-

Merger Approval: The Competition Commission of India (CCI) has approved the $8.5 billion merger between Disney and Viacom18.

-

Investment: Reliance Industries Limited (RIL) will inject $1.4 billion to support the growth strategy of the merged entity.

-

Ownership Structure: Post-merger, Reliance and its associates will hold nearly 56% of the combined entity. Disney will own 36.84%, with the remaining 7.5% belonging to Bodhi Tree.

-

Market Share: The merger will result in a combined market share exceeding 40%, with some markets experiencing complete dominance and reduced competition.

-

Leadership: Nita M. Ambani will serve as the chairperson of the merged venture, while Uday Shankar from Bodhi Tree will act as vice-chairperson.

The Indian media and entertainment sector is on the brink of a historic transformation.

On Wednesday, August 28, 2024, the Competition Commission of India (CCI) granted regulatory approval for a significant merger between Walt Disney Co. and Reliance Industries, valued at $8.5 billion. This merger involves the integration of Disney Star, the Indian subsidiary of The Walt Disney Company, with Viacom18, a media entity controlled by Reliance Industries.

Overview of the Merger

Entities Involved:

-

Disney Star: The Indian subsidiary of The Walt Disney Company.

-

Viacom18: A media entity controlled by Reliance Industries.

This merger aims to combine Disney Star with Viacom18, creating India’s largest entertainment company.

Regulatory Approval and Modifications

The CCI’s approval is a crucial step for this large-scale merger. The regulatory body has given its consent for the merger, though it has mandated some voluntary modifications. These modifications are intended to address competitive concerns and ensure a fair market environment. The specifics of these modifications have not been disclosed by the CCI.

CCI’s Announcement: The CCI confirmed the approval through a post on X (formerly Twitter), stating:

"Commission approves the proposed combination involving Reliance Industries Limited, Viacom18 Media Private Limited, Digital18 Media Limited, Star India Private Limited, and Star Television Productions Limited, subject to the compliance of voluntary modifications."

Details of the Merger Agreement

Agreement Terms:

-

The merger will be executed through a court-approved scheme of arrangement.

-

The joint venture is valued at ₹70,350 crore (approximately $8.5 billion) on a post-money basis.

Financial Contributions:

-

Reliance Industries will invest ₹11,500 crore (around $1.4 billion) to fuel the growth of the combined entity.

Ownership Structure:

-

Reliance and its affiliates will hold nearly 56% of the merged entity.

-

Disney will retain a 36.84% stake.

-

Bodhi Tree, a joint venture between James Murdoch and former Star India CEO Uday Shankar, will own 7.5%.

Market Impact and Regulatory Scrutiny

The merger will create a dominant player in the Indian media landscape, with the combined market share exceeding 40% in some markets. The consolidation is expected to reduce competition significantly in certain regions, which led to the CCI’s careful examination of the merger’s impact.

-

Market Presence: Star India operates leading channels across several regional markets, including Hindi, Marathi, Malayalam, Bengali, and Kannada. The merger will enhance the market presence of both entities.

-

Regulatory Concerns: Given the substantial market share and reduced competition, the CCI scrutinized the potential impact on the market closely. This careful consideration follows the CCI’s previous conditional approval of the now-canceled Zee and Sony merger, which also involved divestments to address competition concerns.

The Way Forward

Clearing the Hurdles

With the Competition Commission of India (CCI) granting its approval, the path is now clear for the Walt Disney Co. and Reliance Industries merger to move forward. This approval marks a significant milestone, removing the most substantial regulatory obstacle from the process. According to insiders familiar with the matter, who requested anonymity, the focus now shifts to obtaining the remaining necessary approvals and initiating the integration process.

Upcoming Approvals

Reliance anticipates securing the final approvals from the National Company Law Tribunal (NCLT) and the Ministry of Information & Broadcasting (MIB) by September 15. The integration phase is expected to commence shortly thereafter, likely before the end of September.

-

NCLT and MIB Approvals: These approvals are considered largely procedural. No significant objections have been raised by lenders or creditors, and as the companies involved are private entities, there is no need for approval from market regulators.

-

Integration Timeline: The insiders suggest that the integration phase is imminent, with no expected delays. The entire integration process should be completed within a couple of months.

Organizational Changes

During the integration phase, the new organizational structure for key managerial personnel (KMP) will be announced. The leadership team is tasked with evaluating each business unit and determining the necessary adjustments.

-

Key Managerial Personnel: A list of KMPs has already been prepared and will be disclosed once all approvals are finalized. The integration process is expected to proceed without delays.

-

Employee Impact: Although exact details on job cuts are not confirmed, media experts predict that at least 1,000 positions might be affected due to overlapping functions between the two companies. This estimate remains unverified.

Post-Merger Outlook

Leadership and Management

Nita M. Ambani is set to lead the merged entity as chairperson, with Shankar serving as vice-chairperson. The joint venture will amalgamate a vast array of media assets, including:

-

Entertainment and Sports Assets: The merger will combine TV channels such as Colors, Star Plus, and Star Gold, along with sports networks like Star Sports and Sports18. It will also integrate streaming content from platforms like JioCinema and Hotstar, which collectively reach over 750 million viewers in India.

-

Disney Content Rights: The new entity will hold exclusive rights to distribute Disney films and productions in India, along with a license to utilize over 30,000 Disney content assets.

Content and Channel Portfolio

The merged entity will operate approximately 100 TV channels, with 70 channels formerly under Disney and the remainder under Viacom18.

-

Impact on Traditional TV Networks: The consolidation of Disney and Reliance’s content libraries and resources could significantly affect traditional TV networks, potentially shifting advertising revenue and viewer preferences.

-

Access to Content Libraries: Reliance will gain access to Disney’s extensive English-language libraries, including coveted Marvel and Lucasfilm catalogs. Additionally, Reliance already has content from Warner Bros. Discovery, including HBO Originals, and is focusing on regional languages such as the four South Indian languages, Marathi, and Bengali.

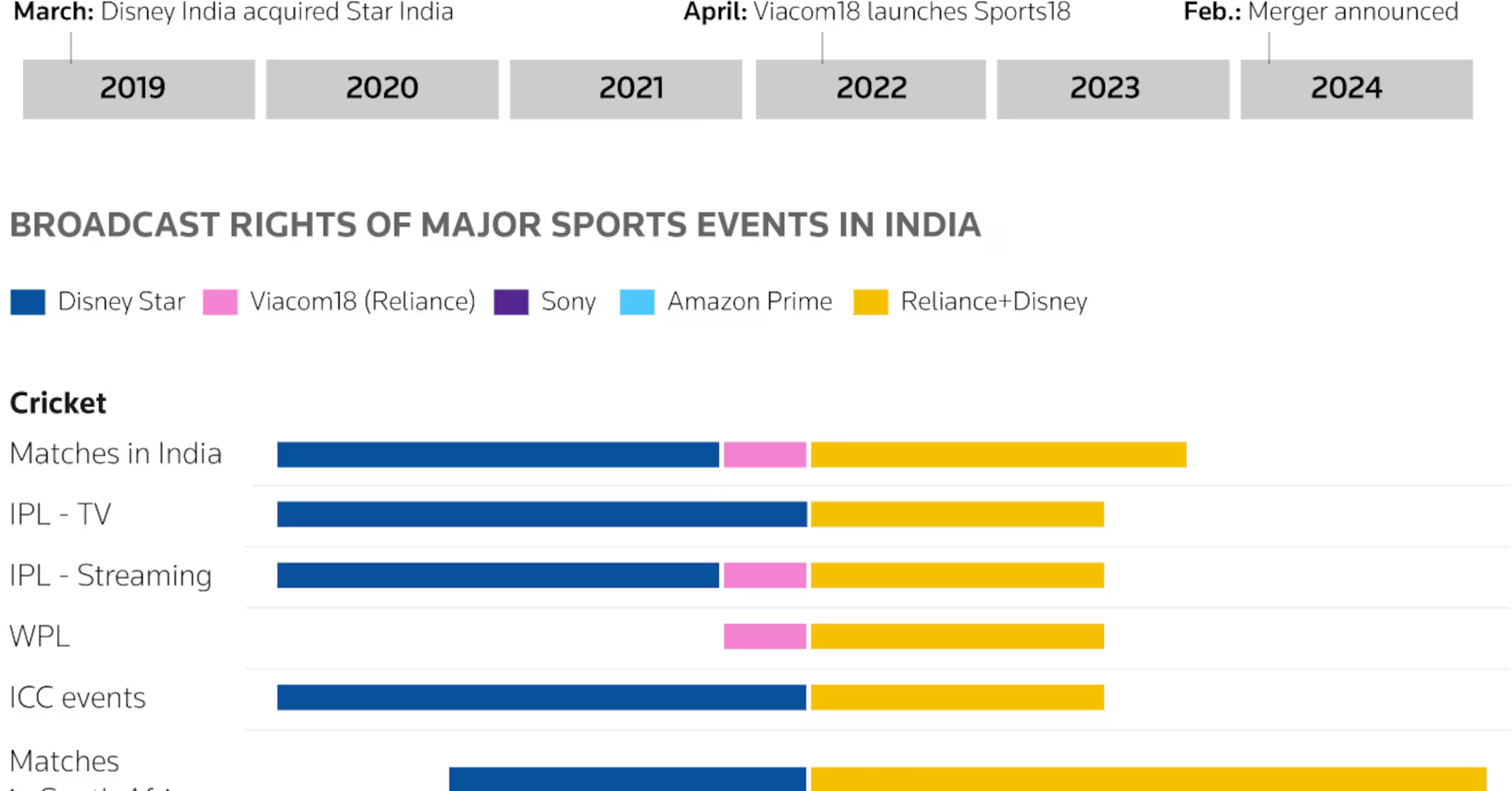

Sports Priority

The merger places a strong emphasis on sports content, leaving limited space for other competitors in this sector. The strategic focus on sports will be a defining feature of the new entity's approach to the market.

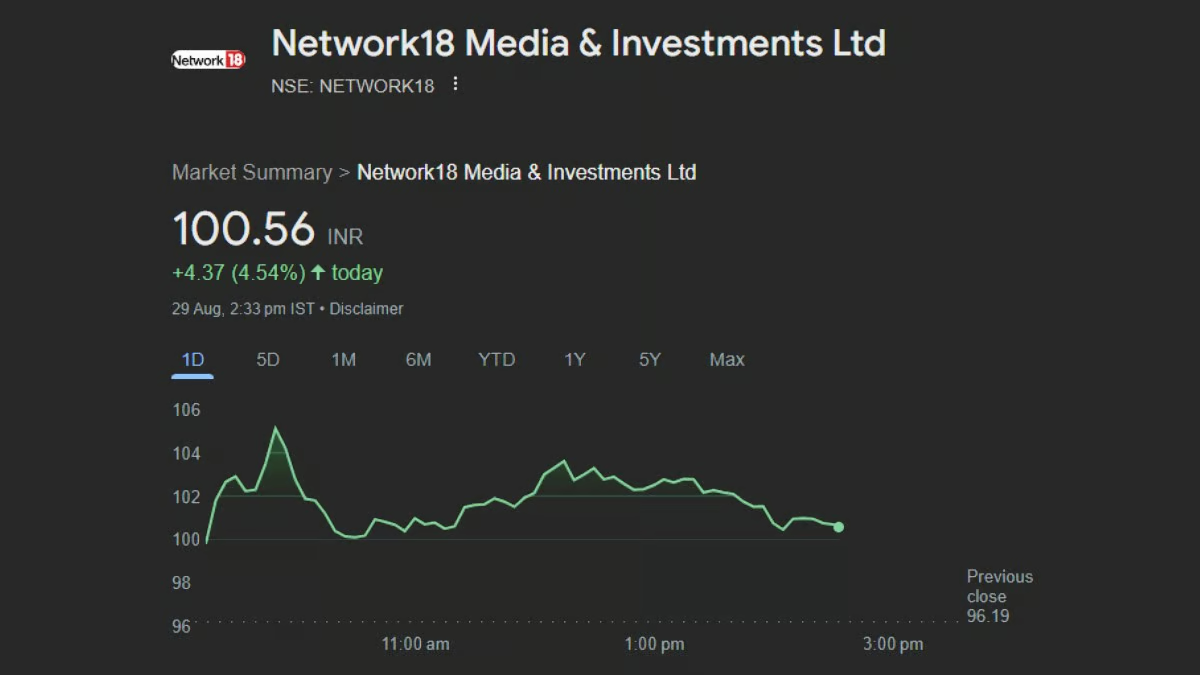

In pic: Reliance-Disney Merger: RIL & TV18 Shares Rise After ₹70,000 Crore Deal

Breakdown of Assets: Disney and Viacom18

In examining the assets of Disney and Viacom18, particularly in the realm of sports rights, it's clear that both companies hold substantial positions in television and streaming. Here’s a detailed breakdown:

- Television Assets

Viacom18

-

Ownership and Channels: Viacom18 is majority-owned by Reliance Industries. It operates 40 television channels, including popular names such as Comedy Central, Nickelodeon, and MTV.

-

Sports Rights: Viacom18 holds the television rights for both domestic and international cricket matches managed by the Board of Control for Cricket in India (BCCI).

Disney Star

-

Channel Portfolio: Disney Star, a well-established name in India, operates approximately 80 channels. Its programming is renowned for Hindi family dramas and a diverse range of Hollywood films.

-

Sports Rights: Disney has secured the TV rights for the Indian Premier League (IPL) until 2027.

Both companies’ channels cover a broad spectrum of genres including general entertainment, sports, children's programming, documentaries, and lifestyle content. They also offer content in various regional languages.

- Streaming Assets

Disney

-

Digital Rights: Disney holds the digital rights for the International Cricket Council (ICC) matches in India through 2027.

-

Streaming Platform: Disney's Hotstar, a major player in the Indian streaming market, was the second-most downloaded video streaming app in 2022, trailing only behind MX Player, according to a report by the Federation of Indian Chambers of Commerce and Industry (FICCI) and EY.

-

Content Library: Hotstar offers a diverse content library, including global blockbusters, Marvel movies, and National Geographic documentaries. It streamed seven out of the top 15 most-watched original shows in India in 2022, as reported by media consulting firm Ormax.

Reliance JioCinema

-

Streaming Rights: JioCinema has acquired the streaming rights for the IPL until 2027, having outbid Disney for this coveted asset.

-

Content Partnerships: JioCinema has expanded its offerings by securing deals with The Pokemon Company to stream content and Warner Bros to enhance its catalog of Hollywood and international films.

-

Content Library: The combined content library of JioCinema and Disney's Hotstar would exceed 200,000 hours, including television dramas, movies, and sports events.

The merger promises to reshape India's media and entertainment landscape, blending extensive content libraries and expanding market reach.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.