Zomato, the well-known food-tech company, has revealed that it has received a show cause notice from the Directorate General of GST Intelligence, Pune Zonal Unit, requesting payment of Rs 401.70 crore in tax liability. The notice concerns the duration from October 2019 to March 31, 2022.

Claims and Defence of Zomato

Zomato strongly denies any tax liability and argues that it simply assists in collecting delivery charges for its partners, placing the responsibility on them.

_1703844204.png)

GST changes and unresolved issues

In January 2022, Zomato and other food delivery platforms were required to comply with a 5% GST on restaurant services. However, the updated GST regulations did not specify the taxation of delivery charges, which has resulted in ongoing disagreement.

Explanation of Zomato Accusations

Zomato's billing structure consists of various components, including the item total (food price), GST and restaurant charges, delivery partner fee, platform fee, and an optional tip. It is worth mentioning that Zomato introduced the platform fee in August 2023 to improve revenue, following a similar action taken by Swiggy.

You may also read: Zomato Introduces ₹2 Platform Fee As An Experiment In Select Markets

Financial Performance

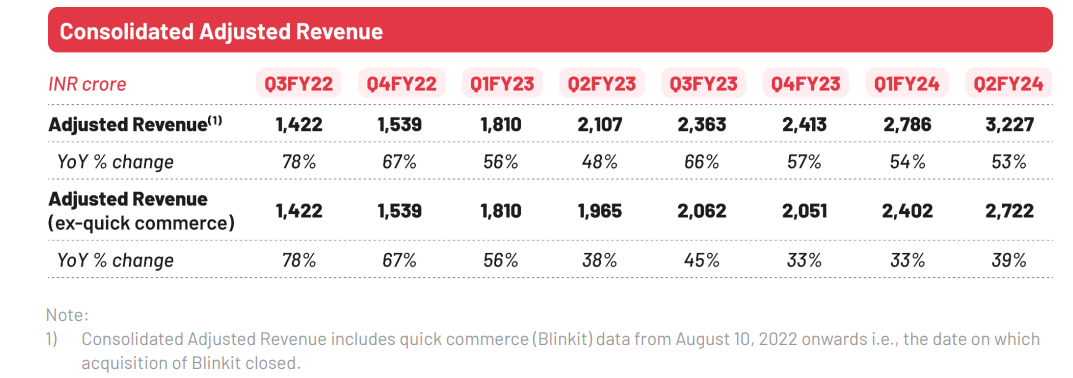

Despite the ongoing tax dispute, Zomato has managed to achieve positive financial outcomes. In a remarkable feat, the company recorded its first-ever quarterly profitability, with a substantial surge of 18-fold in profit after tax to Rs 36 crore in Q2 FY24, as compared to the significant loss of Rs 251 crore in the corresponding quarter of the preceding year. Furthermore, the revenue for the September quarter experienced an impressive growth of nearly 18%, amounting to Rs 2,848 crore.

In conclusion

As Zomato faces the tax challenge, its financial performance continues to remain strong. The company firmly maintains its innocence in the tax matter and continues flourishing in the highly competitive food-tech industry.

Ⓒ Copyright 2023. All Rights Reserved Powered by Vygr Media.