Investing in today's financial landscape requires more than just selecting the right stocks.

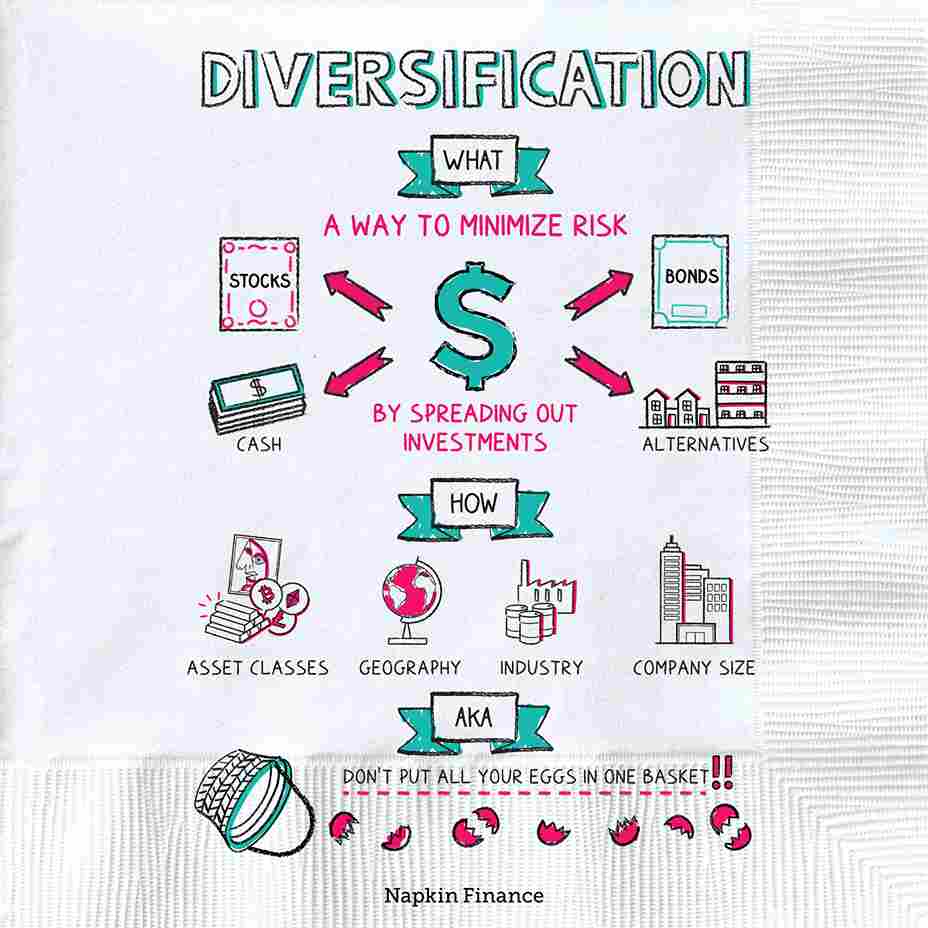

Diversification is a fundamental strategy for building a robust investment portfolio. It involves spreading investments across various asset classes such as equity, debt, real estate, gold, and more to minimize risk. Even within a single asset class like equities, diversification by investing in companies from different sectors and market capitalizations can reduce exposure to individual risks. One popular method of diversification in equity investing is through Index Funds.

What Are Index Funds?

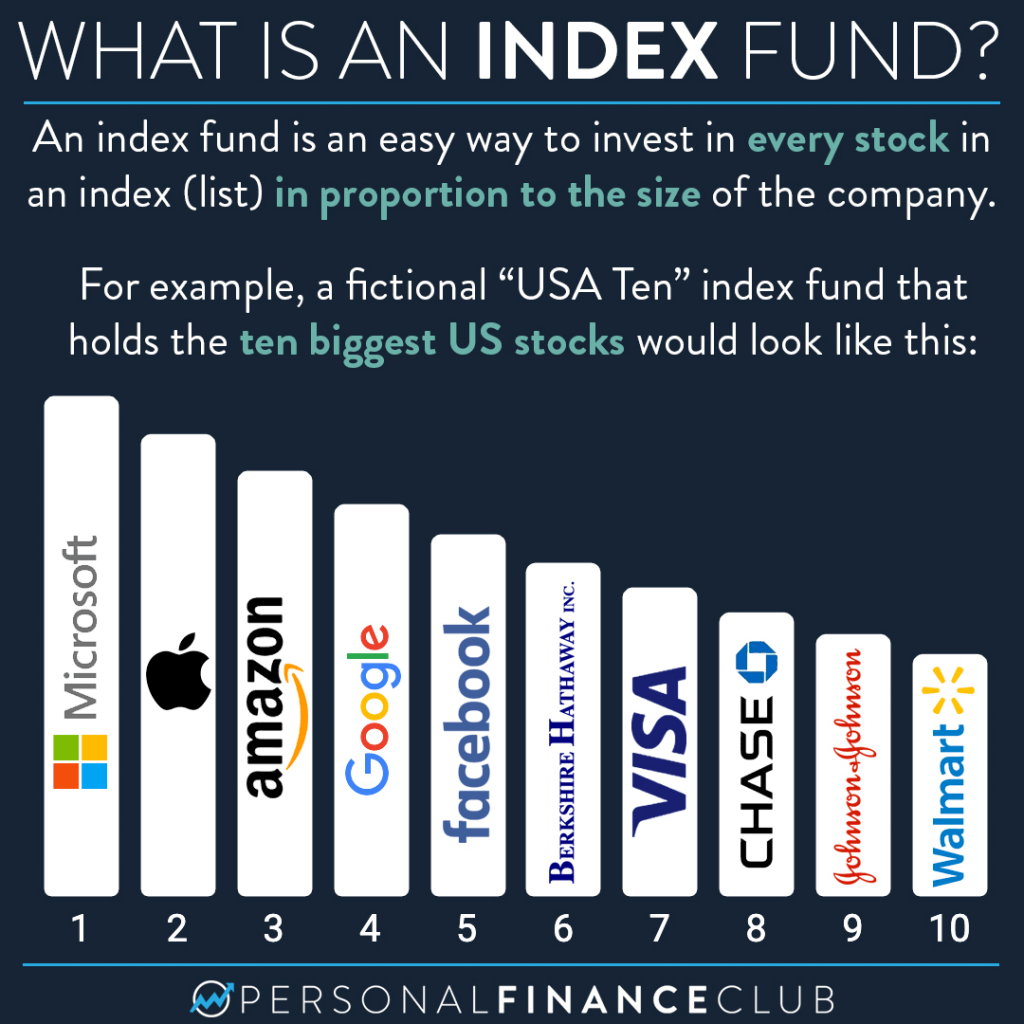

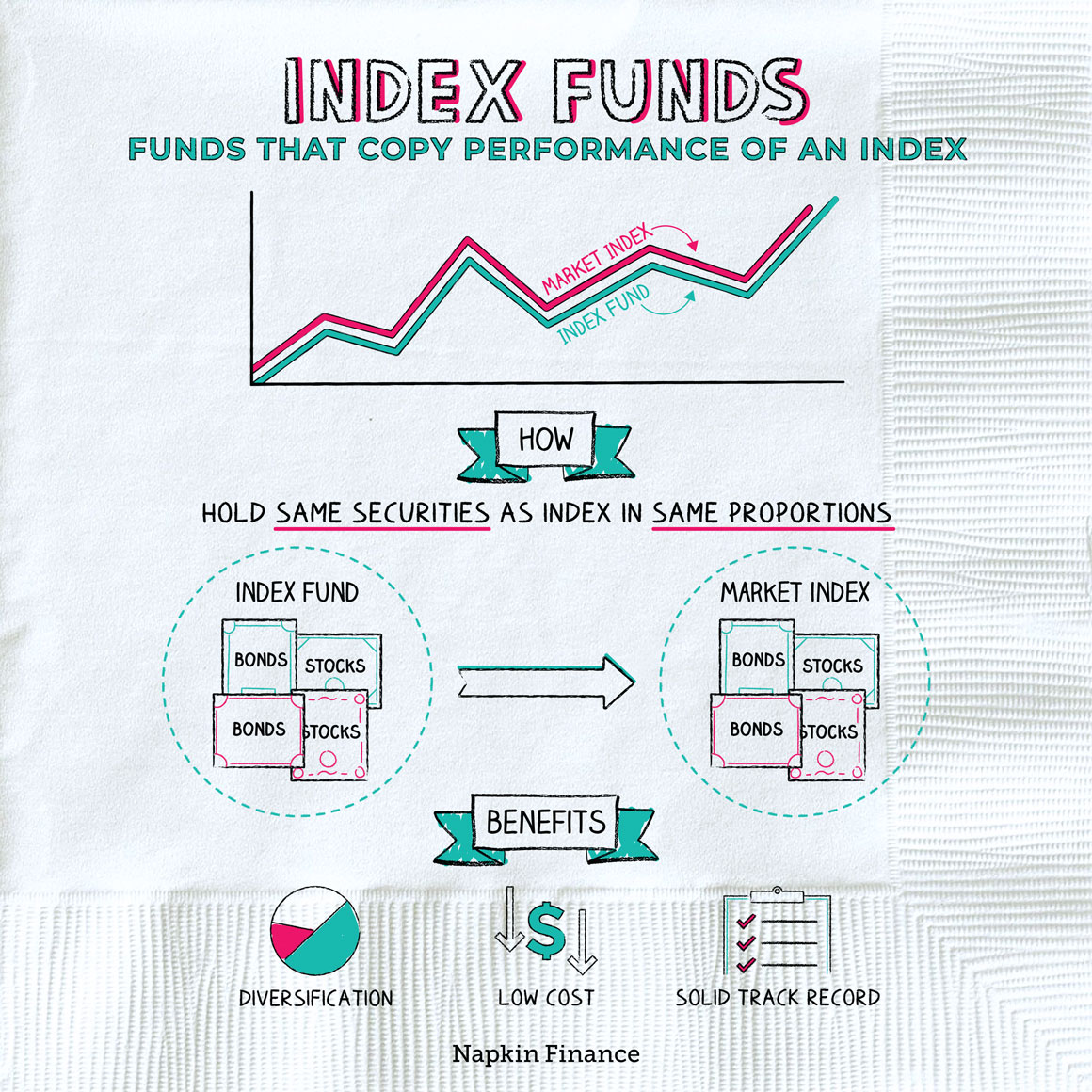

Index Mutual Funds, as the name suggests, are funds that aim to replicate the performance of a specific stock market index, such as the NSE Nifty or BSE Sensex. Unlike actively managed funds, Index Funds are passively managed. This means that the fund manager's role is to mirror the composition of the underlying index, investing in the same securities in identical proportions. The goal is to achieve returns that are in line with the tracked index.

How Do Index Funds Work?

To understand how Index Funds function, consider a fund tracking the NSE Nifty Index. This fund would include 50 stocks in the same proportions as in the Nifty Index. Similarly, a broader market index like the Nifty Total Market Index would involve around 750 stocks from various sectors and market capitalizations. The fund manager maintains this alignment, ensuring that the fund's portfolio is a reflection of the index it follows.

Unlike actively managed funds that aim to outperform their benchmarks, Index Funds focus on matching the returns of their underlying indices. As such, they invest in the full range of securities present in the index, including equity, equity-related instruments, and sometimes bonds.

How to Invest in Index Funds?

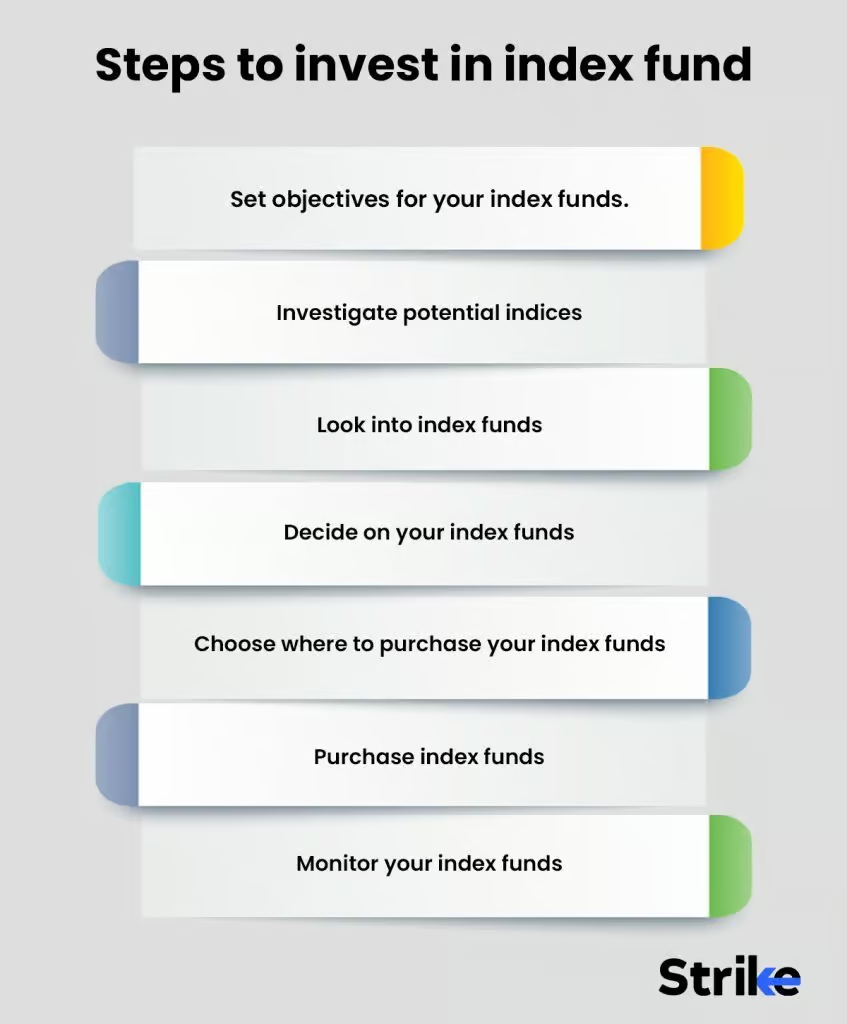

Investing in Index Funds is straightforward and accessible to both novice and experienced investors. Here is a step-by-step guide to getting started:

-

Choose Your Investment Platform: Begin by selecting an online brokerage or investment platform. Look for platforms with strong customer support, robust research tools, and low fees.

-

Open and Fund an Account: After choosing a platform, open an account by providing necessary personal information, setting up credentials, and completing a questionnaire on your investment goals and risk tolerance. Fund your account through a bank transfer.

-

Select an Index Fund: Research various funds to understand their performance history, management fees, and the indexes they track. Consider diversifying your investments by choosing multiple index funds.

-

Buy Shares: Once your account is funded, buy shares of your chosen fund. Most platforms allow direct purchases through their website or app.

-

Monitor and Adjust as Needed: While Index Funds are generally long-term investments, periodically reviewing your portfolio ensures that it remains aligned with your financial goals.

Factors to Consider Before Investing in Index Funds in India

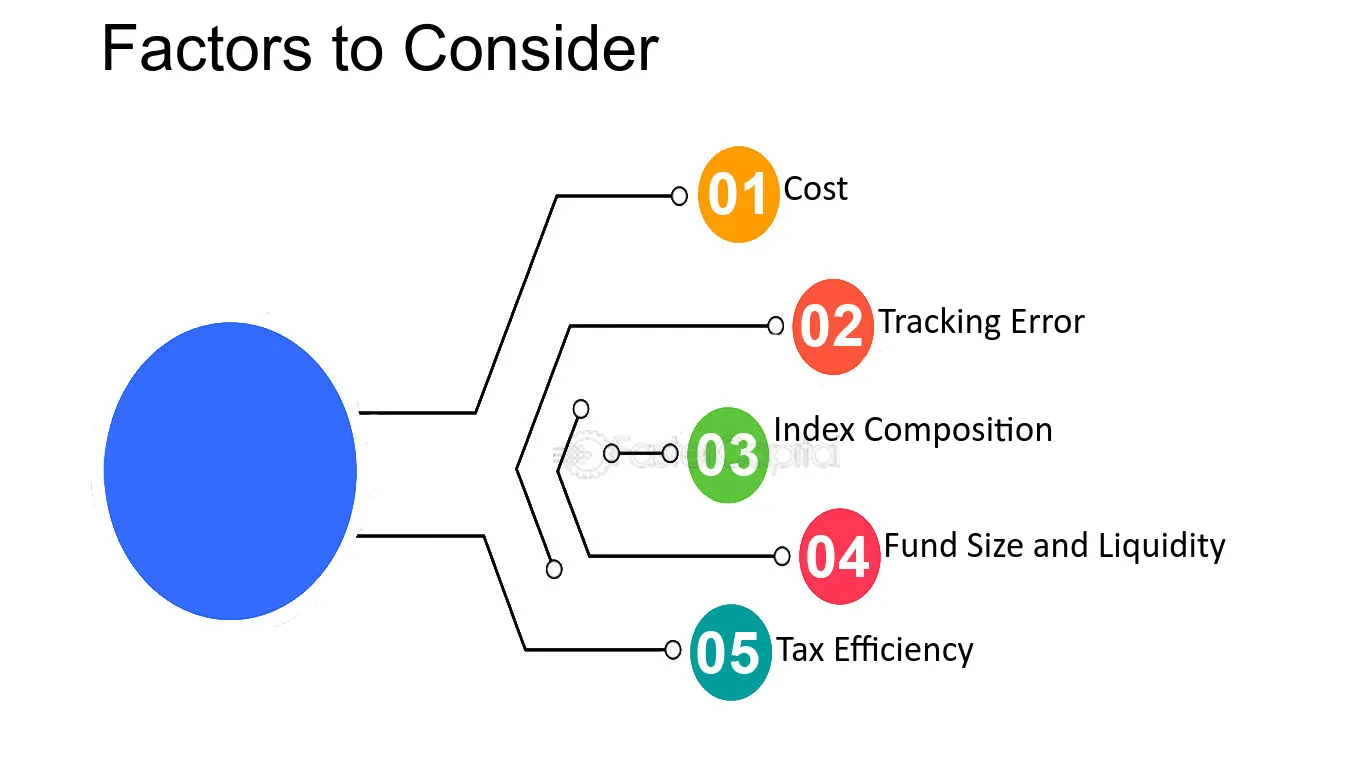

Before investing in Index Funds, consider the following key factors:

1. Risks and Returns

Since Index Funds track a market index and are passively managed, they are less volatile compared to actively managed equity funds, generally offering lower risk. However, during market rallies, Index Funds tend to perform well, whereas they may underperform during downturns. A balanced portfolio with both index and actively managed funds can provide stability and growth. Additionally, look for funds with a low Tracking Error – the difference between the fund's performance and the index it tracks.

2. Expense Ratio

The Expense Ratio is a fee charged by the fund house for management services, expressed as a percentage of the total assets. One of the main advantages of Index Funds is their low expense ratio. Because they are passively managed, the cost of management is lower than actively managed funds, which involve extensive research and active trading strategies.

3. Investment Horizon

Index Funds are ideal for investors with a long-term horizon of 7 years or more. Although they may experience short-term fluctuations, these funds generally stabilize and provide consistent returns over a longer period. A minimum investment window of seven years can yield returns in the range of 10-12%.

4. Tax Implications

As equity funds, Index Funds are subject to dividend distribution tax (DDT) and capital gains tax:

-

Dividend Distribution Tax (DDT): When dividends are paid, a 10% DDT is deducted at the source.

-

Capital Gains Tax: The tax on capital gains depends on the holding period. If the investment is held for more than a year, it qualifies as long-term capital gains, taxed at 10% without the benefit of indexation. Short-term capital gains, for investments held for less than a year, are taxed at 15%.

Who Should Invest in Index Funds?

Index Funds are ideal for investors who prefer predictable returns with lower risks. These funds suit those who want to invest in equity markets without the complexities of active management. Unlike actively managed funds where the fund manager makes investment decisions, Index Funds are passively managed, eliminating the risk associated with human judgment errors. However, for investors seeking higher returns and willing to accept more risk, actively managed equity funds might be a better option.

Are Index Funds Good Investments?

Index Funds have become increasingly popular due to their simplicity, low costs, and the ability to provide broad market exposure. They are particularly beneficial during bull markets, where they can offer attractive returns as the overall market rises. However, they lack downside protection, meaning they can perform poorly in prolonged market downturns.

Investors have two primary approaches to investing in Index Funds:

-

Self-Directed Research: This approach involves educating yourself about Index Fund investing, staying informed about market trends, and regularly reviewing your portfolio.

-

Seeking Professional Advice: Consulting with a financial advisor can help you select the right funds based on your financial goals and risk tolerance. Advisors can also assist in creating a diversified portfolio of Index Funds, ensuring your investments remain balanced and aligned with your objectives.

Benefits of Index Funds

Index Funds offer several advantages:

-

Lower Costs: The passive management of Index Funds leads to lower expense ratios.

-

Broad Market Exposure: Index Funds provide diversification by tracking a specific market index, offering exposure to various sectors and asset classes.

-

Transparency: The holdings of an Index Fund are well-known and readily available, allowing investors to make informed decisions.

-

Historical Performance: Over the long term, Index Funds often outperform actively managed funds, especially after accounting for fees.

-

Tax Efficiency: Lower turnover rates result in fewer capital gains distributions, making Index Funds more tax-efficient.

_1725182241.png)

Drawbacks of Index Funds

Despite their benefits, Index Funds also have certain drawbacks:

-

Lack of Flexibility: Index Funds cannot pivot away from underperforming sectors or companies, which can be a disadvantage during market downturns.

-

Market-Cap Weighting: Many Index Funds use market-cap weighting, leading to a concentration in larger companies. This can magnify risks if these companies underperform.

-

Inclusion of Overvalued Stocks: Index Funds automatically include all securities in an index, even if some are overvalued or fundamentally weak.

Are Index Funds Better Than Individual Stocks?

Index Funds offer the benefit of diversification, reducing the risk associated with holding individual stocks. By spreading investments across various securities, Index Funds mitigate the impact of poor performance by any single stock.

Costs of Investing in Index Funds

Many Index Funds have no minimum investment requirement and feature low annual fees, often around 0.05% or lower. For most investors, lower costs mean more of their money is invested in the market, potentially leading to higher returns over time.

Are Index Funds Suitable for Beginners?

Index Funds are an excellent option for beginners. They provide a diversified, low-cost entry into the stock market and often outperform actively managed funds over the long term. Moreover, their association with major indices like the S&P 500 or Nasdaq allows new investors to stay informed through regular media coverage.

Are Index Funds Safer Than Stocks?

Generally, Index Funds are safer than individual stocks due to their diversification across various sectors and companies. This diversification reduces the impact of a single company's poor performance on the overall portfolio.

Top 10 index funds in India by AUM [2024]

-

Aditya Birla Sun Life Nifty Midcap 150 Index Fund Direct Growth

-

Motilal Oswal Nifty Midcap 150 Index Fund Direct Growth

-

Nippon India Nifty Midcap 150 Index Fund Direct Growth

-

Motilal Oswal Nifty Smallcap 250 Index Fund Direct Growth

-

Nippon India Nifty Smallcap 250 Index Fund Dir Gr Direct Growth

-

UTI Nifty200 Momentum 30 Index Fund Direct Growth

-

Kotak Nifty Next 50 Index Fund Direct Growth

-

DSP Nifty Next 50 Index Fund Direct Growth

-

SBI Nifty Next 50 Index Fund Direct Growth

-

Motilal Oswal Nifty Next 50 Index Fund Direct Growth

Best Index Funds for Retirement

The ideal Index Funds for retirement depend on individual risk tolerance and time to retirement. Broad-market equity index funds like the Vanguard Total Stock Market Index Fund (VTSAX) or the Fidelity 500 Index Fund (FXAIX) are popular choices for growth. Bond Index Funds, like the Fidelity Total Bond Fund (FTBFX), offer diversification and income. Additionally, target-date retirement funds can be a convenient option, automatically adjusting the asset allocation as retirement approaches.

Index Funds are a favored choice for investors seeking low-cost, diversified, and passive investments that often outperform higher-fee actively managed funds. They are designed to replicate the performance of market indices, such as the S&P 500, and are ideal for long-term investments like retirement accounts.

However, while Index Funds offer benefits such as diversification, lower costs, and predictable returns, they are also subject to market volatility and lack the adaptability of active management. When deciding whether to invest in Index Funds, consider your financial objectives, risk tolerance, and investment horizon. Consulting a financial advisor can help tailor your approach to meet your unique financial goals.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.