- PVR Inox Screens Closure: The multiplex giant is closing 70 screens, with a majority of those located at high-cost places, since the screens are non-performing and increasing the loss margins during FY25.

- Real Estate Monetisation: It would be monetizing its real estate, for which it could attract ₹300-400 crore in two years, helping to strengthen its balance sheet.

- Saving on Cost: Due to the closure of underperforming screens, rental expenses will be reduced each year, hence improving EBITDA margins by ₹90-100 crore.

- Expansion Plans: Despite the closures, PVR Inox plans to add 100 new screens in fast-growing markets with an investment of ₹150 crore, while focusing on premium formats such as 4DX and IMAX.

- Strategic Shift Amid Industry Challenges: It is buckling up for the changing consumer preferences and increased OTT competition by streamlining operations and enhancing the cinema experience.

Meanwhile, the country's leading multiplex operator, PVR Inox, in pursuit of its goal to achieve profitability and operational efficiency, proposes to shut down approximately 70 underperforming screens in FY25. Apart from that, monetizing its real estate is also part of a much larger plan the company has in store to optimize its base of assets and strengthen its financial position.

Image Source - ProCapitals

70 Screens Likely to shut in FY25

PVR Inox has identified 70 underperforming screens within its portfolio, with high rentals and low footfalls. These account for about 5% of the operational screens of the company and are placed across high-cost metros and less profitable Tier II and III cities.

The high operating cost of such non-performing properties partly pushed the company into its net loss of ₹333 crore in FY24. Closing these screens is expected to significantly offset the costs for PVR Inox. The company expects a saving of around ₹90-100 crore yearly on rentals due to the screen closures. This would go on to ease off the EBITDA margins for the company, which had suffered setbacks due to the pandemic severe impact on the cinema industry.

Monetize Real Estate

PVR Inox management also aims at real estate monetization as a key strategy that will lead to its financial health improvement. Its current portfolio of owned properties is over ₹800 crores, which will be monetized through selective sales and leaseback. This can again yield a considerable amount of capital for reinvestment in the growth of premium formats and screen upgrades.

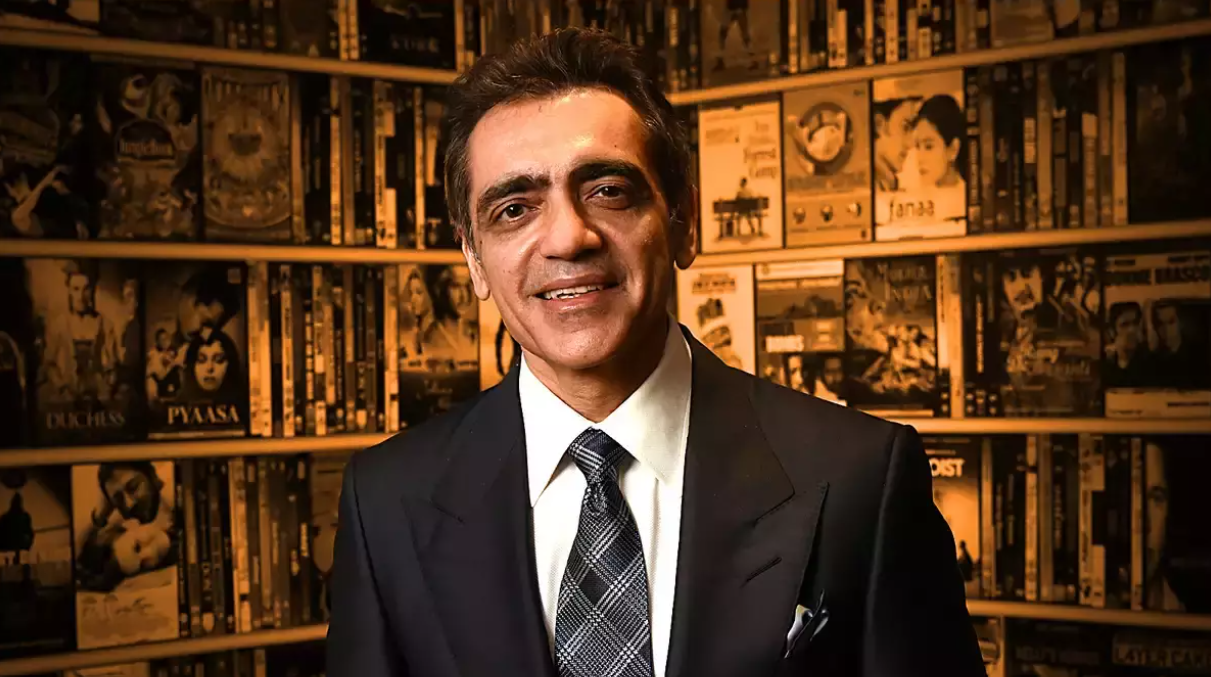

Ajay Bijli- Managing Director of PVR INOX LTD (Image Source - The Economic Times)

Ajay Bijli, the Chairman and Managing Director of PVR Inox, drove home the point that monetizing real estate would give them a financial cushion so that they could focus on their core business without any drag from underperforming assets. The moving in real estate monetizing will bring in an estimated ₹300-400 crores over the next two years, or just the bump cash flows need.

Industry Challenges and Strategic Adjustments

This decision to shut screens and monetize assets is taken at a time when consumer preferences have changed and OTT platforms have brought in newer challenges for movie exhibition companies in the post-pandemic period. Box office revenues, which make up almost 60% of the income that PVR Inox generated in FY24, are yet to reach pre-COVID-19 levels, and hence, the company decided to revisit its operational strategy.

Contrary to all the challenges, PVR Inox remains very bullish about the future and is furthering its presence in fast-growing markets. It will open 100 new screens in FY25; the main focus will be on Tier II and III cities given their resilience and steady demand. This expansion will involve an investment of around ₹150 crore, with added emphasis on premium offerings comprising formats like 4DX, IMAX, and PXL, in line with changing audience preferences for an immersive movie viewing experience.

Image Source - Moneycontrol

Financial Performance and Outlook

PVR Inox's financial performance over the past few quarters reflects broader challenges for the multiplex industry. For Q1 FY25, the company declared consolidated revenue of ₹ 1,400 crore, up 15% YoY but below the pre-COVID level. EBITDA was at ₹ 250 crore, while the margin came at 17.9% and continued its gradual recovery.

The closures and monetization plans are likely to lead to a better balance sheet and higher shareholder value. According to analysts, these moves will help PVR Inox cope with the existing market environment, which is characterized by mixed consumer sentiment and increasing competition from digital platforms.

What's next?

Going ahead, PVR Inox would enhance the movie experience with superior technologies and select content partnerships. The focus will be on creating differentiated and added-value experiences that will bring people back to theaters. This strategic pivot of the company was a well-thought-out step toward continuous market leadership, adjusting to the change in the entertainment landscape.

Inputs by Agencies

Image Source: Multiple Agencies

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.