Pursuing higher education in India often comes with significant financial challenges, especially for students who lack a steady income or fail to meet traditional education loan eligibility criteria. While education loans are tailored for academic financing, an increasing number of students are turning to personal loans due to their flexibility, faster processing, and minimal documentation requirements.

What Are Personal Loans for Students?

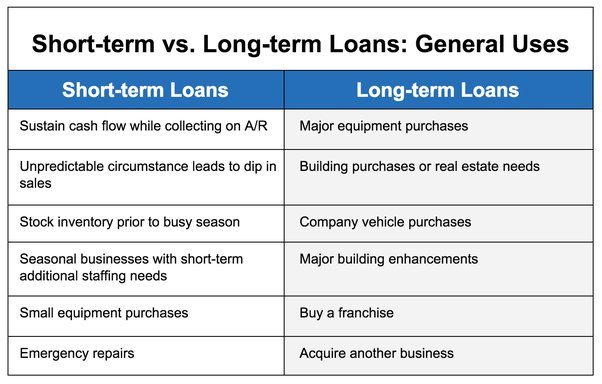

A personal loan is an unsecured loan offered by banks and financial institutions to meet various personal financial needs, including funding higher education. Unlike education loans, which are restricted to covering tuition and associated academic costs, personal loans allow students to use the funds more flexibly—be it for course fees, hostel rent, gadgets, transportation, or exam preparation materials.

Key Features of Student Personal Loans:

-

Unsecured loan (no collateral required)

-

Fixed interest rate and EMIs

-

Tenures ranging from 3 months to 6 years

-

Flexible end-use of funds

Personal Loan Interest Rates for Students in India (2024-25)

Below is a comparison of current personal loan interest rates from leading Indian banks that students can consider:

|

Bank |

Interest Rates (Per Annum) |

|---|---|

|

State Bank of India |

8.05% to 11.75% |

|

Punjab National Bank |

4% to 12.75% |

|

Bank of Baroda |

8.15% to 12.50% |

|

Canara Bank |

9.25% |

|

Bank of Maharashtra |

8.10% to 11.30% |

|

HDFC Bank |

Starting from 9.50% |

|

ICICI Bank |

10.25% |

|

Karnataka Bank |

10.48% |

|

Axis Bank |

13.70% to 15.20% |

Processing Fees and Other Charges

-

Public Sector Banks: Usually charge nominal or zero processing fees for loans aimed at Indian education.

-

Private Banks & NBFCs: Fees range from 0.5% to 2% of the loan amount.

-

Additional Costs:

-

Stamp duty as per state laws

-

Foreclosure charges

-

Late payment penalties

-

Key Factors That Influence Student Loan Interest Rates

-

Credit Score – Higher scores lead to lower interest rates.

-

Loan Amount – Larger amounts may come with higher interest.

-

Loan Tenure – Longer tenure increases total interest paid.

-

Lender Type – Rates differ between banks and NBFCs.

-

Employment Type – Salaried applicants often get better rates than self-employed individuals.

Eligibility Criteria for Student Personal Loans in India

-

Applicant must be an Indian citizen

-

Must be enrolled in a recognized course (India or abroad)

-

Minimum age: 18 years or above

-

Demonstrated academic performance

-

May require a co-applicant/guarantor (parent or guardian)

-

Some lenders may assess college/institution reputation and course type

Documents Required to Apply for a Student Personal Loan

-

Identity Proof: Aadhaar, PAN, Passport, or Driving License

-

Address Proof: Utility bills, Aadhaar, rental agreement

-

Academic Documents: Mark sheets, admission letter, ID card

-

Co-applicant’s Income Proof (if applicable)

-

Recent Bank Statements

-

Passport-sized Photographs

How to Apply for a Personal Loan for Students

-

Compare lenders based on rates, eligibility, and processing time.

-

Check your eligibility using online tools or loan aggregators.

-

Fill in the application form with accurate academic and personal details.

-

Upload documents digitally or submit in-person (depending on lender).

-

Wait for approval, which typically takes 1–3 working days.

-

Once approved, sign the loan agreement and receive the funds in your account.

Top 5 Personal Loan Options for Students in India

Here are the five most popular personal loan products available to students across India in 2024-25:

1. HDFC Bank Personal Loan for Students

-

Eligibility:

-

Salaried employees (public/private/MNC)

-

Age: 21–60 years

-

2 years’ total job experience, 1 year with current employer

-

Net monthly income: ₹25,000 (HDFC account holders), ₹50,000 (others)

-

-

Documents:

-

ID & address proof

-

Bank statements (3 months)

-

Salary slips/Form 16

-

Proof of fund usage

-

-

Loan Features:

-

Interest: 10.50% to 25%

-

Tenure: 3–72 months

-

Processing Fee: Up to ₹4,999 + GST

-

2. Bajaj Finserv Personal Loan for Students

-

Eligibility:

-

Indian nationality, aged 21–80

-

Employed in public/private/MNC

-

Monthly income: From ₹25,000 (city-dependent)

-

CIBIL Score: 685 or higher

-

-

Documents:

-

KYC + PAN + salary slips (3 months)

-

Bank statements (3 months)

-

Utility bills + employee ID

-

-

Loan Features:

-

Interest Rate: 11% to 38% per annum

-

3. Kotak Mahindra Bank Personal Loan for Students

-

Eligibility:

-

Indian national aged 21–70

-

Admission through entrance exam or merit

-

Good credit and repayment history

-

-

Documents:

-

Application form + photos

-

KYC + address proof

-

Signature verification

-

-

Loan Features:

-

Interest Rate: Up to 16% per annum

-

4. ICICI Bank Personal Loan for Students

-

Eligibility:

-

Indian residents aged 20+

-

Salaried with regular monthly income

-

Good credit score

-

Savings account in any Indian bank

-

-

Documents:

-

Salary slips + bank statements (3 months)

-

PAN/passport/driving license/voter ID

-

-

Loan Features:

-

Interest Rate: Up to 16%

-

Processing Fee: Up to 2.5% of the loan amount

-

5. Axis Bank Personal Loan for Students

-

Eligibility:

-

Age: 20–58 years

-

Monthly income: Minimum ₹30,000

-

At least 2 years of work experience

-

Must reside at the same address for at least 1 year

-

-

Documents:

-

KYC + 3 salary slips + 3 bank statements + Form 16

-

-

Loan Features:

-

Interest Rate: 10.65% to 22% per annum

-

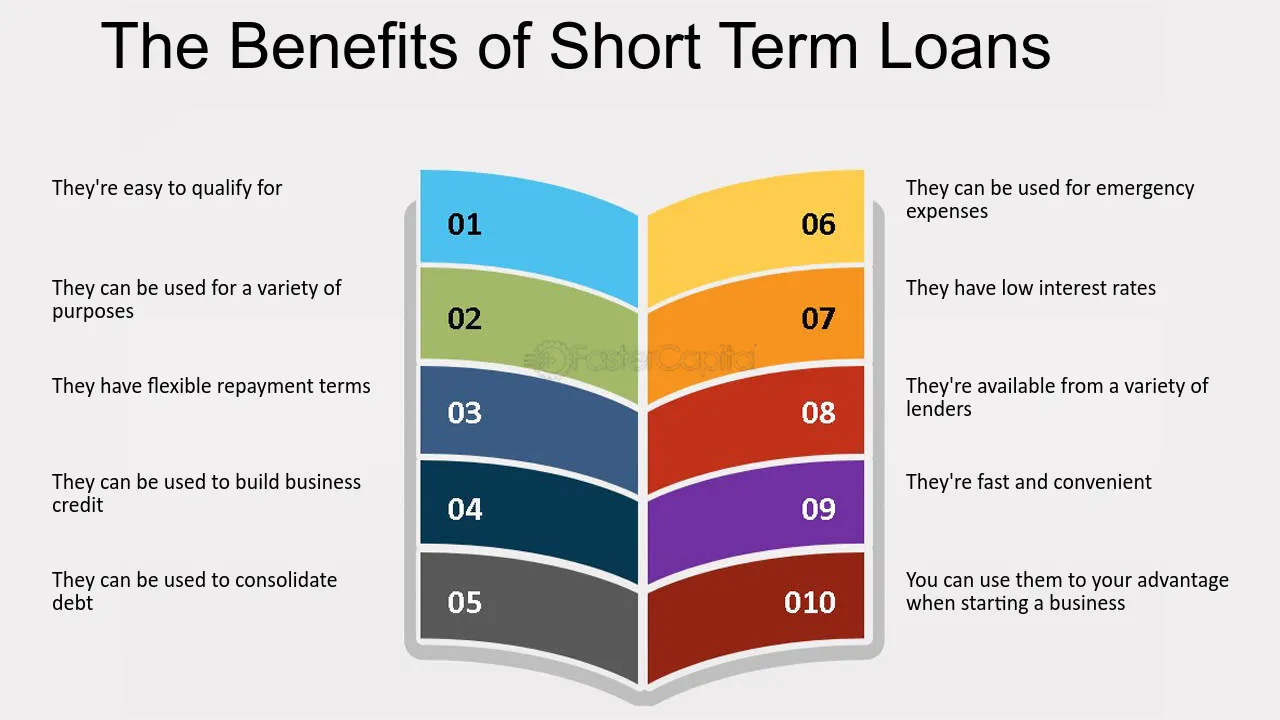

Key Benefits of Personal Loans for Students

-

Loan Amounts from ₹5,000 to ₹10 lakh

-

Fast digital eligibility check

-

No collateral required

-

Interest rates from as low as 14%

-

Fully online process with instant disbursal

-

Flexible repayment terms

-

Approval even with moderate credit score

-

Funds disbursed within 24 hours of approval

Can Students Without Income Get a Personal Loan?

While challenging, getting a loan with no income is possible using:

1. Co-applicant or Guarantor Loans

A guardian with stable income boosts approval chances.

2. Education Loans with Moratoriums

Repayment begins post-course completion.

3. Income from Freelancing/Internships

Some lenders consider informal or freelance earnings.

4. NBFCs & Digital Lenders

Approval may be based on academic performance and future potential.

Getting a Loan Without a Job: Is It Possible?

Students without a job can still access funding via:

-

Co-applicant or guarantor-backed loans

-

Traditional education loans with deferred repayment

-

NBFCs and digital-first lenders

-

Scholarships, grants, and part-time work

Factors to Consider When Choosing a Student Loan

1. Interest Rates & Processing Fees

Compare multiple lenders to find the lowest cost of borrowing.

2. Repayment Flexibility

Check for moratoriums, tenure options, and EMI customization.

3. Eligibility Requirements

Ensure you or your co-applicant meet the lender's criteria.

4. Customer Support Quality

Opt for lenders with responsive and helpful customer service teams.

Small Personal Loans Through Student Loan Apps

Digital lending platforms provide fast, small-ticket loans for students dealing with day-to-day academic and living expenses:

|

App Name |

Loan Range |

App Rating |

|---|---|---|

|

Tata Capital App |

₹5,000 – ₹10,00,000 |

4.3 |

|

SlicePay |

Up to ₹10,000 |

4.5 |

|

PaySense |

₹5,000 – ₹5,00,000 |

3.0 |

|

mPokket |

₹300 – ₹30,000 |

4.4 |

|

Pocketly |

Up to ₹50,000 |

4.2 |

|

StuCred |

₹1,000 – ₹15,000 |

4.6 |

|

CashBean |

Up to ₹60,000 |

N/A |

|

KreditBee |

₹1,000 – ₹5,00,000 |

4.5 |

|

Sahukar |

Up to ₹5,000 |

N/A |

|

BadaBro |

Not Available |

Not Available |

Final Thoughts

Personal loans for students serve as a practical alternative to traditional education loans—especially when you need flexibility in usage or fail to meet conventional criteria. Whether you’re funding overseas education, purchasing a laptop, or covering daily expenses, these instant loans offer a vital financial cushion.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved Powered by Vygr Media.