ITC, the cigarettes to hotels conglomerate has decided to demerge its hotel business into a separate listed entity. The demerger plan holds certain changes for the current shareholders - Under the demerger plan, every shareholder will get 1 share in the demerged hotels business for every 10 shares held in the parent company.

ITC shareholders will directly own 60% of the newly listed entity and the remaining 40% will be through ITC in an indirect manner.

At the moment, the demerger is awaiting approval from its shareholders, creditors, the stock exchanges and regulatory authorities like SEBI & NCLT.

The new entity should take over a year to finally list after completing all formalities.

"The scheme would unlock the value of the hotels business for existing shareholders of the demerged company through an independent market-driven valuation of their shares in the resulting company, which will be listed pursuant to the scheme, along with the option and flexibility to remain invested in a pure play hospitality focused listed entity," ITC said.

A demerger, also known as a spin-off or divestiture, is a corporate restructuring strategy in which a company splits itself into two or more separate entities. In a demerger, the parent company transfers specific assets, liabilities, and operations to one or more new companies, resulting in the creation of independent entities. These new entities can then operate independently with their own management, operations, and financial structures.

Demergers are often undertaken for various strategic and operational reasons, including:

Focus: Companies might choose to demerge in order to allow each entity to focus on its core business or market segment. This can lead to improved efficiency and decision-making within each separate entity.

Unlocking Value: Sometimes, a company may believe that the different parts of its business have more value as separate entities, and a demerger can help unlock that value for shareholders.

Portfolio Simplification: If a company has diverse business segments that are not closely related, a demerger can simplify its overall business portfolio and make it easier for investors to understand and evaluate.

Regulatory Requirements: Regulatory or antitrust issues might necessitate the separation of certain operations to ensure fair competition in the market.

Strategic Focus: A company might want to give specific business units greater autonomy to pursue their unique strategies, which could be hindered within a larger, conglomerate structure.

Demergers can take various forms:

Equity Spin-off: The parent company distributes shares of the new entity to its existing shareholders. These shares become separate tradable stocks on the market.

Carve-out: The parent company sells a portion of its shares in the subsidiary to the public through an initial public offering (IPO), while retaining a controlling interest.

Asset Transfer: The parent company transfers specific assets, divisions, or business units to the new entity.

Split-off: The parent company offers its shareholders the option to exchange their shares for shares in the new entity, with the exchange ratio determined by the company.

Demergers can have legal, tax, and financial implications, and they require careful planning and execution to ensure that the interests of shareholders and stakeholders are protected.

ITC Limited, formerly known as the Imperial Tobacco Company of India Limited, is a diversified Indian conglomerate with interests in various industries, including consumer goods, agriculture, hotels, packaging, and information technology.

ITC is known for its diverse business portfolio. It operates in various sectors such as FMCG (Fast-Moving Consumer Goods), hotels, agri-business, paperboards, and packaging, among others.

ITC's history can be traced back to its origins in the tobacco industry. It is one of the largest manufacturers of cigarettes in India and has a significant presence in the tobacco market.

ITC has a wide range of popular consumer brands under its FMCG segment. Some of its well-known brands include Aashirvaad, Sunfeast, Bingo, YiPPee!, and Classmate.

ITC is also involved in agri-business, which includes sourcing, processing, and exporting agricultural products. It works closely with farmers to improve agricultural practices and increase their income.

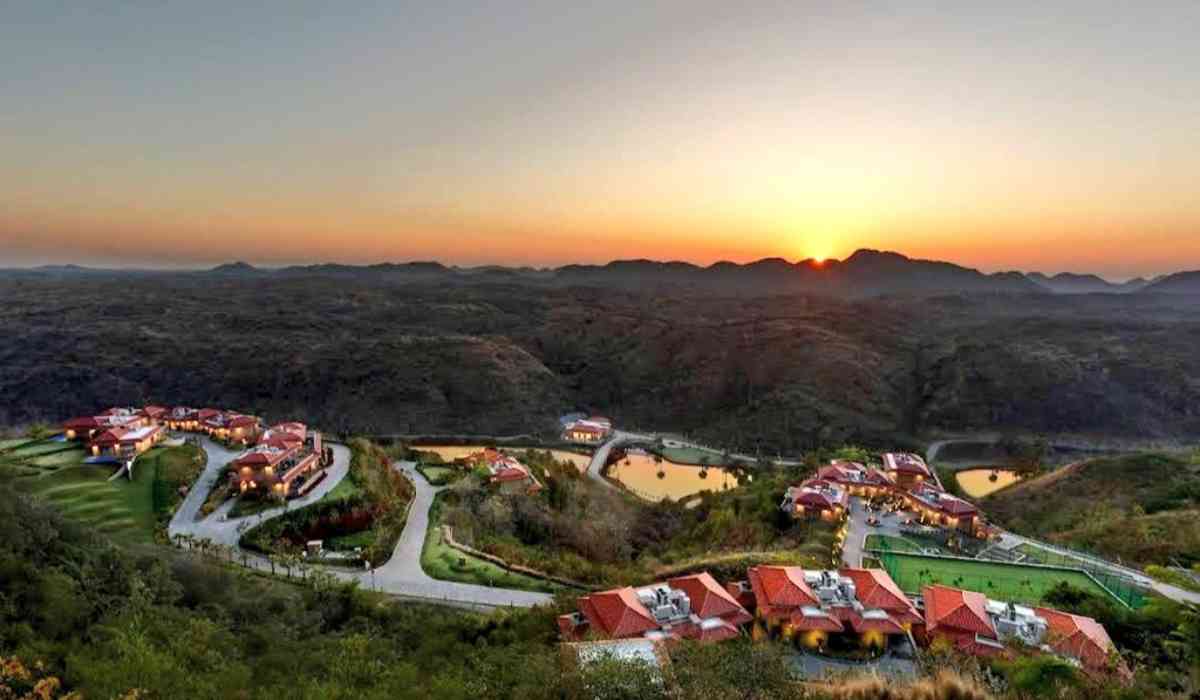

ITC operates luxury hotels under the brand name ITC Hotels.

ITC is one of the largest companies in India in terms of market capitalization and revenue. It has a significant presence in both urban and rural markets.

© Copyright 2023. All Rights Reserved Powered by Vygr Media.