Investing in a house property is often considered one of the most desirable forms of investment. Homeownership provides personal security and stability, while many investors look to generate profit through the eventual sale of the property.

However, it's essential to understand that a house is classified as a capital asset for income tax purposes in India. Therefore, any profit or loss resulting from the sale of such a property is subject to capital gains tax.

What is Capital Gains Tax?

Capital gains tax refers to the tax levied on the profit generated from the sale of a capital asset. In India, any profit or gain that arises from the sale of such assets—such as real estate, stocks, mutual funds, and bonds—is classified as 'income from capital gains.' This income is taxable in the financial year during which the transfer of the capital asset occurs.

-

Types of Capital Gains

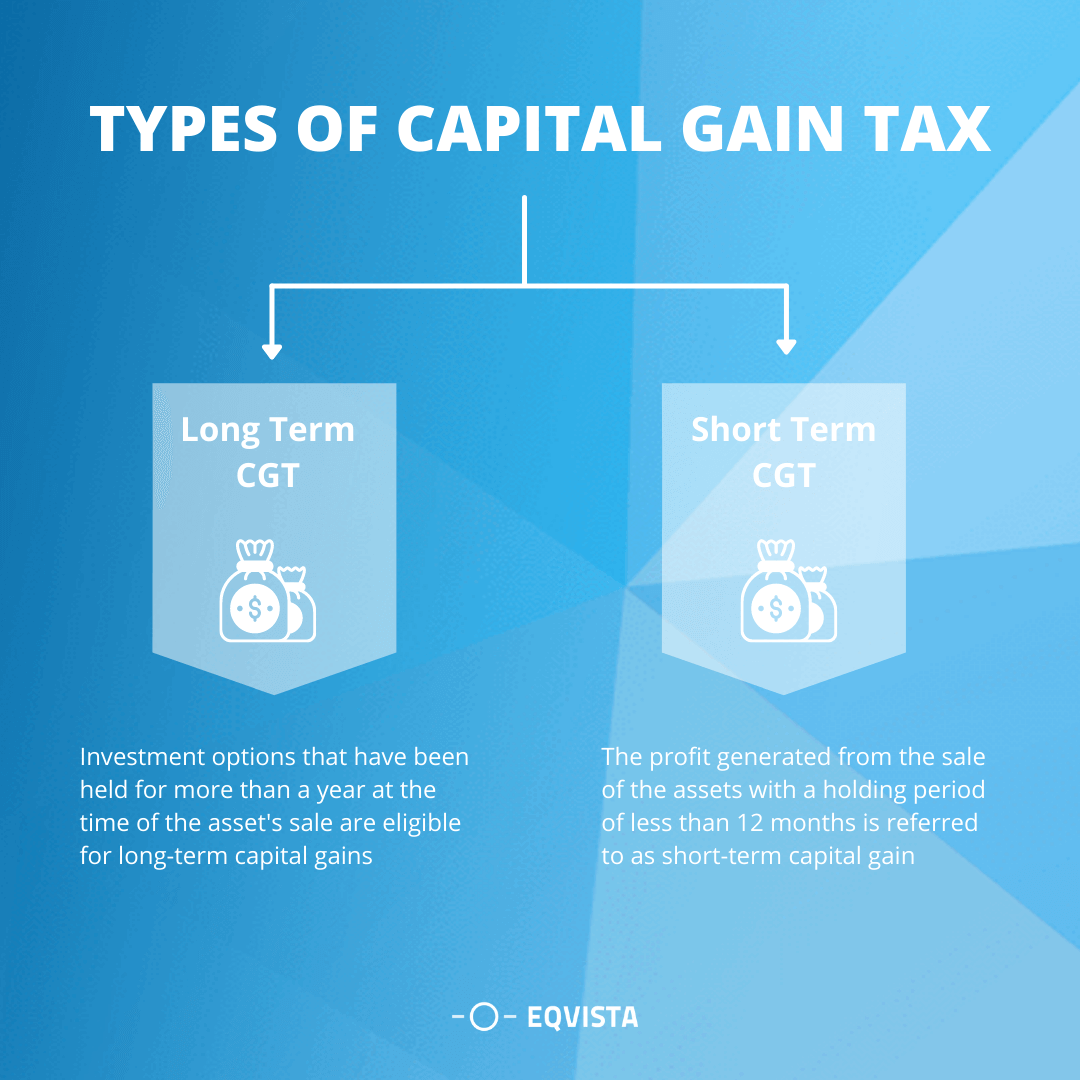

Capital gains can be categorized into two main types:

-

Short-Term Capital Gains (STCG): These gains occur when an asset is sold within a short duration of time, typically within 12 months for assets like stocks and 24 months for real estate.

-

Long-Term Capital Gains (LTCG): These gains arise when an asset is held for a longer period, exceeding the short-term thresholds, making the sale eligible for a more favorable tax rate.

Recent Developments: Budget 2024 Update

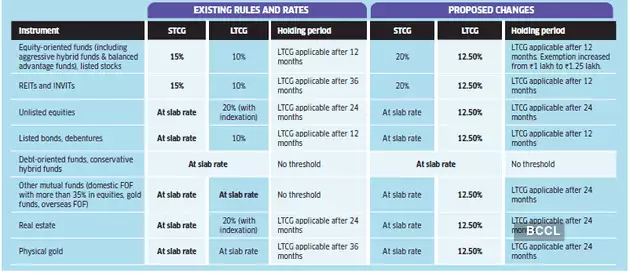

In the Union Budget 2024, announced on July 23, Finance Minister Nirmala Sitharaman proposed significant changes to the capital gains tax structure. The announcement included a reduction in the LTCG tax rate from 20% to 12.5%, alongside the removal of indexation benefits. This decision elicited mixed reactions, particularly from the real estate sector, with concerns raised regarding its potential impact on growth.

-

Key Amendments to Capital Gains Taxation

The following amendments were proposed in Budget 2024, effective from the fiscal year 2024-25:

-

Revised Holding Periods: The classification of assets as long-term or short-term will now rely on two holding periods: 12 months for listed securities and 24 months for all other assets. The previous 36-month holding period has been eliminated.

-

Taxation of Listed Securities: The holding period for all listed securities is now 12 months. Any listed security held for over 12 months qualifies as a long-term asset.

-

Short-Term Capital Gains Tax Increase: The tax rate for short-term capital gains on listed equity shares, equity-oriented funds, and business trusts has been raised from 15% to 20%. Other financial and non-financial assets held for a short term will continue to attract tax at slab rates.

-

Exemption Limits Increased: The exemption limit on long-term capital gains for the transfer of equity shares and similar assets has been increased from ₹1 lakh to ₹1.25 lakh per annum, although the tax rate has also increased from 10% to 12.5%.

-

Changes in Indexation Benefits: The previously available indexation benefit for long-term asset sales has been removed. As a result, any sale of long-term assets made after July 23, 2024, will be taxed at a flat rate of 12.5% without any indexation.

New Choices for Taxpayers

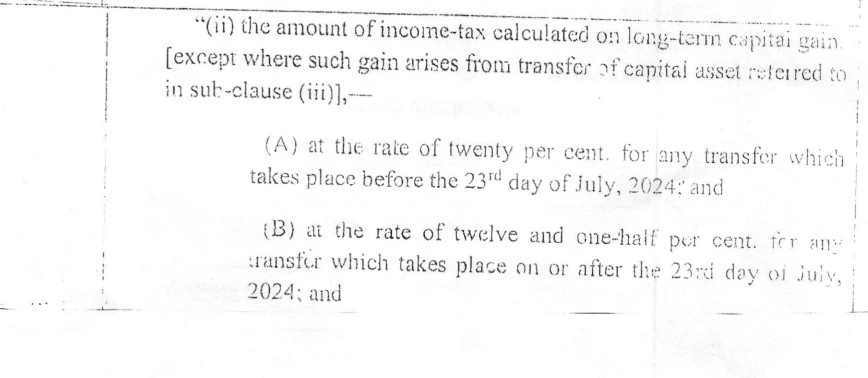

The government has introduced a noteworthy amendment in the Finance Bill to provide taxpayers with options regarding the taxation of long-term capital gains on property sales. Taxpayers who sell property acquired before July 23, 2024, can choose between:

-

Paying the LTCG tax at the old rate of 20% with indexation benefits.

-

Paying the new rate of 12.5% without indexation benefits.

This choice allows taxpayers to calculate their taxes under both schemes and select the one that results in a lower tax burden.

-

Understanding Indexation Benefits

Indexation is a method used to adjust the original purchase price of an asset to account for inflation. This benefit has historically aided property sellers in India by reducing the taxable profit, thereby making real estate investments more appealing. However, the recent budget changes aim to simplify the tax structure while raising the effective tax rate.

-

How Much Tax Do I Have to Pay?

The Finance (No. 2) Bill, 2024, introduced in the Lok Sabha, stipulates that if the tax computed under the new provisions exceeds the tax computed under the old provisions (prior to the amendment), the excess will be disregarded. This ensures that taxpayers are not penalized by the removal of indexation benefits, as they can still opt for the tax scheme that minimizes their tax liability.

How will the new rule impact your tax outgo?

-

12.5% LTCG Rate Without Indexation

Under the new tax regime, taxpayers can opt to pay a reduced LTCG tax rate of 12.5% on gains realized from the sale of property. However, this option does not allow for indexation, meaning that taxpayers will not be able to account for inflation when calculating the taxable capital gains.

Key Points:

-

Reduced Tax Rate: A fixed rate of 12.5% is designed to lower the immediate tax burden on sellers.

-

No Indexation: Gains are calculated without adjusting the original purchase price for inflation, potentially leading to higher taxable gains in periods of significant inflation.

-

20% LTCG Rate With Indexation

Alternatively, taxpayers may choose to pay a 20% LTCG tax rate while utilizing indexation. This means that taxpayers can adjust the property's purchase price according to inflation, as provided by the Cost Inflation Index (CII) from the Central Board of Direct Taxes.

Key Points:

-

Higher Tax Rate: A standard tax rate of 20%, which may initially seem unfavorable.

-

Indexation Benefits: Adjusting the purchase price for inflation can significantly reduce taxable capital gains, thereby lowering the overall tax liability.

Key Points to Note

-

Regulatory Impact: These new rules specifically target capital gains from property sales. The choice between the two tax regimes will be determined by the government based on calculated figures. Taxpayers will not have the option to choose their preferred tax regime.

-

No Offset for Losses: If the old tax regime results in a negative financial outcome, taxpayers cannot offset this loss under the new tax regime.

-

Government Objectives: The primary aim of the new rules is to balance the need for adequate tax revenue while addressing concerns over the removal of indexation benefits.

Why Implement These Changes Now?

The introduction of two tax schemes represents a notable departure from the government's previous position. Finance Secretary TV Somanathan defended the new approach, suggesting that the 12.5% rate without indexation would benefit 95% of taxpayers. He emphasized that the change aims to support the middle class.

However, voices within the real estate sector, as well as some members of the Bharatiya Janata Party (BJP), have expressed concerns about the implications of removing indexation benefits. Critics argue that this change could adversely affect the middle class—an essential support base for the party.

Concerns Raised:

-

Impact on Real Estate Growth: Industry leaders like Samir Jasuja, Founder and CEO of PropEquity, warned that eliminating indexation could hinder the growth of the real estate sector and impede the vision of achieving a $1 trillion real estate economy.

-

Political Backlash: Several members of parliament voiced their concerns, urging the government to reconsider the removal of indexation to protect middle-class interests in real estate investment.

-

Potential for Increased Cash Transactions: The absence of indexation could lead to a rise in cash transactions in property sales as sellers might attempt to deflate transaction values to reduce tax liabilities, potentially increasing black money circulation in the sector.

Benefits for Homeowners

The introduction of the two LTCG tax options offers enhanced flexibility for homeowners, alleviating some concerns about the loss of indexation benefits.

-

For Homeowners

-

Flexibility in Tax Liabilities: Homeowners can now choose between the two tax regimes based on their property-holding duration and market conditions. For properties held long-term during periods of high inflation, the 20% tax with indexation may be more beneficial, as it allows for significant reductions in taxable gains.

-

Short-Term Property Sales: For those who sell properties held for shorter durations or during low-inflation periods, the 12.5% rate could result in a lower tax burden, making it an attractive option.

-

For Homebuyers

The revised tax regulations could stimulate the residential property market by providing clarity and enhancing potential tax savings.

-

Improved Market Sentiment: Clarity on tax obligations may encourage more homebuyers to enter the market, knowing they have options to manage future capital gains tax liabilities effectively.

-

Increased Demand: As property values rise, the potential for tax burden reduction through flexible options may lead to heightened demand in the residential market, particularly in areas experiencing significant appreciation.

The amendments to the capital gains tax structure in Budget 2024 aim to balance tax revenue generation with taxpayers' concerns, providing flexibility and potential benefits for both homeowners and homebuyers.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.