactions, and other securities law violations. The use of offshore shell companies includes 38 entities in Mauritius and others in the UAE, Cyprus, Singapore, and Caribbean islands, controlled by Vinod Adani-an elder brother of Gautam Adani.

_1726220594.avif)

Image Source - Business Standard

Supreme Court Stance on Adani-Hindenburg Controversy

In January 2024, the Supreme Court of India rejected demands to constitute a special investigation team or expert group to probe the Adani-Hindenburg controversy, citing that reports in the media and findings by third-party agencies were inadequate to whisk up demands for further investigation. The Court has underlined that these reports may be taken as input, not as final evidence to discredit the investigation report of the SEBI, which is still conducting its investigation.

Inputs by Business Standard and Moneylife

Image Source: Multiple Agencies

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.