-

Historic Market Loss: Nvidia’s stock plunged 9.5% on Tuesday, marking a $279 billion loss in market capitalization—the largest single-day decline ever for a U.S. company.

-

Investor Sentiment Shifts: The stock drop reflects growing caution among investors about AI technology, which has been a major driver of stock market gains in 2024.

-

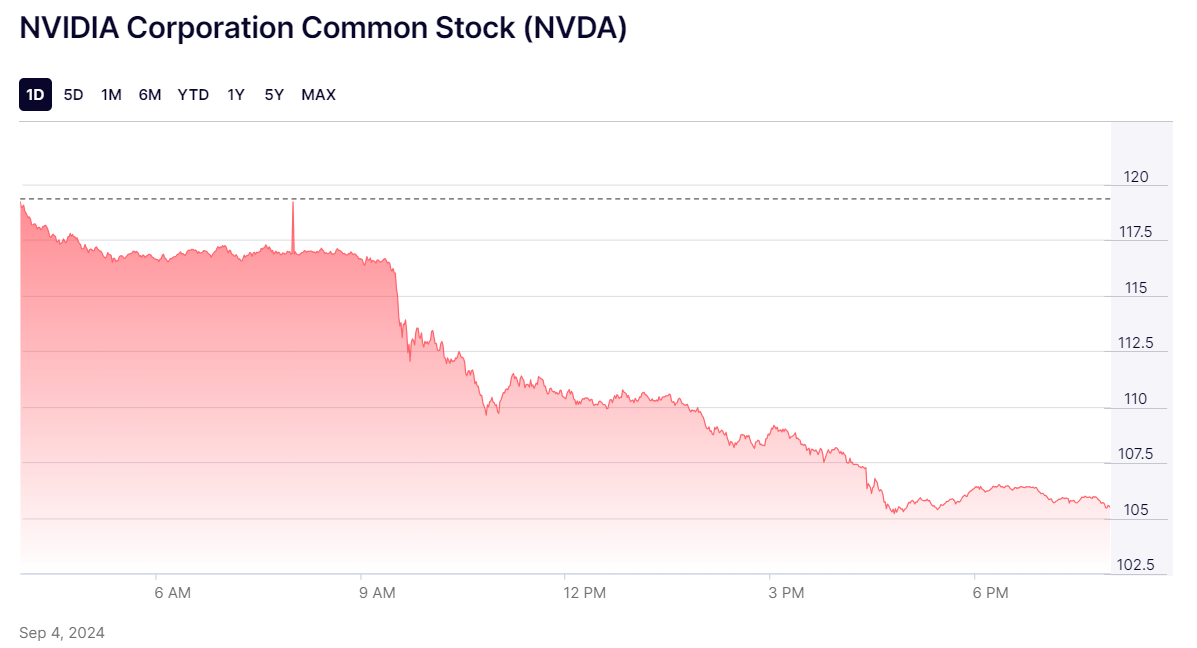

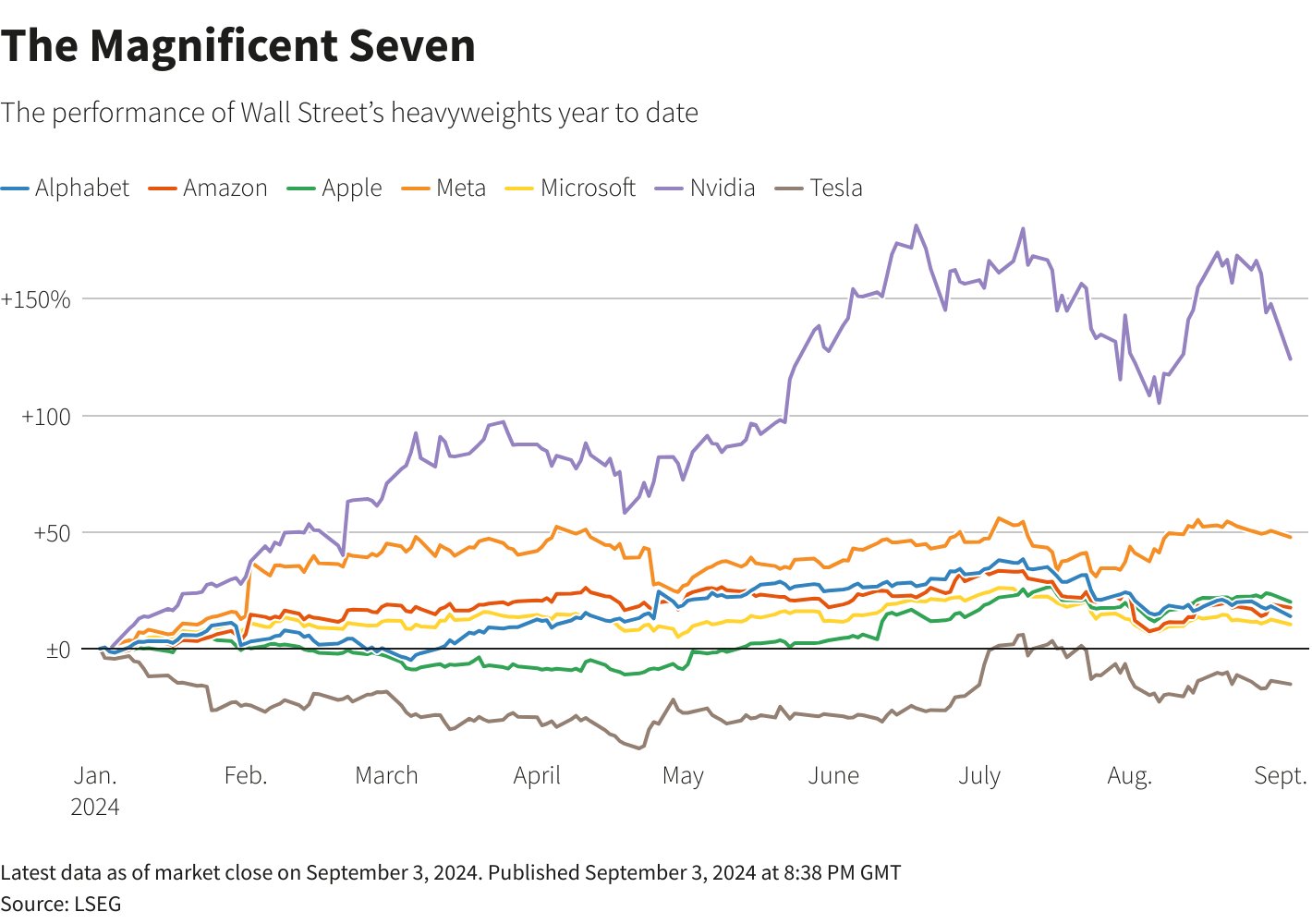

Earnings Disappointment: Nvidia’s shares have fallen 14% over three sessions since its latest earnings report failed to meet high expectations, despite still being up 118% year-to-date.

-

Valuation Adjustments: Nvidia is now trading at 34 times its expected earnings, down from over 40 in June, aligning with its two-year average.

-

Broader Market Impact: The decline in Nvidia shares was part of a broader tech selloff, with the PHLX semiconductor index dropping 7.75%, Nasdaq down 3.3%, and the S&P 500 falling 2.1%.

-

DOJ Antitrust Investigation: The U.S. Department of Justice has issued a subpoena to Nvidia as part of a deeper investigation into the company’s antitrust practices, with concerns over limiting competition in AI chip markets.

Image Source - Bloomberg

On Tuesday, September 3, shares in Nvidia shed close to 10%, which was the largest one-day loss of market value by a U.S. firm. Shares in the AI powerhouse fell 9.5% to $108 each, erasing 279 billion dollars in market capitalization, according to the reports. This dramatic sell-off is a function of the rising investor skepticism over the AI sector's single most dominant driver in this year's surge up the stock market stairs.

Image Source - Nasdaq

Investor Cautiousness on AI Ramps Up

The recent fall in Nvidia's stock shows how attitudes about AI have cooled for investors, even as the trend has powered major gains in the stock market this year. Shares of the chip maker are down 14% over the last three sessions after an earnings report that did little to inspire already lofty expectations. The losses mark a recent setback for Nvidia, whose stock is still up 118% year to date after nearly tripling earlier in the year to a July peak.

The loss marked a one-day market loss of $279 billion for Nvidia, beating the previous record by Meta Platforms of a $232 billion loss on Feb 3, 2022, after the company issued a disappointing financial forecast, according to LSEG ( London Stock Exchange Group) data.

Large-scale selloffs are concerning if Nvidia is largely to blame for the tech- and AI-fueled equity gains of the last 18 months.

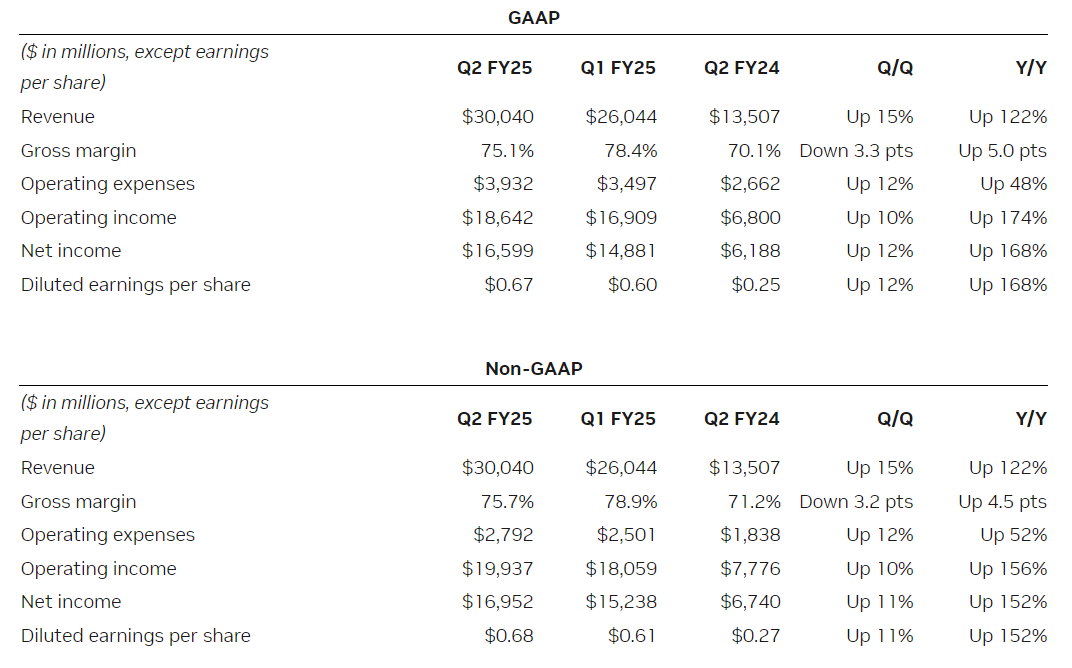

Valuation and Earnings Outlook

With the company's quarterly earnings last week, analysts have lifted their average estimate of net income for Nvidia for the year ending January 2025 to $70.35 billion from $68 billion before the report. The result: Nvidia is trading at 34 times its expected earnings, down from more than 40 times in June and in line with its two-year average.

NVIDIA- Fiscal 2025 Summary ( Image Source - NVIDIA)

Broad Market Selloff and Tech Stock Decline

Tuesday's sell-off in Nvidia shares was part of a broader market sell-off, as weak economic data weighed on the market. The PHLX semiconductor index slumped 7.75% in its worst one-day decline since 2020. Chip stocks took the forefront in a sea of red on Wall Street, with losses of 3.3% from the Nasdaq and 2.1% for the S&P 500.

Image Source - Bloomberg

US DOJ Investigates Nvidia's Antitrust Practices

The U.S. Department of Justice has escalated its probe into antitrust practices by Nvidia Corp. by issuing a subpoena. Antitrust regulators had earlier sent questionnaires and have now delivered legally binding requests for information. Other companies have also been subpoenaed, according to the report.

The probe focuses on concerns that Nvidia is suppressing competition by making it difficult for customers to switch to alternative suppliers and possibly punishing those customers who do not use its AI chips exclusively.

Inputs by Agencies

Image Source: Multiple Agencies

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.