Navigating the trading market is both an art and a science. Whether you’re a beginner or an experienced trader, understanding the right tools, proven tips, and common pitfalls is crucial for long-term success. This guide will help you master the essentials and avoid costly mistakes.

Essential Tools for Successful Trading

-

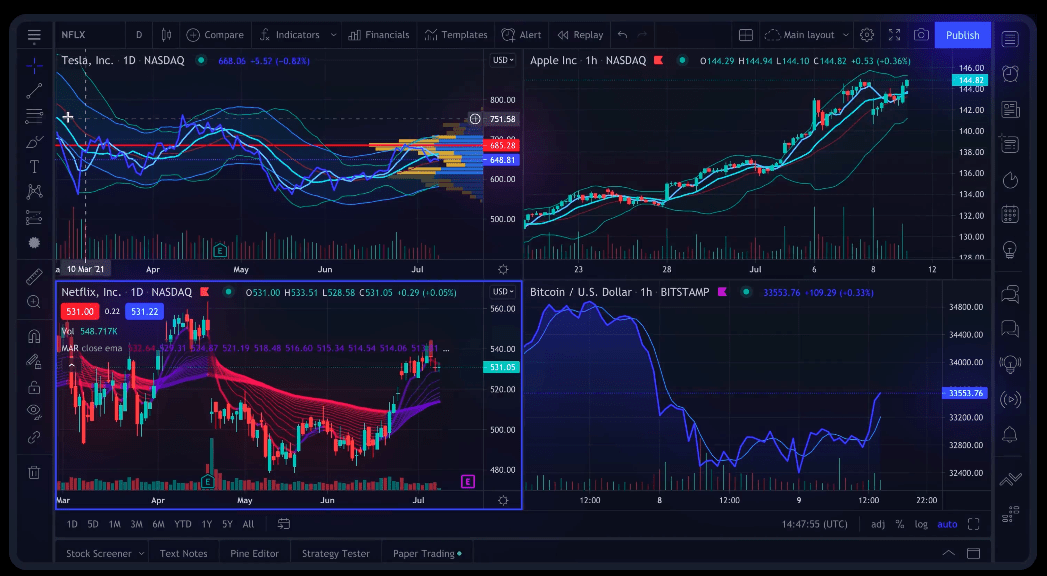

Trading Platform: Choose a reliable, user-friendly platform with robust charting, order execution, and risk management features.

-

Market Research Tools: Use financial news feeds, economic calendars, and research reports to stay informed about market-moving events.

-

Technical Analysis Software: Leverage charting tools and indicators to identify trends, support/resistance levels, and entry/exit points.

-

Risk Management Tools: Utilize stop-loss and take-profit orders to protect your capital and automate your trading discipline.

-

Trading Journal: Maintain a log of your trades, strategies, and outcomes to analyze performance and refine your approach over time.

Proven Tips for Trading Success

-

Do Your Homework: Always research the markets, assets, and economic factors before entering a trade. Informed decisions are less likely to be swayed by rumors or emotions.

-

Develop a Trading Plan: Outline your strategy, risk tolerance, and goals. Stick to your plan, even after a bad day, and avoid impulsive decisions.

-

Start Small: Begin with manageable positions and scale up as you gain confidence and experience.

-

Manage Risk: Never risk more than you can afford to lose. Set a maximum risk per trade (commonly 1-3% of your capital) and use stop-loss orders to limit potential losses.

-

Keep Emotions in Check: Emotional trading often leads to poor decisions. Stay disciplined and avoid trading based on fear, greed, or frustration.

-

Record and Review: Use a trading diary to track your trades, analyze mistakes, and identify patterns in your behavior and strategy.

-

Stay Updated: Markets are dynamic. Keep learning and adapting to new trends, tools, and strategies.

Common Trading Mistakes to Avoid

| Mistake | Why It’s Harmful | How to Avoid |

|---|---|---|

| Trading Without Research | Leads to uninformed, risky decisions | Always research before trading |

| No Trading Plan | Increases impulsive and inconsistent trades | Create and follow a plan |

| Overexposing a Position | Magnifies losses if the market moves against you | Diversify and manage position sizes |

| Ignoring Risk Management | Can result in significant capital loss | Use stop-loss and set risk limits |

| Letting Emotions Drive Decisions | Causes irrational trades and losses | Maintain discipline, avoid revenge trading |

| Overconfidence After Wins | May lead to reckless trading and bigger losses | Stay humble and stick to your plan |

| Not Cutting Losses Early | Small losses can turn into large ones | Accept small losses, don’t move stop-losses |

| Blindly Following the Crowd | You may buy overpriced assets or miss reversals | Trust your research and plan |

| Trading Too Many Assets | Dilutes focus and increases risk | Focus on a few key markets |

In Fact some traders very effectively using trading tools like AccuTraderInsight to work on their trades - The link to the official website is here

Final Thoughts

Success in trading requires the right combination of tools, discipline, and continuous learning. By equipping yourself with robust trading platforms, conducting thorough research, following a solid plan, and avoiding common mistakes, you’ll significantly improve your chances of achieving consistent profits in the trading market. Stay patient, keep emotions in check, and remember: every mistake is an opportunity to learn and grow as a trader.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved Powered by Vygr Media.