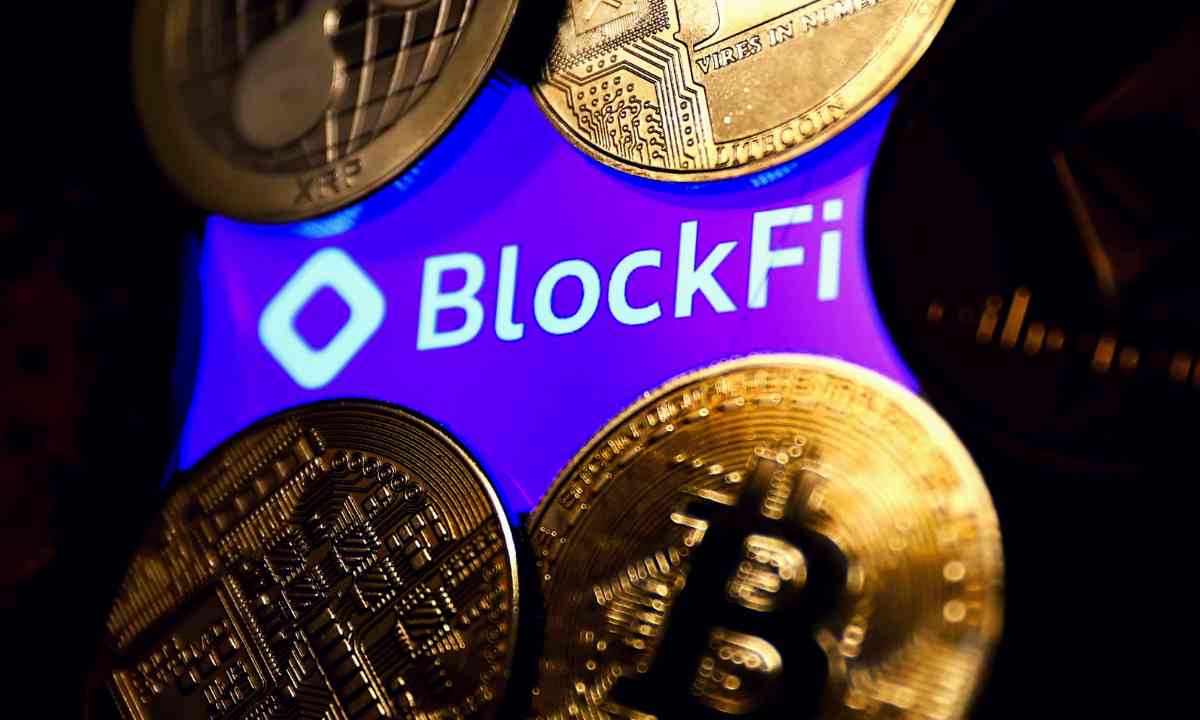

As the spectacular collapse of FTX continues to ripple throughout the sector, the beleaguered cryptocurrency company BlockFi has filed for bankruptcy in the US.

Due to "significant exposure" to FTX, the company has previously ceased the majority of platform activities.

In order to restructure, settle debts, and recover investment monies, BlockFi declared that it was seeking legal protection.

FTX offered BlockFi a rescue option as the value of cryptocurrencies dropped in the early months of this year.

But this month, FTX, a cryptocurrency exchange, experienced its own problems as consumers rushed to remove money from the platform due to worries about its financial stability.

The company declared bankruptcy after Sam Bankman-Fried, the supposed "crypto king" and the previous boss left.

The downturn has reduced trust in the cryptocurrency sector and drawn governmental scrutiny.

BlockFi, a business that offered loans and other financial services guaranteed by the cryptocurrency assets of its clients, described the demise of FTX as "shocking."

In a court declaration, New Jersey-based BlockFi alleged that the company had debts to more than 100,000 people. As its second-largest creditor, it named FTX, a cryptocurrency exchange with $275 million in debt from a loan made earlier this year.

The company now owes $30 million to the Securities and Exchange Commission, a US financial watchdog, after it was determined earlier this year that it had improperly registered its products and had misled the public over the risk levels in its loan portfolio and lending activity.

According to BlockFi, the company will be able to create a "reorganisation plan that maximises value for all stakeholders, including our valued clients," thanks to the Chapter 11 bankruptcy case.

The company said it had $257 million in cash on hand.

BlockFi expects an open process that produces the best result for all clients and other stakeholders. Since the company's founding, BlockFi has worked to develop the bitcoin industry. Mark Renzi, a financial consultant with Berkeley Research Group, said

The 2017 startup BlockFi took satisfaction in bridging the gap between cryptocurrencies and traditional financial products.

Recent investments in it totaling hundreds of millions of dollars have come from renowned IT investors like Bain Capital Ventures and Tiger Global. In 2021, as the value of cryptocurrencies increased, it asserted to be managing assets worth over $15 billion.

Recent investments in it totaling hundreds of millions of dollars have come from renowned IT investors like Bain Capital Ventures and Tiger Global. In 2017, when the value of cryptocurrencies increased, it claimed to handle more than $15 billion in assets.

It wasn't the only business that suffered after the early fall in cryptocurrency prices. The value of Bitcoin, the most well-known digital currency, dropped from more than $64,000 in January to less than $20,000 in June.

Voyager Digital and Celsius Network are two other companies that have already filed for bankruptcy.

© Vygr Media Private Limited 2022. All Rights Reserved.