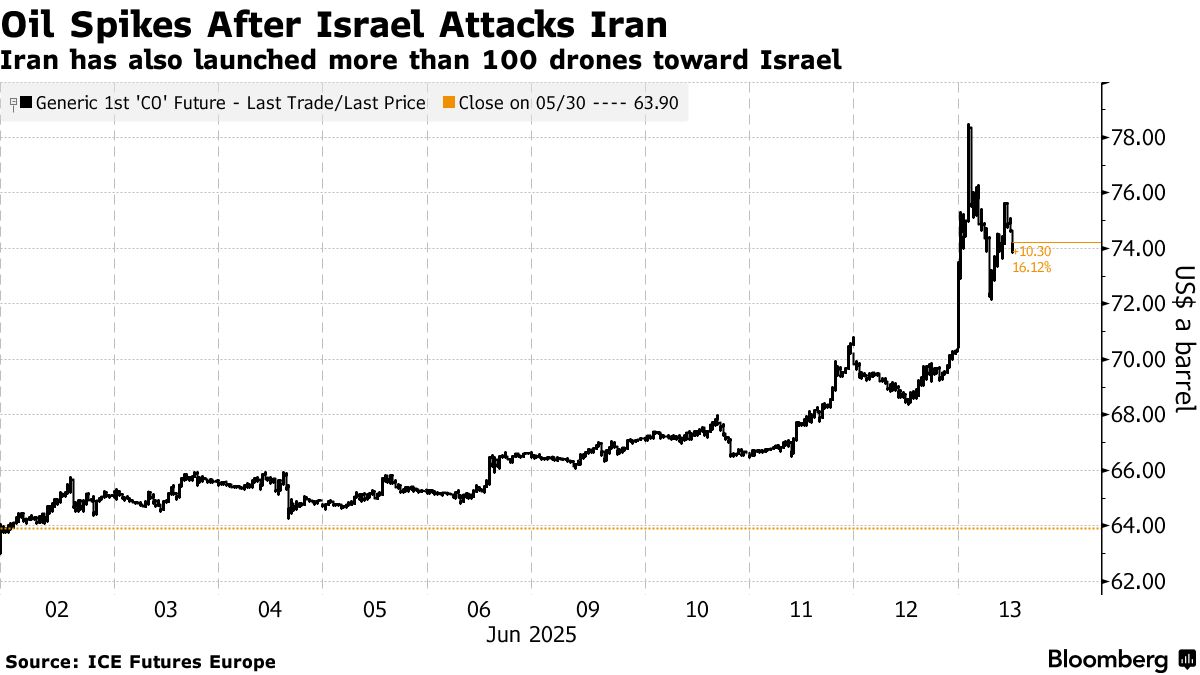

Global oil prices soared on Tuesday amid intensifying tensions between Israel and Iran, with fears mounting that the United States may be drawn into the confrontation. The sharp rise in crude prices came alongside a noticeable dip in US stock markets, reflecting mounting investor anxiety over the geopolitical fallout.

The spike in oil prices followed a hardline statement from US President Donald Trump, who demanded Iran’s “unconditional surrender” while tensions escalated over Israel’s ongoing military strikes. Since Friday, Israel has launched targeted attacks on several of Iran’s key energy facilities, including the South Pars gas field, the Fajr Jam plant, the Shahran oil depot, and the Shahr Rey refinery. While global energy supplies have yet to face significant disruption, the prospect of further escalation — particularly the possibility of direct US involvement — has left markets deeply unsettled.

On Wall Street, the ripple effects were immediate. The S&P 500 declined by 0.84%, while the tech-heavy Nasdaq Composite fell by 0.91%, reflecting the market’s nervousness over potential broader conflict. President Trump intensified his rhetoric on Tuesday, heightening fears of a possible US strike on Iran’s Fordow uranium enrichment site. In a pointed social media post, he issued a thinly veiled warning to Iran’s Supreme Leader, Ayatollah Ali Khamenei, declaring the US knew his whereabouts but had “chosen not to eliminate him – at least for now”.

Iran, home to the world’s third-largest crude oil reserves and the second-largest gas reserves, plays a critical role in global energy markets. Despite heavy sanctions imposed by the United States, the country still managed to produce approximately 3.99 million barrels of oil per day in 2023 — around 4% of global supply, according to data from the US Energy Information Administration. Strategically, Iran controls the Strait of Hormuz, a narrow passage through which an estimated 20–30% of the world’s oil exports flow. Most of Iran’s outbound oil shipments pass through the Kharg Island terminal, which has not yet been targeted in Israel’s campaign.

Analysts warn, however, that this could change. Writing on Monday, Clayton Seigle of the Center for Strategic and International Studies suggested Israel may be calculating that a strike on Iran’s oil exports — though risky — could be a decisive blow in its effort to destabilise Tehran’s leadership. “Israeli planners likely understand that Iran’s ability to export oil is acutely vulnerable,” Seigle noted. “In the broader aim of neutralising a hostile regime, they may consider such a move worth the diplomatic backlash and price volatility it might trigger.”

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved Powered by Vygr Media.