Fortune favours the brave, but Indian venture capitalists seem to lack bravery from all angles. Instead of investing in bold, transformative ideas, they largely funnel money into the same tried-and-tested products and services, resulting in market parity and an inflated startup bubble. While other nations back moonshot innovations, Indian VCs prefer safer bets, leading to a stagnation in deep-tech and artificial intelligence (AI) investments. This reluctance to take risks may have cost India its place at the forefront of the AI revolution. The ones responsible for walking ahead, leading the industry are the ones most plagued with sheep-like behaviour, following each other in herds, leading the market nowhere. It’s a crying shame really, because India is primed to be the home to some of the world’s top AI researchers, with a thriving base in institutions like the Indian Institutes of Technology (IITs) and the Indian Statistical Institute.

Indian-origin researchers play crucial roles in global AI labs, yet domestically, AI startups struggle to secure funding and scale up. While global AI investments have surged, India’s AI startup funding stood at approximately $3 billion in 2023, a fraction of the $52 billion invested in the US alone. India’s AI adoption has primarily been limited to large tech companies and startups working in application-based AI rather than foundational AI research. Companies like TCS, Infosys, and Wipro have integrated AI-driven automation into their services, but they are not leading the charge in AI innovation. Startups that focus on deep learning models, natural language processing, and AI-powered robotics often find it difficult to attract domestic funding, leading them to seek support from foreign investors.

The Conservative Nature of Indian VC Funding

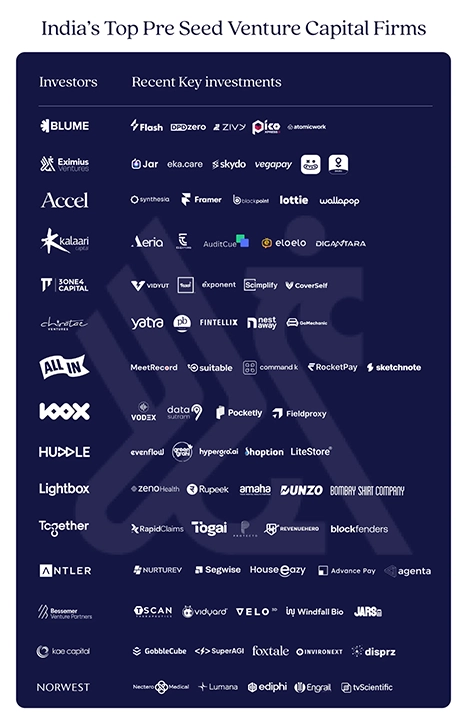

Unlike their counterparts in Silicon Valley and Beijing, Indian VCs tend to be conservative, prioritising profitability over bolder ideas. Investors prefer business models with quick returns rather than long-term bets that require high capital infusion and patience. This has led to an ecosystem dominated by fintech, e-commerce, and SaaS startups rather than deep-tech AI innovation.

Historically, India’s startup success stories have been in sectors like online retail (Flipkart), digital payments (UPIs), and ride-hailing services (Ola). These ventures provided relatively quick returns compared to deep-tech startups that require years of research and development. The fear of failure, combined with the preference for asset-light businesses, has kept AI startups on the fringes of the Indian investment ecosystem.

As artificial intelligence reshapes industries and economies worldwide, India—a country renowned for its IT prowess—finds itself trailing behind AI powerhouses like the United States and China. Despite a vast talent pool and a strong engineering base, India has struggled to produce AI unicorns at the scale of OpenAI, Anthropic, or DeepMind. A major factor contributing to this lag is the cautious, risk-averse nature of India’s venture capital (VC) ecosystem. Has this conservatism stifled India’s AI ambitions?

Case Study: The Struggles of Indian AI Startups

Take, for instance, a Bengaluru-based AI startup, NexGen Vision, which aimed to develop a foundational AI model tailored for Indian languages. Despite demonstrating promising early results, the company faced roadblocks in raising late-stage funding. The reluctance of Indian VCs to back expensive, research-heavy ventures forced NexGen Vision’s founders to seek foreign investors, eventually relocating to Singapore. This brain drain scenario is not unique—several Indian AI startups have moved operations abroad due to lack of local financial support.

Another example is DeepMind co-founder Mustafa Suleyman, who, despite having Indian roots, found the UK to be a more conducive environment for AI research. His company, DeepMind, received substantial backing from investors, leading to its acquisition by Google. India, unfortunately, has yet to create an environment where such AI-driven breakthroughs can thrive domestically.

The Global AI Investment Landscape

Contrast this with the approach taken in the US and China. Silicon Valley VCs are known for their high-risk appetite, funding AI ventures even in the absence of clear revenue models. OpenAI, for example, was initially a non-profit research organisation before attracting billions in investment. China, on the other hand, has a state-backed AI strategy, funnelling vast resources into startups through both government funding and aggressive VC backing. India lacks both these elements—big-ticket VC funding and strong state intervention.

The Chinese government has taken a proactive role in AI funding, establishing national AI strategies and pouring billions into research and development. This has enabled the rise of companies like SenseTime, iFlytek, and Megvii. The US, meanwhile, benefits from a robust academic-industrial complex where universities and tech giants collaborate closely. This synergy has led to transformative innovations emerging from institutions like MIT, Stanford, and UC Berkeley.

The Role of Government and Academia

India’s government has launched initiatives like the National AI Strategy, but these efforts remain fragmented and lack the scale seen in China’s AI push. While institutions such as IITs and the Indian Institute of Science (IISc) produce high-quality research, there is a gap in translating this research into market-ready products. Unlike in the US, where AI research receives substantial funding from entities like the Defence Advanced Research Projects Agency (DARPA), Indian AI research remains underfunded.

There is also a cultural aspect at play. The Indian education system, while rigorous, often emphasises rote learning over experimental and interdisciplinary thinking. AI innovation thrives in environments where researchers can freely collaborate across disciplines, blending insights from computer science, neuroscience, and linguistics. India must foster a culture of innovation within universities and incentivise AI research through grants, public-private partnerships, and dedicated AI funds.

Moreover, a strange right-wing rut has caught hold of India’s scientific centres, where IIT directors are going out in the media praising Cow-Urine and all it’s benevolent benefits. These kind of statements make us a laughing stock of the tech world, and pushed India’s scientific temperament decades back.

Is There Still Time to Catch Up?

While India has missed the first wave of AI breakthroughs, all hope is not lost. The government can play a catalytic role by setting up AI-specific funding schemes, incentivising long-term VC investments, and fostering collaborations between academia and industry. Indian VCs, meanwhile, must rethink their approach—balancing prudence with the willingness to back transformative AI ideas.

Indian corporations with deep pockets—such as Reliance, Tata, and Adani—should take the lead in AI investments. The establishment of AI-focused funds and research centres, similar to Google Brain or OpenAI, could provide the much-needed push. Public-sector banks and financial institutions can also step in by offering AI-focused grants and loans to startups willing to take on deep-tech challenges. Another promising avenue is the adoption of AI in governance, healthcare, and agriculture. If the Indian government actively integrates AI into public infrastructure—whether through smart cities, AI-driven health diagnostics, or precision agriculture—it could create a domestic market for AI solutions, encouraging local investors to bet on the sector.

The cautious nature of Indian venture capital has certainly slowed the country’s AI progress, making it difficult for startups to compete on a global scale. However, with the right policy interventions and a shift in investment philosophy, India can still capitalise on AI’s next growth phase. The question remains: will Indian investors take the leap, or will the country continue to watch from the sidelines as the AI revolution unfolds? As the world enters the next stage of AI innovation, India stands at a crossroads. It can either continue to play catch-up or take bold steps to become a leader in AI. The choice will define its role in the technology-driven future of the world.

© Copyright 2024. All Rights Reserved Powered by Vygr Media.