PayU Payments, a company backed by Prosus, has obtained in-principle approval from the Reserve Bank of India (RBI) to function as a payment aggregator. This milestone allows PayU to onboard new merchants onto its platform, marking a significant development in the fintech sector following recent regulatory changes by the RBI.

Enhanced Services and Competition

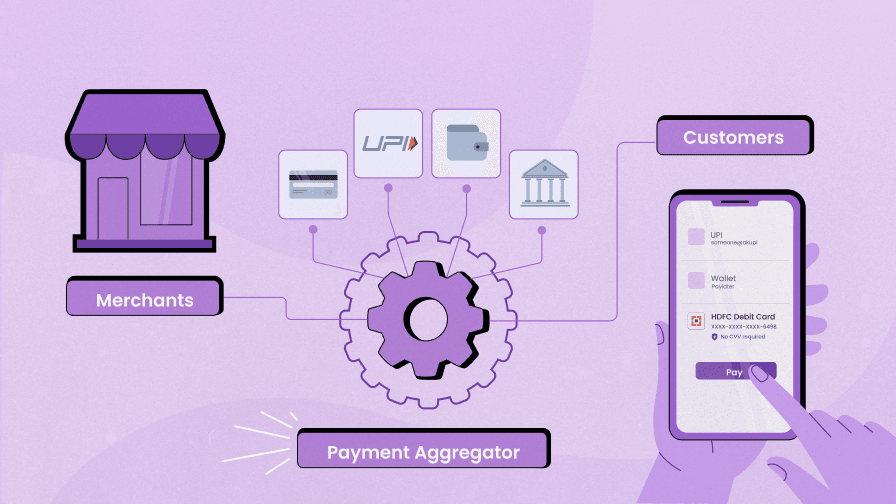

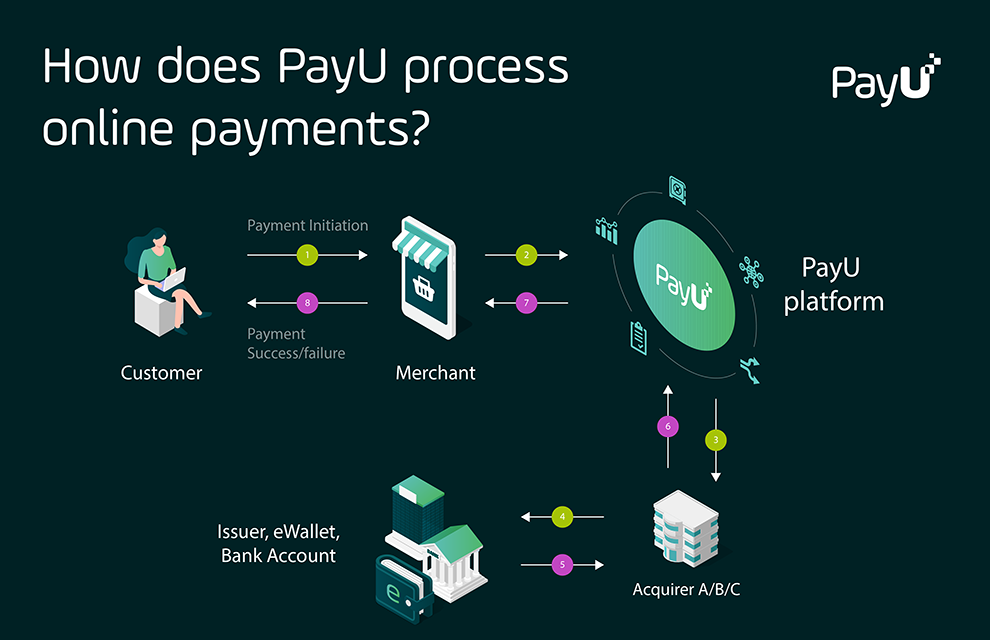

PayU, known for its payment gateway services, offers a range of solutions including buy-now-pay-later options, competing with leading players such as Razorpay and PhonePe. Through PayU, merchant partners can offer customers diverse payment choices, including Credit Card EMI options and innovative combinations like UPI with Credit Card EMIs for increased affordability and convenience.

In a strategic move, PayU has partnered with Loyalty Rewards, a major player in customer engagement and loyalty solutions. This collaboration allows customers from various loyalty programs to seamlessly earn and redeem reward points on transactions processed through PayU. Additionally, PayU reported a robust revenue of $400 million in FY23, demonstrating a substantial 31% growth from the previous fiscal year.

Regulatory Landscape and Industry Developments

The RBI's approval of PayU as a Payment Aggregator aligns with the evolving Payment Settlements Act of 2007. This regulatory shift follows earlier challenges faced by PayU due to its corporate structure, which led to a reapplication process. Anirban Mukherjee, CEO of PayU, underscores the significance of this license in bolstering the company's ambition to establish a prominent digital payment ecosystem rooted in India.

These recent developments mirror broader shifts within the fintech landscape, where players like Razorpay, Cashfree, and CRED have navigated regulatory complexities to secure similar approvals, signaling a dynamic and evolving industry poised for further growth. Paytm, another major player, continues to await its approval, underscoring the ongoing regulatory evolution within India's fintech sector.

What is PayU?

PayU is a prominent payment gateway service that also offers innovative features such as buy-now-pay-later, positioning itself against key competitors like Tiger Global-backed Razorpay and Walmart-owned PhonePe.

Key Features of PayU's Payment Solutions

-

Diverse Payment Methods: PayU facilitates digital transactions by supporting over 150 payment options including credit cards, debit cards, net banking, EMIs, pay-later schemes, QR codes, UPI, and various digital wallets.

-

Comprehensive Affordability Ecosystem: PayU is a preferred partner in the affordability ecosystem, providing extensive coverage across card-based EMIs, pay-later options, and modern cardless EMIs.

-

High Success Rates for E-commerce: E-commerce businesses benefit from PayU's industry-leading success rates, ensuring a smooth checkout process and enhanced customer experience.

PayU's Role in Fintech and Financial Inclusion

PayU plays a crucial role in expanding financial services reach, empowering merchants and consumers to transact securely online. PayU's CEO, Anirban Mukherjee, emphasizes the company's commitment to compliance and corporate governance, reflecting its dedication to regulatory standards.

-

Regulatory Approval: The Reserve Bank of India's recent approval of PayU's operations highlights its adherence to regulatory standards amidst heightened scrutiny in the payments sector.

-

Revenue Growth: PayU India reported significant revenue of $400 million in FY23, with continued growth evident in H1 FY24, indicating a 15% increase in core payments business revenue to $211 million.

What is PA Licence?

A Payments Aggregator (PA) license is a regulatory authorization that enables companies to facilitate payment services for merchants, particularly online businesses and e-commerce firms. This license allows PAs to accept payment instruments from customers and subsequently pool these funds for transfer to merchants within a specified time frame.

Key Features of the PA License

- Enables companies to provide payment services to merchants by accepting payments from customers.

- Involves pooling funds received from customers and transferring them to merchants.

- Regulated by RBI guidelines to ensure consumer protection and business integrity.

RBI Guidelines and License Requirements

The Reserve Bank of India (RBI) introduced PA guidelines in March 2020 to regulate the operations of payment gateways. According to these guidelines, companies providing digital payment acceptance solutions to merchants are required to obtain a PA license.

Eligibility Criteria for PA License

- Fintech firms must comply with RBI guidelines.

- Net worth requirement of Rs 15 crore by March 2021, Rs 25 crore by March 2023, and maintained at Rs 25 crore thereafter.

Enhancing Consumer Trust

In the rapidly evolving landscape of financial technology (fintech), obtaining the necessary licenses is crucial for various reasons that impact both consumers and industry players alike.

- One of the foremost reasons for fintech firms to acquire licenses is to foster consumer trust. Firms authorized by regulatory bodies like the Reserve Bank of India (RBI) are subject to direct monitoring, instilling confidence in consumers regarding the legitimacy and security of their financial transactions.

-

The RBI mandates that e-commerce companies engage exclusively with authorized Payment Aggregators (PAs), a move intended to ensure consumer protection and trust in the ecosystem.

-

As explained by a payment aggregator, failure to secure the required authorization can result in a loss of business, underscoring the significance of regulatory compliance in the fintech sector.

Regulating Activities

Another pivotal aspect of obtaining licenses is to regulate and monitor the activities of Payment Aggregators, preventing potential issues related to Know Your Customer (KYC) compliance and unauthorized dealings with entities like cryptocurrency exchanges and certain gaming applications.

-

Instances involving companies like Cashfree and Zaakpay, which faced scrutiny over KYC lapses and dealings with cryptocurrencies, highlight the necessity of licensing to enforce regulatory guidelines and maintain industry integrity.

-

The licensing process acts as an initial checkpoint for regulators, enabling them to impose necessary controls and oversight from the outset.

Promoting Transparency and Standardization

Despite the rigorous approval process, industry experts anticipate that PA licensing will contribute to greater transparency, standardization, and overall trust within India's fintech ecosystem.

- The licensing framework is seen as a means to establish consistent standards across the sector, ultimately benefiting both businesses and consumers by ensuring operational transparency and compliance with regulatory norms.

- Securing licenses is instrumental for fintech firms, not only for regulatory compliance but also for bolstering consumer confidence, regulating industry activities, and fostering transparency within the dynamic realm of financial technology.

Is the PA license rejection by RBI a red flag?

Four entities—Paytm Payments Services Ltd, PayU Payments Pvt Ltd, Freecharge Payment Technologies Pvt Ltd, and Tapits Technologies Pvt Ltd—have had their applications returned by the RBI.

According to a payment aggregator, these returns essentially mean that the RBI has sent back the license applications and given a 120-day window to reapply. The reason for rejection could be attributed to minor errors found in the applications.

Sources revealed that certain companies applied for the license without meeting the required net worth of Rs 15 crore. It was noted that these companies anticipated raising funds after applying to demonstrate the required net worth, resulting in the return of their applications.

Similarly, some entities applied for licenses for two independent operations in India, but only one received in-principle approval. For instance, Worldline Group applied for Reserve Bank of India (RBI) authorization under the Guidelines on Regulation of Payment Aggregators and Payment Gateways, submitting applications for Worldline ePayments India Private Limited and Worldline India Private Limited. Eventually, they decided to consolidate their payment aggregation business and withdrew the application for Worldline India Private Limited, continuing with a single PA application for Worldline ePayments India Private Limited.

The RBI's list stipulates that companies whose applications have been returned can reapply within 120 days from the return date. Until advised otherwise, they are allowed to continue operations but are prohibited from onboarding new merchants.

The payment aggregator clarified that receiving an in-principle approval means these companies fall under the RBI's supervision and regulation. However, no company in India has yet received a final license to operate as Payment Aggregators (PAs).

Image Source: Multiple Agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.