A Special Report On the Real Estate, Workforce & Population Crisis in China, and How India Can Learn to Profit From It.

Overview

Under Mao Zedong's regime, the concept of private housing was virtually nonexistent. All forms of private property were staunchly condemned as antithetical to Marxist principles. However, the failure of communal property systems prompted the exploration of alternative ownership models during Deng Xiaoping's era. Today, private homeownership has become ubiquitous, constituting approximately 25% of China's GDP and serving as the primary source of household wealth, estimated to comprise nearly 70%.

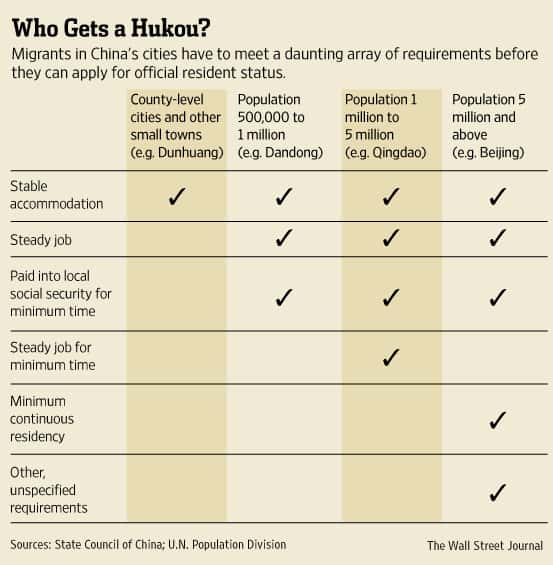

But, before we venture into understanding the real cause of the Real-Estate crash in China, we must understand The Hukou system - a distinctive feature of China's administrative structure, that had erected what many describe as an "invisible barrier" between rural and urban populations. This barrier manifests in stark disparities in access to social benefits, with urban residents typically enjoying far greater advantages than their rural counterparts. The desire to bridge this gap often compels rural migrants to tirelessly pursue the acquisition of an urban Hukou, viewing it as a ticket to improved opportunities and quality of life.

What is the Chinese Hukou System of Housing?

The Chinese Hukou system is a household registration system that has been in place since the 1950s. It serves as a fundamental component of China's administrative and social management structure. It’s a system used in China to officially register and classify households and individuals. It plays a crucial role in controlling population migration, managing social services, and determining access to certain rights and benefits.

Key Components of the Hukou System of Housing:

Urban vs. Rural Hukou:

- The system classifies individuals into two main categories: Urban and Rural.

- Urban Hukou is typically associated with residents of cities and towns, while Rural Hukou is for those in rural areas.

Registration and Documentation:

- Each household is registered in a specific location, either urban or rural, and is issued a Hukou document as proof of registration.

- The Hukou document contains essential information about the household, including members' names, relationships, and other pertinent details.

Access to Services:

- The type of Hukou a person holds significantly impacts access to social services such as education, healthcare, and social welfare.

- Those with Urban Hukou generally have greater access to social services and benefits compared to those with Rural Hukou.

Population Control:

- Historically, the Hukou system played a crucial role in controlling population movement, particularly from rural to urban areas.

- It restricted migration by requiring individuals to obtain permission to change their Hukou status, often leading to disparities in opportunities between urban and rural residents.

Reforms and Changes:

- Over time, the Chinese government has implemented reforms to the Hukou system to address inequalities and promote urbanisation.

- Reforms have aimed to relax restrictions on rural-to-urban migration and provide better access to social services for rural migrants living in cities.

Implications for Society:

- The Hukou system has had profound social and economic implications in China. It has contributed to the formation of distinct urban and rural identities, as well as disparities in income, education, and access to resources.

- Reform efforts seek to bridge these gaps and create a more equitable society.

China’s Housing Crisis - The Real Culprits

Several factors have converged to catalyse China's housing crisis, including debt-fuelled development, limited investment alternatives for households within a socialist market economy framework, a thin social safety net, and government policies that historically bolstered the housing sector. Prior to 2020, these elements coalesced to inflate a housing bubble. Remarkably, it's estimated that a staggering 96% of urban households possess at least one house or apartment. With burgeoning housing demand and escalating prices, a prevailing expectation emerged that prices would perpetually ascend. However, this perception underwent a seismic shift with Xi Jinping's decisive intervention, as he implemented new regulations aimed at quelling speculation and stabilising the market.

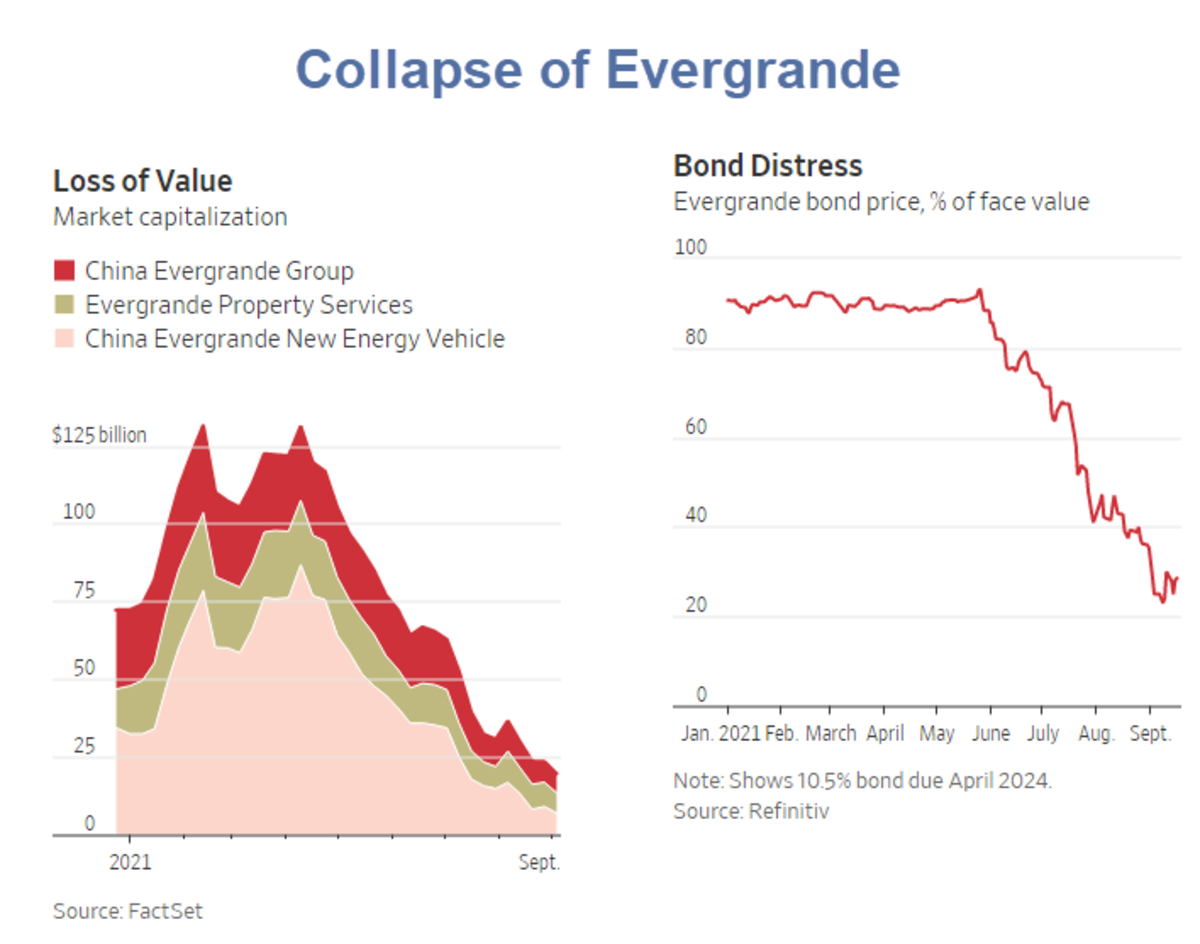

With liquidity constraints, instigated by China's paramount leader Xi Jinping in late 2020, aimed at curbing speculation in the housing market and mitigating excessive leverage among developers, have precipitated a wave of defaults, primarily concentrated in offshore debt. Among the top 50 developers with the highest issuance of dollar-denominated bonds in Hong Kong, approximately two-thirds have defaulted on interest payments. Consequently, the market value of these bonds has witnessed a precipitous decline, with nearly 90% of their value, amounting to $136 billion, evaporating over the past two years.

Is China Aging Out of Relevance?

China, as we knew it, since the last decade or so, as the unstoppable juggernaut, might have started showing cracks in its opaque bubble. With a rapidly aging population, shrinking workforce, and a septuagenarian Paramount Leader, might be facing some unforeseen backwards inertia. Catalysed by the real-estate crash, China is looking vulnerable for the first time in ages.

The collapse of China Evergrande, on top of all that, stands as a poignant symbol of the real estate industry's ongoing turmoil: Nationwide, sales are dwindling, and countless homes remain paid for but undelivered. It's estimated that China currently grapples with approximately 20 million apartments paid for but not yet received. The steadfast faith of Chinese property buyers in real estate's infallibility once propelled the sector to the forefront of the nation's economy. However, over the past couple of years, as corporations faltered under towering debts and new home sales plummeted, Chinese consumers have begun to harbour an equally unwavering conviction: real estate has transitioned from a surefire investment to a precarious gamble.

Evergrande's Fall - The Final Blow?

The erosion of trust in property, traditionally the cornerstone of wealth accumulation for many Chinese households, poses a mounting challenge for policymakers in China. Despite their concerted efforts to resuscitate the ailing real estate sector, results have been scant at best. The stark reality of the industry's woes was laid bare on Monday, when a Hong Kong court mandated the winding up and liquidation of China Evergrande, burdened with a staggering debt load exceeding $300 billion.

In a narrative mirroring the industry's former dominance, Evergrande struggled on for two years post-default on its investor obligations. Depleted of funds to honour its debts, Evergrande attempted to project an air of confidence, insisting that its properties remained a solid investment. The company remained optimistic, buoyed by the belief that the market would inevitably rebound, echoing patterns observed in previous economic downturns. (The ongoing downturn, now marking its longest stretch in history, not only persists but also intensifies with each passing phase.)

According to estimates by Nomura Securities, a prominent Japanese financial services firm, approximately 20 million units of pre-sold homes remain in limbo, awaiting completion. Fulfilling this backlog would necessitate a staggering $450 billion in funding.

Early Cracks

In 2023, China witnessed a significant dip in housing sales, plummeting by 6.5%. December alone saw a staggering 17.1% decline in sales compared to the previous year, as reported by Dongxing Securities, a prominent Chinese investment bank. Concurrently, investment in new projects experienced a deceleration, with real estate development contracting by 9.6% over the course of the year. And these are numbers coming out of China, globally, everyone doesn’t seem to share quite the same positive outlook to things going forward.

Despite expectations of an economic resurgence fuelled by pent-up consumer demand following the relaxation of pandemic restrictions, the property market continues to act as a drag on China’s growth. Given its substantial contribution, accounting for roughly a quarter of China's economy, the lingering malaise in real estate casts a prolonged shadow over the nation's overall economic trajectory.

The property market's descent into stagnation began in the wake of Beijing's concerns regarding a potential housing bubble and its potential repercussions on the financial landscape. In response, a series of regulations were introduced in 2020 aimed at reining in the rampant borrowing habits of real estate developers. With access to debt significantly restricted, developers found themselves grappling with the dual challenge of repaying existing loans and completing construction on properties already sold to prospective homeowners.

The Govt Intervention

In a bid to address the mounting challenges within the real estate sector, China has begun to backtrack on numerous regulatory constraints imposed earlier. Financial regulators are now actively encouraging banks to extend greater lending support to property developers. Xiao Yuanqi, Deputy Director of China's National Financial Regulatory Administration, underscored the imperative role of the country's financial institutions, stating that they hold "an inescapable responsibility to provide strong support" to the property sector.

Mr. Xiao further emphasised that banks ought not to hastily terminate loans to troubled projects but instead explore avenues to support them, such as extending repayment timelines or providing additional financing. Additionally, last week, China's central bank and finance regulator announced measures to permit certain developers to utilise bank loans intended for commercial properties to settle other outstanding loans or bonds.

Xi’s Three Red Lines

In August 2020, the implementation of regulations known as the "Three Red Lines" imposed stringent requirements on property developers. These regulations mandated that developers maintain their liabilities (debt) at less than 70% of their assets, sustain a debt-to-equity ratio below 100%, and uphold a ratio of cash to short-term debt of at least 100%. Additionally, banks faced significant restrictions on extending loans to developers. The immediate consequence of these measures was the collapse of the housing bubble, as credit evaporated for over-leveraged developers. By September 2023, the repercussions were palpable, with sales at China's 100 largest developers plummeting by a staggering 29% compared to the previous year. Notably, Country Garden's sales took a particularly severe hit, plummeting by 81%.

The Fall & Fall of Country Garden

Since 2021, over 50 Chinese property firms, including erstwhile industry giants like Evergrande and Country Garden, have succumbed to debt defaults. Country Garden, once a formidable contender for industry supremacy alongside Evergrande, effectively defaulted in October 2023. Compounding its woes, the company's predicament has exacerbated due to a stark decline in sales.

Country Garden reported that pre-sales of unfinished apartments, a pivotal gauge of future revenue, experienced a ninth consecutive monthly decline in December, plummeting to 6.91 Billion Yuan, equivalent to $962 Million, marking a staggering 69% drop from the previous year. Moreover, in the latter half of 2023, pre-sales witnessed a staggering 74% decline compared to the corresponding period the year before.

Several years ago, in an effort to temper the overheated real estate market, China implemented measures aimed at curbing speculation in property. Among these steps was the imposition of restrictions on speculators seeking to acquire homes. Homebuyers were mandated to provide substantial down payments, a measure intended to dissuade individuals from purchasing multiple properties. Suzhou, a city located in eastern China, made headlines by easing many of its home purchase restrictions. State-run media reported that Suzhou had lifted the majority of its constraints, including limits on the number of properties an individual could purchase and residency requirements.

Despite efforts to relax regulations, the real estate market in China continues to languish. According to the Chinese business magazine Caixin, outstanding mortgage loans in China experienced a rare decline of 1.6% last year compared to 2022. This downturn occurred against the backdrop of ongoing pandemic lockdowns in numerous cities throughout the country. Remarkably, this marked the first contraction in nearly two decades, contrasting sharply with the double-digit annual growth rates witnessed until 2021.

A persistent concern for many potential homebuyers revolves around the substantial inventory of unfinished pre-sold apartments. For years, buyers have committed to purchasing new apartments and commenced mortgage payments long before the units were completed. However, the situation sparked outrage when certain property developers halted construction on pre-sold apartments due to financial constraints, leaving contractors and builders unpaid. This episode underscores the fragility of the real estate market and further dampens consumer confidence in property investment.

The Current Situation:

The demise of China's largest developers spells a precarious future for two prominent private entities. Both Evergrande and Country Garden find themselves teetering on the brink of potential liquidation, having defaulted on their dollar-denominated bonds and accrued liabilities that far surpass their assets.

In December 2021, Evergrande's financial woes were laid bare as it failed to honour two dollar bond coupons. The company stands as the most indebted developer in China, burdened with liabilities nearing $330 billion, which includes a substantial $20 billion in offshore debt.

Compounding Evergrande's predicament, its chairman, Hui Ka-Yan, has faced detention on suspicion of financial misconduct. The company now confronts the looming spectre of liquidation unless it can present a viable restructuring plan for its offshore debt.

Evergrande finds itself ensnared by stringent financial regulations, precluding it from issuing new bonds due to its already precarious level of leverage, signalling a bleak outlook for its future. Adding to its woes, the financial reports for 2021 and 2022 underwent scrutiny by Prism, a small accounting firm enlisted by Evergrande in January. Prism's assessment revealed an inability to verify the accuracy of these reports. Furthermore, it concluded that the myriad uncertainties surrounding the first half of the current year rendered it impossible to issue a definitive earnings report. This lack of transparency underscores a pervasive issue within China's market socialist economy.

Meanwhile, Country Garden, armed with approximately $11 billion in dollar-denominated bonds, defaulted on a $15.4 million interest payment for its 6.15% dollar bond, which was due on September 17. Following the expiration of the 30-day grace period, the company has officially defaulted. The market value of its 6.15% note has plummeted to approximately 5 cents on the dollar. As a result, the prospect of a cross-payment default on other dollar bonds looms large unless Country Garden can devise an acceptable restructuring plan.

Following Country Garden's default, another major developer, China Vanke, has witnessed a steep decline in the value of its dollar bonds. The repercussions of Country Garden's default have reverberated throughout the industry, exacerbating the challenges faced by China Vanke. The company's Hong Kong-listed shares have tumbled by a staggering 50% over the course of this year, mirroring a sharp decline in sales performance. While monthly contracted sales soared to a peak of 100 billion yuan in 2021, they have since plummeted to approximately 30 billion yuan, underscoring the profound impact of the ongoing crisis on the real estate market and its key players.

Once There Was a Dragon

During the global financial crisis of 2007–09, China skilfully navigated the economic turbulence by pivoting towards bolstering domestic demand to offset the downturn in exports. The housing market emerged as a pivotal instrument in China's strategy to stimulate economic activity. However, amidst a backdrop of decelerating economic growth exacerbated by factors such as the pandemic, inefficiencies within state-owned enterprises, Xi Jinping's departure from market-oriented development, demographic shifts including an aging population, financial constraints, and limitations on capital mobility and intellectual freedom, China's trajectory for future development confronts an array of formidable challenges.

In a free market scenario, an oversupply of housing would typically be resolved through a natural process whereby housing prices decrease until a new equilibrium is attained, balancing the quantity supplied with the demand. However, China's commitment to market socialism has led it to employ price supports as a means of forestalling declines in demand. Existing homeowners understandably resist any decline in housing prices, exerting significant political pressure to uphold price supports. However, policymakers acknowledge the imperative of addressing the substantial oversupply in the housing market, with nearly 80 million housing units currently vacant. Transitioning towards a freer market in housing by dismantling price controls could prove instrumental in stabilising the housing market. This shift would empower market forces to naturally adjust housing prices, facilitating a more efficient allocation of resources and potentially alleviating the existing imbalance between supply and demand.

Restrictions lead to chokeholds

China has historically maintained tight control over deposit rates and restricted investment options through capital controls. The absence of a free capital market, coupled with a lack of genuine rule of law and transparency within the financial system, has rendered private housing one of the most appealing avenues for parking savings. As noted by Wall Street Journal columnist Joseph Sternberg, the suppression of interest income from household savings, used to subsidise lending to politically favoured entities, has fuelled significant demand for real estate as an alternative investment.

However, faced with policies discriminating against foreign firms, including restricted access to official economic data, capital flight from China has accelerated. Much of this capital is finding its way to the United States, driven by factors such as a robust dollar, high US bond yields, and the perception of trusted institutions. Notably, China recently experienced its first instance of overall foreign direct investment turning negative in 25 years, with capital outflows surpassing inflows by nearly $12 billion in the third quarter of this year.

While China has taken steps to bolster its financial markets, considerable challenges persist. Ting Lu, Chief Economist at Nomura Securities China, emphasises the critical importance of "removing restrictions and restoring market-driven resource allocation, including the allocation of funds and land resources." This underscores the urgency of transitioning towards a more liberalised and market-oriented approach to financial management.

China's housing crisis is deeply intertwined with the principles of market socialism, wherein the authority of the Chinese Communist Party (CCP) supersedes economic and personal freedoms. This was underscored during the Central Financial Work Conference in October, as reported by Xinhua, which emphasised the paramount importance of adhering to the centralised leadership of the Party, guiding principles laid out by Xi Jinping's ideology, and adherence to Marxist financial theory.

This ambiguity provides ample opportunity for the CCP to retain control over critical policy variables while superficially acknowledging the rule of law and the concept of open markets. However, it also engenders significant uncertainty regarding the trajectory of markets and the allocation of credit. If Shanghai aims to ascend as a global financial hub, China must enact genuine rule of law, embrace transparent accounting standards, abolish price and capital controls, and transition towards a marketplace of ideas. Yet, there is scant indication that Xi Jinping's administration is inclined to pursue such reforms.

Instead, it appears more probable that Beijing will resort to bailing out the housing sector, thereby exacerbating the already substantial moral hazard problem stemming from China's debt-driven housing boom. Lenders have come to expect bailouts, further entrenching risky lending practices and perpetuating systemic vulnerabilities.

Situation Worsens Despite Govt Support

Moody's Analytics emphasised in a note that the success of 2024 hinges largely on the effectiveness of officials in revitalising the property market, indicating the critical role this sector plays in shaping China's economic trajectory. To address the challenges facing the property market, authorities have implemented various measures aimed at bolstering the sector. One such initiative involved increasing the central bank's pledged supplementary lending (PSL) facility in December 2023, which was intended to provide financial support for both property and infrastructure projects.

Efforts to stimulate demand included relaxation of home purchase restrictions in key cities such as Beijing and Shanghai, implemented in mid-December. These revisions included lowering the minimum down payment ratio for first and second homes. However, despite these interventions, home buying sentiment has remained subdued, continuing a downward trend observed since 2021.

"Continued policy relaxation of the commercial housing sector and further support for affordable housing are key to engineering a property soft landing," economists at HSBC highlighted in a research note, underlining the importance of ongoing policy measures in stabilising the property market.

Analysts surveyed by Reuters anticipate the central bank to enact a 10 basis points (bps) cut to the one-year loan prime rate (LPR), the benchmark lending rate, during the first quarter, in a bid to provide additional stimulus to the economy.

According to data from the National Bureau of Statistics (NBS), of the 70 cities included in the home price index, 62 recorded a decline in prices on a monthly basis, marking an increase from 59 cities in November. Additionally, home prices in December experienced the swiftest rate of decline in nine months, with a year-on-year decrease of 0.4%, following a 0.2% decline in November.

In the home resale market, prices across all tiers of cities - tier-one, tier-two, and tier-three - witnessed year-on-year declines for the seventh consecutive month, underscoring the persistent downward trend in the property market.

What Does 2024 Look Like for Chinese Economy?

Addressing China's chronic economic ailments necessitates moving mountains of red-tape. Firstly, the state will have to expand and fortify social safety nets to furnish households with income security, thereby fostering consumer spending and gradually steering the economy away from its current dependence on investment as the primary driver of growth.

In addition to expanding social safety nets, China will have to undertake comprehensive reforms to address structural inequalities and incentives equitable economic participation.

These reforms include:

- Overhauling the Hukou system of household registration that ensures fair access to public services and eliminates barriers hindering spending by migrant workers.

- Reforms in land rights to empower rural Hukou holders to utilise their land for economic gain, thereby contributing to national wealth redistribution.

- Implement a progressive tax system that alleviates the tax burden on low earners while requiring higher contributions from high earners, ensuring a fair distribution of fiscal responsibilities.

- Transform state-owned enterprises by providing employees with ownership stakes, promoting wealth diffusion and incentivising employee engagement.

- Enhance the bankruptcy process to facilitate smoother transitions for struggling businesses, thereby safeguarding workers' rights and bolstering their bargaining power to negotiate higher wages.

These will be near impossible to pull off, given the decades of systemic grip on the free market, in-grained social practices and Political obligations to narrative. Failure to do so will prolong stagnation, akin to Japan's lost decades.

The Central Bank Bailout

It remains premature to place bets on the recovery of China's housing market or the broader economy in 2024. To elucidate this point, let's consider two scenarios: one involving solely the issuance of the 1 Trillion yuan sovereign bond, and another incorporating an additional 1Trillion yuan allocated for new home loans. In the first scenario, where only the sovereign bond issue is enacted, China's economic stagnation is likely to persist. The country's growth model, shaped by years of financial repression, has disproportionately favoured investment and exports over domestic consumption. The stringent measures imposed during the COVID-19 pandemic in China compelled the populace to adopt an even more conservative approach to savings.

Consequently, China grapples with excess capacity and anaemic demand, contributing to its flirtation with deflation throughout 2023. Without concerted efforts from authorities to stimulate household spending, it's improbable that the infrastructure-oriented stimulus plan alone will catalyse a swift rebound in economic fortunes.

If tax cuts were to accompany the bond issuance, such a move could potentially deliver the desired stimulus to the economy. In the financial sector, conflicting signals have emerged. While banks have been instructed to mitigate financial risks, they have also been advised, somewhat paradoxically, to exhibit leniency concerning nonperforming loans. However, the crux of the matter for private businesses lies not in the availability of credit but rather in the absence of demand for credit. Simultaneously, banks, apprehensive of incurring further losses, exhibit reluctance in extending credit to the beleaguered property sector. Consequently, the optimism surrounding the efficacy of supply-side solutions in the first scenario appears largely misguided.

In the context of the second scenario, it's crucial to acknowledge that China has grappled with over two years of consecutive declines in residential home sales and property investment. Despite concerted efforts by local governments, including initiatives such as reducing mortgage rates for second-time homebuyers, these measures have proved insufficient in arresting the downward trajectory.

At the core of the challenge hindering a robust recovery lies the imperative to transition from an investment-centric growth model to one that prioritises household consumption. Such a transition represents a profound shift that could span years to materialise in China, even under favourable conditions. However, having deferred this transformation for over a decade, the Chinese government now confronts the daunting task of effecting it amidst significantly less conducive and more complex circumstances.

In an environment where households prioritise deleveraging, the inclination towards increasing consumption diminishes. The weakened job market compounds this challenge, leaving debtors devoid of income to service their loans. Furthermore, China's inadequate bankruptcy laws contribute to a destructive cycle wherein defaulters find it increasingly challenging to sustain their businesses, further compromising their ability to meet debt obligations.

Looking a Decade Ahead

China Post Xi:

Predicting the future of China after Xi Jinping is a complex task, as it depends on various factors such as political dynamics, economic trends, social changes, and global developments. However, we can make some educated speculations based on current trends and historical patterns.

Political Transition:

China's political landscape is highly structured around the Chinese Communist Party's (CCP) leadership hierarchy. Succession planning is a carefully orchestrated process involving intricate manoeuvring within the party's upper echelons. After Xi Jinping, the selection of a new leader will likely involve a combination of backroom negotiations, consensus-building among party elites, and adherence to established institutional procedures. The identity of the next leader will be influenced by factors such as their political alliances, ideological alignment, and ability to navigate internal power dynamics. While there may be contenders vying for the top position, the ultimate choice will reflect the party's collective interests and continuity with its core principles.

Continuation or Change in Policies:

The future leadership's approach to governance will shape China's trajectory in domestic and foreign policy realms. While some policies initiated under Xi, such as the anti-corruption campaign and Belt and Road Initiative, may persist, others could undergo modifications or be replaced entirely. The incoming leadership will need to assess the effectiveness of existing policies, respond to evolving challenges, and adapt to shifting priorities. Factors such as economic imperatives, social demands, and geopolitical realities will influence the decision-making process, determining whether policies are retained, reformed, or abandoned.

Economic Development:

China's economic trajectory remains a critical determinant of its future prospects. Despite remarkable achievements in recent decades, the country faces formidable challenges, including slowing growth, structural imbalances, and external uncertainties. The post-Xi leadership will need to navigate these challenges while pursuing sustainable and inclusive economic development. This may involve implementing structural reforms to address issues such as over-reliance on investment, debt accumulation, and technological innovation. Balancing economic priorities with social stability concerns will be paramount to ensure continued prosperity and resilience in the face of internal and external pressures.

Social Changes:

China's rapid socio-economic transformation is reshaping its societal fabric and citizen expectations. Urbanisation, demographic shifts, and rising middle-class aspirations are altering the dynamics of Chinese society. Concurrently, there is a growing demand for greater individual rights, political participation, and accountability from the government. The post-Xi leadership will grapple with managing these social changes while upholding stability and party control. Balancing economic progress with social equity and addressing grievances will be crucial to fostering social cohesion and legitimacy.

Global Role:

China’s ascendance as a global power entails complex dynamics in international relations. The post-Xi leadership will inherit a country with expanding global influence and strategic interests. Managing China's relationships with other major powers, navigating geopolitical tensions, and upholding its interests in areas such as trade, security, and climate change will be key priorities. The leadership's approach to diplomacy, multilateralism, and soft power projection will shape China's standing in the international community and its role in shaping global governance structures.

A post-Xi China will be characterised by a mix of continuity and change, influenced by internal dynamics and external realities. The leadership's ability to navigate political, economic, social, and global challenges will determine China's trajectory and its place in the world in the years to come.

The Indian Opportunity:

The tiger vs dragon conversation has all but died down in global circles, as India’s neighbours, like Pakistan, Sri Lanka, Bangladesh, Maldives & Mongolia, have all fallen deep in debt with China. India is still a very young workforce, and is still consistently producing more demand. The hypothetical downfall of China and its potential impact on India's position in the global power scale involves considering several factors. While predicting such scenarios is highly speculative, we can explore potential avenues through which India might be affected.

"The crisis engulfing Chinese Evergrande is a sobering reminder of the complex interplay of variables that affect population trends, worker demographics, and real estate market stability. Although the Chinese scenario poses many difficulties, it offers India a chance for introspection and strategic preparation. India should take proactive steps to reduce risks and seize new possibilities by attentively investigating the root causes of the crisis and evaluating its possible effects on our real estate market. Our expanding population and varied economy provide an ideal environment for creative thinking and long-term growth plans. Let's use this opportunity to strengthen investor trust, fortify our regulatory framework, and cultivate an atmosphere favourable to real estate growth. India can successfully sail through these challenging times and emerge as a symbol of resilience and prosperity in the global real estate market by exercising strategic vision and sound decision-making."

– Rohit Maingi, DnR Consultants' Founder and Partner

The downfall of China could significantly impact India's economic trajectory on the global stage. As China's economic dominance wanes, India stands poised to seize opportunities to bolster its own economic standing. With China's manufacturing costs likely to rise and its export competitiveness diminishing, India could emerge as an attractive destination for foreign investment and as an alternative manufacturing hub. India's vast consumer market and demographic dividend present significant potential for economic growth, positioning the country as a key player in the global economy. However, to fully capitalise on these opportunities, India would need to address structural challenges such as infrastructure deficits, regulatory hurdles, and bureaucratic inefficiencies.

A weakened China could lead to notable shifts in regional power dynamics, providing India with greater strategic leverage in Asia. With China's influence potentially in decline, India may have more room to assert itself in regional security architectures and forge stronger partnerships with like-minded countries. Enhanced cooperation with regional powers such as Japan, Australia, and ASEAN nations could help India counterbalance China's influence and shape the geopolitical landscape in its favour. However, navigating complex regional rivalries and security challenges would require India to adopt a nuanced and proactive approach to diplomacy and security cooperation.

In a post-China scenario, India could leverage opportunities to advance its technological capabilities and innovation ecosystem. With China's technological prowess potentially diminishing, India may find itself in a position to fill the void and emerge as a leading player in emerging technologies. Increased investment in research and development, coupled with collaborations with global tech firms, could propel India's technological innovation and competitiveness. This could have far-reaching implications for sectors such as information technology, biotechnology, renewable energy, and space exploration, positioning India as a key driver of global technological progress.

The hypothetical downfall of China could introduce significant uncertainties and challenges to regional stability in Asia. India would need to navigate complex geopolitical dynamics and security risks arising from China's internal challenges. Border disputes, territorial claims, and geopolitical rivalries could potentially escalate, necessitating a calibrated and proactive approach to regional security. Strengthening partnerships with neighbouring countries, fostering dialogue and confidence-building measures, and promoting regional stability initiatives would be critical priorities for India to safeguard its strategic interests and mitigate security risks.

As a major actor in the Indo-Pacific region, India's role in global diplomacy could undergo notable transformations in a post-China scenario. With China's influence potentially on the decline, India may seek to deepen its engagement with major powers and emerging economies. Asserting leadership in multilateral institutions, promoting global governance reforms, and championing issues such as climate change and sustainable development could enhance India's stature as a responsible global actor. However, navigating shifting geopolitical dynamics and competing interests among major powers would require India to adopt a pragmatic and principled approach to global diplomacy, balancing its strategic imperatives with its commitment to multilateralism and international cooperation.

End.

_1708241830.jpg)