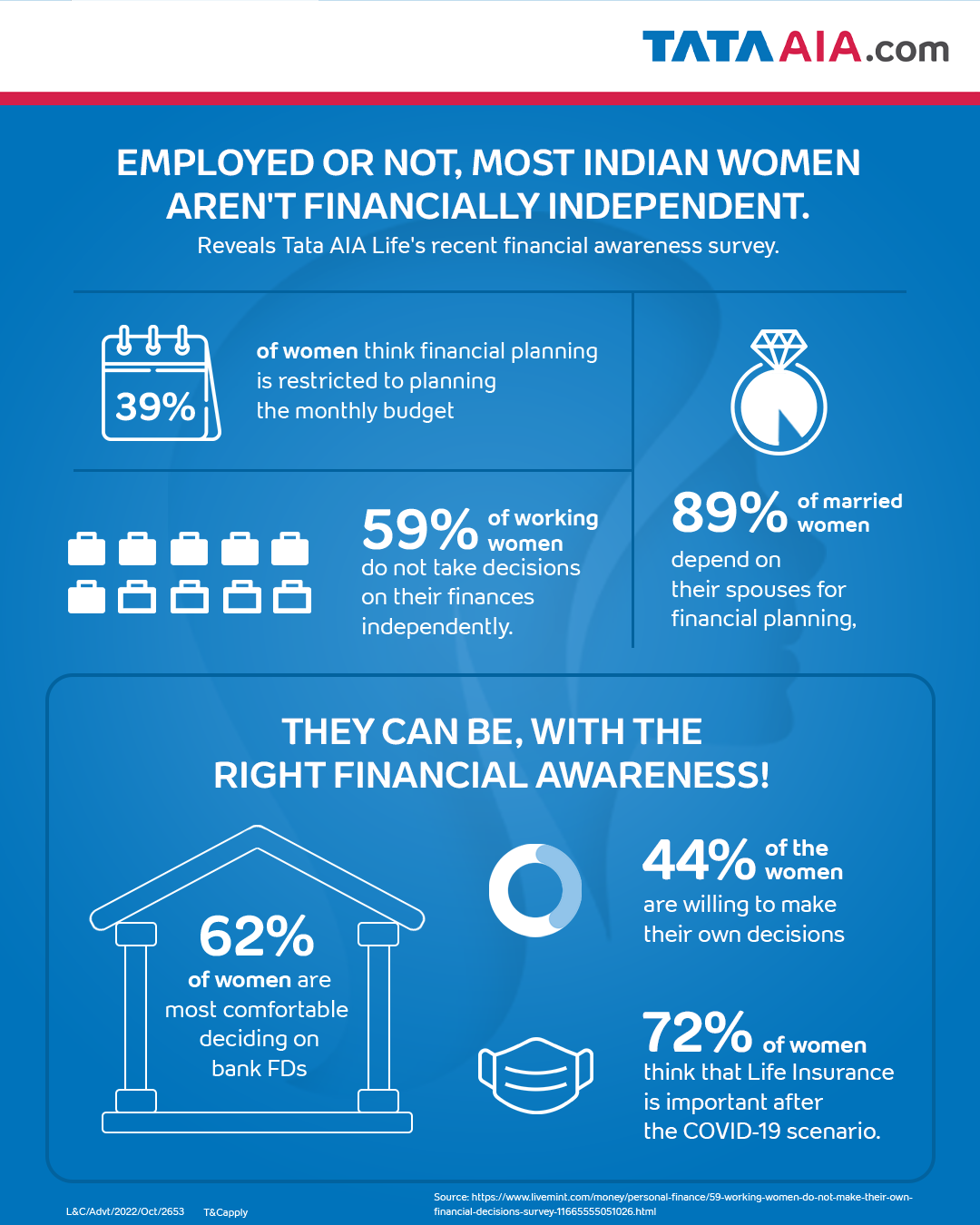

A recently conducted survey by Tata AIA Life Insurance on Financial Awareness Among Women reveals that despite the increase in the proportion of women in the professional sphere, from the grassroots to the boardrooms, women still tend to shy away from making financial decisions. The survey revealed that 59% of women are not willing to independently take financial decisions.

The survey spread across 18 cities and garnered a sample size of 1000 women between the ages of 25-55. The survey implored women from the 3 tier markets. Quite a few conclusions were drawn from this study. Highlights include the following:

According to the survey, 89% of women depend on their spouses when making financial decisions. These decisions are assigned to the male figures in their lives, even before marriage, which is generally their fathers. The average age at which Indian women get married is 20-22, which essentially forbids them from ever having the time to gain financial autonomy.

While 39% of women were making financial decisions, these were only to the extent of monthly budgets. 42% of women have a better understanding of finances, and out of that percentage, 12% are homemakers. Among the remaining working women, 59% do not independently make financial decisions. In the tier 3 sector, the ratio increases to 65% of women who do not make those decisions.

When given the choice, 44% of women would like to make their own financial decisions. There seems to be an increasing awareness and shift towards such decisions in the tier 2 markets. This change could continue with more awareness marketed to their demographic.

The women surveyed were also asked about their priorities. This led to the conclusion that, more often than not, women prioritise the financial security of the family over their own. This could possibly be a result of societal conditioning; the constant shooting down of their opportunities by the environment they were raised in. Another factor that may hold them back is their financial situation.

Among financial instruments, 62% are comfortable with investing in fixed deposits, generally for the benefit of the family. Even in these cases, women trusted their spouses’ decisions.

Girish J Kalra, the chief marketing officer at Tata AIA, commented on these findings: “Understanding our consumers is a critical component of our Consumer Obsession value. Women are an important stakeholder when it comes to financial planning, however very little is known about their preferences and attitude from a financial planning and life insurance perspective. This survey clearly reveals that we have a journey to travel as a society, to involve women more in the financial planning process. At Tata AIA, we will utilise the learning from the survey to introduce women-centric solutions and encourage them to take control of their finances and necessary measures to ensure their own and their family’s financial future."

This survey was conducted to gauge the level of financial awareness in women and their freedom to make said decisions.

© Vygr Media Private Limited 2022. All Rights Reserved.