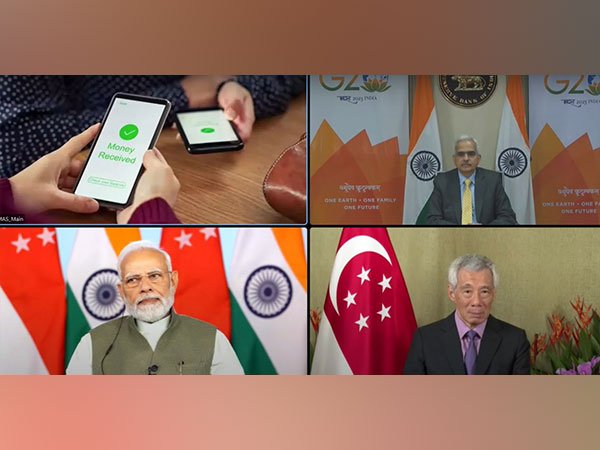

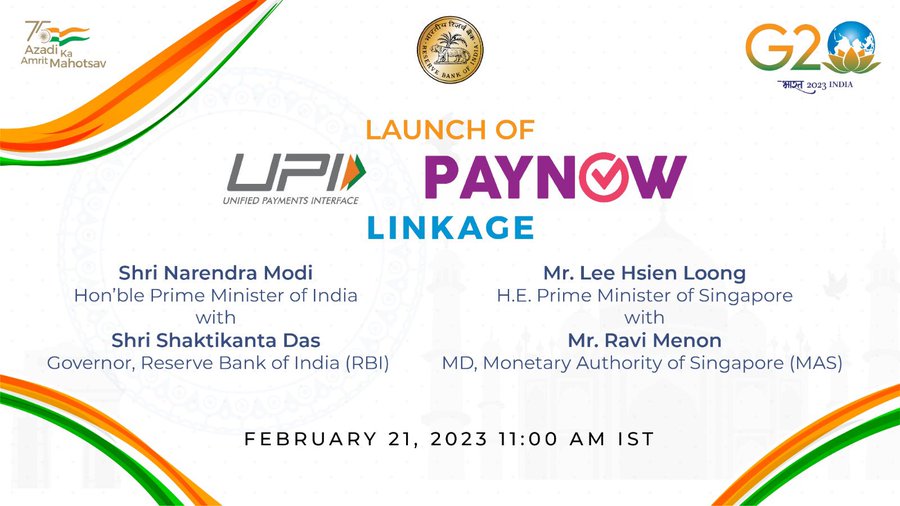

India and Singapore launched a real-time link on Tuesday to make it easier to send money across borders between one of the largest remittance recipients in the world and an Asian financial powerhouse.

Due to the partnership between Singapore's facility and India's Unified Payments Interface (UPI), funds can now be transferred using only mobile phones. Payment costs typically decrease as a result of such cross-border transfer arrangements.

This move is aimed at facilitating seamless and secure cross-border transactions between the two countries. The UPI system is a mobile-based platform that allows users to send and receive money instantly using a unique virtual payment address.

The integration of UPI systems in India and Singapore is expected to promote greater trade and investment flows between the two countries, as it will enable businesses and individuals to make cross-border payments easily and securely. The collaboration between India and Singapore in the field of digital payments is seen as a step towards creating a more integrated and seamless payment infrastructure in the Asia-Pacific region, which is expected to benefit businesses and consumers alike.

© Vygr Media Private Limited 2022. All Rights Reserved.