You’ve finally driven home the car of your dreams. Now what? A robust car insurance policy isn’t just a legal formality—it’s the safety net that shields your finances, your passengers and your peace of mind from accidents, theft and natural calamities. Under India’s Motor Vehicles Act, 1988, at least a basic third-party cover is mandatory, but upgrading to broader protection is often the smarter call.

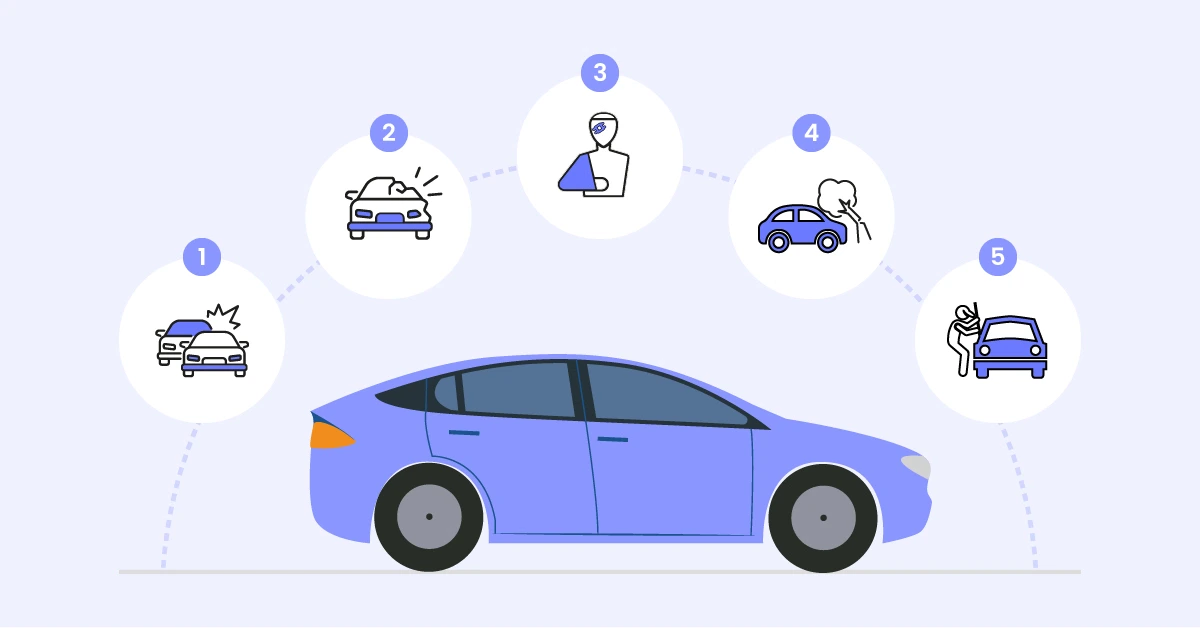

Key Benefits of a Car Insurance Policy

-

Financial Cushion for Repairs

Covers repair or replacement costs after accidents, fire, theft, vandalism or natural disasters—so hefty garage bills don’t drain your wallet. -

Third-Party Liability Shield

Legally protects you from claims if your car injures someone or damages another vehicle/property. -

Personal Accident Cover

Offers a payout for medical expenses, disability or death of the owner-driver. -

No-Claim Bonus (NCB)

Earn up to a 50 % discount on premiums over successive claim-free years. -

Cashless Network Garages

Get repairs done without handing over cash; the insurer settles directly with partner garages.

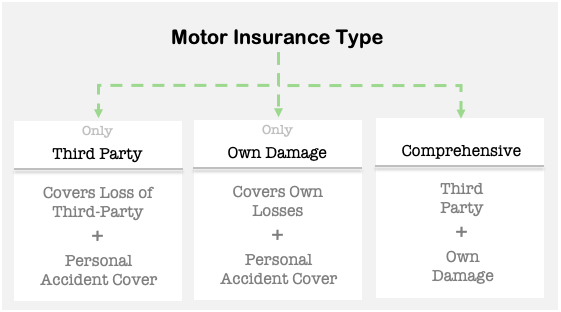

Three Core Types of Car Insurance in India

|

Policy Type |

What It Covers |

Ideal For |

|---|---|---|

|

Third-Party Only (mandatory) |

Damage, injury or death caused to a third party |

Owners looking to meet the legal minimum at the lowest cost |

|

Standalone Own-Damage |

Damage to your own vehicle due to accident, fire, theft, flood, riot and more |

People who already have third-party cover (e.g., bundled by the dealer) but want extra protection |

|

Comprehensive (recommended) |

Combines third-party + own-damage + natural calamities + optional add-ons |

Anyone seeking all-round security for their car and finances |

Car Insurance for Electric Vehicles (EVs)

EVs need specialised protection. An EV insurance policy covers:

-

Accidental damage, fire, theft and third-party liability

-

High-cost components such as battery packs, electric motors and on-board chargers

-

Optional battery replacement cover to offset expensive repairs

Staying insured is not just legally compliant; it safeguards your investment in cutting-edge green tech.

Third-Party vs Comprehensive vs Own-Damage at a Glance

|

Cover Feature |

Third-Party |

Own-Damage |

Comprehensive |

|---|---|---|---|

|

Third-party injury/property |

✔ |

✖ |

✔ |

|

Damage to your car |

✖ |

✔ |

✔ |

|

Natural disasters & fire |

✖ |

✔ |

✔ |

|

Riots, vandalism, terrorism |

✖ |

✔ |

✔ |

|

In-transit damage (road/rail/sea) |

✖ |

✔ |

✔ |

|

Personal accident add-on |

Optional |

Optional |

Optional |

Popular Add-Ons to Supercharge Your Policy

Remember: each add-on raises the premium slightly, so pick what truly fits your driving style and risk profile.

-

Pay As You Drive: Lower premiums if you clock fewer kilometres.

-

Zero Depreciation (Bumper-to-Bumper): Get full claim value for parts without depreciation (usually up to 7 – 10 years old cars).

-

NCB Protector: Keep your earned NCB even after one or two claims.

-

Engine Protect: Covers engine repairs due to water-ingress or gearbox damage—crucial in flood-prone regions.

-

Return to Invoice (RTI): Reimburses the car’s full invoice value (ex-showroom + RTO) in case of total loss/theft, available for the first three years.

-

Roadside Assistance: 24×7 towing, flat-tyre help, fuel delivery and jump-starts.

-

Consumables Cover: Pays for nuts, bolts, lubricants and other consumables during repairs.

-

Electrical / Non-Electrical Accessory Covers: Protects gadgets (music system, fog lamps) or upgrades (alloy wheels, seat covers).

-

Battery Cover (EV/Hybrid): Offsets hefty battery or electric-motor replacement costs.

-

Loss of Personal Belongings: Claim for stolen or damaged items like laptops or sports gear (FIR required).

-

Tyre Protection: Covers accidental tyre damage and alignment/labour charges.

-

Driver Cover: Personal accident cover for your paid chauffeur.

-

Key & Lock Replacement: Pays for re-keying and new lockset if keys are lost or locks tampered.

How to Pick the Best Car Insurance Company

-

Claim Settlement Ratio (CSR)

Aim for insurers with 95 %+ CSR for faster, smoother payouts. -

Customer Service Quality

Round-the-clock support via phone, chat and email ensures quick claim registration and status updates. -

Coverage Flexibility

Check if the insurer offers all three policy types plus useful add-ons customised to your needs. -

Premium Affordability

Compare quotes online—look for the sweet spot between cost and coverage, not just the cheapest tag. -

Financial Strength & Solvency

A strong solvency ratio and high credit rating mean your insurer can honour large volumes of claims, even in crises.

Top Car Insurance Companies in India (2025)

|

Rank |

Insurer |

Network Garages |

Claim Settlement Ratio |

Founded |

|---|---|---|---|---|

|

1 |

SBI General Insurance |

16,000+ |

100 % |

2009 |

|

2 |

HDFC ERGO General Insurance |

6,800+ |

99.48 % |

2002 |

|

3 |

Royal Sundaram General Insurance |

3,300+ |

98.60 % |

2001 |

|

4 |

Bajaj Allianz General Insurance |

4,000+ |

98.50 % |

2001 |

|

5 |

Reliance General Insurance |

8,200+ |

98.00 % |

2000 |

Figures represent the latest published CSR data for FY 2023-24.

Pro Tips to Save on Your Premium

-

Bundle Policies: Insure multiple vehicles or add home insurance with the same company for a multi-policy discount.

-

Increase Voluntary Deductible: Agree to pay a higher out-of-pocket share and enjoy lower premiums (only if you can afford it).

-

Install Anti-Theft Devices: ARAI-approved security systems fetch premium rebates.

-

Drive Safely & Earn NCB: Avoid claims for minor dings; let the NCB discount grow year after year.

-

Opt for Long-Term Policies: Pay once for 3-year third-party cover; lock in today’s rates and dodge annual price hikes.

Ready to Hit the Road Securely?

Choosing the right car insurance isn’t just a checkbox—it’s a strategic decision that can save you lakhs of rupees and endless stress. Compare plans online, weigh add-ons, check the insurer’s claim reputation and lock in a policy that matches your driving habits and budget. Drive smart, stay protected, and enjoy every kilometre with confidence.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved Powered by Vygr Media.