Gold has always been associated with affluence and good fortune. From ancient times through to modern-day economies, it is among the most trusted and valued assets available. Whenever markets fall and currencies continually lose value, gold seems like the haven that most investors run to for cover. This article explores the importance of gold as an investment, how to maintain its value, and why it should be part of your financial strategy.

Image Source - The Balance

Gold as an Investment

Value in investment is associated with gold since the metal has the property of operating as a store of value. Over the long term, gold holds its value much better than stocks or bonds. Gold will more or less keep, and even appreciate, value in economically unsettled times since it is immune to stock and bond drives that appear in such times. Most people go for it since it is the best reason for diversification in an investment portfolio.

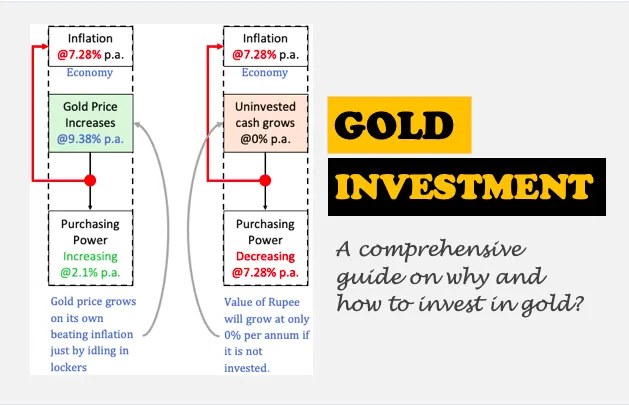

Hedge Against Inflation: The main reason investors look toward gold is protection against inflation. When the currency's value drops, the price of gold usually goes up, hence maintaining purchasing power. For example, during the global meltdown in 2008, the price of gold rose apace while global markets were on their noses.

Physical Asset: Gold is a physical asset that cannot just get wiped away, unlike digital or even paper investments. It provides this sense of security in that one knows it cannot be taken away based on the performance of some company or government entity. This is something one can have with him whenever economic uncertainty arises.

Global Demand: The demand for gold is not just one viewed locally but one experienced throughout the world. In whatever form it may be, whether jewelry, coins, or bars, every inhabitant in this world recognizes value in it. It is because of this global demand that gold maintains its value in all places and at whatever condition.

Image Source - getmoneyrich

Types of Investment in Gold

Investors have a few options for investment in gold, given their goals and preferences for risk and storage.

Physical Gold: The direct ownership of this form of gold is in bar, coin, and piece-of-jewelry form. In the process, while physical gold offers direct control, there is also a need for safe storage and even insurance. Popular options include the American Gold Eagle and the Canadian Maple Leaf coins, which are highly liquid and widely recognized.

Gold ETFs and Mutual Funds: Gold ETFs and mutual funds are convenient for investors who do not want to hold gold physically. These financial products give an investor exposure to gold, but in any case, there is no inventory that an investor needs to pay for in the whole process. Gold mining stocks are an even better route to take in gaining exposure to gold, but this option is always highly volatile and relies on the performance of individual companies. Needless to say, such gold prices may yield even better returns.

Gold futures and options: Gold futures and options instruments enable more sophisticated investors to place a forward-looking wager on the movement of gold prices. These instruments carry higher risks and, thus, demand greater knowledge of the markets.

Image Source - Groww

Maintenance and Maximization of Gold Investments

Once an investment has been made in gold, a major course of action involves the management and maximization of the value of such an investment. A few mechanisms to ensure the investment stays safe and profitable include the following.

Correct Storage: If one happens to own physical gold, then the storage of that gold needs to be upright. One may opt for a safe deposit box or even a home safe. For massive sets, move to professional and safe storage with a facility that deals with precious metals. The gold should be insured against theft, loss, or damage.

Market Valuation: The price of gold fluctuates around the market. It is good that, from time to time, you check on the prevailing market price and assess the value of your holding. This guides your informed decisions in buying or selling.

Diversification: As valuable as gold is, it should not be an end-only. Gold should be combined with other investments like stocks, bonds, and real estate that can help mitigate risks and increase the final return.

Being informed: Watch global economic conditions and geopolitical events, as changes in these can indicate fluctuations in the price of gold. Staying informed will enable you to act upon market conditions and make timely changes in your investment plan.

Image Source - IIFL Finance

Is Gold Investment Ideal for You?

People find this extra amount of money invested in gold very captivating because of its solid value and stability. Gold investments, whether physical, in ETF form, or mining stocks, are highly crucial to a diversified investment portfolio. It is in the different types of gold investment and their intrinsic value where, for a long period, your gold shall ensure financial security.

Inputs by Agencies

Image Source: Multiple Agencies

Ⓒ Copyright 2024. All Rights Reserved Powered by Vygr Media.