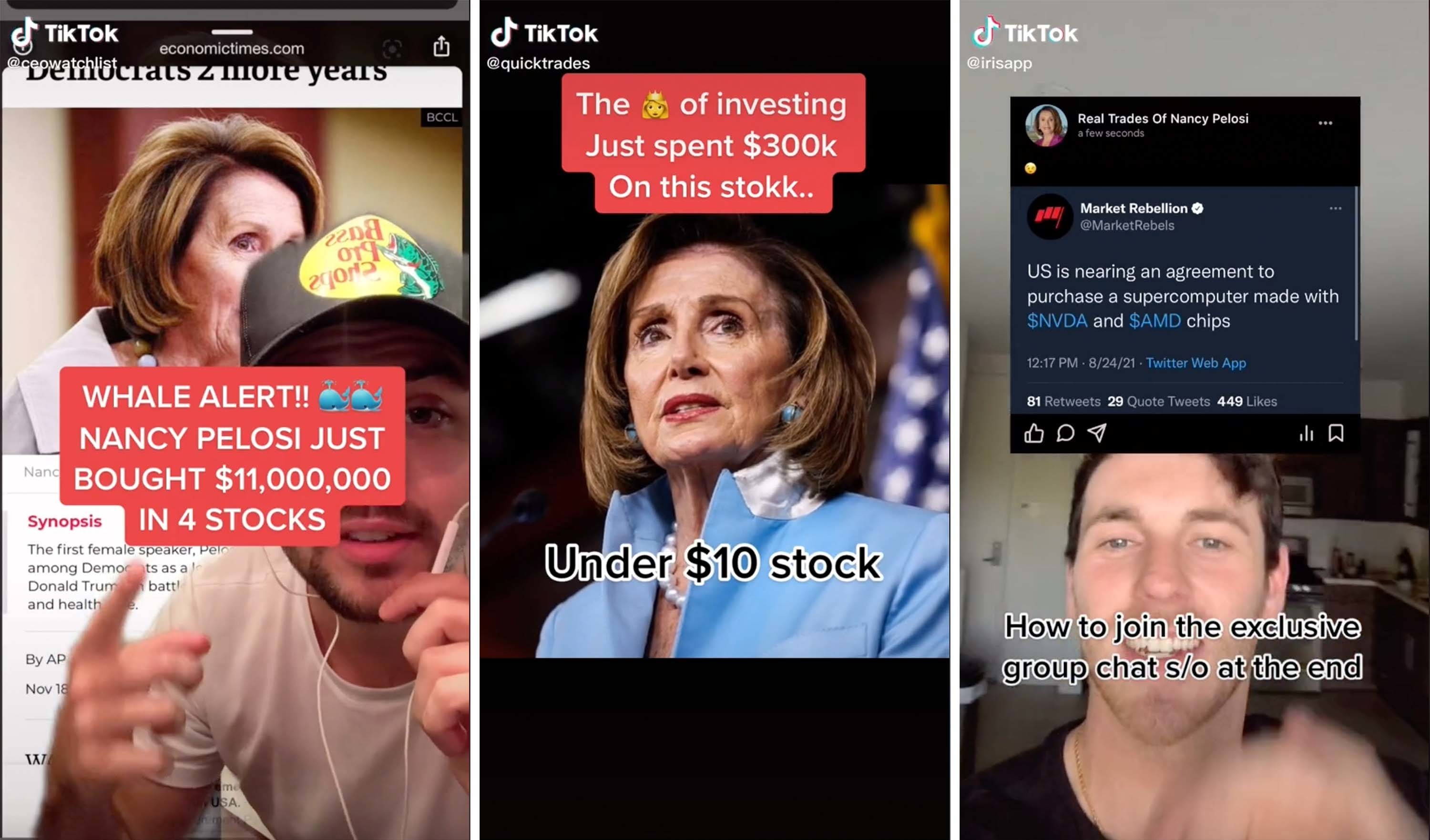

Picture this: House Speaker Nancy Pelosi, in oversized sunglasses and a hoodie, striding through the halls of Congress, whispering stock tips like a Wall Street ninja. Okay, maybe not exactly like that, but it’s no secret that her stock trades, or rather those made by her husband Paul, have become a sensation on TikTok. Amateur investors, fueled by pandemic boredom and inspired by Wall Street Bets, dissect Pelosi's stock disclosures like they're cracking a secret code.

On TikTok, finance enthusiasts share Pelosi’s latest trades alongside crypto tips and high-yield savings hacks, turning her into the Beyoncé of stock bellwethers. It’s all fun and games, but it shines a light on a serious topic: insider trading. So, let’s dive into what insider trading really is, why it’s illegal, and why you should think twice before following anyone’s trades—be it a politician or a TikTok influencer.

What Is Insider Trading?

Imagine a secret race where some runners know the track layout beforehand. That’s insider trading! It occurs when someone buys or sells stocks based on confidential information not available to the public. This information could include details about a company's financial health, upcoming announcements, or other critical data, giving those in the know an unfair advantage in the stock market.

Why Is It Illegal?

1. Fairness: Just like a race with hidden shortcuts isn’t fair, insider trading creates an uneven playing field, allowing a select few to profit while others are left in the dark.

2. Market Integrity: Trust is essential for a healthy stock market. Insider trading undermines this trust, damaging confidence in the fairness and integrity of financial markets.

3. Level Playing Field: Laws against insider trading ensure that everyone has access to the same information, promoting transparency and fairness.

Consequences of Insider Trading

♦ Fines and Penalties: Offenders face hefty fines and legal consequences, sometimes reaching into the millions.

♦ Loss of Reputation: Being caught can tarnish reputations and ruin careers.

♦ Imprisonment: In severe cases, those found guilty can end up behind bars.

Insider Trading Around the World

► India

In India, insider trading is governed by the Securities and Exchange Board of India (SEBI) Act, 1992. Offenders can face fines ranging from ₹5 lakh to ₹25 crore or three times the profit made, whichever is higher, and can also be sentenced to up to five years in prison.

► Global Scenario

Globally, insider trading is considered a significant violation of business ethics and a threat to public trust in stock exchanges. Regulations aim to ensure fair transactions by requiring the disclosure of all material information that could affect trading.

Notable Cases

•→ Rakesh Agrawal vs. SEBI: This case involving the managing director of ABS Industries Ltd. highlighted the complexities of insider trading laws in India.

•→ Hindustan Lever Limited vs. SEBI: In this case, Hindustan Lever Limited was accused of insider trading before a merger announcement, underscoring the need for strict regulations.

•→ Ketan Parekh: A well-known stockbroker who manipulated stock prices and was banned from trading for 14 years, Parekh's actions are a classic example of insider trading abuses.

Conclusion

Insider trading isn’t just an ethical misstep; it’s a crime with severe consequences. From legal penalties to ruined reputations, the risks are high. Whether it’s being dissected on TikTok or making headlines in courtrooms, insider trading undermines the fairness of the financial markets.

So, while it might be entertaining to watch TikTok’s finance gurus decode Nancy Pelosi’s trades, remember that the stock market should be a level playing field for everyone, with no secret shortcuts allowed. Stay informed, be mindful of where you get your financial advice, and always play fair in the investing game.

Inputs by Agencies

Image Source: Multiple Sources

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.