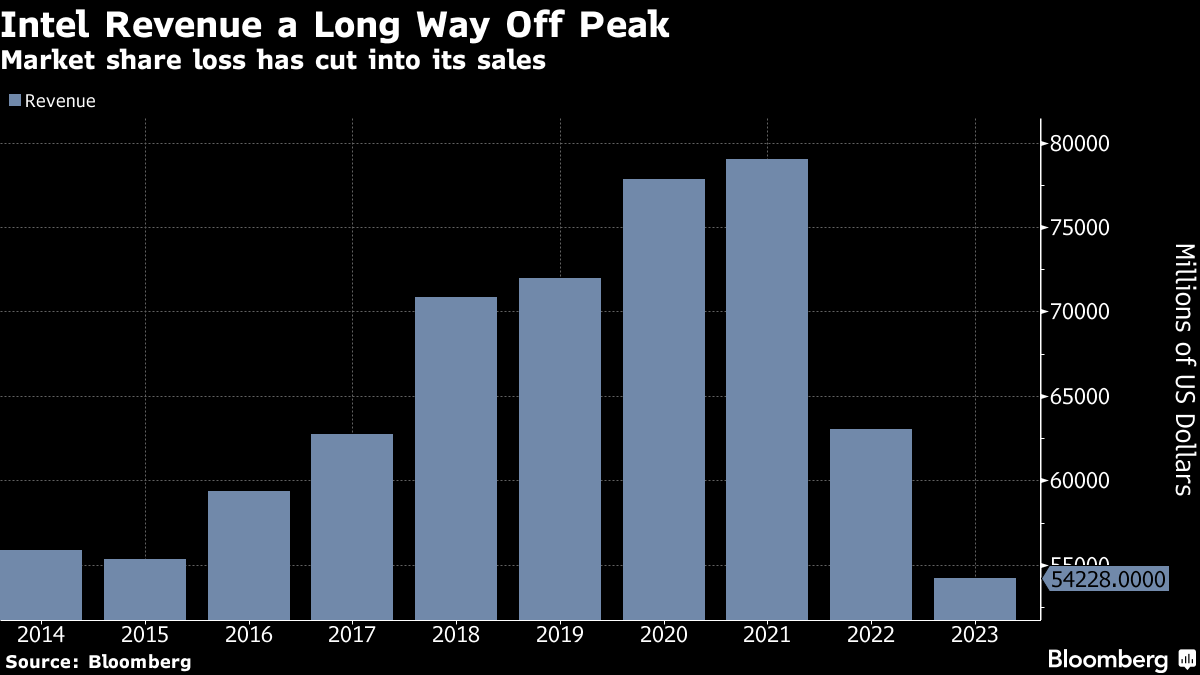

Intel has unveiled a substantial workforce reduction, announcing plans to cut 18,000 jobs, which accounts for 15 percent of its total employees. This significant move is part of the company's broader strategy to remain competitive against industry leaders like NVIDIA and AMD.

Intel's Financial Challenges

- Disappointing Financial Performance

Intel's decision to reduce its workforce follows a challenging financial quarter marked by a notable loss and decline in revenue. In the April-June period, Intel reported a loss of $1.6 billion, a stark contrast to the previous year's profit of $1.5 billion. Revenue slightly dipped from $12.9 billion to $12.8 billion, falling short of analysts' expectations.

- Cost-Cutting Measures

In response to these financial difficulties, Intel has also suspended its stock dividend, a move aimed at conserving cash. The company's stock took a hit, dropping by 19 percent in after-hours trading, potentially erasing $24 billion from its market value.

Strategic Adjustments to Mitigate Financial Downturn

- Workforce Reduction and Retirement Programs

To address its financial challenges, Intel plans to introduce an enhanced retirement offering for eligible employees and a voluntary departure program. The majority of the layoffs are expected to be completed within the year. CEO Pat Gelsinger emphasized the need to align Intel's cost structure with a new operating model to improve margins and better position the company for future growth.

- Long-Term Growth Focus

Despite current setbacks, Intel is concentrating on long-term growth in the AI and chip fabrication markets. Gelsinger has noted that while investments in the AI PC market may pressure profit margins in the short term, they are anticipated to yield significant benefits by 2026, with AI PCs expected to represent more than 50 percent of the market.

Future Prospects and Market Position

- Expansion of Semiconductor Foundry Business

Unlike many competitors, Intel manufactures its chips and is working to expand its semiconductor foundry business in the US, competing with major players like Taiwan Semiconductor Manufacturing Co. (TSMC). Intel has also been a key beneficiary of the 2022 CHIPS and Science Act, which aims to boost chip manufacturing in the US.

- Role in US Economic Strengthening

President Joe Biden has highlighted Intel's role in this initiative, celebrating agreements to provide substantial funding and loans for new chip plants across the country. This investment is seen as crucial for strengthening the US economy and reducing dependence on foreign-made chips. As Intel navigates these changes, the company faces the challenge of building specialized facilities and upskilling the local workforce, underscoring that these transformations will take time to realize fully.

Intel's Multiyear Transformation Strategy- Key Priorities

As part of its strategic realignment, Intel has outlined four key priorities:

-

Reducing Operating Expenses: Intel plans to streamline operations and significantly cut spending and headcount. The goal is to reduce non-GAAP R&D and marketing, general, and administrative (MG&A) expenses to approximately $20 billion in 2024 and $17.5 billion in 2025, with further reductions expected in 2026.

-

Reducing Capital Expenditures: The company is shifting its focus toward capital efficiency and investment levels aligned with market requirements. This will reduce gross capital expenditures in 2024 by more than 20 percent from prior projections, bringing them to between $25 billion and $27 billion. Intel targets net capital spending in 2024 to be between $11 billion and $13 billion, and in 2025, between $12 billion and $14 billion.

-

Reducing Cost of Sales: Intel expects to generate $1 billion in savings in non-variable cost of sales in 2025. Product mix will continue to be a headwind next year, contributing to modest year-over-year improvements to 2025's gross margin.

-

Maintaining Core Investments to Execute Strategy: Intel remains focused on advancing its long-term innovation and path to leadership across process technology and products. The increased efficiency from its actions is expected to further support its execution. Additionally, Intel continues to sustain investments to build a resilient and sustainable semiconductor supply chain in the United States and around the world.

Financial Outlook and Dividend Suspension

- Prioritizing Liquidity

In another step to bolster its financial position, Intel has decided to suspend its dividend starting in the fourth quarter, recognizing the importance of prioritizing liquidity to support the investments needed to execute its strategy. Nonetheless, Intel reiterated its long-term commitment to a competitive dividend as cash flows improve to sustainably higher levels.

- Second Quarter 2024 Financial Results

In the second quarter of 2024, Intel reported revenue of $12.8 billion, down 1 percent year-over-year. The second GAAP earnings (loss) per share attributable to Intel was $(0.38), while non-GAAP earnings per share attributable to Intel was $0.02.

Intel's significant workforce reduction and strategic realignment reflect the company's efforts to navigate financial challenges and position itself for future growth. By focusing on cost-cutting measures, long-term investments in AI and chip fabrication, and leveraging government support, Intel aims to overcome its current difficulties and emerge stronger in the competitive semiconductor industry.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.