February 1, the day for the Union Budget 2023 is here. All eyes are on Finance Minister Nirmala Sitharaman as she is set to announce the budget is finally here.

Feb 01, 11:00 AM IST

Finance Minister begins her speech in Parliament.

UPDATES from FM Speech

30. Personal Tax: Income tax rebate limit to Rs 7 lakh under new tax regime

29. Calamity cess on cigarettes: 16 percent increase in the calamity cess imposed

28. Indirect Tax proposals:

- Govt to reduce customs duty on shrimp feed to promote exports

- Taxes on cigarettes hiked by 16 percent

- Basic import duty on compounded rubber increased to 25 percent from 10 percent.

- Basic customs duty hiked on articles made from gold bars

- Customs duty on kitchen electric chimney increased to 15 percent from 7.5 percent.

- Customs duty on parts of open cells of TV panels cut to 2.5 percent.

- Customs duty on import of certain inputs for mobile phone manufacturing.

27. Expansion of the Government digital certificate depository Digilocker services for the fintech sector

26. 100 labs for developing apps using 5G services will be set up in engineering institutions

25. Phase 3 of the eCourt's project launched: Rs. 7,000 crores outlay

24. Personal Finance Big hits: One-time, new savings scheme for women with a tenure of two years to offer 7.5 percent interest rate with partial withdrawal option. Investment limit in small savings schemes like Senior Citizen Saving schemes (SCSS) increased to Rs 30 lakh Investment limit in Monthly income scheme (MIS) increased to Rs 9 lakh, joint accounts the limit has gone up to Rs 15 lakh

23. MSME assistance: Government infuses Rs 9000 cr into the corpus Will enable additional collateral free credit guarantee of Rs 2 lakh crore rupees

22. Replacing old government vehicles will provide a fillip to the economy

21. PM Awaas Yojana: 64 percent increase in allocation to Rs 79,000 crore

20. Green Hydrogen Mission: Budget provides for Rs 35,000 crore capital investment for energy transition and net zero objective

19. Government will provide R&D grant in lab grown diamond sector

18. A National Digital Library for children and adolescents will be set up

17. Eklavaya Model Residential Schools: Centre will recruit 38,800 teachers and support staff for 740 schools serving 3.5 lakh tribal students

16. PMPBTG Development mission will be launched for tribals

15. Vivad Se Vishwas scheme: The scheme will settle contractual disputes of government and government undertakings where an arbitral award is under challenge in a court.

14. Ease of Doing Business:

More than 39,000 compliances have been reduced, over 3,400 legal provisions decriminalised

PAN will be used as a common identifier for all digital systems

13. NDA makes its choice for its Last Full Budget: Job creation and Infra development over populism

12. Capex outlay increased by 33% to Rs 10 lakh crore for FY24. PM Awas Yojana outlay hiked by 66 pc to Rs 79,000 cr. Govt to provide Rs 5,300 cr assistance to drought-prone central region of Karnatak

11. Higher agricultural credit target not going down well with markets

10. Increasing capital expenditure by 33 percent to Rs 10 lakh crore, which would be 3.3 percent of the GDP.

9. Government to launch PM MATSYA SAMPADA YOJANA

8. Agriculture credit target expanded to Rs 20 lakh crore.

7. 157 nursing colleges to be set up Rs 2,200 crore Aatmanirbhar clean plan programme to be launched

6. Budget is based on 7 priorities

1. Green growth

2. Youth power

3. Inclusive development

4. Reaching the last mile

5. Infrastructure and investment

6. Unleashing the potential

7. Launch of digital platform

5. India is already the largest producer and second largest exporter of millets NOW, India to become a global hub for Sri Ann or Millets

4. Green growth’ would be one of the priorities of the budget - Reduce carbon intensity, create green jobs

3. This is the first Budget in Amrit Kaal

2. Blueprint has been drawn for India@100

1. India is a bright star in the world economy, says FM Nirmala Sitharaman

Feb 01, 9:30 AM IST

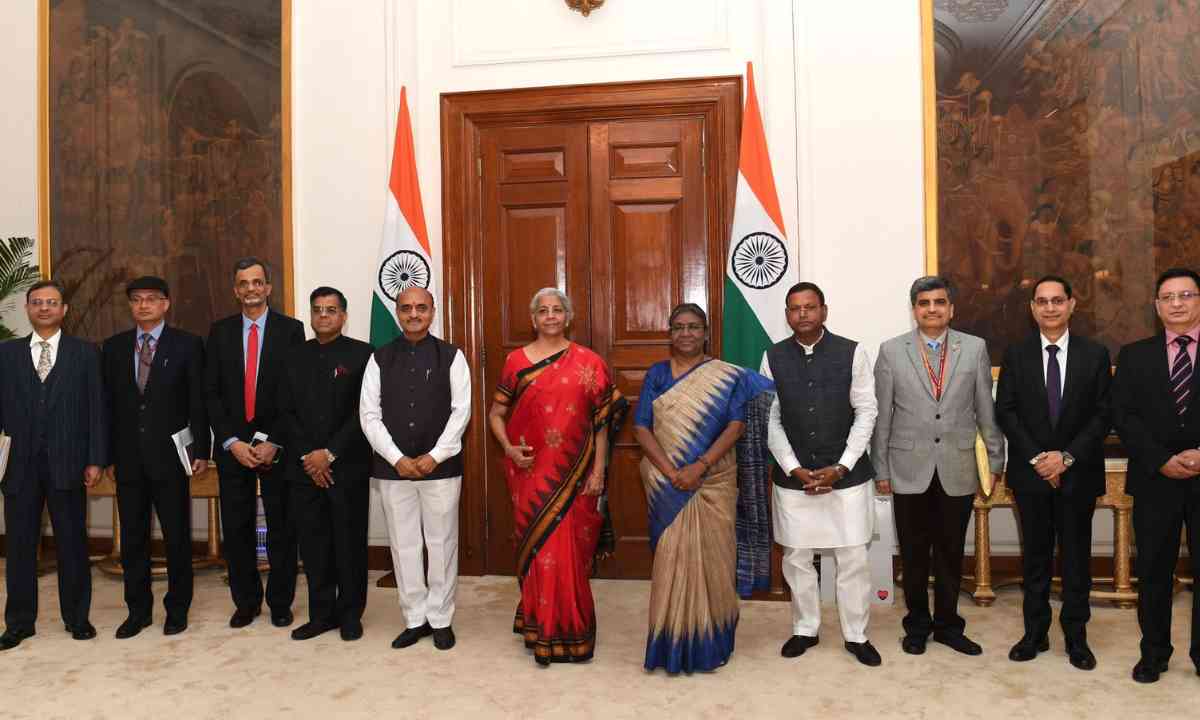

Nirmala Sitharaman meets President Droupadi Murmu at Rashtrapati Bhavan.

Feb 01, 9 AM IST

Union Finance Minister Nirmala Sitharaman arrives at the ministry of finance before the Budget Presentation.

Did you know?

Sitharaman is the 6th Finance Minister to present the Union Budget for 5 consecutive years out of the 28 Finance Ministers India has had.

This is the last full budget presented by Nirmala Sitharaman as the next one will be an interim budget.

What is the Interim budget?

Interim Budget is presented by a government which is going through a transition period as an incumbent government cannot present a full Union Budget in the election year.

Read detailed document from Finance Ministry - Budget 2023

© Vygr Media Private Limited 2023. All Rights Reserved.