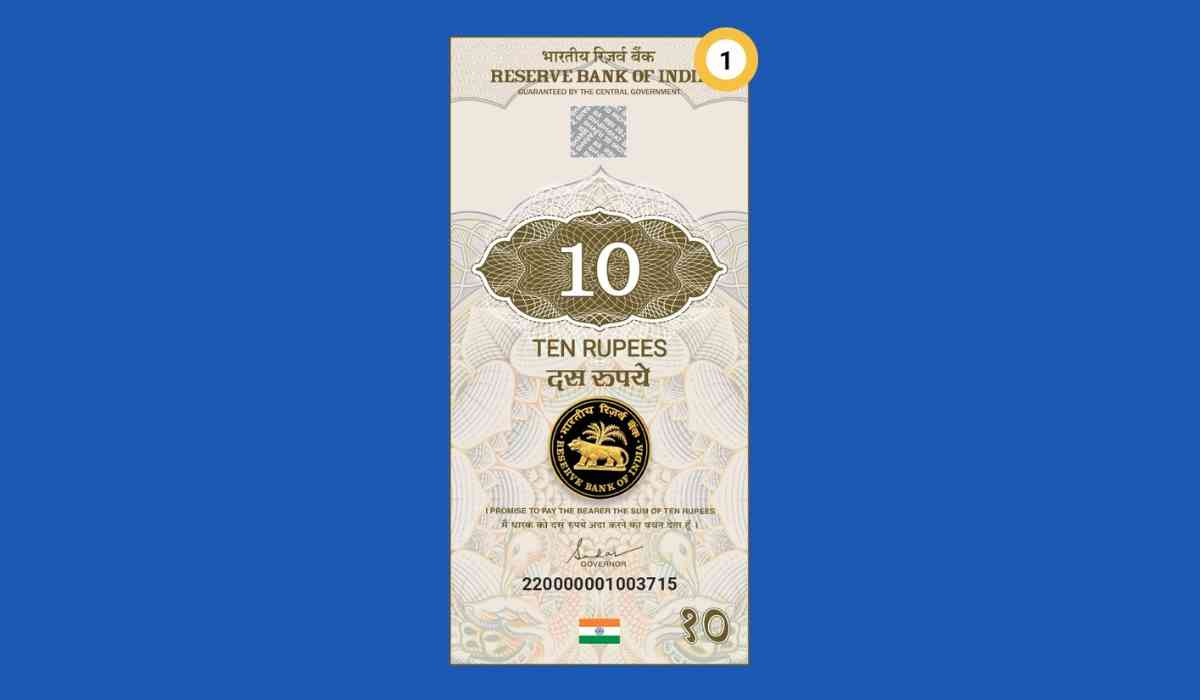

The Reserve bank of India (RBI) has launched India’s first virtual currency named Digital Rupee. Finance Minister of India, Nirmala Sitharaman said in a statement that the Central Bank Digital Currency (CBDC) or Digital Rupee will bring new ease in the field of contactless transactions and will further popularize the use of largescale e-transactions, adding new opportunities and independence in the financial sector.

Although the digital currency will be virtual in nature, it is much different from other cryptocurrencies as unlike other cryptos which are decentralised digital assets based on blockchain technologies, the digital rupee will be regulated by the Reserve Bank of India (RBI) and will be both legal and acceptable to the government of India.

According to sources CBDC will be classified into two categories:

1) Retail (CBDC-R) - potentially available for use of all.

2) Wholesale (CBDC-W) – specifically designed for use in selected financial institutions.

The retail segment is planned to launch in selected locations, within closed user groups comprising of mainly merchants and customers. Nine banks have been selected for the launch of the new digital currency, these banks are Union Bank of India, HDFC Bank, State Bank of India, Kotak Mahindra Bank, IDFC First Bank, Bank of Baroda, ICICI Bank, HSBC and Yes Bank.

Many financial experts have appreciated RBI’s step to launch a digital currency, noting that the digital rupee will be equivalent to physical currency, and due to the significant backing from the government, it will be more intrinsic in value, in contrast to other cryptocurrencies. Individuals of all age groups will be made part of the retail project, to better asses public feedback, acceptability and experience with the new digital rupee.

Also due to the digital nature of the currency, all transactions happening between authorized networks will be accessible to the government, thus subjecting the transactions to all the relevant financial laws within the nation, thereby implementing the government's long-awaited vision of financial transparency, accessibility, interoperability and financial inclusivity.

The life term of the digital rupee will also be much greater than that of physical currency, in a sense it can be said that digital currency will never be lost or unaccounted for, unlike physical currency. It will also eliminate the risk of counterfeit physical currency, which was previously a major problem to the financial stability of the nation.

According to RBI, the new retail digital currency can be used in the purchase and sale of government securities like government bonds as well as to avail of other government-related services that require payment. The long-awaited dream of the Indian Government to create a digital form of the national currency, is about to come to life within the next month or so.

@Vygr Media Private Limited. All Rights Reserved.