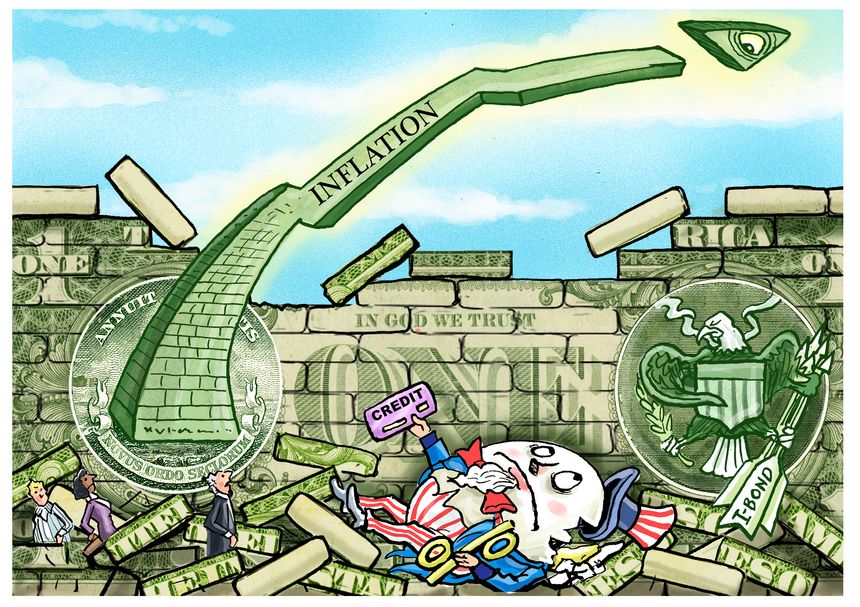

US inflation decreased more than expected in October, providing encouragement that the strongest price gains in decades are slowing down and allowing Federal Reserve officials the opportunity to ease off on their swift interest-rate increases.

The Labor Department's October data indicated that important goods like rent increased less than anticipated, while the price index for resale cars—which was responsible for the original, pandemic-related spike in inflation—declined by 2.4%, marking the fourth straight monthly fall. The cost of travel, healthcare, and clothing all decreased.

Despite prices rising 7.7% from the past year, total inflation continued to rise by historical standards. However, the rate of "core" inflation, which includes unpredictable food and energy prices, decreased by 50% from the previous month to 0.3% in October.

According to some economists, inflation, which emerged as the major challenge to the economy last year, may only be beginning to be subdued. The S&P 500 rose over than 4% in morning trade as a result of the news, sending U.S. markets surging on optimism that, even while the Fed is unlikely to switch to a more dovish stance anytime soon, it won't be compelled to adopt a more aggressive stance.

The 2-year U.S. Treasury note yield, which is most influenced by Fed rate predictions, fell by about 20 percentage points on Monday, the highest in a single day from June. Investors now anticipate the torrid pace of policy strengthening to ease next month and for the Fed to end its rate hikes sooner than people think, according to traders in futures contracts linked to the Fed's benchmark rate.

After dramatically increasing rates this year greater than at any moment since the 1980s, including four consecutive 75-basis-point rate hikes that brought the policy rate to a range of 3.75%–4% as of last week, the Fed is now expected to switch to a half-point rate hike succeeding month and quarter-point hikes then after. Rate futures contracts currently anticipate the top policy rate to be in the 4.75%-5% range in March of next year, which is lower than the 5%-plus range anticipated prior to the report, as well as interest rate reductions in the second period of the year.

The report provided some comfort to Fed policymakers, but they also noted that the battle against increasing prices would be far from done because of their early upbeat outlook of inflation, which left them doing catch-up. "This morning’s CPI data were a welcome relief, but there is still a long way to go," President of Fed Lorie Logan informed. "While I believe it may soon be appropriate to slow the pace of rate increases so we can better assess how financial and economic conditions are evolving, I also believe a slower pace should not be taken to represent easier policy," he said.

© Vygr Media Private Limited 2022. All Rights Reserved.