Mumbai-based Sarvagram, a digital lending firm targeting rural households, is in the final stages of securing approximately $50 million in funding. This round includes contributions from both new and existing investors, with the company’s valuation expected to nearly double to between $170-200 million since its last funding in January 2023, according to sources.

Key Investors and Funding Structure

Venture capital firms like Peak XV, Apis Partners, Beams Fintech Fund, along with global impact investor Creation Investments Capital Management LLC, are leading the charge in this funding round. The $50-million raise is anticipated to involve a combination of primary and secondary transactions, with secondary transactions enabling current investors to exit by selling their shares to new or existing investors. Existing backers such as Elevar Equity, Elevation Capital, Temasek, and TVS Shriram Growth Capital are also likely to participate in the primary funding.

Expansion Plans and Business Model

Sarvagram has been aggressively scaling its offline operations, known as Sarvamitras, beyond its initial presence in four states. The firm operates a franchisee model, with Sarvamitras—local residents trained by the company—facilitating access to credit through Sarvagram’s non-banking finance company (NBFC) arm, Sarvagram Fincare Private Limited (SFPL), as well as partner lenders.

Additionally, the company offers services like farm mechanization on a pay-per-use basis and insurance to its rural customers. Sarvagram currently operates 125 branches across Gujarat, Maharashtra, Karnataka, and Rajasthan, and plans to further expand within the current financial year, including venturing into new states and deepening its footprint in existing ones.

Unique Approach to Rural Lending

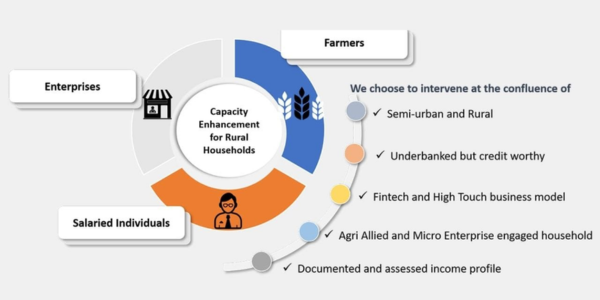

Founded in 2018 by Utpal Isser and Sameer Mishra, Sarvagram stands out due to its focus on the underbanked but creditworthy segment of semi-urban and rural households. The company segments its customers into salaried individuals, farmers, and micro, small, and medium enterprises (MSMEs) to offer various loan products, including gold, housing, personal, farm, and consumer durable loans.

Unlike traditional lending models that assess individual income, Sarvagram adopts a household-centric approach, considering the entire household as a single economic entity when evaluating creditworthiness. This includes households with a chief wage earner, those involved in agriculture or dairy farming, and those engaged in small-scale manufacturing, retail, or services like kirana stores, pharmacies, and doctor’s clinics.

Financial Performance and Future Outlook

Despite being in its early operational stages, Sarvagram’s NBFC arm, SFPL, became profitable in FY24, reporting a profit after tax of Rs 7.6 crore. However, Sarvagram Solutions Private Limited (SSPL), another entity under the Sarvagram umbrella, continues to operate at a loss. Nonetheless, SSPL managed to reduce its net loss to Rs 11.6 crore in FY24, a 65% improvement compared to the previous year, with total assets under management (AUM) increasing by 1.5 times to Rs 1,166 crore.

Beyond its lending services, Sarvagram, which holds a 79.6% stake in its NBFC arm, also offers non-lending financial services like farm mechanization solutions and insurance distribution in the regions served by SFPL through its Sarvamitras.

Investor Interest and Corporate Silence

While Sarvagram has not responded to queries, and major investors like Peak XV, Temasek, and Elevation have declined to comment, the company’s strategic expansion and unique business model continue to attract significant investor interest. This latest funding round comes over a year after Sarvagram successfully raised $35 million from a group of private equity investors, reflecting the growing confidence in the company’s vision and operational strategy.

Inputs by Agencies

Image Source: Multiple Agencies

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.