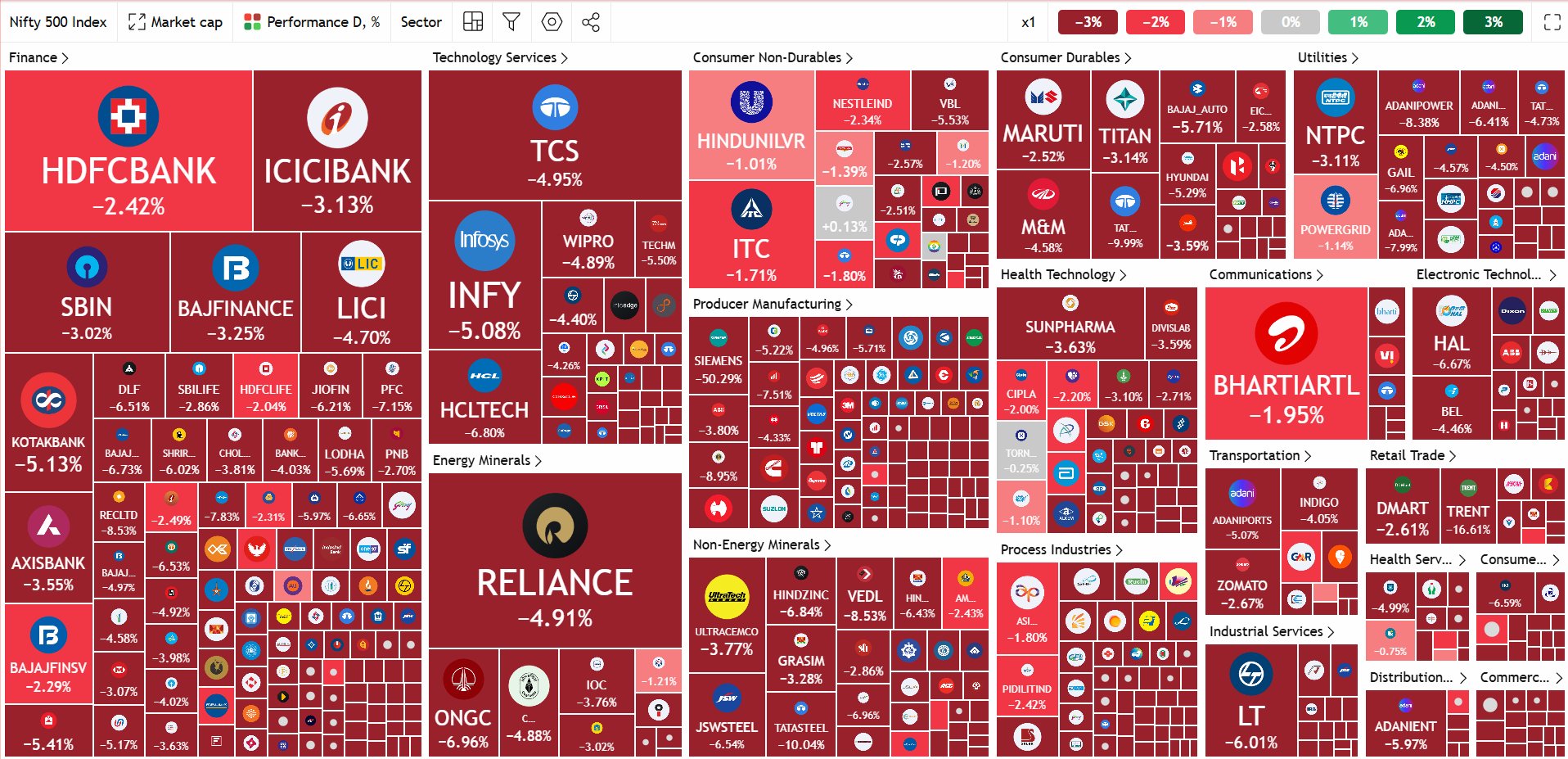

In a single morning, over ₹20 lakh crore in investor wealth was erased from the Indian stock markets — the result of a global panic set off by US President Donald Trump’s newly announced tariff regime. Within seconds of the opening bell, Indian equities crashed to a 10-month low, mirroring the sell-off that has gripped markets across Asia and beyond.

The Sensex fell by a staggering 3,939 points in early trade, dropping to 71,425.01, while the Nifty plummeted over 1,160 points to 21,743.65. These were not slow losses—they were immediate, brutal, and indiscriminate. Even the Indian rupee faltered, sliding 30 paise to open at ₹85.74 against the dollar. Trump’s move, part of a sweeping “reciprocal tariff” agenda, aims to rebalance what he calls decades of unfair trade. For India, the US has slapped a 26% tariff—one of the most severe among targeted countries—alongside a baseline 10% duty across the board. The White House insists this is a necessary corrective for American industry, but the message to global markets was clear: brace for turbulence.

Markets in Free Fall, Leadership in Denial

Despite the deepening crisis, President Trump appeared unshaken. In a statement to the press, he likened the tariffs to a bitter pill needed to “fix something broken.” However, to investors and analysts, the rhetoric felt hollow—especially with Asian equities crashing across the board. In China, which retaliated with its own 34% tariffs, major indices lost over 4%, while Hong Kong’s Hang Seng is down more than 10%. Japan’s Nikkei suffered a 6.5% fall, and Taiwan and Singapore saw drops nearing 10%.

Wall Street is unlikely to escape the carnage. Futures on the New York Stock Exchange are already flashing red, signalling that the American economy, too, may be heading into stormy waters.

India: Collateral Damage in a Trade War It Didn’t Start

India, whose economic fundamentals remain largely sound, finds itself caught in a crossfire. According to market expert Ajay Bagga, India is bearing the brunt of global capital flight and sentiment-driven sell-offs. “This isn’t about India’s domestic economy—it’s about being a link in the global investment chain. We now need coordinated fiscal, monetary and structural reforms to insulate ourselves from this economic winter,” he told ANI.

Sunil Gurjar, a SEBI-registered analyst, pointed out that key technical levels have been breached. “Nifty has already broken past its first support. If the downtrend continues, we’re looking at a prolonged bear phase.”

The stock market bloodbath is just one dimension of the damage. Exporters are staring down the barrel of reduced competitiveness, especially in sectors like pharmaceuticals, jewellery, and ready-made garments. With America being India’s largest trading partner, the fallout could reverberate across employment, manufacturing, and foreign exchange reserves.

Global Risks, Local Consequences

Beyond numbers and charts, this moment represents something bigger—a crisis of confidence in the global trade system. Trump’s tariffs, rather than strengthening the US, could backfire by accelerating a retreat from the dollar-dominated order. As countries like India, China, Brazil, and Russia seek to shield themselves, the stage is set for a recalibration of global trade partnerships—one where new blocs like BRICS might play a more assertive role.

SPI Asset Management’s Stephen Innes summed it up bluntly: “Markets are in free fall. This isn’t a negotiation tactic anymore—it’s being treated like a victory lap.”

The Bottom Line

The numbers speak volumes—₹20 lakh crore wiped out, thousands of points lost, and panic gripping global exchanges. But behind the chaos lies a deeper truth: economic nationalism, when weaponised without diplomacy, rarely ends well. For India, this is a wake-up call. For the world, it may be the beginning of a long, uncertain trade war—one that leaves no economy untouched.