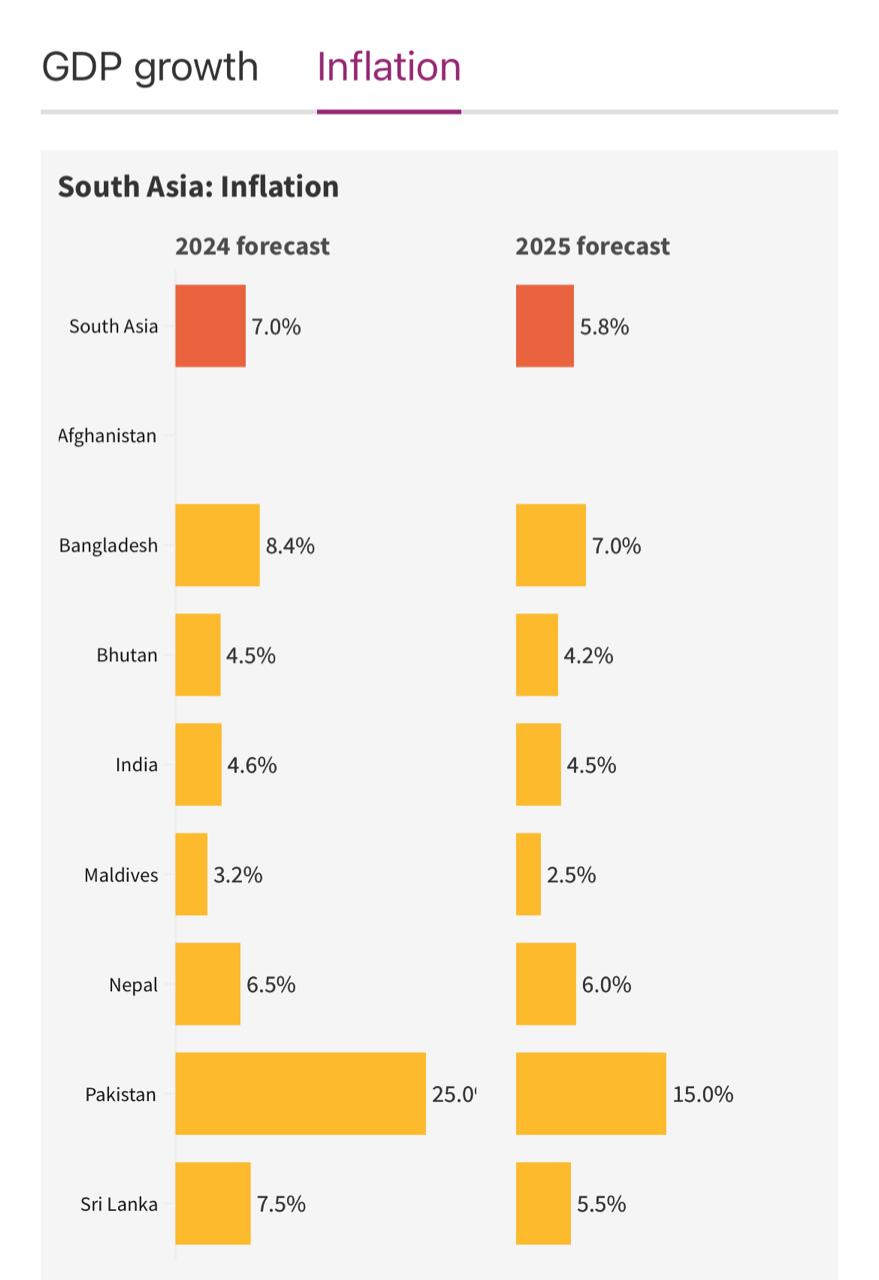

Out of all countries in Asia, Pakistan tops the list with the highest living cost with a stunning 25% inflation rate in the current fiscal year. This was revealed in a report released by the Asian Development Bank (ADB) on Thursday, 11 April.

Pakistan’s economy as forecasted by ADB may grow with 1.9% in the region, fourth last after Myanmar, Azerbaijan and Nauru. There will be a 2.8 per cent growth rate for the fiscal year 2024-25, ranking Pakistan fifth lowest in the region, the report mentions.

The Inflation rate is projected to soar to 15 per cent in the upcoming fiscal year, maintaining Pakistan’s status as the leader in inflation among 46 countries surveyed. Some 40 per cent of the population lives below the poverty line, now with the skyrocketed inflation, more people are expected to move below this line.

What is the Asian Development Bank?

The Manila-headquartered lender, founded in 1966, is collectively owned by 68 members, 49 of which are from the Asia region, with a primary goal of alleviating poverty. Japan holds the largest stake in ADB at 15.677%, followed by the U.S.A (15.567%), China (6.473%), and India (5.812%).

Where do India and the South Asian region stand as per the report?

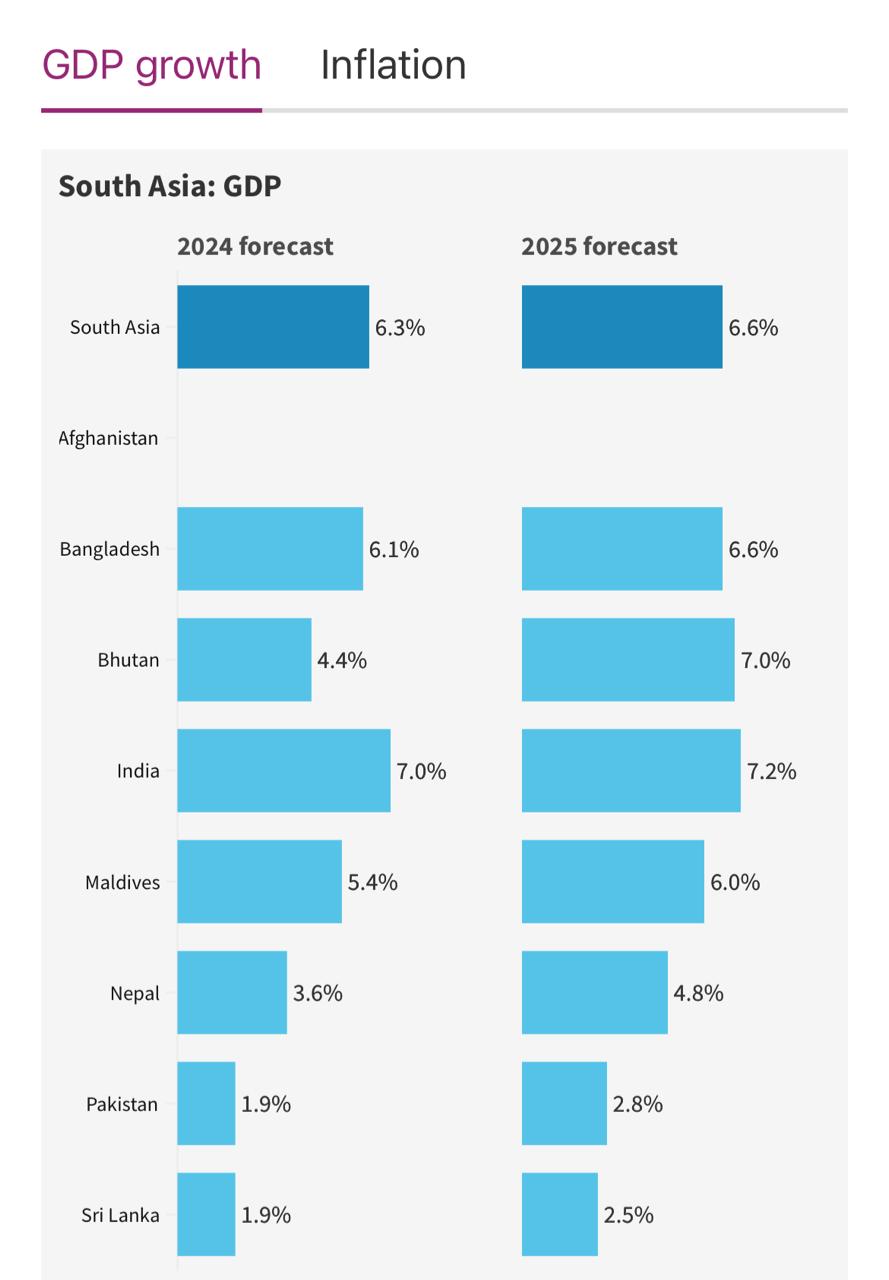

India's growth is predicted to be the strongest of the eight South Asian countries at 7.0% for the fiscal year (FY) 2024 (ending on March 31, 2025), slower than the 7.6% growth in FY2023. As rising consumption supports ongoing investment growth, growth is anticipated to pick up speed to 7.2% in FY2025. The primary driver of growth will continue to be services, with manufacturing predicted to play a significant supporting role.

South Asia continues to be the fastest-growing subregion, according to the report, as improvements in domestic demand help most economies control inflation. The subregion will continue to grow faster than the average for the region, with 6.3% and 6.6% growth in 2024 and 2025, respectively.

Bangladesh's GDP growth rate, is 6.1% with 8.4% inflation. Except Pakistan, every other country in South Asia has an inflation rate below 10%, including Sri Lanka, which recently underwent its worst economic crisis.

https://www.adb.org/outlook/editions/april-2024

To have a look at China, or The People’s Republic of China, specifically, our immediate neighbour in East Asia, the Growth Rate was 4.8%, with just a 1.1 % inflation rate.

What are the top reasons for this high Inflation rate?

Political Uncertainty:

While Pakistan was facing a challenging economic situation, It held its Parliamentary Elections in 2024, where the power again shifted from Imran Khan to Shehbaz Khan’s government, again with the agenda to establish a new, steadfast government that could stabilise an economy in crisis

Pakistan has consistently experienced political unrest brought on by unstable governments with no prime minister in history to complete their term of office. One factor impeding the development of better policies for Pakistan's 241 million citizens is the unpredictability of regime changes.

Even the Asian Development Bank states said political uncertainty that affected macroeconomic policymaking would remain a key risk to the sustainability of stabilisation and reform efforts.

Conflict in the Middle East:

As per ADB, the potential supply chain disruptions from the escalation of the conflict in the Middle East, with Israel and Palestine at war, and Pakistan’s conflict with Iran, all have negatively affected the country’s economy on the external front,

2022 Pakistan Floods:

Pakistan in 2022, was hit with what its leaders called "climate catastrophe”. In August, persistent monsoon rains led to the flooding of the Sutlej River, displacing 162,257 individuals and submerging 153,231 acres of farmland with standing crops. It tarnished the country's economy to an extent that it still has not yet recovered from.

As per ADB, Macroeconomic risks persist as Pakistan grapples with challenges such as a significant current account deficit, high public debt, and reduced demand from traditional export markets amid sluggish global growth.

In the last fiscal year, Pakistan’s economy contracted due to the lingering impacts of 2022’s devastating floods; uncertainty; policy slippage; as well as weakened production, consumption, and investment, the ADB pointed out.

In 2023, rural areas saw a 50% surge in food prices compared to the previous year, with an unprecedented inflation rate of 28.3%. This inflationary trend subtly undermines food security, making it harder for households to afford necessities, especially food.

The floods led to supply disruptions, causing a significant hike in the prices of essential consumer items, as reported by the country’s Bureau of Statistics. This price instability exacerbates a humanitarian crisis that has already impacted 30 million people. Poverty in the worst-hit regions deepened in the aftermath of the flooding.

External debts

Pakistan is in a debt trap. Pakistan is confronting an imminent debt payment crisis, with the central bank indicating $24 billion of external debt obligations due by June 2024. Reports reveal that Pakistan is obligated to repay $77.5 billion in debt over the next three years, amounting to nearly a quarter of its gross domestic product.

Pakistan's external debt dynamics are complex, and influenced by historical relationships with China and Saudi Arabia. The total external debt comprises multilateral, Paris Club, private, and commercial loans, with Chinese financial institutions holding more than 30 per cent of the debt. The short-term nature and high-interest rates of certain loans, especially from private bonds and Chinese debt, pose substantial challenges for Pakistan's debt management.

Pakistan's debt-to-GDP ratio is now over 70%, and this year's interest payments on its debt are expected to account for 50% to 60% of the country's government revenue, according to projections from the IMF and credit rating agencies. This is the highest ratio found in the sizable economies around the world.

Finance Minister Muhammad Aurangzeb and IMF Managing Director Kristalina Georgieva are scheduled to meet in Washington next week to discuss a new bailout package.

Georgieva mentioned this week that Pakistan is engaged in discussions for a potential follow-up program with the IMF. However, she highlighted "very important issues" that need addressing in Pakistan, including expanding the tax base, ensuring contribution from the wealthier segments of society, improving the direction of public spending, and fostering a more transparent environment.

The IMF has previously raised concerns about the lack of transparency surrounding the Sovereign Wealth Fund and the Special Investment Facilitation Council (SIFC).

More Challenges for Pakistan Ahead?

The report states that even with a substantial 22 per cent interest rate, the State Bank of Pakistan and the federal government are expected to fall short of their inflation target of 21 per cent for the current fiscal year.

Pakistan has been experiencing stagflation for a while, and the World Bank warned last week that any negative shocks could push another 10 million people into poverty. In Pakistan, an estimated 98 million people already lead impoverished lives.

According to the ADB, Pakistan's domestic demand would be restrained by low confidence, rising living expenses, and the imposition of stricter macroeconomic policies as part of the IMF program.

The government aimed to attain a 0.4 per cent primary surplus and a 7.5 percent overall GDP deficit in FY2024, with a gradual decline in each of the two in the following years. The World Bank stated last week that Pakistan would fail to meet both of these budgetary goals as well, as per reports.

(Inputs From Various Agencies)

©️ Copyright 2024. All Rights Reserved Powered by Vygr Media.