The digital mapping and navigation market in India is heating up, with international giant Google Maps facing stiff competition from domestic players MapMyIndia and Ola Maps. Recent developments, including legal disputes, significant price cuts, and India-specific features, underscore the high stakes involved as these companies vie for dominance. This article explores the key players, their strategies, and the ongoing battles shaping the future of digital maps in India.

MapMyIndia's Legacy and Legal Challenges

MapMyIndia, formally known as CE Info Systems, is a pioneer in the Indian mapping industry, established in 1994. With a stronghold in the automotive Original Equipment Manufacturer (OEM) sector, MapMyIndia controls nearly 80% of the market, powering navigation systems for major automakers. It also provides mapping data for Apple Maps, offering a critical alternative to Google Maps for iOS users.

However, MapMyIndia recently found itself embroiled in a legal battle with Ola. In a legal notice, MapMyIndia accused Ola of duplicating its Application Programming Interface (API) and Software Development Kits (SDKs) to develop Ola Maps. The notice alleged that Ola had reverse-engineered MapMyIndia's proprietary data, violating their 2022 agreement when Ola Electric used MapMyIndia's navigation services for its S1 Pro electric scooter. MapMyIndia demanded that Ola cease using the allegedly copied data and return all related materials.

Ola, however, has vehemently denied these accusations, stating that they stand by the integrity of their business practices and would respond to the notice appropriately. The outcome of this legal confrontation could have significant implications for the mapping market in India, potentially affecting the competitive landscape and customer trust in these platforms.

Google's Consumer Dominance and Strategic Response

Google Maps has long been the go-to mapping service for Indian consumers, thanks to its widespread availability on Android devices and its comprehensive, accurate turn-by-turn navigation. Many applications, including ride-hailing services like Uber, rely on Google's mapping system, making it a dominant force in the consumer space.

In response to Ola's move away from Google Maps, Google introduced substantial price cuts for developers using its platform, offering up to 70% reductions on most APIs. This move was perceived as a direct response to Ola's actions and a strategic effort to retain developers. Additionally, Google collaborated with the Open Network for Digital Commerce (ONDC), providing even steeper discounts for developers working with ONDC, with up to 90% off select APIs.

These aggressive price cuts also impacted MapMyIndia, whose share prices dropped by nearly 11% during intraday trading following Google's announcement. The intertwined nature of these competitors' strategies highlights the delicate balance each must maintain to stay competitive.

Ola's Nationalistic Approach and Cost-Cutting Measures

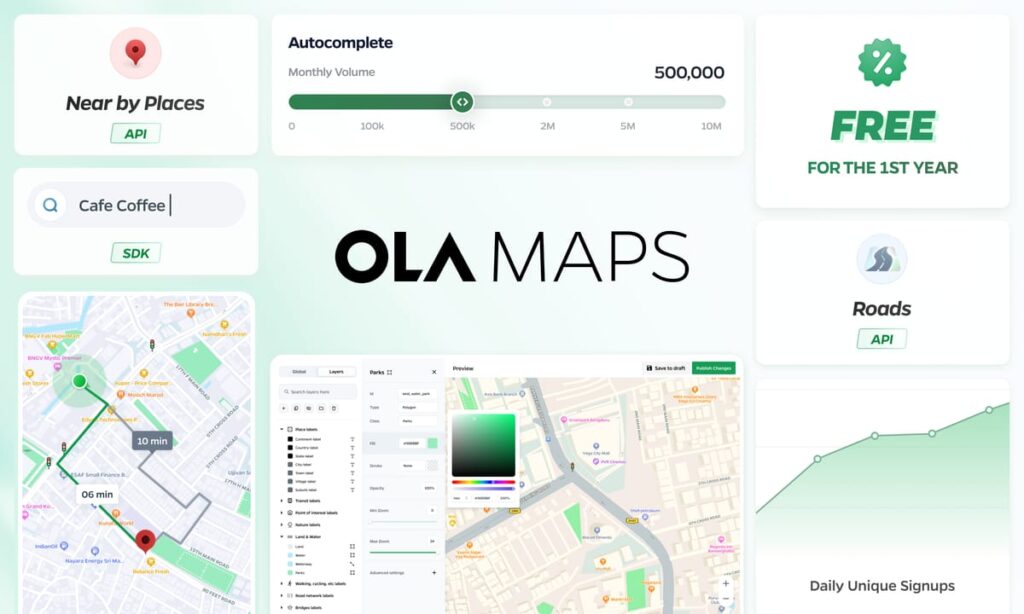

Ola Maps, the latest entrant in the market, has been aggressively positioning itself as a homegrown alternative. Ola's CEO, Bhavish Aggarwal, has been vocal about the need for domestic champions in India's tech landscape. Earlier this month, Ola announced it would switch from using Google Maps to its proprietary Ola Maps, citing significant cost savings.

Ola's decision to develop its mapping system, partially based on the open-source OpenStreetMap and augmented with proprietary data, was driven by financial considerations. Aggarwal revealed that the company had been spending ₹100 crore annually on Google Maps, a cost eliminated by the transition to Ola Maps. To further entice developers, Ola announced its APIs, allowing them to integrate Ola Maps into their services and reduce reliance on Google Maps.

In retaliation, Google introduced India-specific features, including an option to indicate whether a particular flyover should be taken and providing information on electric vehicle (EV) charging stations. These additions, along with AI-driven routing capabilities to avoid narrow roads, aim to cater specifically to Indian users' needs and enhance Google Maps' value proposition.

FINAL THOUGHTS

The battle for supremacy in India's digital mapping market is intensifying, with Google Maps, MapMyIndia, and Ola Maps each deploying unique strategies to gain an edge. Legal disputes, competitive pricing, and India-centric innovations are just some tactics these companies employ to secure their positions. As this competition unfolds, consumers and businesses stand to benefit from improved services and more choices. However, the outcome of ongoing legal and market maneuvers will likely shape the future landscape of digital mapping in India, making this a crucial period for all involved players.

Inputs by Agencies

Image Source: Multiple Sources

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.