Budget 2025: Updates

( Feb 1, 2025 12:09 AM IST) Budget 2025 LIVE: Nirmala Sitharaman announced new tax slabs.

( Feb 1, 2025 12:09 AM IST) Budget 2025 LIVE: Nirmala Sitharaman lists focus areas of tax proposals

- Personal income tax reforms with special focus on middle class

- Rationalisation of TDS and TCS

- Reducing compliance burden

- Ease of doing business

- Employment and investment

( Feb 1, 2025 11:58 AM IST) Budget 2025 LIVE: FM Sitharaman claims that the new income tax bill will be easy to comprehend.

Regarding direct tax ideas, FM Nirmala Sitharaman stated: "I am pleased to announce that we will continue the spirit of 'nyay' with regard to the new income tax, and the new bill will be straightforward and unambiguous in its wording. Taxpayers will find it easy to grasp, which will decrease litigation.

( Feb 1, 2025 11:56 AM IST) Budget 2025 LIVE: 9 items added in duty free sector

Nine items will be in the duty-free sector, according to Nirmala Sitharaman's announcement.

( Feb 1, 2025 11:55 AM IST) Budget 2025 LIVE: Fiscal deficit projected at 4.4% of GDP, said by Sitharaman

According to Nirmala Sitharaman, the fiscal deficit is expected to be 4.4% of GDP in the Union Budget 2025 LIVE.

( Feb 1, 2025 11:55 AM IST) Budget 2025 LIVE: Nirmala Sitharaman said new income tax bill to come next week

“I propose to introduce the new income tax bill next week,” said Nirmala Sitharaman.

( Feb 1, 2025 11:49 AM IST) Budget 2025 LIVE: Fund to support innovation in collaboration with the commercial sector

According to Finance Minister Nirmala Sitharaman, ₹20,000 crore will be allocated to foster innovation in collaboration with the business sector.

( Feb 1, 2025 11:47 AM IST) Budget 2025 LIVE: Bihar's greenfield airports were announced by FM Sitharaman.

"The modified 'Udaan' scheme will carry four crore additional passengers in the next ten years," Nirmala Sitharaman declared. Additionally, the plan would help micro airports and helipads in hilly, ambitious, and northeast regional regions.

Following FM Sitharaman's announcement that greenfield airports would be built in Bihar to accommodate the state's future demands, the opposition started chanting in Parliament.

( Feb 1, 2025 11:45 AM IST) Budget 2025 LIVE: FM Sitharaman declared a revised "Udaan" Scheme.

According to Nirmala Sitharaman, the Udaan regional connectivity project has made it possible for 1.5 crore middle-class people to fulfil their need for quicker travel. A modified Udaan program will be introduced to improve regional connectivity to 120 new destinations, motivated by the success.

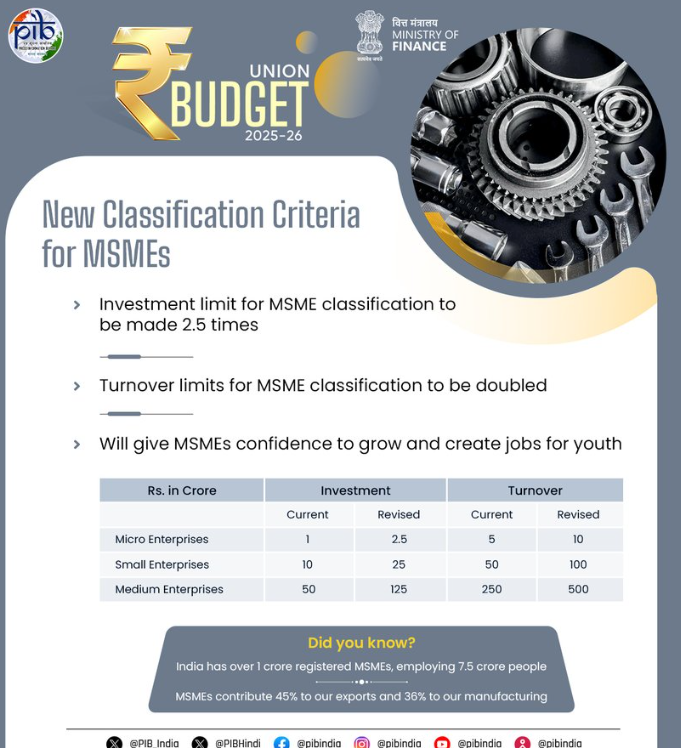

( Feb 1, 2025 11:34 AM IST) Budget 2025 LIVE: New classification criteria for MSMEs

( Feb 1, 2025 11:31 AM IST) Budget 2025 LIVE: FM Sitharaman states that 10,000 more seats will be added to medical colleges.

During the presentation of the Union Budget 2025, FM Nirmala Sitharaman declared that 10,000 more seats would be added to medical colleges.

( Feb 1, 2025 11:30 AM IST) Budget 2025 LIVE: Expansion of capacity in IITs

According to Finance Minister Nirmala Sitharaman, 23 IITs have exceeded their 1.35 lakh student capacity in the last ten years.

"I had announced three excellence centres in AI for agriculture in 2023," she added. Now, 500 crores would be spent to establish an educational centre of excellence.

( Feb 1, 2025 11:24 AM IST) Budget 2025 LIVE: Funds for Startups

To support entrepreneurship, a new "Fund of Funds for Startups" will be established with: In addition to the Rs. 10,000 crore already contributed by the government, there is a new contribution of Rs. 10,000 crore. A new program for first-time business owners who are Scheduled Castes, Scheduled Tribes, and 5 lakh women

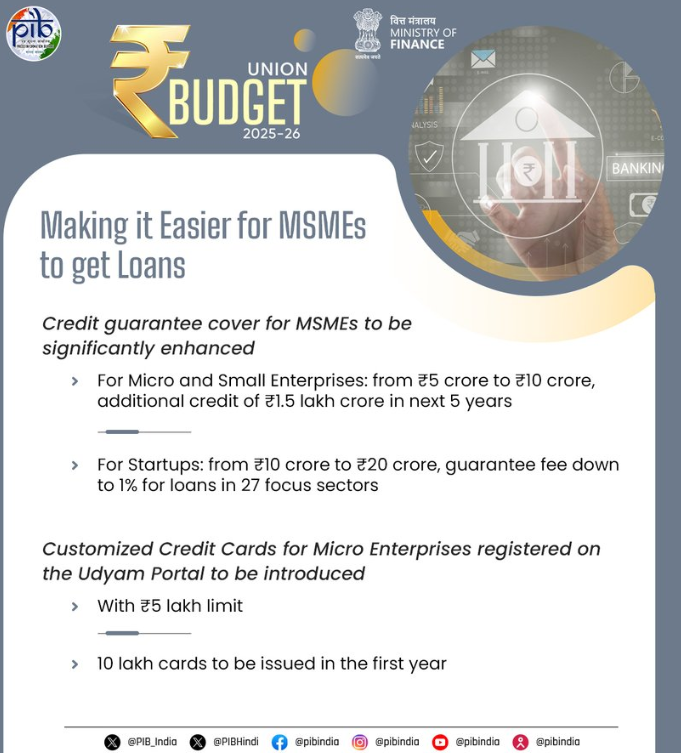

( Feb 1, 2025 11:22 AM IST) Budget 2025 LIVE: Govt to enhance credit guarantee cover for MSMEs

( Feb 1, 2025 11:20 AM IST) Budget 2025 LIVE: Nirmala Sitharaman on MSMEs

LIVE Budget 2025: MSMEs are the Union Budget 2025's second engine.India is now positioned as a global manufacturing hub thanks to the efforts of over one crore registered MSMEs, which account for 45% of our exports and 37% of our manufacturing. The investment and turnover thresholds for all MSMEs will be increased to 2.5 and two times, respectively, to assist them. Nirmala Sitharaman declared, "This will give them the confidence to grow and generate employment for our youth."

( Feb 1, 2025 11:17 AM IST) Budget 2025 LIVE: India Post to be transformed as large public logistics organisation

Finance Minister Nirmala Sitharaman declared that India Post would be restructured as a major public logistics company.

( Feb 1, 2025 11:16 AM IST) Budget 2025 LIVE: FM Sitharaman claims that agriculture will be the primary driver of the 2025 budget. Budget 2025 LIVE:

When introducing the Union Budget 2025 in Parliament, Finance Minister Nirmala Sitharaman declared that agriculture would be the first engine of the budget: One hundred districts with low production will be covered under PM Dhandhanya Krisihi Yojna. At the panchayat level, it will increase storage and boost agricultural yield. 1.7 crore farmers would be covered by this initiative. States will be involved in the program's inception. It seeks to create lots of opportunities. There will be global procedures involved. With an emphasis on urad, tuar, and masoor, our administration will begin a pulse program," FM Sitharaman stated.

“With rising income levels, the consumption in fruits is also increasing and remuneration for farmers will also increase in collaboration with states. There is a special opportunity in Bihar, the Makhana board will be established in the state. The board will provide training and support to Makhana farmers,” Nirmala Sitharaman added.

( Feb 1, 2025 11:15 AM IST) Budget 2025 LIVE: 10 Budget 2025 Focus Areas

Budget 2025 LIVE: Finance Minister Nirmala Sitharaman stated that the proposed development measures in Budget 2025 focus on Garib, Youth, Annadata, and Nari and cover 10 major areas.

( Feb 1, 2025 11:08 AM IST) Budget 2025 LIVE : According to FM Sitharaman, India's GDP is expanding at the fastest rate among all major economies.

Of all the major economies in the world, India's economy is expanding at the fastest rate, according to Finance Minister Nirmala Sitharaman. "The world has taken notice of our development record over the last ten years and structural improvements. The belief in India's potential and competence has only increased during this time. In the Lok Sabha, Nirmala Sitharaman began presenting the Union Budget 2025. "We see the next five years as a unique opportunity to realise 'Sabka Vikas,' stimulating balanced growth of all regions," she said.

( Feb 1, 2025 11:04 AM IST) Budget 2025 LIVE : Sitharaman starts presenting the budget, causing chaos in Parliament.

The opposition protested when Nirmala Sitharaman started presenting the budget, and chaos ensued in Parliament.

Finance Minister Nirmala Sitharaman is set to present her eighth consecutive Union Budget on February 1, 2025. This marks a significant milestone in Indian political history, as she becomes the first finance minister to achieve this feat. Her tenure began in 2019 when she was appointed as India's first full-time woman finance minister, and since then, she has consistently presented the budget each year under Prime Minister Narendra Modi's leadership.

Historical Context

Sitharaman's achievement brings her closer to the record of 10 budgets presented by former Prime Minister Morarji Desai, who delivered six budgets from 1959 to 1964 and four more between 1967 and 1969. Other notable finance ministers include P Chidambaram with nine budgets and Pranab Mukherjee with eight. However, Sitharaman holds the record for the most consecutive budgets presented in a row.

Economic Background

The Economic Survey released prior to the budget presentation projected India's GDP growth for 2025-26 between 6.3% and 6.8%. This reflects a moderation in growth rates, highlighting the need for structural reforms and deregulation to bolster medium-term growth potential. The government aims to address the economic challenges posed by high inflation and stagnant wage growth, particularly affecting the middle class.

Key Expectations for Budget 2025

- Tax Relief for Middle Class: There are high hopes for income tax reliefs, including potential hikes in tax slabs and an increase in the standard deduction to alleviate financial pressure on taxpayers amid rising costs of living.

- Support for Farmers: The budget may expand direct income support schemes like PM-KISAN and improve policies surrounding Minimum Support Price (MSP) to aid farmers.

- Healthcare and Education Funding: Increased allocations are expected for health initiatives like Ayushman Bharat and for implementing the National Education Policy, focusing on skill development and research.

- Climate Change Initiatives: The government may introduce incentives for renewable energy projects as part of its commitment to achieving net-zero emissions by 2070, which could include tax benefits for electric vehicle manufacturing.

- Infrastructure Investment: Continued investment in infrastructure is anticipated, particularly in areas that stimulate economic activity while adhering to fiscal discipline targets.

Budget 2025

- Nirmala Sitharaman is set to present her eighth consecutive Union Budget.

- Industry leaders expect tax relief to stimulate consumer spending.

- Focus on infrastructure investment and job creation is anticipated.

- Quotes from experts highlight the need for investment in manufacturing and renewable energy.

- Economic growth projected between 6.3% and 6.8% in the Economic Survey.

- Tax reforms, especially changes in income tax slabs, are expected.

- Increased standard deduction may be introduced to ease taxpayer burden.

- Stakeholders will monitor impacts on agriculture and technology sectors.

- Overall, Budget 2025 aims to shape India's economic landscape for the year ahead.

What is the Meaning of Tax Slab Changes in Indian Income Tax

- Tax slab changes adjust income tax brackets affecting taxpayer obligations.

- Higher basic exemption limits can reduce tax liabilities for many.

- New slabs can target specific income groups for relief or increased revenue.

- Changes are typically announced during the annual budget presentation.

- Adjustments aim to promote fairness and stimulate economic growth.

- Tax slab modifications influence consumer spending and savings behavior.

- They reflect the government's priorities in economic policy.

- These changes are crucial for maintaining taxpayer compliance.

What is the Meaning of Budget Deficit

- A budget deficit occurs when expenditures exceed revenues within a fiscal year.

- Governments may borrow funds to cover shortfalls, increasing national debt.

- Persistent deficits can raise concerns about fiscal sustainability.

- High deficit-to-GDP ratios may signal risks to investors and credit agencies.

- Strategic deficits can fund essential projects and stimulate growth.

- Balancing short-term stimulus with long-term fiscal discipline is vital.

Who is the Father of the Indian Budget

- Morarji Desai is often called the "Father of the Indian Budget."

- He served as Finance Minister from 1958 to 1963 and later as Prime Minister.

- Desai presented six budgets as Finance Minister and four as Prime Minister.

- He emphasized transparency and accountability in government spending.

- His policies focused on poverty alleviation and agricultural development.

What Were the Highlights of the Indian Budget in 2024

- Increased infrastructure spending on roads, railways, and urban development.

- Enhanced funding for public health initiatives.

- Introduction of new tax slabs for middle-class relief.

- Increased subsidies and support schemes for farmers.

- Emphasis on skill development programs for job creation.

- Investments in renewable energy projects for climate commitments.

- Boost to digital economy through technology infrastructure investments.

- Initiatives promoting women's workforce participation highlighted.

- Encouragement of public-private partnerships for infrastructure development.

- Commitment to maintaining fiscal discipline amidst rising expenditures.

Will Recession Hit India as Per 2025 Estimates

- Concerns about a potential recession hitting India are being discussed among experts.

- GDP growth projected between 6.3% and 6.8%, indicating moderate growth expectations.

- Global economic uncertainties could significantly impact domestic growth trajectories.

- Industry experts warn that unchecked inflation may pose challenges.

- Strategic investments in infrastructure could mitigate recession risks by creating jobs.

- Focus on enhancing manufacturing capabilities seen as a positive step forward.

- Targeted fiscal measures may help cushion vulnerable sectors from downturns.

Inputs by Agencies

Image Source: Multiple Sources

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.