The globe was rocked by the massive release of 11.5 million private documents known as the Panama Papers in 2016. These records, which came from the Panamanian law firm Mossack Fonseca, revealed an intricate web of offshore holdings, shell corporations, and tax havens that were painstakingly created to hide assets, avoid paying taxes, and maybe aid in illicit activity. Starting Monday, 27 individuals are set to go on trial for money laundering in connection with the scandal.

A Web of Secrecy Exposed

Unearthing the Global Elite's Offshore Network:

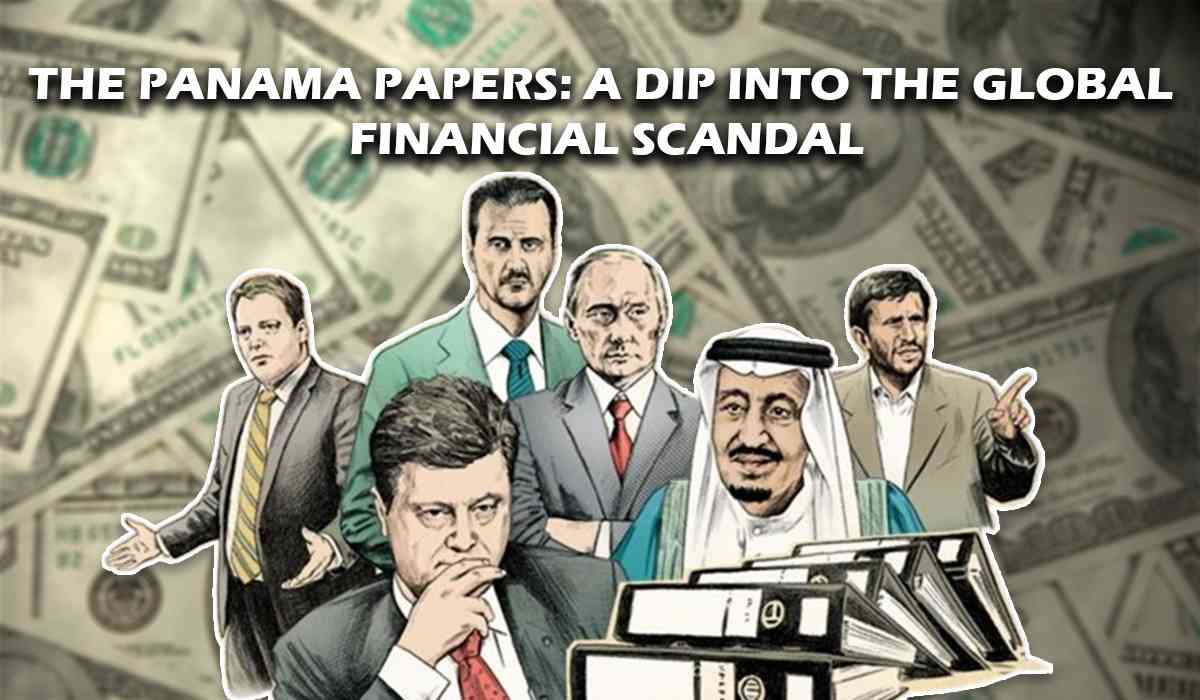

The extensive usage of offshore havens by the world's elite was made shockingly evident by the leak. There were almost 140 high-profile individuals accused, including corporate moguls, political leaders, celebrities, and athletes. The papers made clear the complex networks of shell corporations and loose laws in tax havens that are used to conceal wealth, both legally and illegally. Stories of national leaders syphoning off public cash, celebrities hiding endorsement payments, and corporate titans dodging taxes caused a public outcry. This leak exposed the enormous wealth gap and increased public ire at the idea that the wealthy and powerful followed different laws.

Global Repercussions and a Call for Reform:

National boundaries did not stop the Panama Papers from sparking a global dialogue about financial corruption, tax evasion, and wealth inequality. This dialogue resulted in demands for increased openness and stronger restrictions. The information leak proved to be a powerful weapon for investigative journalists and anti-corruption watchdogs across the globe. A wave of public indignation propelled the offshore haven controversy onto a global platform. Reforms to strengthen rules and improve transparency were discussed in parliament. Numerous nations' law enforcement authorities initiated inquiries, which resulted in the apprehension and litigation of individuals. Even evidence from the leak was used in courtrooms to prosecute people accused of evading taxes. The narrative had a widespread impact on popular culture, serving as an inspiration for films, novels, and documentaries that revealed the inner workings of this dubious financial system.

Financial Fallout and Market Tremors:

The Panama Papers created a financial earthquake. Equipped with the evidence that was used against them, governments undertook a determined effort to recoup lost tax revenue. The outcome was an incredible $1.36 billion in overdue taxes and penalties. The world's financial markets were shaken. Investors acted quickly, devaluing the approximately 400 publicly traded companies involved in the fraud by an estimated $135 billion. The disclosure demonstrated the interdependence of the international financial system as well as the possible dangers of offshore havens, where a dearth of transparency could enable financial instability to remain undetected.

The Far-Reaching Effects of the Global Secrecy Web and Its Enduring Consequences

_1712583347.png)

What are Offshore Accounts and Shell Corporations ?

Globally, financial regulatory bodies in relevant jurisdictions have the authority to regulate and supervise offshore accounts. To stop tax erosion and money laundering through offshore accounts, the Organisation for Economic Cooperation and Development (OECD) has created worldwide guidelines for the sharing of financial data between nations. In order to guarantee compliance with tax laws and regulations, numerous nations have also signed agreements to exchange financial data.

Offshore Accounts:

1. Tax Planning: To lower tax obligations, benefit from tax breaks, or shield assets from high domestic taxes, offshore accounts are a valid tool for tax planning.

2. Asset Protection: By protecting assets from creditors, lawsuits, and other risks in the individual's home country, offshore accounts can offer an additional layer of asset protection.

3. Privacy and Confidentiality: Compared to domestic accounts, offshore accounts offer more financial privacy and confidentiality because certain countries have stringent banking secrecy laws that safeguard the account holder's identity and financial data.

4. Diversification: By allowing people to spread their holdings and investments across several currencies, asset classes, and jurisdictions, offshore accounts help to lower risk and improve financial stability.

The Reserve Bank of India (RBI) and the Income Tax Department are in charge of regulating the use of offshore accounts in India. Indian nationals are required to follow the Foreign Exchange Management Act (FEMA) guidelines for opening and maintaining offshore accounts. Any income from offshoring accounts must be declared to the Income Tax Department and' the taxes paid on it, as well as Indian tax regulations.

Shell Corporations:

A shell corporation is a business entity that has little to no actual business activity. It's initially a legal framework for a company without the substance of employees, products, or ongoing' perations. There are some characteristics of a shell corporation:

Limited Activity: These corporations typically don't have any employees or generate their own income. Their primary purpose is to hold accounts or act as a financial institution.

Security: Shell corporations can be used to confirm the true owner(s) of assets or the source of funds. They often operate in secrecy and with minimal disclosure requirements about ownership and' financial activities.

Tax Advantages: In some cases, corporations can be used to minimise tax liabilities by taking advantage of tax advantages with lower corporate tax rates.

Potential for Misuse: The lack of transparency surrounding corporations makes them susceptible to misuse. They can be used to facilitate illegal activities like money laundering, fraud, and tax evasion.

Here's an analogy: Think of a small corporation as an empty box. It has a legal name and structure, but it is devoid of the actual products or services that a typical business would have.

A large network of people and organisations that made use of offshore tax havens and shell corporations was made public by the Panama Papers. Below are the names of some of the people involved:

National Leaders: The leak identified at least 12 current or former world leaders, including heads of government, their families, and close associates.

Prominent Figures:

-

Vladimir Putin (Russia) - with a trail of $2 billion linked to offshore accounts.

-

Nawaz Sharif (Pakistan) - former Prime Minister, disqualified from office due to the scandal.

-

Ayad Allawi (Iraq) - former interim Prime Minister.

-

Petro Poroshenko (Ukraine) - President at the time of the leak.

-

Sigmundur Davíð Gunnlaugsson (Iceland) - former Prime Minister who resigned due to the scandal.

Public Officials: Over 128 public officials and politicians from various countries were named in the leak.

Examples of Public Officials Exposed:

-

Khalifa bin Zayed Al Nahyan (United Arab Emirates) - Former President and Emir of Abu Dhabi.

-

Mauricio Macri (Argentina) - Former President.

-

Malcolm Turnbull (Australia) - Former Prime Minister.

-

Silvio Berlusconi (Italy) - Former Prime Minister.

-

Hamad bin Khalifa Al Thani (Qatar) - Former Emir.

-

Ahmed al-Mirghani (Sudan) - Former President.

Celebrities and Businesspeople: Hundreds of celebrities, businesspeople, and wealthy individuals from 200 countries were linked to offshore holdings.

Examples of Celebrities and Businesspeople Exposed:

-

Shakira (Singer, Colombia) established companies in tax havens like the British Virgin Islands.

-

Ringo Starr (Musician, UK) formed companies in the Bahamas for real estate purchases.

-

Amitabh Bachchan (Actor, India) - allegedly a director of offshore shipping firms in the British Virgin Islands and Bahamas.

Additional Revelations:

-

A key member of FIFA's ethics committee, responsible for cleaning up corruption within the organisation, was linked to individuals and companies charged with bribery.

-

Latvia: The nonprofit investigative news organization Re:Baltica revealed details of a $10 million trust owned by the daughter of an influential Latvian politician, Aivars Lembergs. Liga Lemberga, the daughter, is connected to offshore vehicles, including Cerise Trust Savings. Her father, Aivars Lembergs, has been indicted on corruption and financial crimes charges.

-

In Algeria, Nacim Ould Kaddour, son of Algeria’s state oil company chief, had offshore connections.

Only a small portion of the people and organisations revealed in the Panama Papers are included in this list. The leak brought attention to the widespread use of offshore havens for conceivably illegal activities and has sparked debates about financial transparency and responsibility for the powerful and wealthy.

Impact on the Global Economy:

The Panama Papers had a significant impact on the global economy.

-

Financial Fallout: The fraud resulted in $1.36 billion in overdue taxes, causing global financial markets to be shaken and investors devaluing 400 companies, highlighting the dangers of offshore havens. This demonstrated how intertwined the world financial system is.

-

National Reactions: As a result of investigations prompted by the leak, governments all around the world discovered concealed assets and recovered about $1.36 billion in overdue taxes, fines, and penalties.

-

Reforms and Resignations: The controversy had a significant impact on prominent individuals, leading to the resignation of Iceland's prime minister, the disqualification of Pakistan's prime minister, and the involvement of British prime minister David Cameron, among others. Due to significant harm to its reputation, Mossack Fonseca, the law firm at the core of the controversy, also had to close.

_1712585579.png)

Continuing Impact and Call to Action

The Panama Papers remain a seminal global reference point, propelling continuous discussions regarding financial crime, inequality, and corruption. There are still ongoing investigations, penalties, court changes, and worldwide initiatives. The struggle for financial openness is still motivated by this game-changing discovery.

The worldwide public was at the centre of the Panama Papers, not just statistics or legal nuances. A grim fact was made clear by the leak: while many people face financial hardships, a privileged few use systemic manipulation to secretly amass fortunes. This demands that justice and openness be served.

There are more players in the battle against financial secrecy than just governments and investigative journalists. Everyone is engaged in combat. We have the power to demand stricter laws, hold authorities responsible, and work towards levelling the playing field. Understanding global finance underwent a sea change after the release of the Panama Papers. By supporting investigative journalism, lobbying for policy reforms, and maintaining awareness, we may make the most of this awareness.

The Panama Papers provide compelling evidence of how crucial transparency is to all financial transactions.

Sources : Multiple agencies

ⒸCopyright 2024. All Rights Reserved Powered by Vygr Media.