Finance Minister Nirmala Sitharaman tabled the much-anticipated Income Tax Bill 2025 in Parliament on February 13, 2025. This new legislation is designed to simplify tax laws, reduce litigation, and make the language more accessible to taxpayers. While the bill does not introduce new taxes, it replaces the Income Tax Act of 1961, aiming for a more user-friendly tax structure.

1. Simplified Language and Structure

One of the most significant improvements is the simplification of tax laws:

-

The bill eliminates complex jargon, making it easier to understand.

-

It reduces explanations and provisos, which often led to confusion and misinterpretation.

-

Taxpayers will now make fewer filing errors due to improved clarity.

-

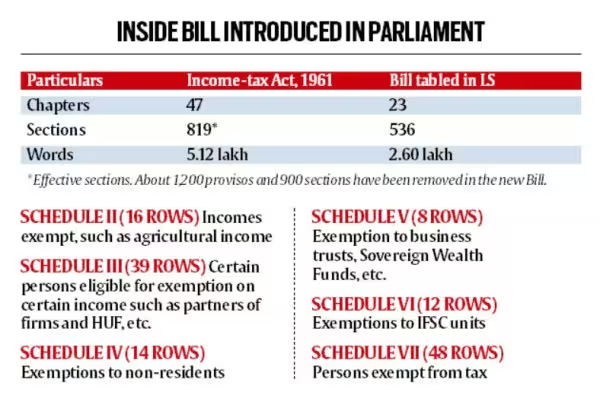

The number of chapters has been reduced from 47 to 23, consolidating redundant sections.

-

The existing assessment and previous year terms have been replaced with a simpler "tax year" system.

2. Shorter and More Concise Legislation

-

The old Income Tax Act (as amended in 2024) had 823 pages, whereas the new bill has only 622 pages, making it 201 pages shorter.

-

While the number of sections has increased from 298 to 536, they have been broken down into simpler provisions for easier interpretation.

-

The bill includes 23 chapters and 16 schedules, consolidating cohesive matters to improve comprehension.

3. Changes in Income Tax Slabs

One of the most crucial changes is the revision of income tax slabs, which provides greater relief to the middle class:

-

Income up to ₹12 lakh is now tax-exempt.

-

A standard deduction of ₹75,000 has been introduced, effectively making income up to ₹12.75 lakh tax-free for salaried individuals.

-

These revised slabs increase disposable income, potentially boosting consumer spending and savings.

4. Default New Tax Regime, Old Regime Still Available

-

The new tax regime will be the default, meaning taxpayers automatically fall under it unless they opt out.

-

However, the old tax regime remains available for those who prefer it.

5. Simplification of Tax Laws and Compliance

-

The new bill reduces the number of sections by 25-30%, making tax laws more user-friendly.

-

It clarifies the scope of total income while keeping existing tax principles intact.

-

Changes in deductions and exemptions include modifications to Sections 10 and 80C to 80U, affecting investments, donations, and expenses.

-

The time limit for filing updated returns has been extended from two years to four years, allowing taxpayers to rectify errors more conveniently.

6. Capital Gains and Presumptive Taxation

-

The classification of capital gains (short-term and long-term) remains unchanged, as introduced last year.

-

The presumptive taxation issue for professionals (Section 44AD/44AE/44ADA) is now resolved, as the bill clarifies the method of computing profits.

7. Higher Limits for Business and Professionals

The bill increases thresholds for businesses and professionals under Section 44AD:

-

The turnover limit for businesses has been raised from ₹2 crore to ₹3 crore.

-

For professionals, the limit has increased from ₹50 lakh to ₹75 lakh.

These changes aim to benefit small businesses and self-employed professionals, offering them greater flexibility.

8. Cryptocurrency and Digital Asset Taxation

-

Sections 67 to 91 introduce new provisions for virtual digital assets (VDAs).

-

Cryptocurrencies are now categorized as assets, alongside property, jewellery, shares, paintings, and drawings.

-

These changes ensure taxation clarity for digital assets, addressing previous regulatory gaps.

9. Rules for Non-Profit Organizations

-

The new bill strengthens tax compliance for non-profits, replacing the existing provisions under Sections 11 to 13.

-

Clauses 332 to 355 clearly define taxable income, compliance rules, and restrictions on commercial activities.

-

This ensures better regulatory oversight while maintaining tax benefits for genuine charitable activities.

10. Other Key Provisions

-

The bill maintains that tax audits will continue to be conducted by Chartered Accountants (CAs), dismissing earlier speculations about including CS and CMA professionals.

-

The bill will be referred to the Parliamentary Standing Committee on Finance for consultations before its final approval.

-

It provides provisions for startups, digital businesses, and renewable energy investments, making it easier for new ventures to navigate tax obligations.

What’s Next?

With the New Income Tax Bill 2025 now tabled in Parliament, it will undergo further review by the select committee. If passed, these changes will streamline tax compliance, reduce disputes, and provide greater clarity for both individual and business taxpayers.

Stay updated as the bill progresses through the legislative process and prepares for major reforms in India's taxation system.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.