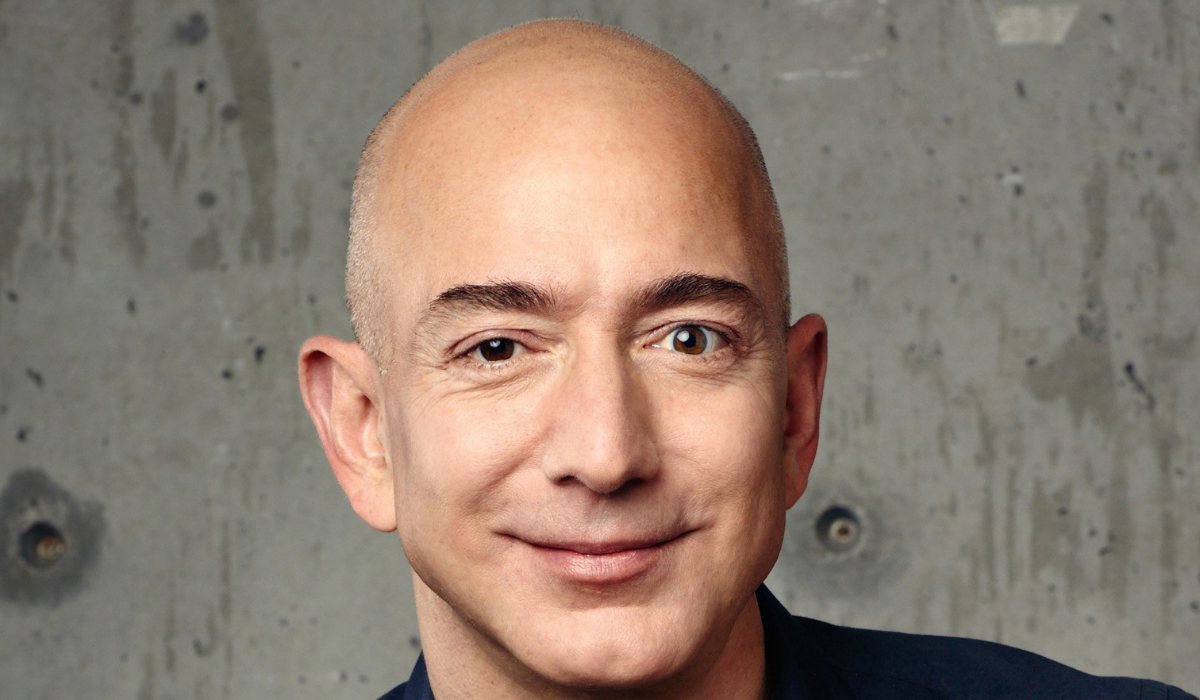

Jeff Bezos‘s Amazon recently hit a 52-week low losing 1 trillion dollars making it the first publicly traded U.S. company to land on this tragic milestone, said Bloomberg in its new valuation report. The article claims that this year's historic sell-off in the company's stock has been brought on by a mix of growing inflation, tightening monetary policies, and unimpressive earnings reports.

Its share price closed 4.3% lower, taking it to $879 billion from a high of $1.88 trillion in July 2021. According to Bloomberg, the top five US tech businesses by revenue have already seen evaporating about $4 trillion in market value this year as a result of growing inflation and instability in global conditions. It's not just Amazon that's losing money. Throughout the year there’s a sharp curving slowdown which has been seen as consumers are returning to pre-pandemic routines. This has also increased the fear of recession.

The company’s share has almost fallen by 50%, increasing prices and interest rates too. And the wealth of own Jeff came down by about $83 billion to $109 billion. It’s a worrying situation as the company is also firing its employees too.

Besides, some other sectors are suffering too, video streaming giants like Netflix are also trying to find some stability.

Although, According to Thursday's Wall Street Journal story, Amazon CEO Andy Jassy recently began a review of the company's cost-cutting procedures. It appears that this also entails reassigning staff and stopping or ending unsuccessful projects. Amazon is also closely examining its device division, which includes Alexa-enabled smart speakers.

© Vygr Media Private Limited 2022. All Rights Reserved.