Once celebrated as a symbol of innovation, WeWork's journey from stardom to bankruptcy has been nothing short of a rollercoaster. The SoftBank Group-backed startup, which once held the title of the most valuable U.S. startup at a staggering $47 billion, has filed for U.S. bankruptcy protection. This fall from grace was driven by a combination of factors that plagued its once-promising business model.

The Why Behind WeWork's Downfall:

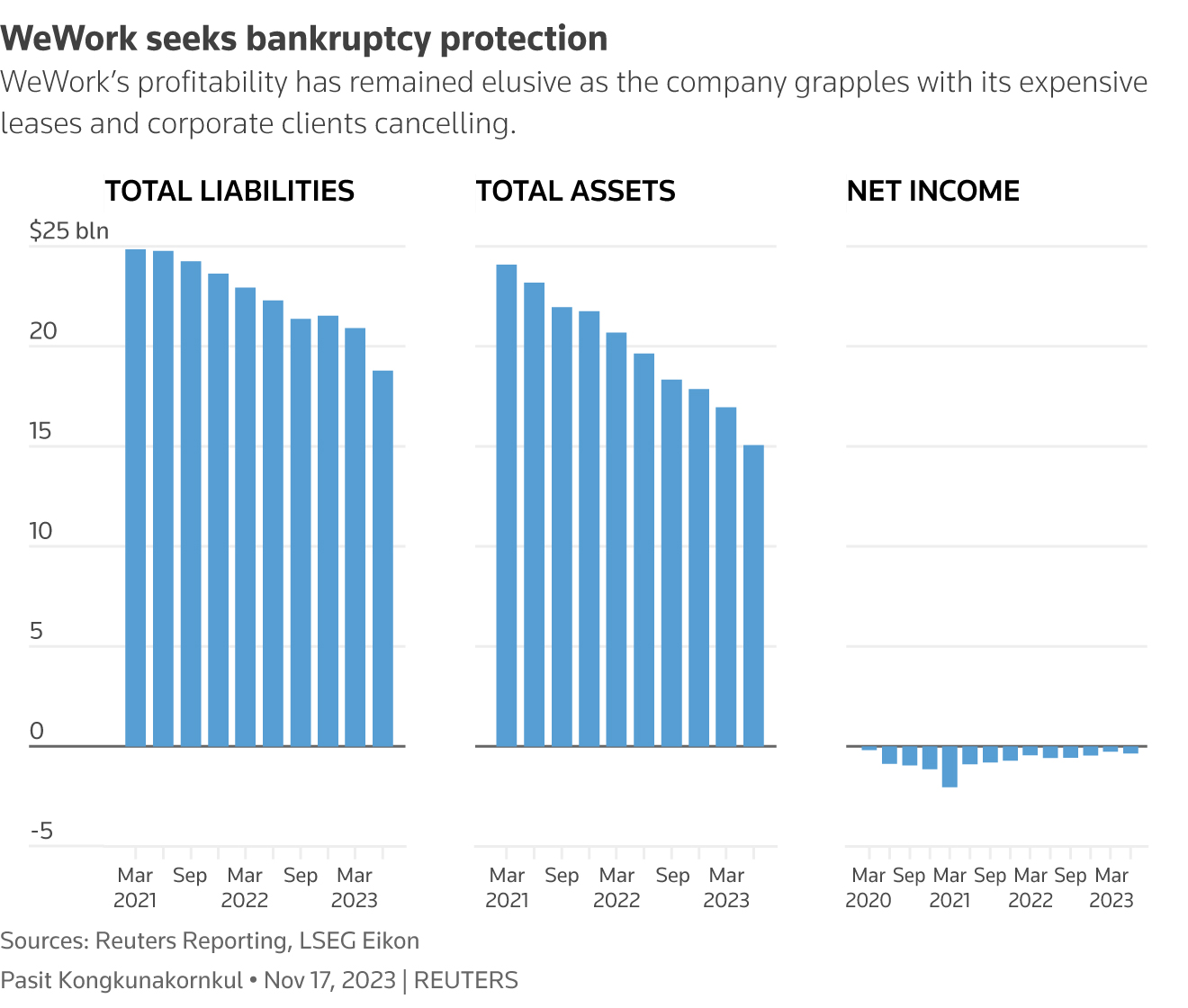

The bankruptcy filing is an admission of defeat by SoftBank, the Japanese technology conglomerate that owns a substantial 60% stake in WeWork. Despite investing billions of dollars in an attempt to turn the company's fortunes around, it became evident that WeWork could not survive without a drastic overhaul of its costly leases. The allure of profitability had remained elusive, as WeWork struggled to cope with its expensive lease agreements, which consumed a staggering 74% of its revenue during the second quarter of 2023.

The Weight of WeWork's Liabilities:

WeWork's financial woes are significant, with estimated assets and liabilities ranging between $10 billion and $50 billion, as indicated in the bankruptcy filing. The company's bankruptcy filing might be the lifeline it needs to shed itself off its burdensome leases, according to law firm Cadwalader, Wickersham & Taft LLP, and this prospect has left some landlords anticipating a substantial impact.

Pic Source: Reuters

From a Star to a Fallen Giant:

WeWork's dramatic rise and subsequent fall are inextricably tied to its flamboyant founder, Adam Neumann. At its zenith, WeWork was the most valued U.S. startup, boasting investments from prominent players such as SoftBank, Benchmark, and major Wall Street banks like JPMorgan Chase. Neumann's insatiable appetite for rapid expansion at the expense of profits, along with revelations about his eccentric behaviour, eventually led to his ouster and the derailment of an initial public offering in 2019. SoftBank was compelled to double down on its investment and brought in real estate veteran Sandeep Mathrani as the startup's CEO. In 2021, WeWork's path to going public took a different route through a merger with a blank-check acquisition company, valuing the firm at $8 billion.

The Pandemic Wound:

WeWork managed to renegotiate 590 leases, resulting in savings of approximately $12.7 billion in fixed lease payments. However, the blow dealt by the COVID-19 pandemic was insurmountable, as office workers worldwide were compelled to work from home. Many landlords, facing their own financial pressures, were hesitant to provide any relief to WeWork. Furthermore, increased inflation and deteriorating economic conditions led to reduced spending by WeWork's predominantly small and startup clientele. Adding to the challenges, some of WeWork's landlords began offering short and flexible leases to navigate the changing landscape of the office sector.

New Leadership and Debt Restructuring:

Sandeep Mathrani was succeeded as WeWork's CEO in 2023 by David Tolley, a former investment banker and private equity executive. Tolley's experience as the chief executive of Intelsat, helping the debt-stricken satellite communications provider emerge from bankruptcy in 2022, brings hope for WeWork's future. WeWork engaged in debt restructurings and even secured a seven-day extension from its creditors on an interest payment, in a last-ditch effort to negotiate and avoid bankruptcy. Despite these efforts, filing for bankruptcy protection was ultimately the path chosen to address WeWork's overwhelming financial challenges.

© Copyright 2023. All Rights Reserved Powered by Vygr Media.