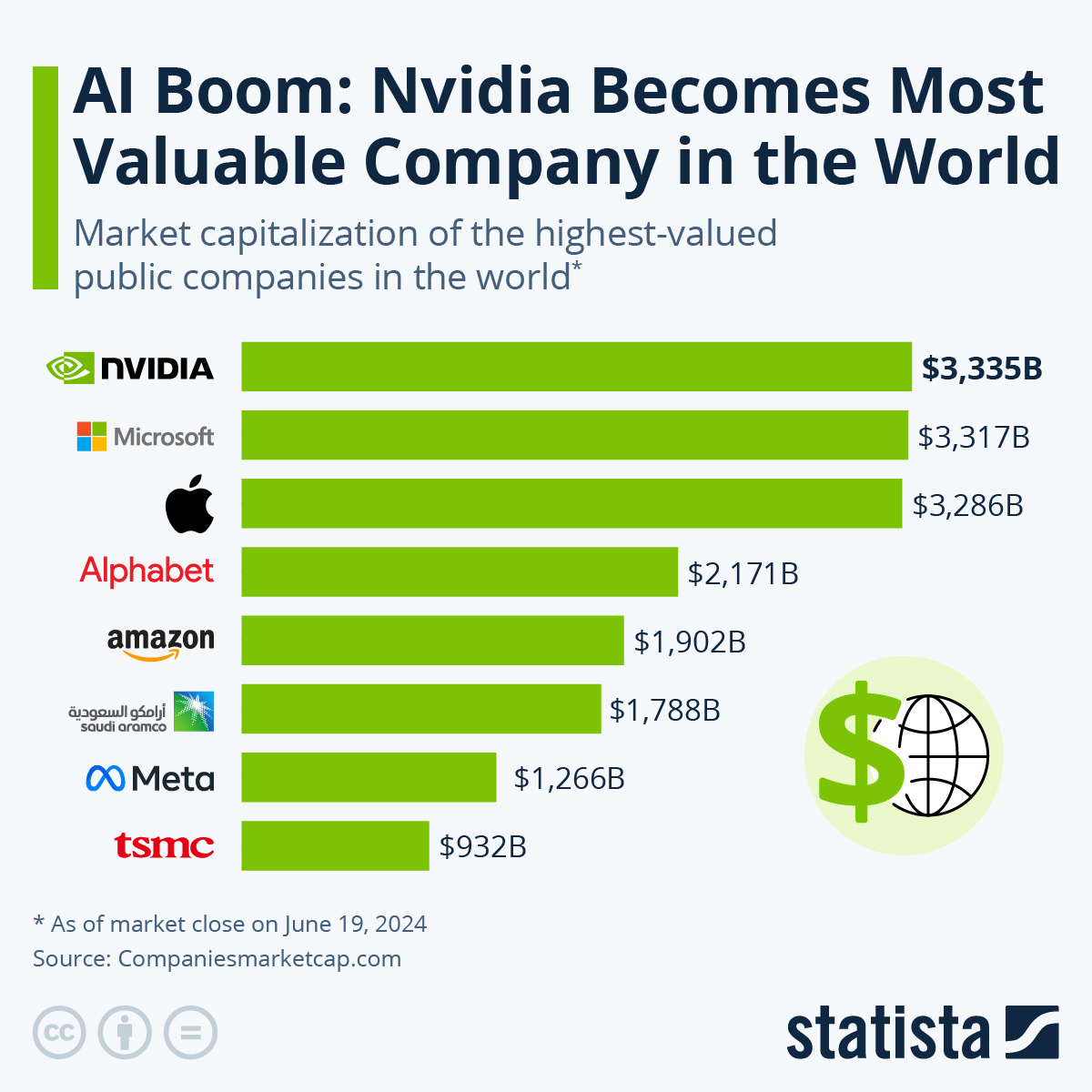

In a remarkable turn of events, NVIDIA has overtaken Apple and Microsoft to become the world’s most valuable company. On Tuesday, NVIDIA's shares surged by 3.2 percent, reaching $135.21 and boosting its market capitalization to an astounding $3.34 trillion, surpassing Microsoft's $3.32 trillion and Apple's $3.29 trillion.

The Surge in NVIDIA's Stock

NVIDIA's stock has experienced a phenomenal rise this year, with shares skyrocketing by about 173 percent, a stark contrast to Microsoft's 19 percent increase. This surge is driven by the soaring demand for NVIDIA’s advanced processors, which are central to the ongoing race to dominate artificial intelligence (AI) technology. On Tuesday alone, NVIDIA's stock climbed 3.5 percent to $135.58, lifting its market capitalization to $3.335 trillion, and cementing its position as the world's most valuable company.

Historical Milestones and Market Dynamics

NVIDIA's journey to the top has been marked by significant milestones. The company's market value expanded from $1 trillion to $2 trillion in just nine months in February, and it took just over three months to hit $3 trillion in June. NVIDIA's rally has lifted the S&P 500 and Nasdaq to record highs, though some investors express concern over the unbridled optimism about AI potentially waning if spending on the technology slows down.

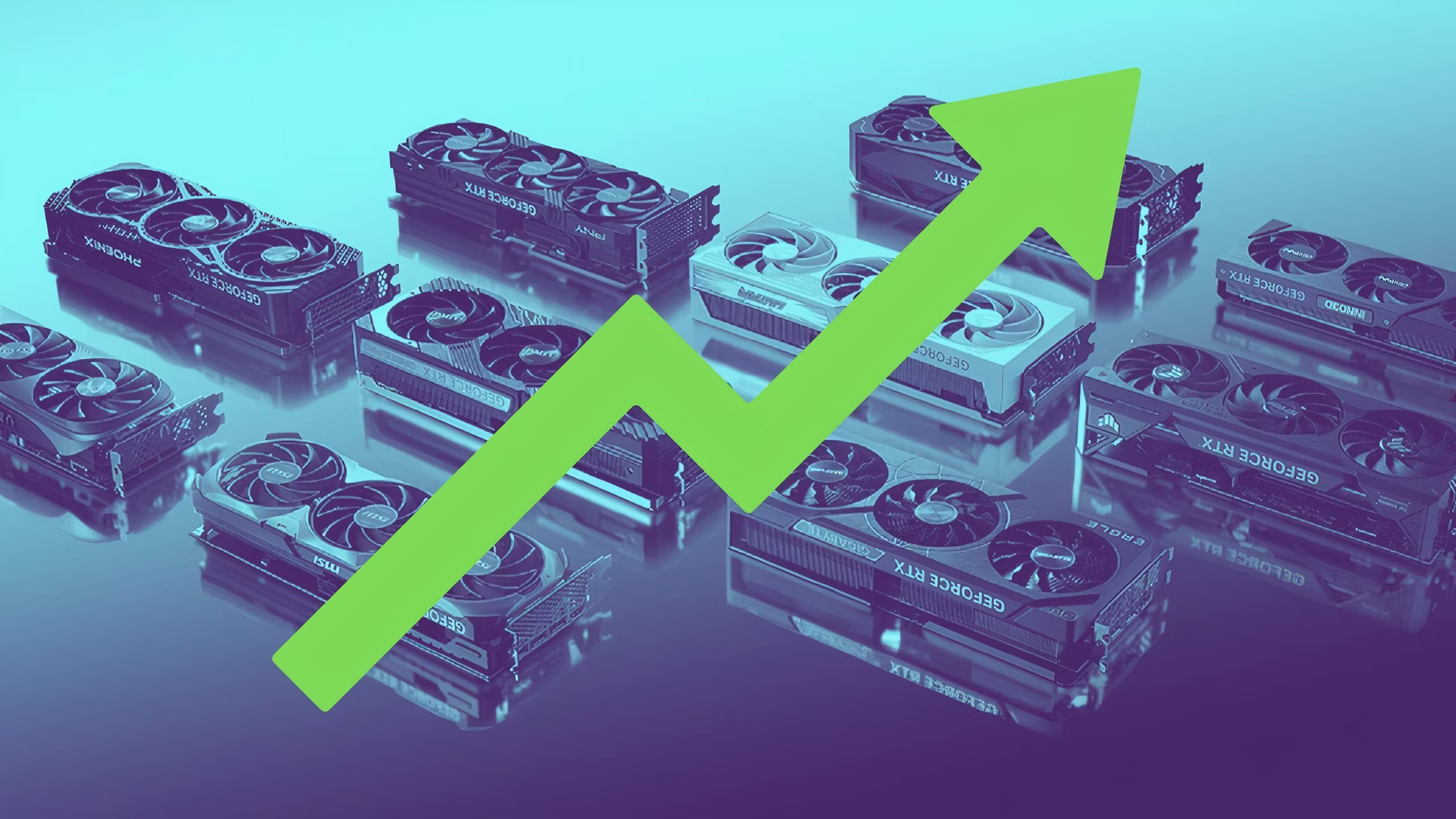

NVIDIA's Role in AI Technology

NVIDIA's advanced processors play a pivotal role in AI technology, with the company accounting for about 16 percent of all trading in S&P 500 companies. The demand for NVIDIA's AI processors considered far superior to competitors' offerings, has outpaced supply. This has led to NVIDIA becoming the most traded company on Wall Street, with daily turnover recently averaging $50 billion, compared to around $10 billion each for Apple, Microsoft, and Tesla.

The Competition and AI Revolution

Tech giants like Microsoft, Meta Platforms, and Alphabet are fiercely competing to enhance their AI capabilities, but NVIDIA remains at the forefront. The company's processors are essential for AI computing, and the soaring demand for these processors has led to a record high in NVIDIA's stock, adding over $110 billion to its market capitalization. The company has consistently exceeded Wall Street's lofty expectations for revenue and profit, with demand for its graphics processors far outstripping supply.

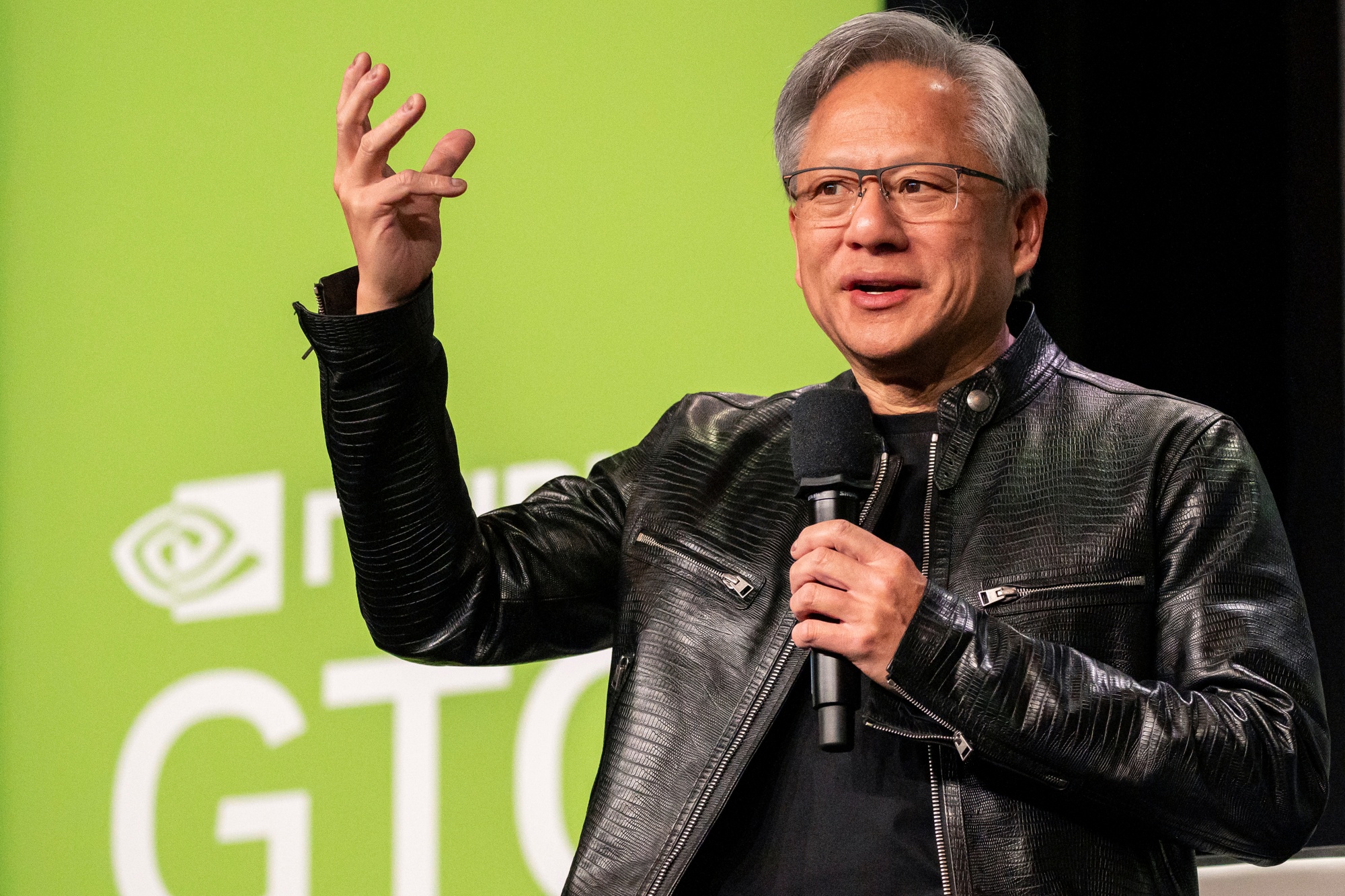

The Journey of NVIDIA

Founded in 1993, NVIDIA's journey to the top has been extraordinary. The company joined the S&P 500 in less than three years after debuting on the Nasdaq stock exchange in 1999. Since its initial public offering, NVIDIA's total return, including reinvested dividends, stands at an impressive 591,078 percent, making it one of the best-performing stocks of the last quarter-century. Despite experiencing significant value drops on several occasions, NVIDIA's strategic focus on graphics chips and the vision of co-founder and CEO Jensen Huang have driven its success.

Impact of OpenAI and Cryptocurrency

NVIDIA's rise is significantly attributed to the release of OpenAI’s ChatGPT in late 2022, which led to a surge in orders for NVIDIA’s chips. Additionally, the cryptocurrency boom played a crucial role in NVIDIA's ascent, with crypto miners and GPU scalpers driving up demand for NVIDIA’s GPUs. This trend significantly contributed to NVIDIA's stock rally during numerous crypto rushes.

Regulatory Scrutiny and Market Dominance

As NVIDIA and Microsoft solidify their positions in the AI revolution, they face increasing scrutiny from competition authorities. The US Department of Justice (DOJ) and the Federal Trade Commission (FTC) have reached a deal to investigate the firms' dominant positions in the AI space. The FTC will focus on the relationship between Microsoft and OpenAI, while the DOJ will investigate NVIDIA's competitive edge in the AI semiconductor market, where the chipmaker holds around 80 percent market share.

Smaller Players and Market Influence

Regulators believe that smaller players are being forced into exclusive deals to run technology from dominant companies like NVIDIA and Microsoft. This dynamic raises concerns about innovation and market competition. Recent mergers, such as Microsoft's $650 million acquisition of Inflection AI, are likely to be probed to ensure fair market practices.

The Broader Impact on the Tech Industry

The increased scrutiny on tech giants is already affecting the sector. Mergers and acquisitions hit a multi-year low last year, with the value of all buyouts falling below $300 billion. The tech giants are becoming increasingly cautious about acquiring promising startups, impacting the ecosystem where many startups aim to be acquired. This ongoing regulatory scrutiny underscores the need for a balanced approach to ensure market competition and innovation.

Future Prospects: NVIDIA’s Historic Bull Run

Despite a recent dip, NVIDIA’s remarkable year is expected to continue, driven by the ongoing demand for AI technology. The Philadelphia SE Semiconductor Index, which tracks the performance of companies in the semiconductor industry, has reached record highs, reflecting strong market performance.

Analysts like Dan Ives from Wedbush Securities believe that the rise of AI technology will continue to benefit major tech companies, with established firms like Microsoft, Oracle, Dell, Amazon, Meta, Apple, and Google leveraging AI to enhance their market positions.

The competition among NVIDIA, Microsoft, and Apple to be the world’s most valuable companies highlights the rapidly evolving nature of the tech industry. As AI and semiconductor technology continue to drive market trends, the importance of innovation and strategic positioning in maintaining and enhancing market leadership cannot be overstated. The ongoing race among these tech giants underscores the critical role of technological advancements in shaping the future of the industry.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.