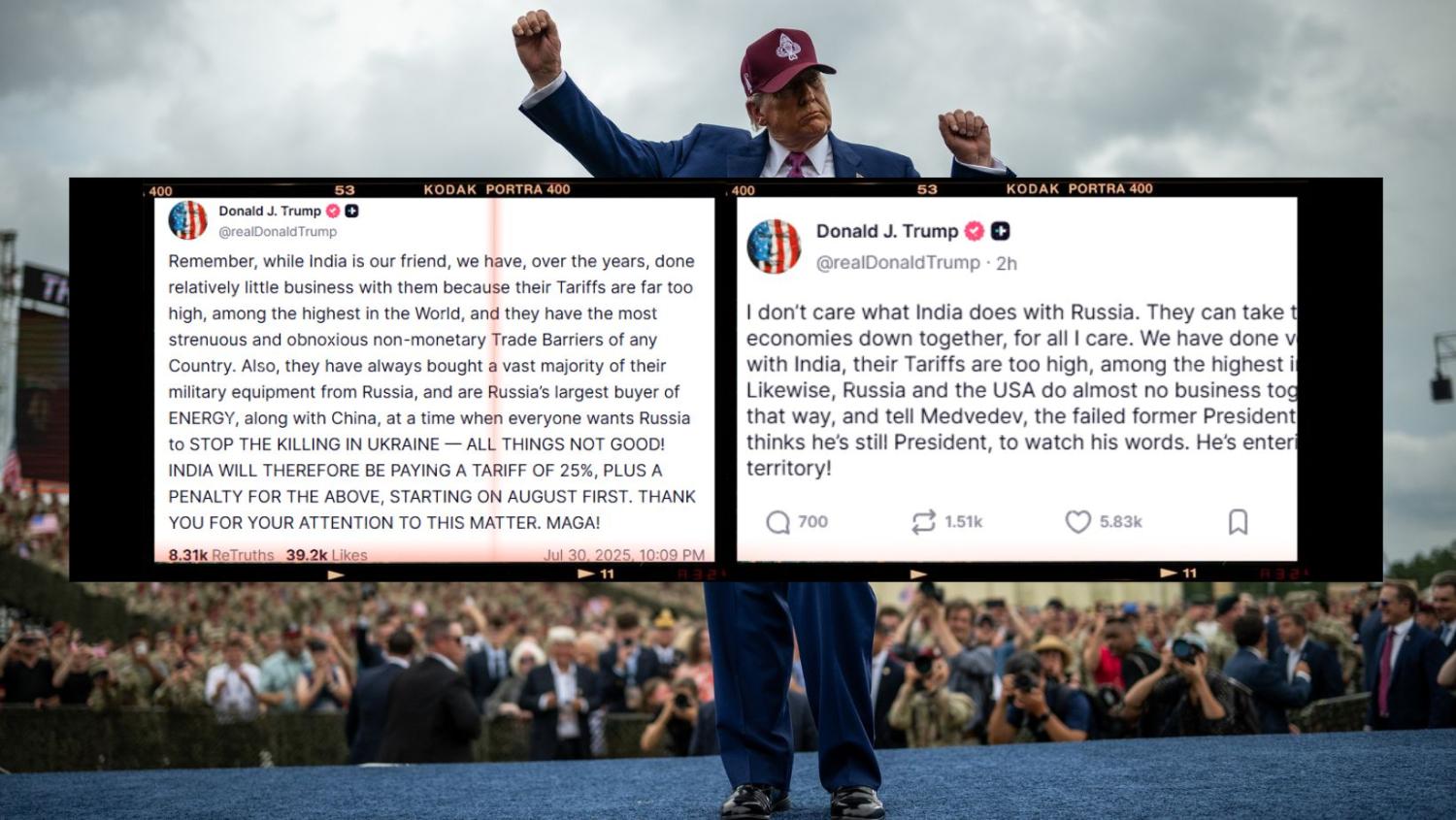

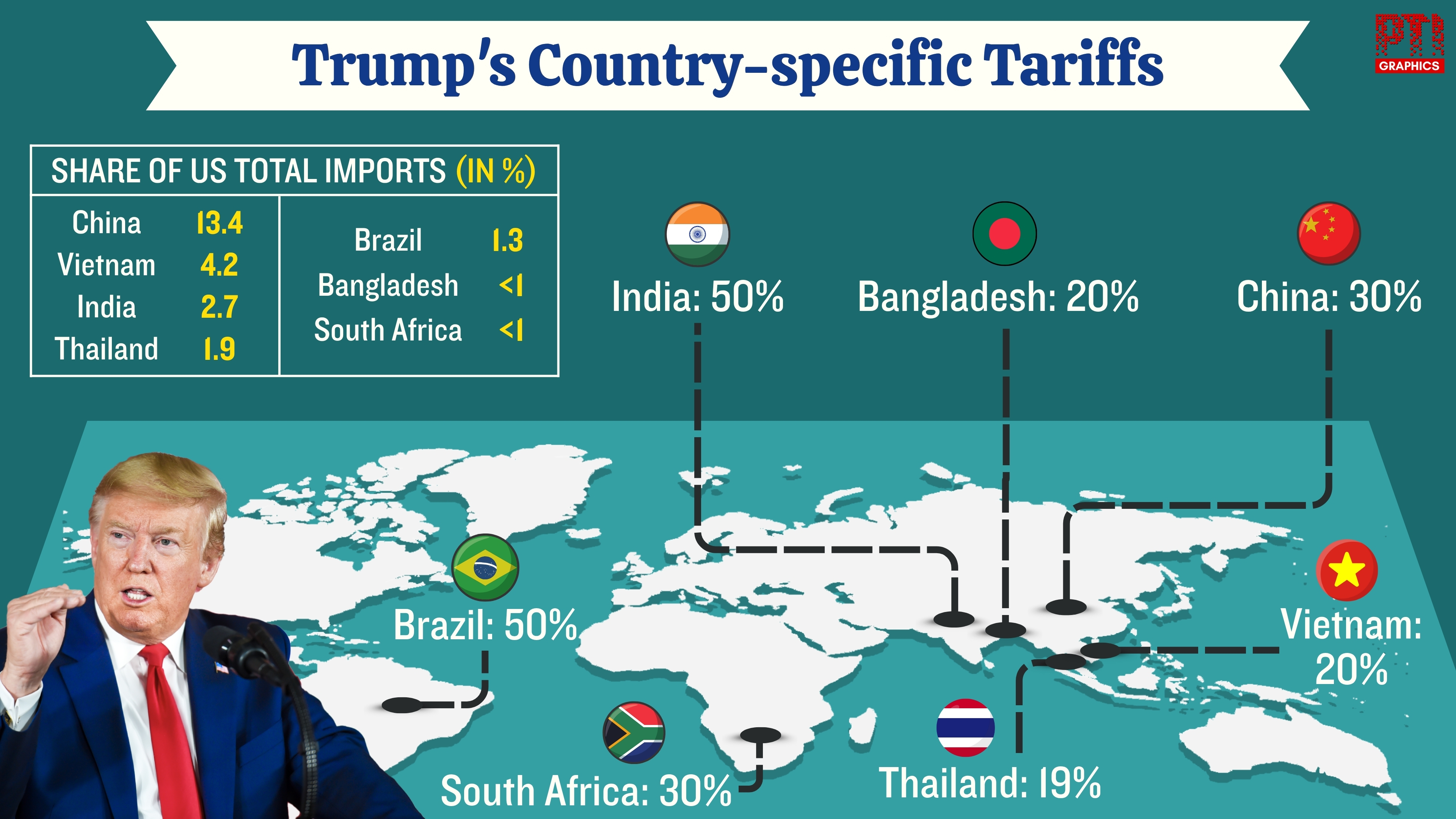

In a move that has stunned New Delhi and rattled global trade corridors, US President Donald Trump has escalated tariffs on Indian exports to 50%, doubling the previous 25% rate, as punishment for India’s continued imports of Russian crude oil. The announcement, made on August 6, has set off a 21-day countdown before the tariffs take effect on August 27 — a period Trump’s team insists is not for negotiation, but for India to “resolve” the dispute by halting its Russian oil trade.

The White House frames this as a calculated strike at Moscow’s oil revenues, part of a broader campaign to pressure Russian President Vladimir Putin into ending the Ukraine conflict. But in targeting India — the world’s third-largest oil consumer and America’s largest democratic partner in Asia — Trump has ignited a geopolitical firestorm that could, ironically, benefit Beijing more than Washington.

India in the Crosshairs

India’s pivot to Russian oil was born out of economic necessity. When the Ukraine war broke out in 2022 and the West shunned Russian crude, Moscow offered its heavy Urals blend at steep discounts. For New Delhi, dependent on imports to power its fast-growing economy, the deal was irresistible. From near-zero Russian oil imports in 2021, India now buys 1.8–2 million barrels per day, accounting for roughly 37–40% of total crude imports.

The arrangement slashed India’s oil bill, kept inflation under control, and turned local refiners into profit powerhouses. Indian refiners bought cheap Russian crude, processed it into diesel, gasoline, and jet fuel, and sold those products globally at market rates — a lucrative arbitrage model that, until recently, the US quietly tolerated. Treasury officials last year even called the price-cap mechanism a way for India to “access discounted oil while keeping global markets stable.”

But that tolerance has evaporated. Trump’s 50% tariff is designed to force India’s Russian oil imports to zero. A secondary 25% penalty specifically tied to the Russia trade is set to take effect on August 27, on top of the base tariff.

A Strategic Trap — and a Gift to China

Experts say Trump’s move risks unraveling 25 years of US–India strategic progress. Ashley Tellis of the Carnegie Endowment warns that the pressure “puts India in a trap” — Modi may reduce Russian oil purchases in practice, but cannot publicly admit to yielding to US pressure without appearing weak.

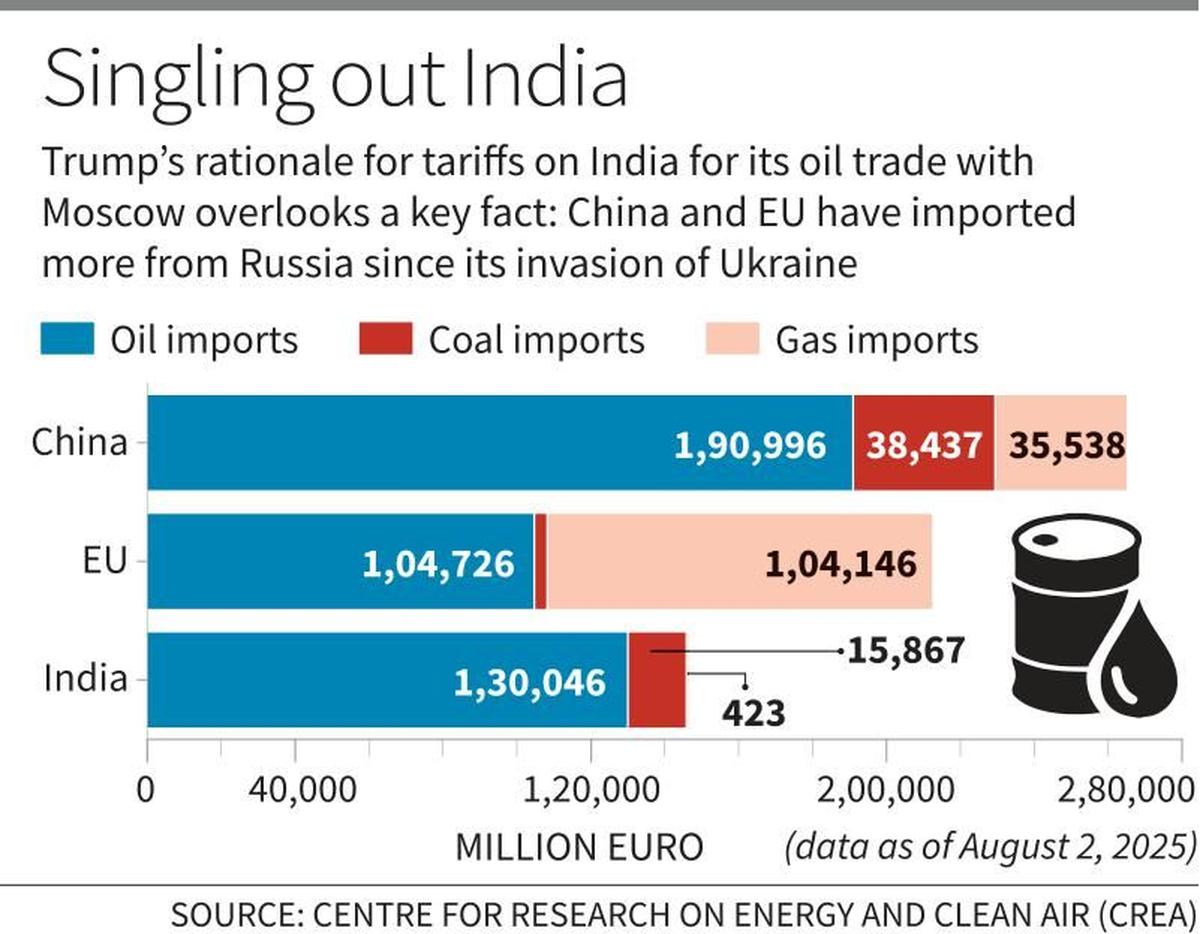

Meanwhile, China — the largest buyer of Russian oil, importing around 2 million barrels daily — has so far escaped Trump’s tariff wrath. By singling out India, Washington could inadvertently hand Beijing a golden opportunity to buy more discounted Russian crude, bolster its energy security, and deepen its Eurasian alliances. With Indian refiners expected to scale back, the competition for cheap Russian barrels will vanish, letting Chinese refiners stockpile at even better prices.

“It’s not pressure — it’s punishment,” said a South Korean trade analyst. “And it creates space for China.”

India’s Calculus: Balancing Economics and Sovereignty

For Modi, the challenge is twofold: keep fuel costs manageable at home while avoiding the appearance of bowing to Washington. He has made clear that agriculture, fisheries, and dairy sectors are non-negotiable, telling a domestic audience:

“India will never compromise on the interests of its farmers, dairy farmers, and fishermen. I am ready to personally pay the heavy price.”

The economic trade-off is stark. India saved around £3.8 billion on oil purchases until March despite narrowing discounts on Russian crude. By contrast, its exports to the US totalled £87 billion in 2024. As ING’s Warren Patterson put it:

“Are you going to risk $87 billion worth of exports to save a few billion from oil discounts?”

The math is further complicated by falling discounts: in May, Indian buyers paid just $4.50 less per barrel for Russian crude compared to Saudi oil — down from over $23 a barrel in 2023.

Diplomatic Realignment in Motion

The tariff shock has triggered a flurry of high-level diplomacy. Modi has spoken with Brazilian President Luiz Inácio Lula da Silva about a BRICS response, while NSA Ajit Doval travelled to Moscow, meeting Putin and confirming the Russian leader’s planned visit to India later this year. Both sides reaffirmed their “strategic partnership.”

At the same time, Modi is preparing for his first visit to China in seven years to attend the Shanghai Cooperation Organisation summit in Tianjin on August 31–September 1, with bilateral talks with Xi Jinping on the sidelines. China’s ambassador to India openly criticised US tariff policy, likening it to bullying.

This dual engagement — warming ties with both Moscow and Beijing — underscores a potential diplomatic realignment. A senior Indian official told Reuters that while India will “gradually repair ties with the US,” it is now exploring deeper links with Russia, China, and the BRICS bloc.

The US–India Rift: From Strategic Partners to Tariff Rivals

Since the early 2000s, US–India relations had been on an upward trajectory, cemented by shared Indo-Pacific goals and initiatives like the Quad. But Trump’s mercantilist trade agenda has disrupted that alignment. His administration’s erratic approach — from punitive tariffs to outreach to Pakistan — has strained trust in New Delhi.

Russia, by contrast, has remained a consistent partner, supplying arms and energy without public criticism of Indian policies. Kremlin spokesperson Dmitry Peskov has condemned Washington’s “illegal” pressure, affirming that sovereign nations have the right to choose their trading partners.

The last time the US forced India’s hand so dramatically was during the 1960s arms embargo, which drove New Delhi into Moscow’s embrace — a pattern many analysts see repeating now.

Domestic and Global Economic Fallout

While Trump touts increased tariff revenue — $29 billion monthly by July 2025 — US households are paying the price, with Yale’s Budget Lab estimating an average $2,400 annual cost per household. US GDP growth has slowed to 1.2% in early 2025, down from 2.8% last year. Manufacturing job growth has stalled, and trade hubs like the Port of Los Angeles are under capacity.

Globally, if India cuts Russian oil imports sharply without alternative supply arrangements, prices could spike, echoing the volatility of 2022. China’s willingness to absorb diverted barrels will determine whether markets stabilise — and whether Trump’s next tariff target becomes Beijing.

A Potential Self-Goal for Washington

By pushing India away at a time when it is central to counterbalancing China, Trump risks undermining a cornerstone of US Indo-Pacific strategy. The world’s fastest-growing major economy — and a fellow democracy — could drift closer to America’s strategic competitors.

Ajay Srivastava of the Global Trade Research Initiative summed it up:

“US action will push India to reconsider its strategic alignment, deepening ties with Russia, China, and many other countries.”

What began as a bid to squeeze Moscow’s war chest may end up strengthening the very axis Washington seeks to contain.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved. Powered by Vygr Media.