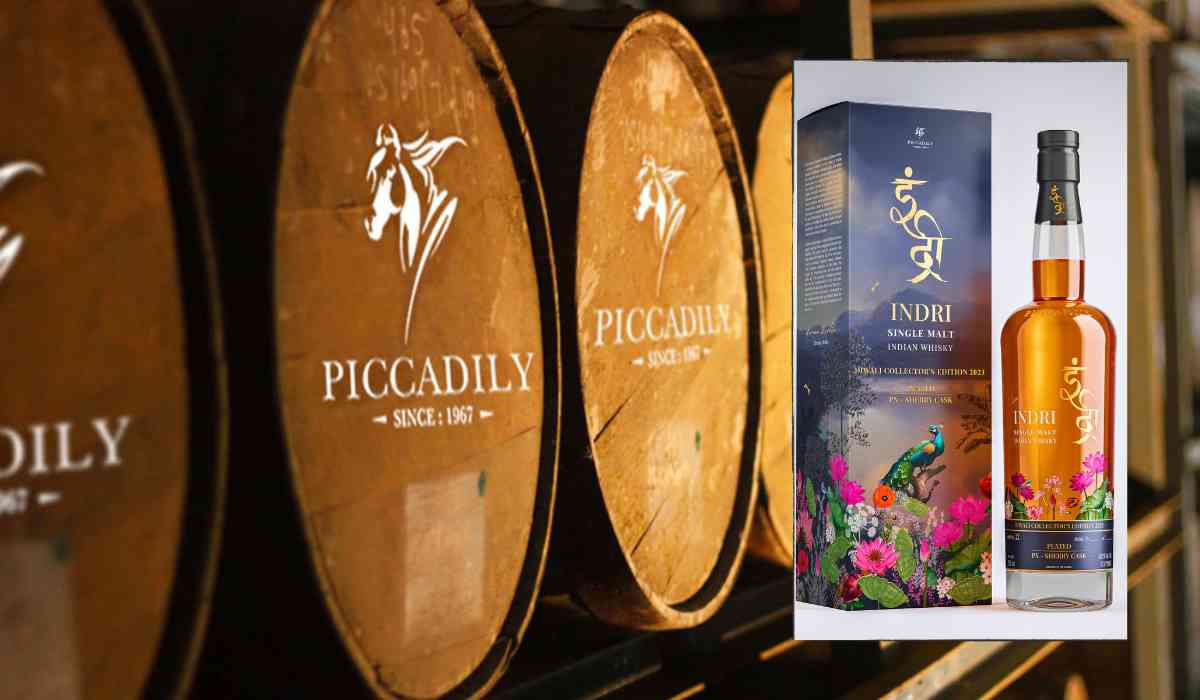

In a distillery located near New Delhi, there is a growing accumulation of oak casks that were previously utilized for bourbon and wine. These casks are currently being filled with whisky that is undergoing the ageing process. Piccadily, a two-year-old Indian brand, is the proud owner of this distillery and is successfully manufacturing close to 10,000 bottles daily of their renowned Indian single malt, known as Indri. This whisky has garnered global acclaim and is esteemed as one of the finest in the world.

Nestled amidst sugarcane and mustard fields rather than peat bogs, the distillery is creating a buzz in India's thriving $33 billion spirits industry. Renowned brands such as Glenlivet and Talisker compete with esteemed local contenders like Indri, Amrut, and Rampur by Radico Khaitan for coveted spots on the shelves.

India, known for its traditional affinity for whisky, is currently witnessing a transformation in its spirits scene. The nation's single malts are gaining worldwide acclaim, driven by international accolades, increasing prosperity, and a rise in individuals seeking out novel brands amidst the COVID-19 pandemic.

Indri's Diwali Collector's Edition, which is priced at $421, was honoured with the esteemed "Best in Show" title at the Whiskies of the World Awards in San Francisco.

_1702892049.png)

In light of the growing trend, esteemed global brands such as Pernod Ricard and Diageo have been seeking opportunities in the Indian whisky market. Pernod Ricard, for instance, has recently introduced its inaugural Indian-made single malt, Longitude 77, which is priced at $48 and has aspirations for global outreach.

Diageo, Pernod's competitor, recently introduced its Indian single malt, Godawan, in five international markets, including the United States. This shift is notable as Indian single malts have been surpassing Scotch, exhibiting a growth of 144% in 2021-22, in comparison to Scotch's 32% growth, as stated by IWSR Drinks Market Analysis.

Piccadily Distilleries, the esteemed manufacturer behind Indri, has set forth a commendable objective of elevating its production capacity by a substantial 66% to reach an impressive 20,000 litres a day by the year 2025. This strategic move is aimed at facilitating expansion beyond the existing 18 foreign markets. The surge in demand for our delightful Indian malts is unequivocally evident, as growth projections indicate a remarkable annual ascent of 13% until 2027, surpassing the growth rate of Scotch, which stands at a respectable 8%.

Although local brands such as Indri, Amrut, and Rampur have higher prices, consumers are attracted to their distinctive flavours. Pernod's Glenlivet, which used to be the leading single malt in India, had to contend with competition from Amrut, which experienced a remarkable 183% increase in volume growth during the previous year.

As Indian single malts acquire recognition and popularity in both domestic and worldwide markets, industry executives see the category's enormous potential and designate it as the "category of the future." Diageo and Pernod Ricard have emerged as frontrunners in this movement, proving that Indian whisky is more than just a fad but a serious challenger in the ever-changing spirits business.

In conclusion, the emergence of Indian single malts represents a remarkable transformation in the worldwide whisky industry. With esteemed recognition and growing consumer inclination, renowned brands such as Indri, Amrut, and Rampur are playing a significant role in shaping India's thriving $33 billion spirits market. As international players venture into this domain, the trajectory indicates a highly promising outlook for Indian malts, positioning them as a category worth observing in the dynamic realm of spirits.

PC: Multiple sources: Reuters, MoneyControl, Whiskey Reviews

Ⓒ Copyright 2023. All Rights Reserved Powered by Vygr Media.